UPI payment via credit card: How it will work

UPI payment via credit card: How it will work

UPI payment via credit card: In a move that will broaden the scope of digital payments in the country, the Reserve Bank of India (RBI) has allowed credit cards to be linked with the unified payments interface (UPI) for payments. UPI, launched in 2016, has played a pivotal role in transforming the digital economy of the country and has emerged as a favourite digital payment choice by citizens.

Till now, only debit cards connected to savings bank accounts and current accounts are allowed to link up to the UPI platform. RBI Governor Shaltikanta Das said that the basic objective of linking credit cards to UPI is to provide a customer with a wider choice of payments.

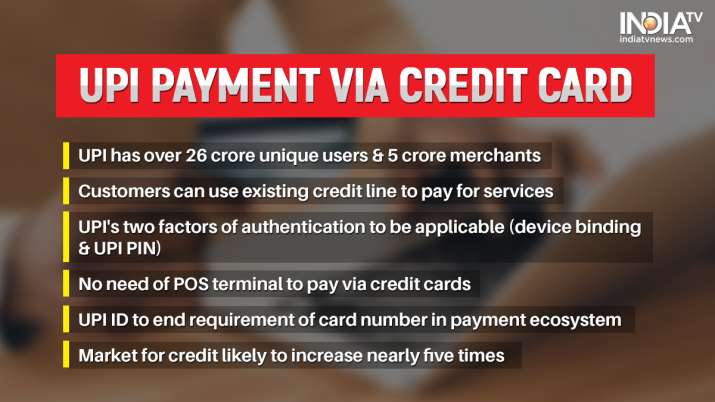

Going by the RBI data, UPI has over 26 crore unique users and 5 crore merchants. The central bank’s data show that 594.63 crore transactions amounting to Rs 10.40 lakh crore were processed through UPI in May.

To begin with, the central bank said that it is allowing the facility to be availed through RuPay credit cards. Although the Rupay network, billed as an indigenous alternative taking on global biggies like Mastercard and Visa, has a low market share in the segment, experts say that the RBI’s decision has the potential to expand the market for credit by nearly five times. The overall credit outstanding against credit cards stood at Rs 1.5 lakh crore as of April.

UPI payment via credit card: How it will work

Dinesh Khara, chairman, SBI, said that linking credit cards to UPI will be very similar to linking debit cards. It will add more avenues and convenience to customers in making payments through the platform.

Mehul Mistry, global head strategy, Digital Financial Services and Partnerships at Wibmo, A PayU company, said that the decision will promote customer convenience and digitisation. He said linking credit cards with UPI will allow customers to make transactions using the same credit line at merchant establishments that accept UPI payments.

“Therefore, there is no additional credit risk on those customers,” he said, adding that there shouldn’t be any additional threat or financial frauds given the UPI framework that works on two factors of authentication — device binding and UPI PIN. “Both will apply for UPI transactions as well as for linked credit cards. In fact, UPI also helps tokenized cards by creating a token (UPI ID) which ensures that the card number doesn’t travel in the payment ecosystem.”

No need of POS

Pranay Jhaveri, MD, India & South Asia, Euronet Worldwide, said the move will drive higher card utilisation levels and increase per card spending for banks that operate a higher share of Rupay cards. Customers can now make payments to the merchant who doesn’t have a point-of-sale (POS) terminal for processing payments via cards.

“Traditional UPI apps were using the facility to pay the beneficiary directly from bank accounts. The addition of RuPay credit cards adds a credit line facility to UPI. Having a choice of payment, benefits both the merchant and the customer, as now the UPI payment can be done using a RuPay credit card without the merchant having a card-enabled POS terminal,” Pranay said.

How much will banks charge for the service?

Now comes the pricing part. The central bank has not announced any charges for using credit cards for UPI payments and left it to the banks to decide the pricing.

To a specific question pointing out the differences between UPI and credit cards from a usage fees perspective, Mehul said going into the pricing structure for such a service right now will be akin to jumping the gun.

At present, making UPI payments via a debit card or saving account is free. The mechanism is, however, slightly different when it comes to making payments via a credit card. Credit card companies usually depend on the merchant discount rate (MDR), which is charged on every usage for making merchant payments as a revenue stream.

READ MORE: RBI allows credit cards to be linked with UPI platform

Latest Business News

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.