Zomato net loss jumps to Rs 360 crore in Q4; Invact Metaversity is in trouble

Credit: Giphy

Also in this letter:

■ Invact Metaversity may wind down ops, cofounder says

■ Marico picks up 54% stake in D2C food brand True Elements

■ Zepto explores medicine delivery service

Zomato Q4 Results: net loss jumps to Rs 360 crore

Zomato said on Monday that net losses in the fourth quarter of FY22 stood at Rs 359.70, a 2.5x jump from Rs 134 crore in the same quarter of FY21. It had reported a net loss of Rs 67.20 crore in the third quarter of FY22.

On a sequential basis, Zomato saw its total revenue grow to Rs 1,350 crore for the fourth quarter, a 7% jump from Rs 1259.70 crore in the third quarter. Zomato’s total revenues in the fourth quarter of FY21 stood at Rs 750.8 crore.

Revenue from operations stood at Rs 1,211.8 crore for the fourth quarter of FY22.

FY22 results: On a consolidated basis, annual losses stood at Rs 1,222.5 crore in FY22, from Rs 816.42 crore in FY21.

The company also announced that its total revenue more than doubled to Rs 4,687.3 crore in FY22 from Rs 2,118.4 crore in the previous fiscal year. Revenue from operations also more than doubled to Rs 4,192.4 crore for the fiscal.

Annual total expense of the food delivery major also grew substantially to Rs 6,205.5 crore in FY22. Total expenses in FY21 stood at Rs 2,608.7 crore.

Deepinder Goyal, cofounder and CEO of Zomato, said in a letter to shareholders, “We did see a low quarter-on-quarter (QoQ) growth in Q3FY22 as dining-out and travel opened up post-Covid. We believe that was a one-time correction of our growth trajectory on the back of two strong quarters. We think our growth trajectory is back on track, and we don’t foresee “post-Covid ramifications” affecting our growth rate anymore. Having said that, even before Covid, growth in our business has been lumpy (and not linear) – so it is essential to take a long-term view,”

Invact Metaversity may wind down ops, cofounder says

(L-R) Invact Metaversity founders Manish Maheshwari and Tanay Pratap

Metaverse edtech startup Invact Metaversity, cofounded by former Twitter India head Manish Maheshwari, may wind down operations just days after launching its first cohort.

The edtech startup has cancelled its first cohort and refunded money, with interest, to students who had enrolled for the course.

Founded in 2021 by Maheshwari and Tanay Pratap, Invact was building immersive educational courses in the emerging metaverse ecosystem.

Driving the news: Maheshwari wrote in a series of tweets on Monday that the company is “standing at crossroads” and exploring several options, including cutting its cash burn, pivoting to another idea, letting one of the founders run the startup, or even returning unspent capital back to its investors.

Maheshwari and Pratap have been at odds over the company’s vision of late, which Maheshwari acknowledged in his tweets.

He added, “As we started testing the early version of the Metaversity platform with students, it became apparent to us that the immersive classroom and the community experience were not getting delivered at a level that we had envisaged.”

Big-name backers: In February, Invact had closed a $5 million seed round led by Arkam Ventures. It also raised funds from over 70 prominent global investors including tech giants Google, Microsoft and Meta.

Another Protonn? Invact’s story is reminiscent of Protonn’s, a startup founded by former Flipkart executives Anil Goteti and Mausam Bhatt. It shut down in January, less than six months after picking up investor capital.

Protonn offered a platform for independent professionals such as lawyers, graphic designers and nutritionists to launch their businesses online, create videos, conduct live sessions, generate payment links, and track financial performance.

But the company could not find the right product-market fit and the founders could not agree on a pivot, sources told us, leading to its closure.

Head of Shopsy set to quit: Meanwhile, senior Flipkart executive Prakash Sikaria, who headed the company’s new social commerce venture Shopsy, is on his way out, sources said. Sikaria’s exit comes at a time when Flipkart is doubling down on the new initiative.

TWEET OF THE DAY

Marico picks up 54% stake in D2C health food brand True Elements

Marico Limited, maker of Parachute and Saffola oil, said it has acquired a 54% stake in HW Wellness Solutions, owner of health food brand True Elements through a primary infusion and secondary buyouts. It did not disclose the size of the deal.

True Element, a digital-first brand in the healthy breakfast and snacks segment, clocked sales of Rs 54 crore in FY22. Its products include Western breakfast items such as oats, quinoa, muesli, granola and cornflakes, and Indian breakfast dishes such as poha, upma and dosa. It sells these products on more than 90 online platforms and more than 12,000 physical stores.

With this investment, True Elements aims to expand its offline presence over the next few years.

ETtech Done Deals

■ NextBillion.ai, a Singapore-based artificial intelligence (AI) spatial data and location mapping platform, has raised $21 million in a funding round led by Mirae Asset Capital. It plans to use the funds to expand its market share in building and managing decentralised geospatial technology stacks for enterprises.

■ Ras Luxury Oils, a direct to consumer (D2C) luxury skincare and personal care brand, has raised $2 million in a funding round from Sixth Sense Ventures. It said it would use the funds to develop and launch new product categories, expand deeper into marketplaces, and establish an international presence.

■ Minus Zero said it has raised $1.7 million led by Chiratae Ventures, with participation from Jito Angel Network and senior executives from tech companies like Nvidia and Lyft. The deal marks the first time an Indian self-driving car company has attracted venture capital.

Quick-commerce firm Zepto explores medicine delivery service

(From left) Zepto cofounders Aadit Palicha and Kaivalya Vohra

Quick-commerce startup Zepto may launch online pharmacy delivery services, the Times of India reported.

Soonicorn: Founded by Stanford University dropouts Palicha and Kaivalya Vohra, Zepto launched its quick commerce service in April 2021.

It recently closed a $200 million funding round at a valuation of $900 million and has raised $360 million to date.

Quote: “It’s probably a category we will be excited about in the future,” Zepto founder Aadit Palicha said. “There will be a lot of innovation that will need to be done in the space. This is something we will focus on in the medium to long term and probably not in the short term,” he added.

Covid consolidation: The pandemic has triggered consolidation in the Indian healthcare industry and witnessed the entry of large players such as Reliance and Tata, which picked up Netmeds and 1mg, respectively.

Flipkart’s recent moves: In April, we reported that Flipkart has launched a separate app, Flipkart Health+, for its healthcare business. The platform will operate on a marketplace model, in which third-party sellers will offer medicines and healthcare products.

Earlier we reported that Flipkart had invested $143 million in its healthcare unit and appointed former Apollo Health executive Prashant Jhaveri as chief executive of the healthcare business in March.

Zepto’s other plays: We reported on February 15 that Zepto was planning to tap private labels to improve margins and lower its cash burn.

The company is also piloting a service to deliver coffee, tea, and similar items in 10 minutes in parts of Mumbai.

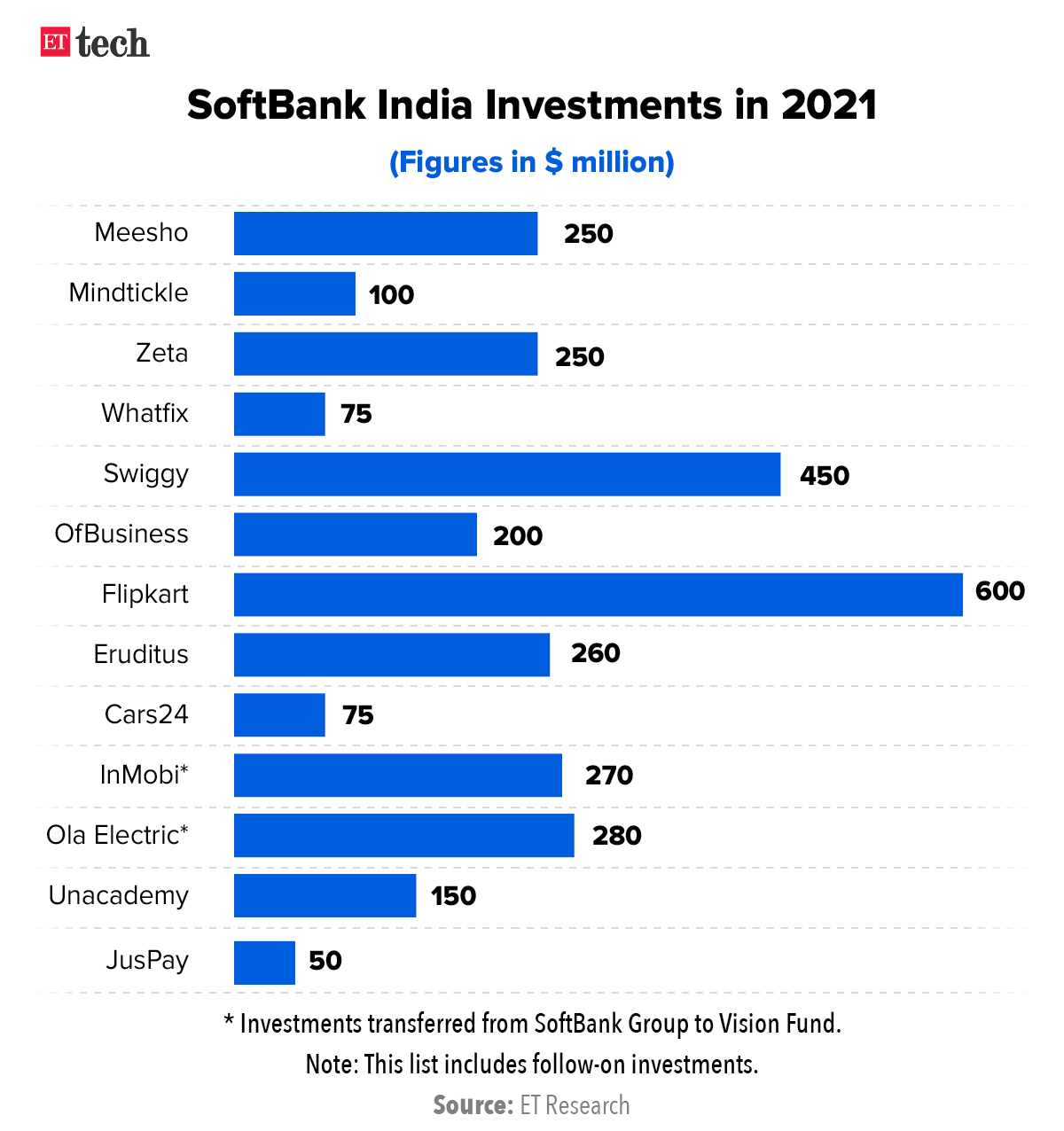

PM Modi recognises SoftBank’s role in India’s startup ecosystem

Prime Minister Narendra Modi met with SoftBank founder Masayoshi Son on Monday to explore the Japanese conglomerate’s future involvement in India’s technology, energy, banking, and R&D sectors.

Modi recognised SoftBank’s importance in India’s startup environment as they reviewed reforms being implemented to make it easier to conduct business in India.

“India’s future is bright, PM Narendra Modi is committed to the success of India, supporting startups and making it the centre of technology. New startups coming every day and becoming unicorns quickly,” Son said.

India bets: SoftBank is a major investor in Indian startups, having backed huge companies such as Paytm and Policybazaar, both of which are now publicly traded. It has also invested in Oyo Hotels & Homes, Delhivery and Unacademy.

Yes, but: Earlier this month, Son said that this year the group will likely invest only half or even a quarter of what it did in 2021. Son’s comment confirmed what the startup ecosystem in India and worldwide had been expecting for some time – a slowdown in big-ticket funding.

SoftBank posted a net loss of 1.7 trillion yen ($13.12 billion) for the year ended in March as the tech investor faces a sliding tech portfolio.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Arun Padmanabhan in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.