Wipro, Tech Mahindra post subdued earnings; Oyo says it is cash flow positive

Also in this letter:

■ Madras HC asks Google not to delist matrimony app

■ IPL gives a fillip to fantasy sports platforms

■ Meta Q1 revenue inches up 3%, net income falls

Wipro Q4 profit dips, TechM profit falls 26% YoY

IT major Wipro Ltd posted a consolidated net profit of Rs 3,074 crore for the fourth quarter ended March 2023, down 0.4% from Rs 3,087 crore in the year-ago period. Meanwhile, Tech Mahindra reported a 26% year-on-year drop in net profit to Rs 1,118 crore.

Wipro financials: Revenue from operations during the reporting quarter rose 11% year-on-year (YoY) to Rs 23,190 crore. The company’s board has approved a buyback of shares through a tender offer, at Rs 445 per share.

Wipro will buy back about 26.9 crore shares from shareholders on a proportionate basis, for a sum not exceeding Rs 12,000 crore.

Quote, unquote: “The buyback is proposed to be made from existing shareholders of the company (including persons who become shareholders by canceling American Depository Receipts and receiving underlying equity shares) as on the record date on a proportionate basis under the tender offer route,” Wipro said in an exchange filing.

TechM numbers: The IT major’s net profit was lower than ET Now Poll estimates of Rs 1,260 crore. Revenue from operations during the reporting quarter rose 13.2% year on year to Rs 13,718 crore. Earnings before interest, taxes, depreciation, and amortisation (EBITDA) declined 3.2% YoY to Rs 2,021 crore.

The board recommended a final dividend of Rs 32 per share, taking the total dividend for FY23 to Rs 50 per share, the company said in an exchange filing.

Managementspeak: “As we step into FY24, we see the increasing need for businesses to stay agile by leveraging next-generation technologies. We are strongly focused on helping our customers stay competitively dominant and relevant in the era of fast-evolving market conditions by helping them adapt to leaner and sustainable business models,” said CP Gurnani, MD & CEO of Tech Mahindra.

Oyo says it turned cash flow positive in Q4 2023

In an internal employee town hall held on Thursday, Oyo told its employees that it had turned cash flow positive in the fourth quarter of FY23.

Details: The company told staffers in an internal presentation that it ended the quarter with Rs 90 crore of surplus cash flow.

Sources told us that the positive cashflow trajectory is expected to continue into the first quarter of FY24. The cash corpus on the company’s balance sheet is Rs 2,700 crore.

Tell me more: Oyo is attributing the developments to a spike in bookings across all key geographies, especially in the Europe homes business.

Oyo founder Ritesh Agarwal had last month told employees in a town hall that the company could post adjusted earnings of nearly Rs 800 crore before interest, tax, depreciation and amortisation in financial year 2024.

IPO check: The travel tech startup refiled its Draft Red Herring Prospectus (DRHP) with capital market regulator SEBI last month, under the pre-filing route.

The issue size has likely been reduced to $400-600 million, consisting entirely of freshly issued shares with all the proceeds going to the company.

Madras HC restrains Google from ejecting Bharat Matrimony app from Play Store

Google will not be able to divorce Bharat Matrimony for at least another month.

Granting an interim injunction in a case filed against Google by Matrimony.com, which owns the Bharat Matrimony platform, the Madras High Court on Thursday directed the tech giant not to delist the Indian platform’s app from its Play Store until June 1.

What’s driving the news? Matrimony.com had approached the Madras High Court alleging that Google was forcing app developers to adopt its user-choice billing (UCB) system, and charging a commission at the rate of 11-26%, even if payments were being made by users through non-Google payment options.

‘Big relief’: Murugavel Janakiraman, CEO, Matrimony.com, called the injunction a “great relief”. He added, “The fee structure proposed by Google is a death knell to Indian startups. Google is forcing app developers to agree to its payment policy of charging a service fee at the rate of 11% and 26%, even with respect to the payments made by customers through its new user choice alternate billing system, without providing any services at all.”

Catch-up quick: The ruling is significant given that Google’s new in-app purchase billing policy has been disputed with the Competition Commission of India (CCI) as well.

The competition regulator, under directions from the Delhi High Court, is currently hearing complaints by startup lobby Alliance of Digital India Foundation (ADIF) — of which Matrimony.com is a member.

The group has alleged that the UCB policy is violative of CCI’s October orders against how Google operated the Android mobile operating system.

Tweet of the day

Fantasy sports platforms eye user base boost as IPL gathers pace

Fantasy sports platforms Dream11, My11Circle and WinZo Games will be spending a large chunk of their annual marketing budgets on the cash-rich Indian Premier League (IPL), amid an overall decline in advertising by startups.

Market estimates: The fantasy sports platforms could spend anywhere between Rs 700 crore to Rs 800 crore during the tournament.

Per a recent report by RedSeer Strategy Consultants, fantasy sports platforms are expected to record 30–35% growth in their gross gaming revenue, at Rs 2,900–3,100 crore, during the IPL this year.

The number of transacting users during the IPL season is expected to grow 25–30%, with nearly 60–65% coming from Tier-2 cities and beyond, it said.

Quote unquote: Vikrant Mudaliar, chief marketing officer of Dream Sports, which owns India’s largest fantasy sports platform, Dream11, sees the IPL as the biggest driver of user engagement.

“As with every year, we expect to see growth in our user base, which has already crossed 150 million,” he noted.

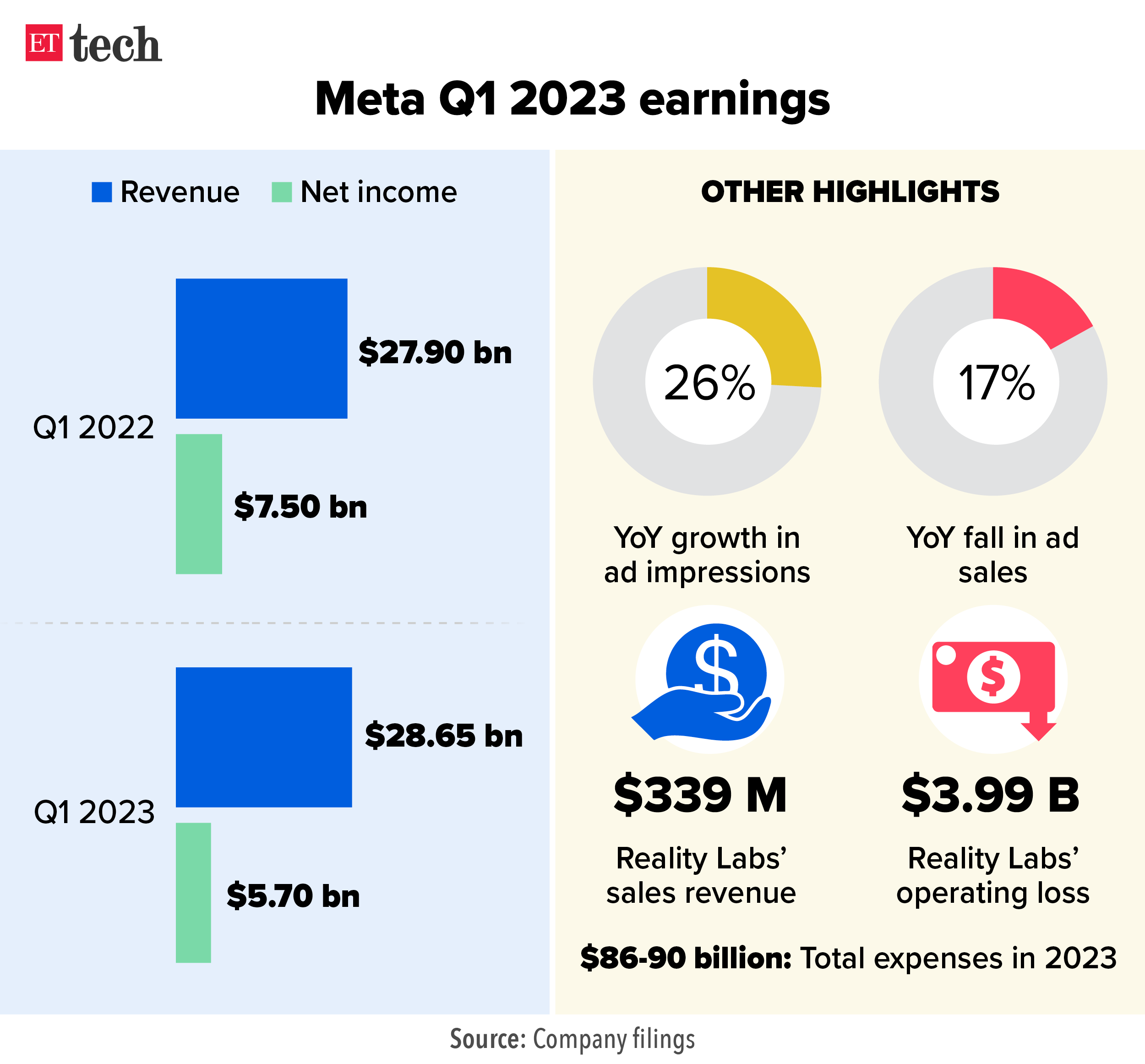

Meta Q1 results: Revenue inches up 3% to $28.7 billion

Facebook-parent Meta reported better-than-expected earnings for the first quarter (Q1) of 2023 as revenue rose 3% to $28.65 billion from $27.9 billion in the year-ago period.

Key numbers: Despite the resilient revenue figures, Meta reported a 24% drop in its net income to $5.7 billion, from $7.5 billion in the first quarter of 2022.

Advertising impressions rose 26% year-on-year, while ad prices fell 17%.

Spending on AI retooling has spiked the company’s capital expenditure, which came in at $7.1 billion for the quarter. Meta shares spiked 12% in after-hours trade on Wednesday.

AI, metaverse in focus: Meta’s Reality Labs unit, the brainchild behind its virtual reality and augmented reality technologies for the Metaverse, recorded $339 million in sales but at an operating loss of $3.99 billion, which the company expects to increase this year.

“A narrative has developed that we’re somehow moving away from focusing on the metaverse vision. I just want to say up front: that’s not accurate,” CEO Mark Zuckerberg said. “We’ve been focusing on both AI and the metaverse for years now, and we will continue to focus on both.”

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta in New Delhi and Megha Mishra in Mumbai. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.