Twitter could go bankrupt, Elon Musk warns; SoftBank books heavy Vision Fund loss

Also in this letter:

■ SoftBank unveils more Vision Fund pain with FTX writedown

■ Ola says it will shut ‘connected car’ service Ola Play on Nov 15

■ Foxconn plans to quadruple workforce at India plant

Musk warns Twitter could go bankrupt; more senior executives quit

Elon Musk warned Twitter employees on Thursday (early Friday India time) that the company he bought two weeks ago for $44 billion faced the possibility of going bankrupt.

The billionaire’s admission capped a chaotic day, which included a warning from a US privacy regulator and the exit of three senior Twitter executives.

Bankruptcy concerns: On his first mass call with employees, Musk said he could not rule out the possibility that Twitter would go bankrupt.

Reuters reported, citing credit experts, that Musk’s deal for Twitter left the company’s finances in a precarious position.

Twitter has $13 billion in debt after the deal and faces interest payments totaling close to $1.2 billion in the next 12 months. The payments exceed the company’s most recently disclosed cash flow, which amounted to $1.1 billion as of the end of June.

Senior execs quit: Yoel Roth, who has overseen Twitter’s response to combat hate speech, misinformation and spam on the service, resigned on Thursday, two people familiar with the matter told Reuters.

Chief privacy officer Damien Kieran and chief compliance officer Marianne Fogarty also quit.

Some media reports said Robin Wheeler, the company’s top ad sales executive, was also leaving, but Wheeler denied this, tweeting, “I’m still here.”

Regulator perks up: The US Federal Trade Commission said it was watching Twitter with “deep concern” after the three privacy and compliance officers quit. These resignations potentially put Twitter at risk of violating regulatory orders.

Musk attorney Alex Spiro told some employees in an email late on Thursday that Twitter would remain in compliance.

Musk’s Twitter’s takeover has also sparked concerns that he could face pressure from countries that try to control online speech.

SoftBank unveils more Vision Fund pain with FTX writedown

SoftBank Group reported its first quarterly profit in three quarters, buoyed by the sale of some of its stake in China’s Alibaba even as its massive Vision Fund unit posted another heavy quarterly loss.

FTX exposure: The sprawling Vision Fund, which upended the world of technology with its big bets on startups, will also write down its investments in troubled crypto exchange FTX to zero, a source close to SoftBank told Reuters. Those investments amounted to less than $100 million, the source added.

The complications at FTX mark the latest difficulty for Vision Fund, which has been hammered in recent quarters by a global tech rout, prompting SoftBank boss Masayoshi Son to sharply scale back fresh investments.

The source said bailing out FTX, which was valued at $32 billion in January but is now scrambling to raise about $9.4 billion, would be a question for larger investors, as the tech conglomerate retrenches to cut costs and refocuses on managing its existing portfolio.

Losses force cuts: Vision Fund plans to cut staff by more than 30%, its chief financial officer Navneet Govil told analysts on Friday.

Vision Fund’s investment losses were 1.38 trillion yen ($9.75 billion) in the three months to September 30 as the value of its portfolio continued to slide. That brought the fund’s total cumulative investment loss to around $60 billion in the nine months to end-September.

Son to go silent: Son told a briefing this would be the last time he would speak at a post-earnings briefing for the “foreseeable future”, adding he had no health issues and would focus his additional time and energy on business opportunities related to British chip designer Arm.

“For at least the next few years, I plan to focus solely on Arm’s forthcoming explosive growth, while other (SoftBank) businesses will remain defensive,” Son said. “I’m good at offence by nature. I would like to focus on offence for Arm.”

Ola says it will shut ‘connected car’ platform Ola Play on Nov 15

.jpg)

In a public notice published in a newspaper on Friday, ride-hailing firm Ola said it will shut its ‘Ola Play’ service in India on November 15. The company said its parent firm ANI Technologies has taken appropriate measures to remove Ola Play from the market.

‘Connected cars’: Ola had launched Ola Play in 2016 as a ‘connected car’ platform, with music and other value-added services. Ola Play cabs were listed separately on the Ola app and charged a higher fare.

Ola Play was launched with the aim of attracting premium customers who were, at the time, moving to Uber. Initially, drivers were keen on having the tabs installed in their cars as they attracted higher fares. However, Ola started facing issues with the project, especially with the advertising model, with cost-per-click and cost-per-view metrics being lower in India.

Uber dives into ads business: The development comes at a time when Ola’s rival Uber has started piloting in-car tablets to display ads and other value-added services to riders in Delhi and Mumbai as part of a global rollout, as we reported in September.

ETtech Deals Digest

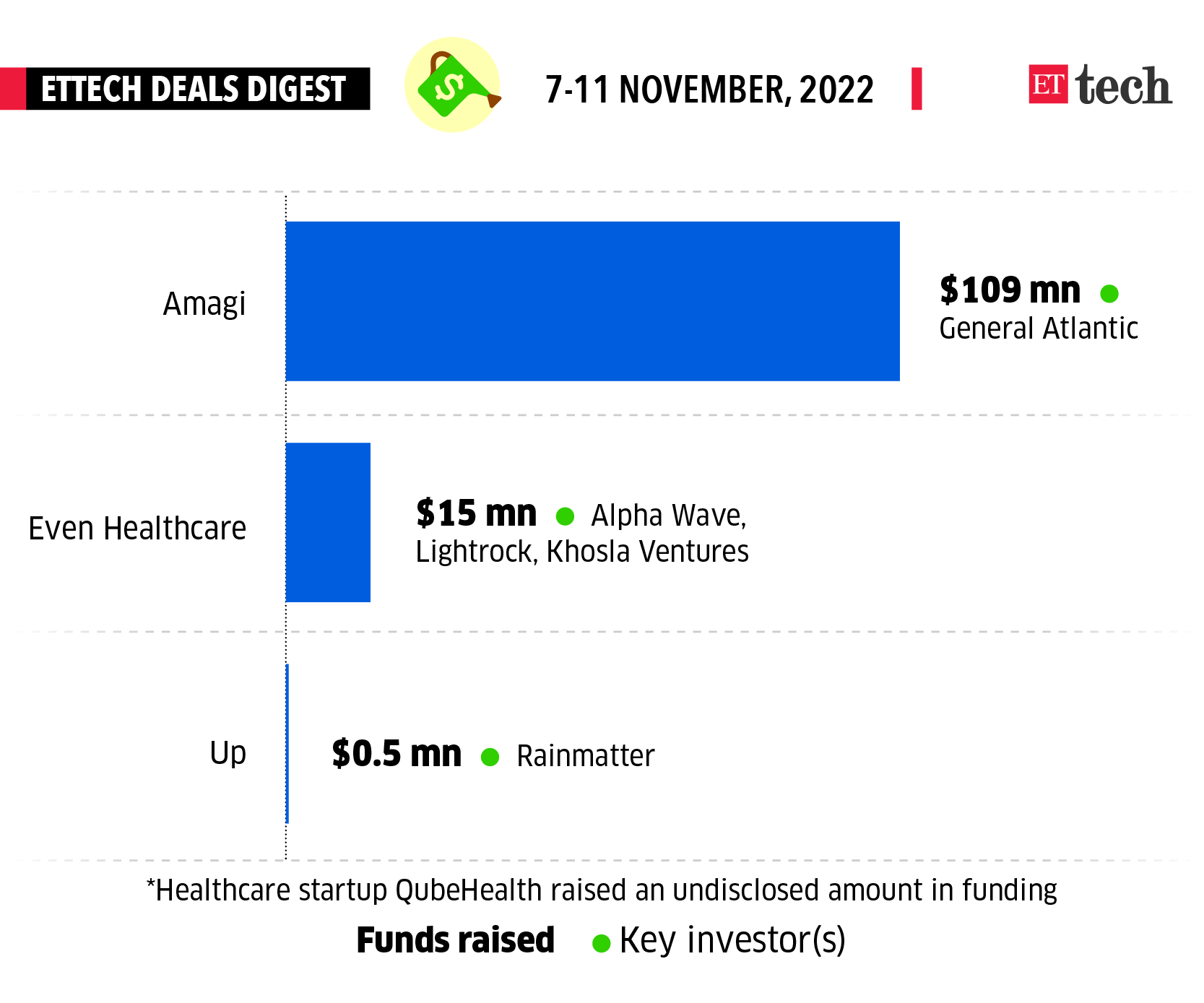

It’s the second week of November, a time typically marked by chilly winter winds in north India. For Indian startups, though, it’s been winter all year long. The cold spell of funding for Indian startups continued this week, with things only looking worse for many established startups. The week was marred by news of layoffs at both Indian and foreign startups, as well as Big Tech in the US. Edtech startup Unacademy cut 10% of its workforce, laying off 350 people, while Meta announced it would sack as many as 11,000 workers.

There was a tiny ray of sunshine for Indian startups, though. The International Financial Service Centre Authority (IFSCA) announced a grant for fintech startups, starting from early next year. The IFSCA Fintech Incentive Scheme will have six grants ranging from Rs 15 lakh to Rs 75 lakh. Another piece of good news came from the Indian insurance regulator, IRDAI, which proposed to the government that insurance companies be allowed to buy more than 10% of unlisted companies. Currently, insurers cannot invest in unlisted firms without IRDAI’s approval.

Here’s a list of all the startups that raised funds this week

TWEET OF THE DAY

Apple supplier Foxconn plans to quadruple workforce at India plant

Apple supplier Foxconn plans to quadruple the workforce at its iPhone factory in India over two years, two government officials with knowledge of the matter told Reuters, pointing to a production adjustment as it faces disruptions in China.

Taiwan-based Foxconn now plans to boost the workforce at its plant in southern India to 70,000 by adding 53,000 more workers over the next two years, the sources said.

China curbs: Foxconn has grabbed headlines in recent weeks, with tight virus restrictions at its Zhengzhou plant, the world’s largest iPhone factory, disturbing production and fuelling concerns over the impact of China’s virus policy on global supply chains.

The disruptions prompted Apple to lower its forecast for shipments of the premium iPhone 14 models this week, dampening its sales outlook for the busy year-end holiday season.

Also Read: Pegatron follows Foxconn to make iPhone 14 in India

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai. and Siddharth Sharma in Bengaluru. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.