Worry for tech startups after Silicon Valley Bank failure

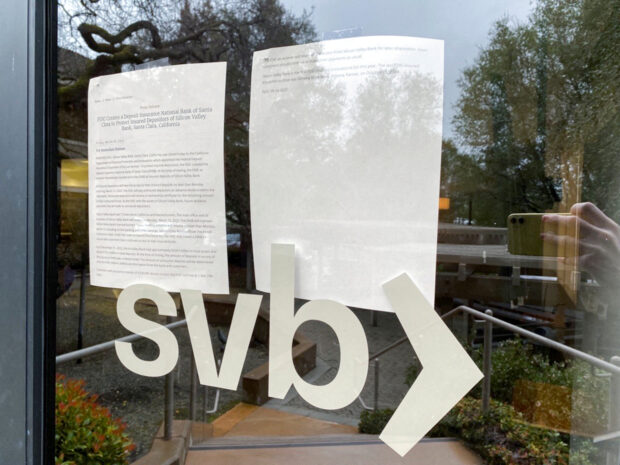

A locked door to a Silicon Valley Bank location on Sand Hill Road is seen in Menlo Park, California, US, March 10, 2023. REUTERS/Jeffrey Dastin

New York, United States — Silicon Valley Bank’s stunning collapse has led to the freezing of tens of billions of dollars stored there by startups and their private equity backers, raising fears of a wider tech sector fallout.

The company, whose website says it is “the financial partner of the innovation economy,” was taken over Friday by the US Federal Deposit Insurance Corporation (FDIC) to prevent further damage.

“SVB knew the entrepreneurial community,” Joseph DeSimone, a professor at Stanford University and founder of several startups, told AFP.

“They helped us recruit people, helped with securing mortgages for transplants, gave financial advice to new executives… So their disappearance is a real loss,” he said.

The company previously boasted that “nearly half” of technology and life science companies that had US funding banked with them, leading many to worry about the possible ripple effects of its collapse.

For banks that are FDIC-insured, only $250,000 per account is guaranteed.

But according to SVB’s latest annual report, 96 percent of its total $173 billion in deposits was uninsured.

The FDIC said Friday that all accounts would quickly get access to the insured portions of their deposits, but that the rest would depend on how much is recovered from sales of the bank’s assets, an often lengthy process.

“The real victims of the SVB fallout are the depositors: startups with 10 to 100 employees, who cannot make payroll, and will have to furlough or shutdown workers as soon as Monday,” tweeted Garry Tan, head of the well-known incubator Y Combinator.

He warned that “years of US innovation” are on the line, as an entire “generation of American startups” could be destroyed in a month or two.

‘Doesn’t look good’

Activist investor Bill Ackman raised a similar alarm on Twitter, saying that SVB’s collapse “could destroy an important long-term driver of the economy.”

“If private capital can’t provide a solution, a highly dilutive gov’t (government) preferred bailout should be considered.”

According to several US media reports, SVB had discussed on Thursday and Friday a possible buyout with several banks, but could not find a solution quickly enough.

Champ Bennett, cofounder of the video platform Capsule, revealed on Friday that the $5 million raised in mid-February during the company’s first seed funding round was housed at SVB and now inaccessible.

“What happens next is anyone’s guess, but it doesn’t look good,” he tweeted.

Bennett added that an intervention should not be viewed as “bailing out ‘The 1’ or ‘Big Tech’,” pointing to the “thousands of the most hardworking, talented individuals” at impacted companies who are currently “struggling.”

According to the news website Semafor, hedge funds are offering to front cash to SVB’s corporate clients, but at a 20 to 40 percent discount.

Beyond that, Adam Arrigo, boss of virtual gig platform Wave, warned his fellow tech entrepreneurs: “Whether or not you had money in SVB, you are not unaffected. This is going to materially impact everyone.”

Like others, Bennett says he is also concerned about the fate of other banks favored by the tech industry, including California’s First Republic, whose stock price fell 30 percent in two days.

Some see in the back-to-back failure of two banks, SVB and Silvergate Bank, an example of the financial system’s precariousness.

“What happened to everyone talking about how banks (SVB, Silvergate) are safe and better than Crypto DEFI?” tweeted US investor Arjun Sethi.

DeFi, or decentralized finance, allows users to theoretically access their funds at any time and without intermediary, but comes without deposit protections or regulations.

RELATED STORIES:

Silicon Valley Bank staff offered 45 days of work at 1.5 times pay

Silicon Valley Bank slams global shares, US payrolls loom

Read Next

Subscribe to INQUIRER PLUS to get access to The Philippine Daily Inquirer & other 70+ titles, share up to 5 gadgets, listen to the news, download as early as 4am & share articles on social media. Call 896 6000.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.