UK and EU at risk of losing green energy projects to US unless investment matched, two fast-growing firms warn

The UK and European Union (EU) are at risk of losing green energy projects to the US – if they fail to match its new investment environment, warned two fast growing energy companies.

James Basden, founder and director of clean energy storage specialist, Zenobe Energy (Zenobe), told City A.M. that his company was going to “accelerate what we’re doing in America because of the tax credits.”

He said: “We’re not alone. The UK and the EU are going to have to change, I’m afraid, because markets move very fast.”

Zenobe has been establishing roots in the US over recent months, signing a memorandum of understanding with JERA Americas, the US subsidiary of Japanese power company JERA, to jointly develop utility-scale battery storage projects in New York and New England.

The company mission statement is “to make clean power accessible across the world.”

So far, it has secured funding to pursue e-buses and charging infrastructure, alongside large-scale battery facilities in the UK – which aim to provide renewable energy in response to wind farms being switched off, as an alternative to gas supplies.

Nils Aldag, chief executive of German hydrogen technology experts Sunfire, was also weighing up the possibility of pivoting projects and investment Stateside if the EU failed to provide with more support.

“We will have to consider the US if we do not see Europe respond in time,” he said.

The looming possibility of a mass exodus of clean energy players follows the passing of the US Inflation Reduction Act in Washington last August.

The legislation, ostensibly focused on reducing the deficit, provides significant opportunities to invest in renewables.

The bill will raise $738bn, which includes $391bn of committed spending on clean energy – making it the largest piece of federal legislation ever to address climate change.

This includes $128bn for renewable energy and grid storage, $30bn for nuclear power, $22bn for home improvements and $13bn for electric vehicle incentives.

It also features hefty production tax credits to help US manufacturers accelerate production of solar panels, wind turbines, batteries, and process key minerals.

By contrast, the UK has imposed a fresh levy on electricity generators, snatching 45 per cent of revenues for legacy operators that have provided clean power to meet the country’s energy needs for decades.

EU has to back green energy goals with policies

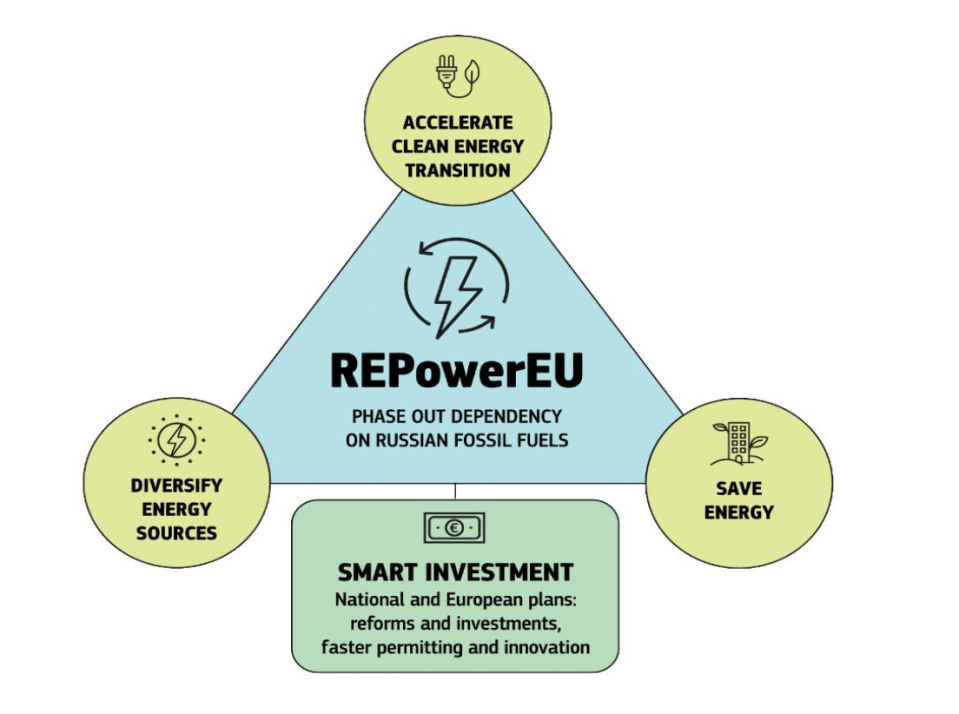

The EU has its own ambitious generation targets for renewable energy as part of its RePowerEU plan – designed to reduce its reliance on Russian imports following the country’s invasion of Ukraine last year.

Sunfire is a nascent, high-quality electrolysis company, developing hardware for green hydrogen production industries and businesses developing green energy projects.

This makes them highly appealing to the EU, which has included 200GW of hydrogen generation over the coming decade – including 10m tonnes of production and 10m tonnes of imports.

However, Aldag feared Europe was missing the “unlocking factor” of regulation and support schemes to allow its hydrogen goals to be realised.

He said: “It’s really the regulatory framework in Europe that is that is not yet sufficiently in place for this target to actually be met. The US has basically given a whack to the whole industry, and European regulators understand they have to act quickly now.”

In his view, the EU and US were not just competing for projects and could be each other’s second market if an attractive investment environment was created across the West.

This would ensure a strong market to compete with the growing influence of China and India in the renewables sector.

The EU has initiated plans to take on Biden’s legislation, through loosening subsidy restrictions and speeding up permits across the bloc for green energy projects.

EU Commission President Ursula von der Leyen announced at the World Economic Forum in Davos yesterday that Brussels would also water down state aid rules and offer more funding support to strategic industries that were climate friendly.

She said: “To keep European industry attractive, there is a need to be competitive with offers and incentives that are currently available outside the European Union.”

UK waking up to Biden’s challenge

In the UK, the response has so far been more muted despite its own highly aggressive generation targets for domestic renewable production over the coming decades.

However, the publication of Tory MP Chris Skidmore’s net zero review suggests there could be more pressure in Westminster on the Government to compete with the US.

In his report, Skidmore labelled net zero as the “economic opportunity of the 21st century’ and called for more and called on the Government to boost investment in green energy projects.

| Energy Source | Current Generation | Target | Date |

| Solar | 14GW | 70GW | 2035 |

| Offshore wind | 11GW | 50GW | 2030 |

| Hydrogen | <1GW | 10GW | 2030 |

| Nuclear | 7GW | 24GW | 2050 |

BEIS Select Committee member Alexander Stafford told City A.M. the “global race to net zero is well and truly on”.

The first step, in his view, was to offer clean energy firms an investment allowance in line with the windfall tax for oil and gas firms, so that the Electricity Generator Levy does not “deter investment and push firms overseas.”

He said: “The US hopes to lure electric car manufacturers and renewable energy firms into crossing the pond through its Inflation Reduction Act’s generous tax credits. If the UK is going to compete, ensuring these new industries and better-paid jobs come here, we need to back these clean enterprises wholeheartedly.”

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.