Trouble brewing for online marketplaces as govt eyes ‘related party’ services ban; TCS in for major leadership rejig

This and more in today’s ETtech Morning Dispatch.

Also in this letter:

■ Opposition MPs raise concerns over Data Protection Bill

■ Airtel Nxtra to double down on smaller cities

■ Paytm allows wallet users to pay via UPI QR codes

Ecomm, food-delivery firms face fresh trouble as govt may ban related party service

Hi, this is Pranav Mukul in New Delhi. Today, my colleague Digbijay and I are reporting on the central government’s discussions to chart out the country’s ecommerce regulations which were put forth first in 2021.

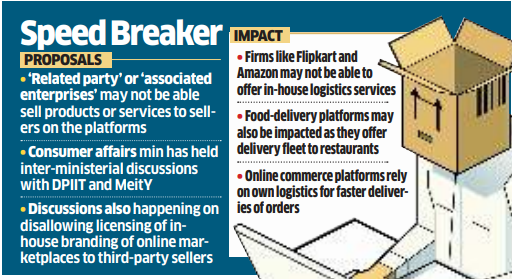

What’s the latest? The consumer affairs ministry is leading the latest round of inter-ministerial deliberations, which were held earlier this month. In the proposed e-commerce rules, for which the talks are being held, the government wants to prevent ‘related parties’ or ‘associated enterprises’ from engaging in business lines that online marketplaces operate in. Two entities would be considered associated enterprises, if one holds direct or indirect economic participation through equity or otherwise, or if they are affiliates. Here, being an affiliate means control of two entities directly or indirectly being with one person or entity.

What’s the significance? It will essentially mean that companies like Flipkart and Amazon India cannot offer their in-house logistics services, Ekart and Amazon Transportation Services, to their merchants. Even food-delivery platforms like Zomato and Swiggy, which offer their delivery fleet to restaurant partners, would come under the purview of a proposed clause on related parties or associated enterprises.

What else is important: Talks are also ongoing around stipulating marketplaces to not license in-house branding to third-party sellers who will sell it online. For instance, Amazon Solimo cannot be licensed to outside vendors if it ends up getting finalised into rules issued by the government.

Catch-up quick: The rules under discussion pertain to ecommerce regulations that the Consumer Affairs ministry had proposed in 2021. At the time, online retailers including Walmart-owned Flipkart, Amazon and even the Tata Group had raised red flags over some of the provisions of the draft rules.

TCS set for major top-level reorganisation

IT major Tata Consultancy Services (TCS) is poised for a widespread reorganisation of its top leadership, including the positions of chief technology officer (CTO) as well as chief operating officer (COO) with two top executives set to retire in the coming year, people aware of the matter said.

Upcoming rejig: India’s biggest software exporter will also pick a new name for its largest vertical – banking and financial services. Sources told us that four to five candidates are being evaluated to fill the position vacated by its newly appointed CEO K Krithivasan.

Probable names: Harrick Mayank Vin, the chief services innovation officer, is likely to take charge as CTO following the retirement of K Ananth Krishnan in October, while president of the enterprise growth business Krishnan Ramanujam is among the front runners to take over as COO following the retirement of TCS veteran N Ganapathy Subramaniam in May 2024.

Catch up quick: Earlier on March 16, Rajesh Gopinathan unexpectedly resigned as chief executive and managing director. The board appointed Krithivasan as CEO-designate with effect from March 16. At 59, Krithivasan is among the senior most candidates to be appointed to the role at the company. Gopinathan will stay on till September to oversee the transition.

Opposition MPs propose over 40 changes in Data Protection Bill

Several Parliamentary panel members have mooted close to 40 amendments in the draft Digital Data Protection (DPDP) Bill, 2022.

Details: Among concerns raised by Opposition party MPs of the Standing Committee on Information Technology (IT) were excessive centralisation of power, a lack of independence of the Data Protection Board, blanket exemptions to some data fiduciaries and unchecked exceptions provided to the government in the draft Bill.

Members also flagged the alleged lack of attention to protecting children’s data and the impact on the Right to Information (RTI) Act.

MP speak: Karti P Chidambaram, MP (Congress), Jawahar Sircar, MP (Trinamool Congress), and John Brittas, MP (CPI-M) told ET they plan to raise these issues in the next meeting of the committee.

“We may have more than 40 suggestions for the draft Bill in its current form,” Brittas said.

“I have raised concerns around excessive centralisation of power with the government, lack of independence of the Data Protection Board, blanket exemptions to some data fiduciaries, unchecked exemptions to the government and lack of attention to the protection of children’s data,” Chidambaram told us.

What does the draft bill say? According to the draft Bill, the chief executive entrusted with the management of the affairs of the board shall be an individual the central government may appoint, and the terms and conditions of her service shall be as the central government may determine. Experts say this could limit the independence of the board.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Airtel Nxtra to double down on tier II, III cities fuelled by local data consumption

Nxtra, telecom operator Bharti Airtel’s data centre subsidiary, is planning to expand its presence in tier-II and -III cities such as Lucknow, Sambalpur and Ludhiana. It is also aiming to increase its investments in these cities in the next one-two year, given the increase in data consumption in the country, its top executives told us.

CEO speak: “A lot of consumer-led businesses (like banks and OTT players) would like to be as close as possible to their consumers and therefore these smaller cities become attractive,” Nxtra chief executive Ashish Arora said.

Go deeper: Consumption of low latency applications such as augmented reality, virtual reality and gaming will also “definitely” increase in these cities due to 5G adoption and will further drive demand for local edge cloud services for data storage.

Talking about the impact of demand deceleration seen by large cloud services players, or hyper scalers, such as AWS, Azure or Google, Arora said the India market is still in its infancy and therefore relatively immune to macro headwinds, while the US market is way more matured in terms of cloud adoption.

TWEET OF THE DAY

Paytm allows wallet users to pay via UPI QR codes

After the Reserve Bank of India (RBI) mandated all Prepaid Payment Instruments (PPI) like wallets to be interoperable with Unified Payments Interface (UPI) and card networks by March 31 last year, Paytm Payments Bank Ltd (PPBL) has extended complete interoperability, with wallet users now able to pay by scanning UPI codes.

Interchange revenue: Paytm said in a statement that the “Bank (PPBL) will earn 1.1% interchange revenue when its wallet customers (i.e., the KYC wallets issued by Paytm Payments Bank) make payment on merchants acquired by other payment aggregators or banks”.

After last year’s order, fintech firms found it difficult to fully implement RBI’s order due to issues around zero merchant discount rates (MDR) for UPI and interchange fees.

PPBL will pay 15 basis points (bps) as charges for adding more than ₹2,000 using UPI, and in turn, will also earn 15 bps when any other wallets use the bank to add more than ₹2,000 using UPI, it said.

Other Top Stories By Our Reporters

Oyo tells staff it expects Rs 800-crore adjusted Ebitda in FY24: Oyo founder Ritesh Agarwal told employees in an internal town hall on Monday that it expects to clock adjusted Ebitda of nearly Rs 800 crore in the upcoming financial year 2024. The company’s current cash corpus on the balance sheet is Rs 2,700 crore. Agarwal told staffers this can be attributed to ‘’sustained growth’ in India, Indonesia, the US and the UK besides ‘relevant optimisations’ and ‘synergies’ in the European vacation homes market.

Big announcement on an Indian version of ChatGPT soon, says IT minister: In a few weeks, India can expect a “big announcement” on the Indian equivalent of OpenAI’s chatbot ChatGPT, revealed union IT Minister Ashwini Vaishnaw on Friday. When asked if India will be able to produce an Indian equivalent of ChatGPT, without divulging any specifics, he said, “Wait for a few weeks, there will be a big announcement”.

Global Picks We are Reading

■ Uber Eats to Take Down Thousands of Virtual Brands to Declutter the App (WSJ)

■ ChatGPT Opened a New Era in Search. Microsoft Could Ruin It (Wired)

■ The swagged-out pope is an AI fake — and an early glimpse of a new reality (Verge)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.