Zomato and Blinkit will soon be one; Myntra plans live-commerce blitzkrieg

Credit: Giphy

Also in this letter:

■ Myntra bets big on live commerce for end-of-summer sale

■ Mumbai is most forgetful city in India, says Uber report

■ VCs continue to bet on Indian and Southeast Asian startups

Zomato likely to sign Blinkit deal on June 17

Zomato is likely to call an extraordinary general meeting on June 17 to clear the acquisition of quick commerce startup Blinkit, two sources aware of the discussions told us.

Long courtship: The news comes almost two years after the two entities first discussed a potential acquisition.

Zomato has previously invested in Blinkit, and extended a loan of up to $150 million for the quick-commerce entity earlier this year.

Deal details: According to sources, the deal is tied to a certain number of Zomato shares that Blinkit’s investors will receive.

- Blinkit’s investors are also expected to have a lock-in period of six months, one of the sources said.

- After the deal, Blinkit’s shareholders are expected to get a little less than 10% stake in Zomato.

- Blinkit’s largest investor, SoftBank Vision Fund, will get an almost 4% stake in Zomato, one of the sources said.

We had reported on March 15, citing sources, that the deal was expected to value Blinkit at around $700-800 million based on Zomato’s market capitalisation at the time. That was lower than Blinkit’s previous valuation of a little over $1 billion. Further, shareholders of Zomato are expected to get 10 Blinkit shares for each held in their company, we had reported earlier.

Cost-conscious: Zomato has been trying to enter the quick commerce space after twice dropping plans to deliver groceries online since the start of the pandemic in 2020. But during its investor call in May, its first since going public last year, CEO Deepinder Goyal said the company was “very conscious” about not overpaying for Blinkit.

Myntra bets big on live commerce for end-of-summer sale

Online fashion retailer Myntra will go big on live commerce during its end-of-summer event, called the End of Reason Sale, from June 11 to 16.

“Over 1,000 live sessions hosted by more than 2,500 influencers, 750 of which are brand-led, will be on M-Live… [it] is going to be a big part of EORS,” said Nandita Sinha, CEO of Myntra to ET.

Great expectations: Sinha said the company expects to see five million customers transact during the six-day sale, with over one million of those expected to be new customers. About 40% of customers will be from tier-2 and tier-3 cities, she said.

Myntra expects a 26% jump in traffic for this year’s sale from last year’s, and a significant boost for its beauty and personal care business.

“This year’s EORS has come at an opportune time when customers are stepping out after almost two years. This has given a great impetus to fashion overall and we are hoping to see that momentum,” said Sinha.

Focus areas: In her first interview after taking over as CEO, Sinha told us on February 24 that personalisation, influencer-led live commerce, and beauty and personal care would be key focus areas for Myntra’s leadership team.

Competition: Myntra has been seeing increased competition in India’s online fashion space, which it has long dominated.

- Reliance’s Ajio has made significant inroads since the pandemic started and has emerged as a significant second player in the market.

- Beauty retailer Nykaa has also said it plans to sell fashion brands.

Mumbai is most forgetful city in India, says Uber’s lost-and-found report

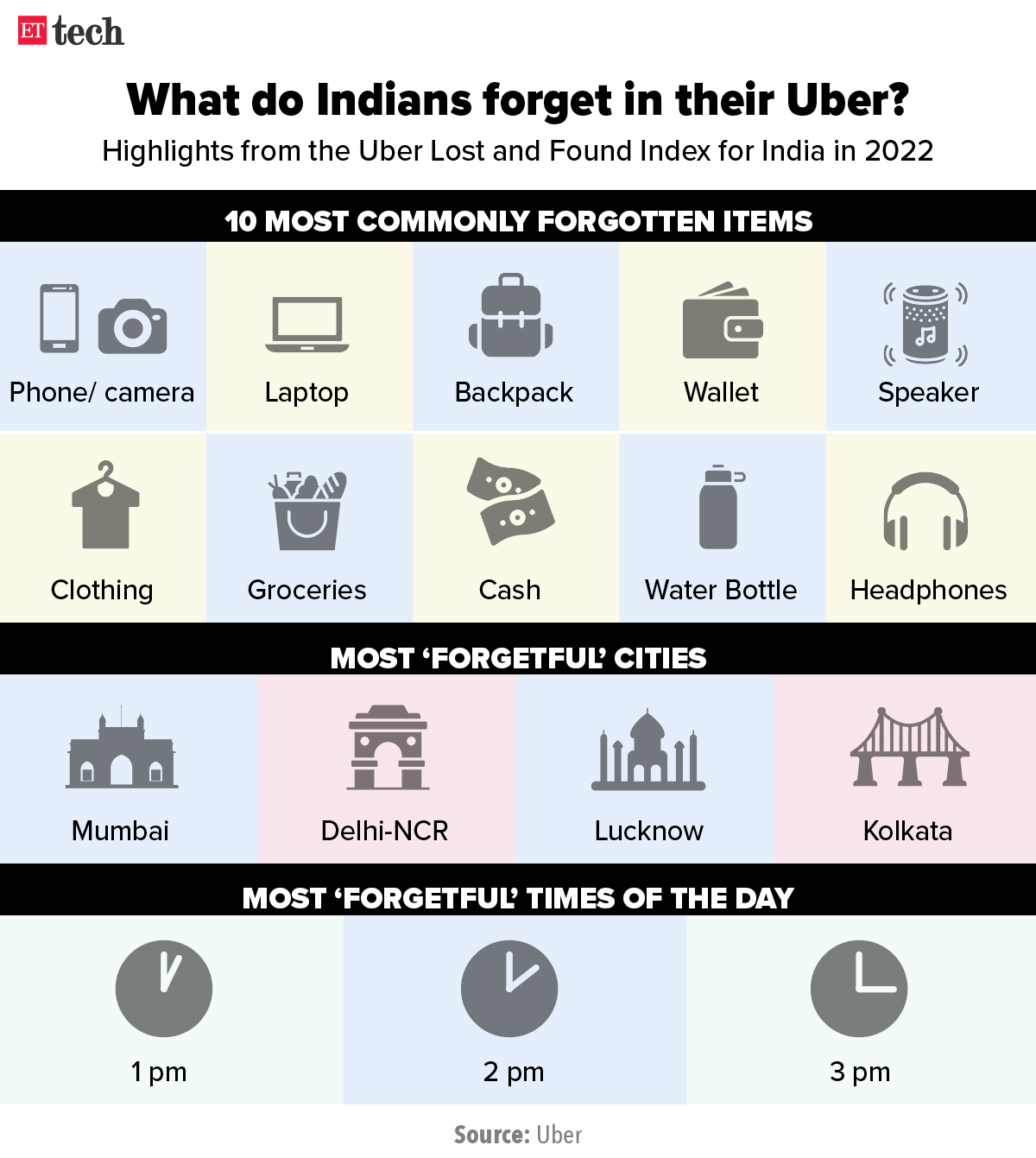

Uber has released an interesting snapshot of the items its customers most commonly forget in cabs. The Uber Lost of Found Index India 2022 also lists the most forgetful ‘cities’ in India, and times of the day, days of the week, and times of the year when Uber riders tend to be most forgetful.

Mumbai topped the list of the most ‘forgetful’ cities in India for the second time in a row, the report said. It was followed by Delhi and Lucknow. It said the most ‘forgetful’ time of day for Indians was 1 pm to 3 pm.

Over the past year, the five most commonly forgotten items were phones/cameras, laptops, backpacks, wallets and speakers, the report said.

Apart from the usual, Indians also left behind some unique and unusuals items in Uber taxis. These included ghewar (an Indian sweet dish), flutes, Aadhaar cards, dumbbells, a bike handle, cricket bats, spike guards and college certificates, to name a few.

The report also had insights on which items are forgotten the most on certain days. For example, people are most likely to forget their clothes on Saturdays, laptops on Wednesdays, and headphones/speakers on Mondays and Fridays.

VCs continue to bet on Indian and Southeast Asian startups

Despite poor performance from growth-stage startups, Indian and Southeast Asian VC funds have raised $3.1 billion so far this year, according to London-based investment data firm Preqin. In comparison, Chinese VCs have raised $2.1 billion, down from $27.2 billion last year.

What’s fuelling the interest? Nikkei Asia reported last week that VC firms that back startups in India and Southeast Asia are raising record sums for new funds as investors back away from China.

Many investors consider startups from these regions to be safer bets than their Chinese counterparts, especially since China’s crackdown on its tech sector last year.

These firms find India and Southeast Asia to be attractive investment options thanks to their growing middle class, young population and increased digital adoption.

Yes, but: Celebrated VC firm Sequoia Capital recently postponed the closing of its $2.8-billion India and Southeast Asia fund after alleged financial irregularities and corporate governance issues at some of its portfolio firms.

Tweet of the day

China set to conclude Didi probe, lift ban on new users

China’s regulators are wrapping up their investigation into ride-hailing giant Didi Global and are set to allow its apps back on domestic app stores after over a year, reports the Wall Street Journal.

Angry regulators: Didi, which listed in the US last year, ran into trouble after Chinese regulators alleged that the company had illegally collected users’ personal data. A probe was launched against the company and Chinese app store operators were asked to remove its apps.

Authorities also told the company to stop registering new users, citing national security and the public interest.

The company had to halt its Hong Kong listing plans earlier this year, after it failed to appease regulators.

Large penalty ahead: With the investigation nearing completion, Didi is expected to receive a large fine from regulators. Last year, Alibaba had received a record $2.8 billion fine at the height of China’s crackdown on its tech giants.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.