UK at greater risk of mortgage default wave than international counterparts

The UK is at greater risk of being jolted by an uptick in mortgage defaults during the global economic slowdown, a top Wall Street bank has warned.

Goldman Sachs reckons the country will undergo a bigger unemployment surge compared to fellow English speaking countries, dealing a heavy blow to households’ capacity to pay off home debts.

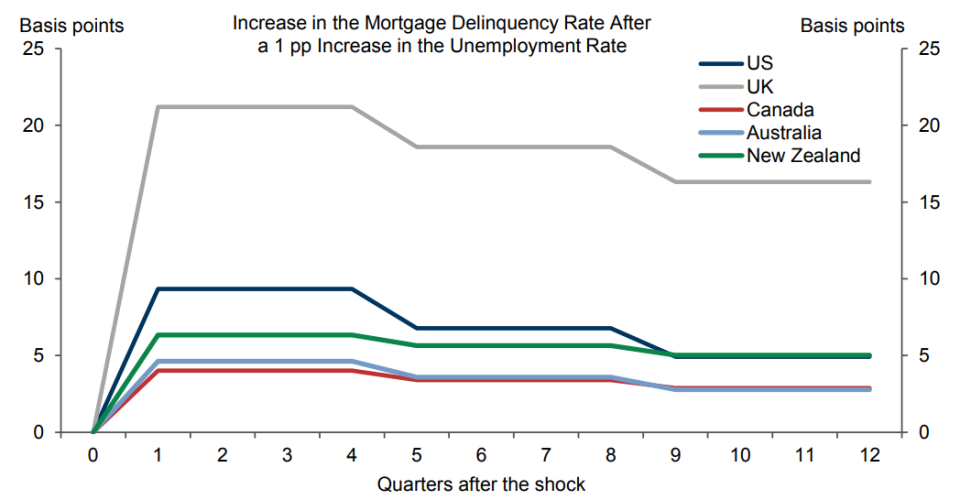

A one percentage point jump in joblessness results in a 20 basis point rise in mortgage defaults in Britain, Goldman estimated.

Unemployment has actually held low and is running at the lowest level since the 1970s, although this has been partly driven by an exodus of workers from the jobs market.

Spending power in the UK is on course to drop quickly over the next two years, fuelled by pay growth failing to keep pace with historically high inflation, which is currently running at 40-year high of 10.1 per cent and is expected to stay over the Bank of England’s two per cent target until the middle of 2024.

“Income shocks pose a significant risk to defaults in the UK,” Goldman said.

Higher unemployment in UK drives up defaults more than other countries

Last week, the Bank of England forecast around 2m homeowners could face a £3,000 jump in their annual mortgage bills when they refinance due to banks passing on soaring UK debt rates sparked by Liz Truss’s mini-budget.

It also said the country is on course for the longest recession on record, at eight consecutive quarters, if interest rates climb to 5.25 per cent, as priced in by financial markets in mid-October.

Governor Andrew Bailey said that is unlikely and that mortgage lenders should not have raised rates so steeply after the mini-budget.

Average rates are now over six per cent, a huge jump from last year when they were hovering around two per cent amid rock bottom borrowing costs set by the Bank.

Goldman said the US, Canada and Australia are much less likely to undergo an uptick in mortgage defaults, due to a combination of homeowners locking in debt for longer, a less severe rise in unemployment and a weaker living standards hit compared to the UK.

Housing debt in the UK looks more shaky due to “the shorter duration of UK mortgages, our more negative economic outlook, and the bigger sensitivity of default rates to downturns,” the Wall Street titan warned.

Figures from Halifax and Nationwide, two of Britain’s largest mortgage lenders, revealed house prices dropped over the last month as demand is whacked by tighter financial conditions.

The Bank of England has raised rates eight times in a row, including a 75 basis point rise last Thursday, the biggest move in over 30 years. Rates are now three per cent, up sharply from 0.1 per cent this time last year.

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.