This 529 savings plan myth is making college pricier for families, consultant says: ‘It’s candidly, blatantly not true’

Kevin Dodge | The Image Bank | Getty Images

SEATTLE — For many families, paying for college is a financial burden, and experts say education-funding myths may be adding to the student loan debt crisis.

“There’s often this perception that somehow people are being penalized for saving for college,” said Cozy Wittman, national education and partnerships speaker with College Inside Track. “It’s candidly, blatantly not true.”

Parent-owned 529 college savings plans are assessed at 5.64% when filing the Free Application for Federal Student Aid, known as the FAFSA, she said, speaking at the Financial Planning Association’s annual conference on Tuesday.

That means for every $10,000 of 529 plan savings, roughly $564 counts toward the parents’ expected family contribution, potentially reducing financial aid by roughly the same amount, according to the College Savings Plans Network.

More from Personal Finance:

3 unexpected financial pitfalls unmarried couples needs to know

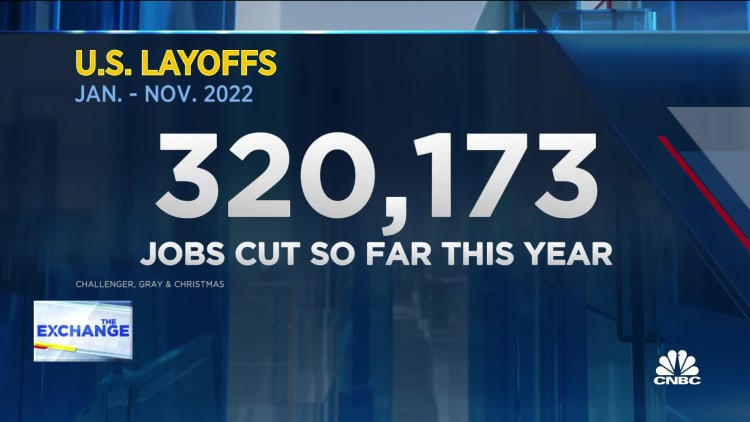

Here’s the inflation breakdown for November 2022 — in one chart

IRS: Why ‘early filers’ should wait to submit their tax return in 2023

A 529 plan offers several benefits: The owner keeps control of the funds, there’s tax-free growth for qualified expenses and flexibility to change the beneficiary, Wittman said.

The average 529 account value was $30,287 in 2021, the College Savings Plans Network reported.

Grandparent 529 savings won’t count on the FAFSA

However, recent FAFSA changes scrapped that rule, effective for the 2023-2024 school year, meaning “grandparents’ [529 plan] savings has no impact on the student,” she said.

“This has real-world implications for where people save,” Wittman said.

While many grandparents like contributing to parent-owned 529 plans rather than opening their own, “it would actually be smarter today to flip that around,” she said.

Why to consider colleges with price ‘flexibility’

There’s also a lack of knowledge around college pricing, Wittman said. “This concept that public schools are cheap and private schools are expensive does not serve the narrative well.”

“The way to think about college today is not public and private,” she said, noting that it’s better to explore which schools may have flexible versus inflexible pricing.

Wittman said the easiest way to find schools with merit-based scholarships is by comparing the acceptance rates. Typically, when the acceptance rate is below 20%, “there’s no incentive for them to give away money,” she said.

However, “colleges are the No. 1 provider of scholarship dollars,” and there’s generally more money to give at private schools, Wittman said.

Ideally, you’ll want to begin the college search during the student’s sophomore or junior year, she said. “You can’t do a great college search if you start a month before applications are due,” she said.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.