‘The Language of Fraud’ is contributing to scams in Canada

Digital scams are more common than ever, and language has played an important role in popularizing them.

According to a recent analysis by Visa, fraudsters create messages that take advantage of people trusting “too-good-to-be-true texts and emails.”

Visa surveyed 6,000 adults from various countries, including Canada, Germany, and France.

The analysis found Canadians are more confident than those surveyed globally about recognizing scams; 58 percent of Canadians believe they know about fraudulent behaviours and can spot a scam, compared to 48 percent globally. But that doesn’t mean they aren’t vulnerable, and “The Language of Fraud,” as Visa calls it, plays a big role.

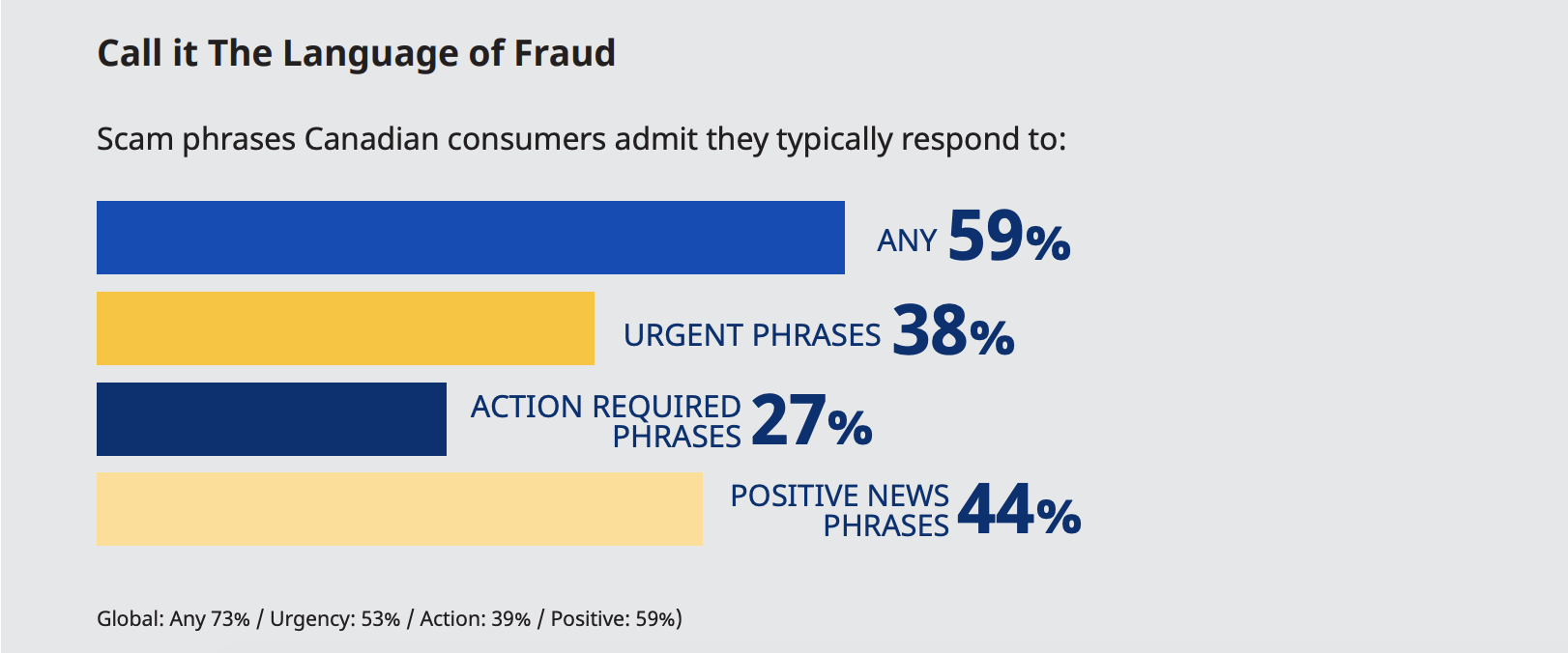

The analysis found 59 percent of Canadians respond to common phrases scammers use. For example, texts or emails containing “urgent,” “action required,” or “positive news” phrases typically receive a response. A further 35 percent of surveyed Canadians said they’ve fallen for a scam on more than one occasion.

“A turn of phrase can turn a simple click into a breach of personal information,” Visa said.

Image credit: Visa

But digital scams aren’t the only thing people need to be wary of.

Businesses also need to be aware of fraudulent activity. According to Moneris, a Canadian finance tech company, fraud cases have increased by nearly 30 percent since businesses have resumed regular activity following pandemic restrictions. Figures are based on fraud cases Moneris has investigated.

Nearly half of these incidents come from the card-not-present category. These transactions relate to remote orders that don’t involve payment cards being used through payment terminals.

Chargeback fraud is another important category. In this instance, a fraudulent transaction leads the scammer to get their money back after they dispute a charge on their payment card.

There are various actions Canadians can take to keep themselves and their businesses safe. Visa recommends Canadians update their password regularly and avoid clicking on links in unsolicited messages. Moneris warns businesses to protect their payment terminals and to review their transactions for suspicious activity regularly.

Image credit: Shutterstock

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.