Vedantu to sack another 424 employees; PhonePe to buy WealthDesk, OpenQ for $75M

Also in this letter:

■ PhonePe set to buy WealthDesk, OpenQ for $75 million

■ Amazon to help offline stores in India set up digital storefronts

■ Twitter board plans to enforce $44-billion deal with Musk

Vedantu to lay off another 424 employees as capital becomes scarce

Edtech unicorn Vedantu said it is laying off another 424 employees – about 7% of its workforce – just days after sacking 200 contractual and full-time employees amid falling demand for online education.

Statement: CEO and founder Vamsi Krishna wrote in a blog post that the company decided to layoff employees “as capital will be scarce for upcoming quarters” because of inflationary pressures from the war in Ukraine, impending recession fears, and Fed interest rate hikes.

He added, “With Covid tailwinds receding, schools and offline models opening up, the hyper-growth of 9X Vedantu experienced during the last two years will also get moderated. For long term sustenance of the mission, V would need to adapt too.”

Cost-cutting: On May 5 we reported that Vedantu had laid off about 120 contractual and 80 full-time employees.

The company has also been focusing on reducing the cost of its courses to manage the tapering demand for online education as offline learning centres open up.

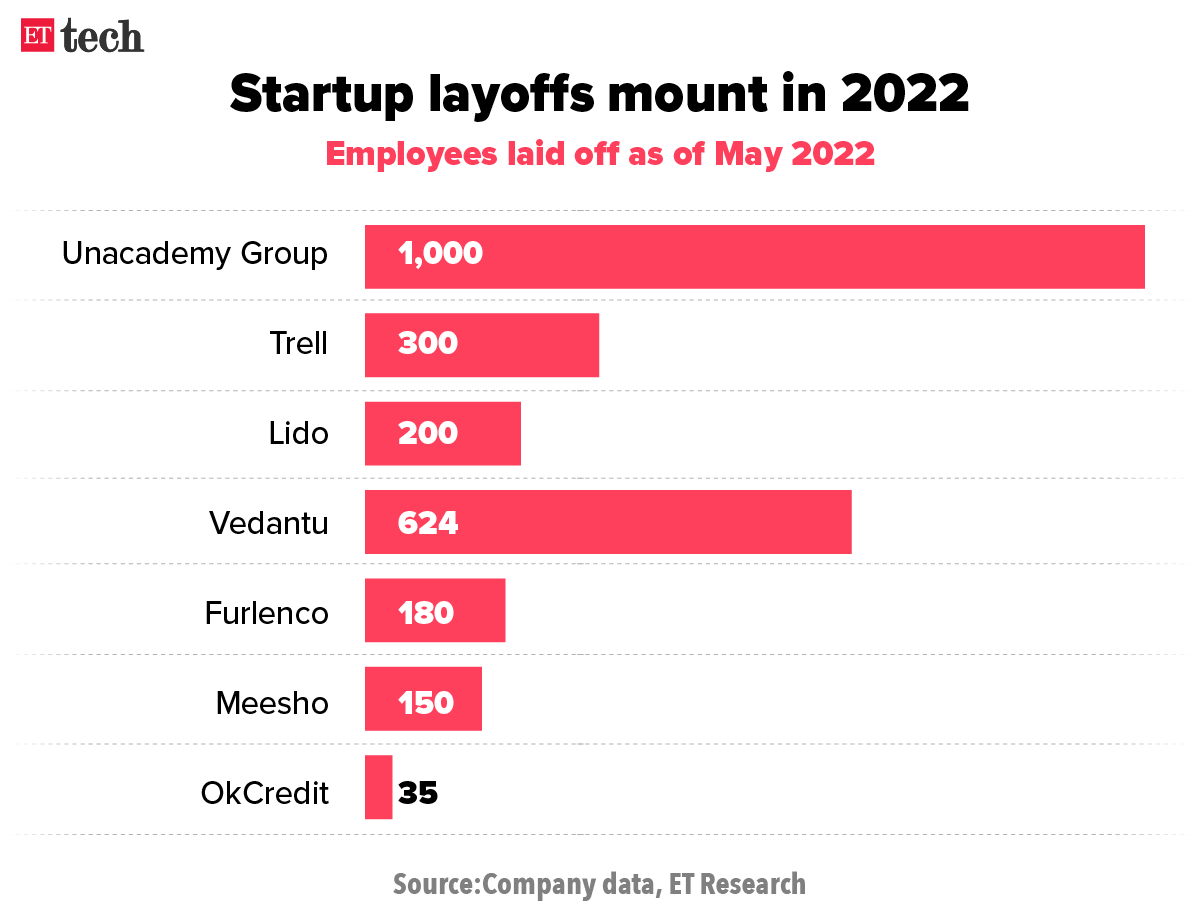

Season of layoffs: Several Indian startups, including Unacademy, Lido Learning, Meesho, Trell and Furlenco have laid off employees over the past couple of months, amid a downturn in funding.

On April 28, we reported that more than 1,800 contractual and full-time employees had cumulatively been fired from various startups as investors began to ask high-growth companies to go back to basics — chase profits and reduce their cash burn.

Many startup founders, investors and analysts we spoke to said the layoffs were all at late-stage startups with large valuations and significant cash burn, and a marked slowdown in large financing rounds ($100-150 million).

We wrote then that the trend was likely to play out further, even though early-stage funding is yet to significantly taper off.

Also Read | Edtech’s offline push continues with Unacademy Centres

PhonePe set to buy WealthDesk, OpenQ for $75 million

Walmart-owned PhonePe is acquiring two wealth management companies WealthDesk and OpenQ as it looks to boost its play in the wealth management and distribution space.

Details: The company is expected to acquire WealthDesk for roughly $50 million and OpenQ for $25 million, sources told us, as it looks to unlock new revenue streams and diversify its offerings for users of its payments services.

PhonePe said WealthDesk’s founder and team will work as a part of the PhonePe group and both platforms will remain independent.

It added that OpenQ would be instrumental in creating its wealth ecosystem.

New battleground: Financial services is the next big battleground, after digital payments, for companies such as PhonePe, Amazon, Google and Paytm.

PhonePe already has a mutual fund distribution licence. It applied for a mutual fund licence with the Securities and Exchange Board of India (Sebi) in December 2021.

The company also planned to enter the merchant-lending business in the first half of 2022.

Its cofounder and chief executive Sameer Nigam previously told us he expects 40%-45% of PhonePe’s revenues to come from financial services.

On Tuesday we reported that the RBI denied a banking licence to Chaitanya India Fin Credit, owned by Flipkart founder Sachin Bansal, denting his ambition of becoming a banker.

Amazon will now help offline stores in India set up digital storefronts

Amazon has unveiled a new initiative in India called Smart Commerce that will help offline retailers create their own digital storefronts, in addition to selling on Amazon’s India marketplace.

Rollout: Going forward, Amazon’s Smart Commerce will release its first set of solutions, including e-billing and inventory management. This will be followed by the launch of other capabilities to help offline stores create their online storefront in minutes, the company said.

- Two years ago, the ecommerce giant launched Local Shops in India, assisting local businesses in becoming Amazon India sellers.

- In 2020, it also launched Smart Stores, a scheme that gave physical stores QR codes to accept digital payments using Amazon Pay.

Amazon’s latest initiative comes as large ecommerce companies such as Walmart-owned Flipkart and Reliance Industries’ JioMart are also looking to onboard more offline stores on their platforms and expand their ecommerce footprint.

Tweet of the day

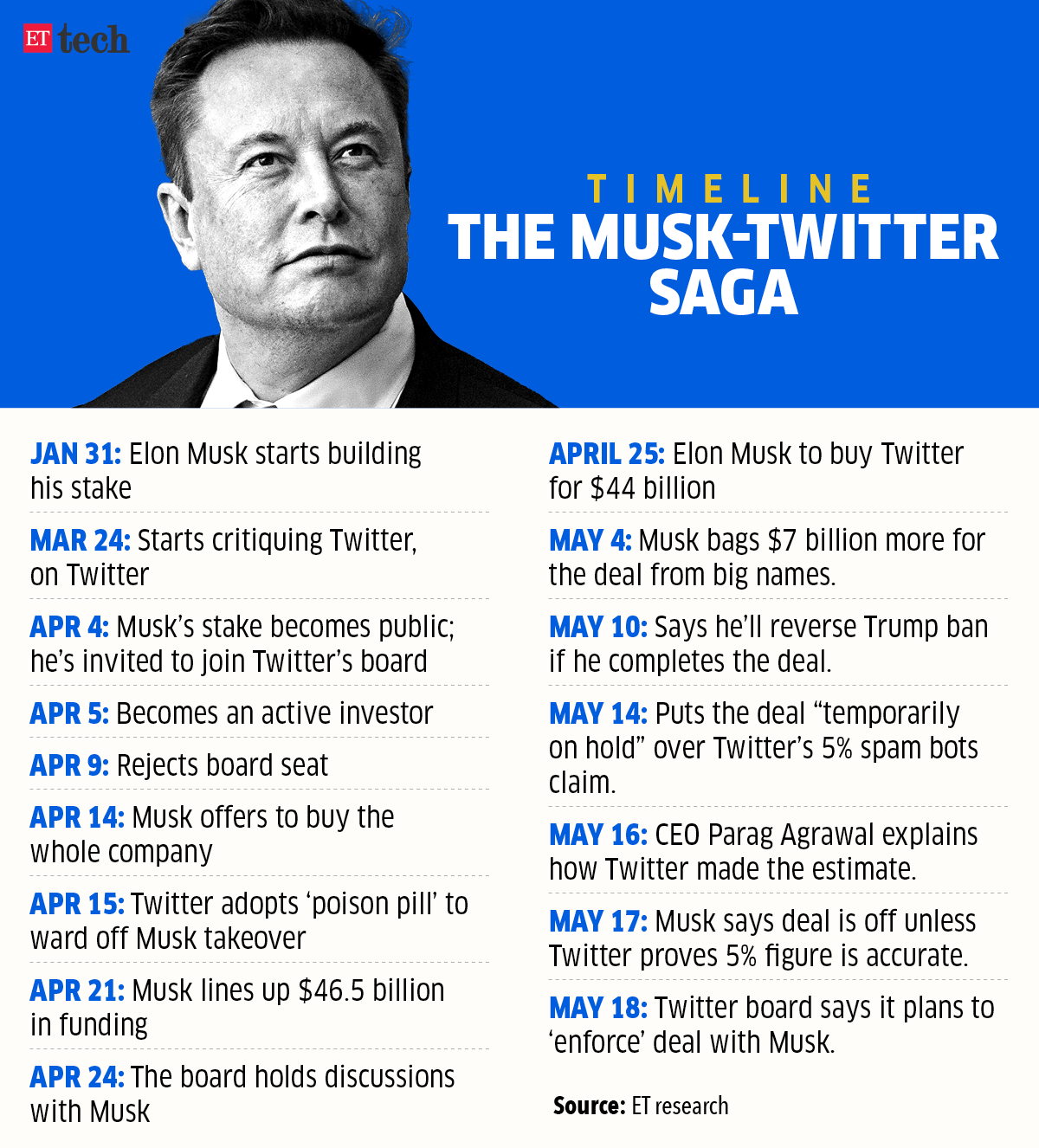

Twitter board plans to enforce $44-billion deal with Musk

Twitter’s board plans to enforce Elon Musk’s $44 billion transaction, saying it is in the best interests of all shareholders, according to a Bloomberg report.

“We intend to close the transaction and enforce the merger agreement,” the company said.

A $1-billion breakup fee was included in the proposed takeover for each party, which Musk will have to pay if he terminates the transaction or fails to provide funding. Musk, however, may be exempt from the requirement if he can show a significant change in the company’s condition or the information it has provided.

The board’s move comes as Musk appears to be renegotiating the $44 billion deal, saying it can’t go ahead unless Twitter shows proof of its claim that fake and spam accounts make up less than 5% of its users.

More senior employees quit Twitter: The company is losing three more senior employees, including two vice presidents. They are: Ilya Brown, a VP of product management; Katrina Lane, VP of Twitter service; and Max Schmeiser, head of data science. All three chose to quit on their own, according to internal memos.

ETtech Done Deals

■ Direct-to-consumer (D2C) beauty and wellness brand Wow Skin Science announced it has raised primary growth capital from Singapore’s sovereign wealth fund GIC. The company declined to comment on the amount raised and the valuation it racked up in the new round.

■ D2C women’s activewear brand BlissClub said it has raised $15 million in a new funding round led by Eight Roads Ventures and Elevation Capital. This comes less than a year after the Bengaluru-based startup raised $2.25 million in May 2021.

■ Treasury management and infrastructure platform Coinshift has raised $15 million led by Tiger Global. The company will use the funds to develop its product and technology. It will launch its latest version in beta next week, which will be available via a waitlist.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai, Ruchir Vyas in Ludhiana and Arun Padmanabhan in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.