Truss mini-budget boosts Brits’ confidence as experts warn against austerity 2.0

Brits’ confidence in their finances and the economy bumped higher in the aftermath of former prime minister Liz Truss’s mini-budget, a closely watched survey published today reveals.

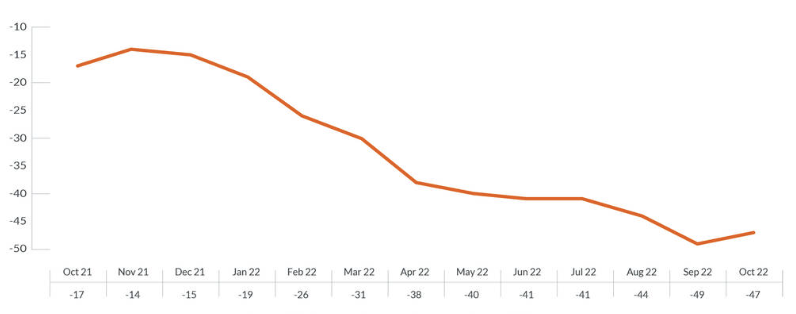

Consumer confidence rose for the first time since last November this month, up to minus 47 from a record low minus 49, according to research firm GfK.

Optimism in the trajectory of the economy jumped seven points over the last month, while confidence in personal finance rose six points over the same period.

On 23 September, Truss froze typical household energy bills at £2,500 for two years and cut taxes by £45bn.

The measures were roundly assessed by economists to have averted what was likely to be the biggest hit to household living standards on record.

Consumer confidence has plummeted this year

However, the scale of government needed to fund the measures sparked turmoil on UK financial markets, driven by investors sweating over the country’s financial credibility and demanding a higher return to buy bonds.

In the days after the mini-budget, yields on the 30-year gilt hit their highest level in over 20 years and the pound hit its lowest level against the US dollar on record.

Severe market volatility forced Truss – now the shortest serving prime minister on record at 44 days – to U-turn on nearly everything in last month’s package, eventually prompting her resignation.

There are doubts over whether the new prime minister will stick to the existing 31 October fiscal statement date in which current chancellor Jeremy Hunt is expected to roll back government spending or raise taxes to plug a £40bn hole in the public finances.

Analysts said pulling government spending at a time when households are grappling with a 40-year high inflation rate of 10.1 per cent would weaken the UK economy.

Brits “are now facing the likelihood of tax rises and even austerity measures,” Joe Staton, client strategy director at GfK, said.

“For ordinary consumers, this web of uncertainty and turmoil amounts to a ‘new abnormal’. The negative environment will deflate future spending plans, and cautious consumers could easily slow the UK economy still further,” he added.

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.