There is a fundamental flaw in the crypto economy

by VJ Angelo

In 2018, I joined the growing ranks of crypto entrants. I was driven there looking for a technology solution for a major problem in the Fixed Income Futures markets. During that time, I was fortunate to witness both the peak and crash of the crypto and ICO markets during that time. I say “fortunate” as the experiences were very enlightening in terms of learning how the market was operating in those days.

Four years later, I am learning more about how the market has evolved, what lessons have been learnt and those that haven’t. By becoming more deeply involved with cryptocurrencies and digitisation through Inspira Wealth, I have become more analytical and critical, leading to a very high level of enthusiasm for the future of this new technology and economy, offset now, by a healthy level of criticism of its major flaws.

The growth and development, of the crypto market since 2018, has been very strong and has brought a new level of sophistication and innovation to the crypto economy. However, this growth, has also brought with it some major vulnerabilities, that have the potential to jeopardise the future of the crypto economy, if not addressed soon.

To understand the vulnerability, we first need to understand the growth of the crypto world over the last four years. In its simplest form, crypto has been market that has benefited from COVID in ways that others have not.

As with many financial markets, during COVID era, there was a sense of mystery in the early days as to why this market was growing and rose in value during one of the greatest economic challenges, humanity has faced in centuries. As economies around the globe came to a complete standstill, a collapse of the global economy seemed very likely. In a way, it is a testament to politicians the world over that we are now looking at a relative normalisation of economies. The solutions that were provided for COVID have presented us with some significant challenges which are now being exacerbated by geopolitical disruptions.

In an attempt to save the global economy, governments have pumped unprecedented amounts of cash into the pockets of corporations and individuals. Coupled with the fact that all discretionary and some essential spending stopped virtually overnight, led to huge amount of surplus capital being available for a very small number of opportunities.

Initially, the cautious began hoarding cash for even rainier days. “How long could the COVID last?”, “What would the world look like once it reopened?”. As the lockdowns wore on and people began to change their lifestyles, the question, “Do I want to go back to an office or full-time employment?”-, became a hot topic. So began the allocation of all that disposable cash.

The excess funds, were first used for new properties with more space or outside cities. Historic low interest rates offered a great opportunity to get out of the city and set up that long-term semi-COVID life. Then, came the question of how to sustain this new lifestyle.

Crypto slaked the thirst for quick returns

The number of novice traders and investors to stock, commodities, FX and other markets was overwhelming for the providers of trading platforms and eventually for the markets themselves. The search for quick returns drove many investors to crypto. Volatility and the prospect of high returns with relatively simple barriers to entry, brought a flood of fresh cash, investors and companies to crypto and token issuance. People could invest and see quick returns. Start a business and get money quickly and easily, without the many problems of the traditional debt and equity markets.

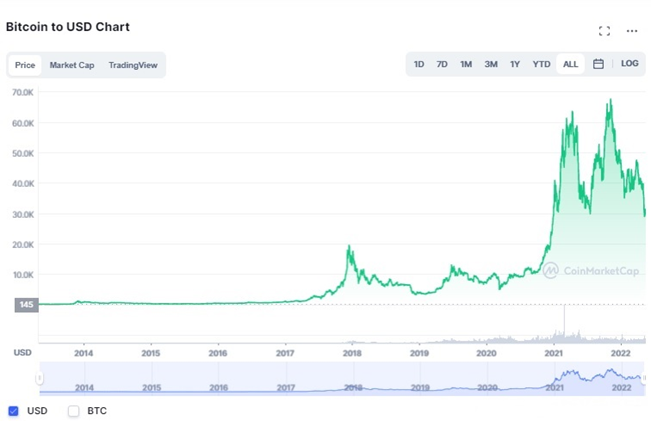

If we look at the pre-COVID crypto market charts, we see that BTC (market indicator and trend leader) was moving in a range between its lows of mid $3,000s and highs of mid $11,000s. $20,000 highs was never in danger. One could argue that a steady rise was taking place, but at that point all indications were, that it could be a long time coming. Nevertheless, liquidity was rising and with it, volatility, with the price trend positive. These are three key factors for the crypto economy to function, let alone thrive.

During the first lockdown in 2020 there was a combination of panic, risk off to get liquidity and a rapid need for cash reserves, while we understood what exactly the post-COVID world would look like and how long it would take us to get there. Crypto prices have held up relatively well all things considered, but are still in the $5-6,000 range.

A small tentative reopening of the economies in the summer of 2020 also distracted from the economic problems, briefly. As the world moved towards the inevitable second lockdown in late autumn of 2020, something strange happened. We got a taste of the “democratisation” of the financial markets. The term Robin Hood no longer stood for a man in tights, with a bow and arrow swinging through the forests of northern England like Tarzan. It now meant to bloody the noses of hedge funds and investment banks while making profits, often in a completely irrational way.

Fractional ownership, a term well-known to crypto participants and evangelists, had now arrived in the real-world economy. Fractional ownership of shares alerted everyone to the power of the small investor when added to all his peers. Along with the Robin Hood phenomenon, crypto came to the scene and set new highs. Covid-trapped-cash-rich-apple-computer-owners now bored and less fearful, were combining anger and frustration with a desire to make the most out of their excess cash.

A new economy of investors, “venture capitalists” and “crypto economy experts”- has come together to pour huge sums of cash to crypto companies and develop a range of products that promised huge returns. The pre-existing flaw in the crypto economy was now on steroids.

Traditional institutions, that had previously been sceptical and cautious either leapt in for the profits, or were pressured by their clients to act quickly. Family offices, investment banks, hedge funds and even conservative asset managers either invested or announced their intentions to remain relevant. Each new promise of liquidity reinforced price support, – and profits expectation. The market lived and breathed on the promise of new investors. Elon Musk, the never-ending story of profit and the clever use of PR and marketing, ensured a price spike for BTC and a coin that should be a warning rather than cause for enthusiasm. Doge was a tulip-like phenomenon.

Fast forward to the end of 2021, economies are opening up, offices are opening up, the cash stream into crypto is starting to slow, the price starts to drop, the market is trading in ever tighter ranges, volatility is drying up. A result of the combination of decreasing liquidity and increasing professional participants. Cryptocurrencies were experiencing the effects of becoming commoditised. The effect of market makers and institutional traders getting in on the act has something of a “be careful what you wish for” feel to it. The crypto flaw became increasingly apparent.

The flaw?

So, what is the flaw? The crypto market is totally reliant on a continuous stream of fresh cash to drive up prices. There are no other cash flows supporting the market save for a handful of genuine use cases. Returns can only be gained through a continuous rise in prices, requiring the influx of new cash into the market. If there is no new cash the system will start to stall. Businesses reliant on returns from selling assets increasing in price struggle to generate cash flow to meet operational costs, let alone continue to invest.

To generate new returns and prop up the markets, a rash of “staking” platforms developed. These lending and staking systems also relied on continuous liquidity, or high volatility to generate staggering and mostly unrealistic returns, over the medium to long term. As the market volatility slowed and cash injections reduced, these returns were no longer realistic. A readjustment of the rates of theses platforms began in Q1-Q2 of 2022. Then the inevitable happened. A major player in the lending staking arena failed. I will come back to this point.

Cryptocurrency as an asset class has suffered from naivety and inexperience in how economies workand develop over an extended period of time. The fundamental operating tenant of any economy is a return to its investors. It cannot survive purely on the never-ending increase in the price of its main assets. Cryptocurrencies need new cash and constantly rising prices to operate. For the vast majority of tokens, there is no return for the investor beyond the price of the token.

With the crypto price increasingly stuck in very tight ranges on a diminishing price level, it has become increasingly difficult to see returns for investors, in the way they have become used to. This has caused VC’s and investors to turn off the taps. There are no yields to rely on while the price recovery commences. Liquidity is drying up. As the press begins to publicize the market conditions new money shies away. Cautious money retreats or at best holds back.

The problem for cryptocurrencies comes from several directions, that exacerbate and compound the problem. Inflation has returned the traditional economy with vengeance. A set of circumstances that was predictable with so much cash injected into the economy. However, the addition of a massive energy price shock as a result of the Ukraine war, was not expected. The inflationary push is quickly hitting discretionary spending as household bills rise. Governments act in the only way they can, turning off the taps as well as raising interest rates. It’s a perfect storm for households, the likes of which have not been seen since the early 90s. Even the GFC did not have the same inflationary effect. All this means that investors liquidating the riskiest assets and anything that does not produce consistent returns to try offset the inflationary cost spiral that is currently hitting spending.

So, no new investments mean no new businesses can be opened, another important pillar of any economy and even more so the crypto market. Investments now must be held much longer in the hope of a price recovery, depriving businesses and investors of much needed cash for operational and capital expenditure. The first of what is likely to be a growing number of large crypto businesses starts to fail for precisely the very reasons that the crypto market is weak.

Terra’s failure laid bare

Terra began to fail for the simple reason that its entire model relied on a never-ending stream of new cash coming into the system. The company and its partner Luna, constantly needed more money to keep the system running. If there was any doubt about the underlying problem, their immediate reaction to solve the crisis was to take the Weimar Republic approach and try to mint/print their way out of trouble. Since this was their immediate reaction, it means consciously or otherwise, they were aware of how the system worked.

Before I announce the good news, let me summarize. Cryptocurrencies have very little substance in their investment structure. The investment structure itself, is deeply flawed as it is one dimensional. Large returns are based on constant price rises and new inflow of cash. There is no secondary return for investors that provides some cash flow or incentive to look more closely, at the company they are investing in.

Here is the good news. I believe in the crypto market’s intentions, for whatever that’s worth. Traditional financial markets need innovation and disruption. I believe I have met some incredibly intelligent, well-meaning people who can make the change they seek to the world. I believe in the technology solutions that are being developed and deployed, and I believe in the ability of cryptocurrency and digitisation to facilitate the creation and growth of wealth for their investors. I believe that they are already changing the next generations’ view of the world around them and giving them hope for a better future. I also believe that it is time for some of the naïve flaws in the market to be rectified.

Is there a solution that does not drag cryptocurrencies into the quagmire of the traditional economy or financial markets? We at Inspira Wealth believe there is. A solution that provides the opportunity to underpin a token purchase and create a solid more responsible foundation for this new economy. Not everyone will like or appreciate the content of this article. The important thing to remember is that every innovation goes through growing pains and adjustments. The dotcom economy proved what can be done. The dotcom crash of 2002, showed that a readjustment is not a bad thing. Now is the time for cryptocurrency to embrace this change and show its true strengths.

VJ Angelo,

CEO, Inspira Wealth

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.