Tech firms face record attrition; Delhivery files for IPO

Also in this letter:

- Key takeaways from Delhivery’s IPO filing

- Ola reports first operating profit ahead of potential IPO

- Google India’s profit rose 38% to Rs 808 crore in FY21

Highest attrition in a decade keeps IT recruiters on their toes

How many candidates does it take to fill one tech position? The answer is: at least five, if it’s an Indian company trying to hire.

The dream run for tech talent in India has led to record attrition rates and the buoyant market is keeping recruiters on their toes. They’re being forced to keep a shortlist of at least five candidates for one job posting, experts told us.

Attrition in the IT domain is at 24.4%, the highest in a decade, according to data from Aon, shared exclusively with us.

In their words: Tech hiring has become a headache for clients and consultants, said A Ramachandran, CEO, new business initiatives, at executive search firm EMA Partners India. “Given the massive surge in need for these talents across levels, we are looking at having five to six backup candidates for each mandate and still there is no surety of candidates taking up the offer,” he said.

Xpheno cofounder Kamal Karanth echoed this. “Technology hiring has become a game of talent funnel management. Depending on the digital skills you are hiring, an offer pipeline of at least 50-75% higher in the supply chain is a must for hiring companies to be able to get closer to the desired onboarding ratio,” he said.

Roopank Chaudhary, partner in Aon’s human capital business, said, “This is not surprising given that organisations are bouncing back and there is a surge in hiring demand, both for replacement hires as well as fresh hiring.”

Increments ahead: To cope with the record attrition, companies are planning steep increments and more promotions for digital talent in FY22, according to the Aon data.

While the payout for top talent is slated to be 1.7x of the average increment, it’s projected to be 1.9x for digital talent. And promotions as a percentage are higher for digital talent as well — 13.1% compared with 11.6% overall.

Reasons for leaving: The main reason behind the rush to leave jobs is not getting paid well enough. Other attrition drivers are limited growth opportunities, underutilisation of skill sets, and the nature of the work, according to the data.

Yes, but: IT services companies such as Mindtree and Wipro told us that attrition rates are likely to simmer down in the coming quarters. “The talent market continues to be competitive, reflective of the significant surge in demand after a challenging year and the magnitude of opportunities ahead of the IT services industry,” said a spokesperson for Mindtree. “We do not expect the current trends in attrition to continue for long.”

Delhivery files for Rs 7,460-crore IPO: the key takeaways

Delhivery filed its draft IPO papers with the markets regulator yesterday, joining a growing list of top-tier startups that have filed for IPOs after Zomato’s stellar listing in July.

Here are some key takeaways from Delhivery’s filing.

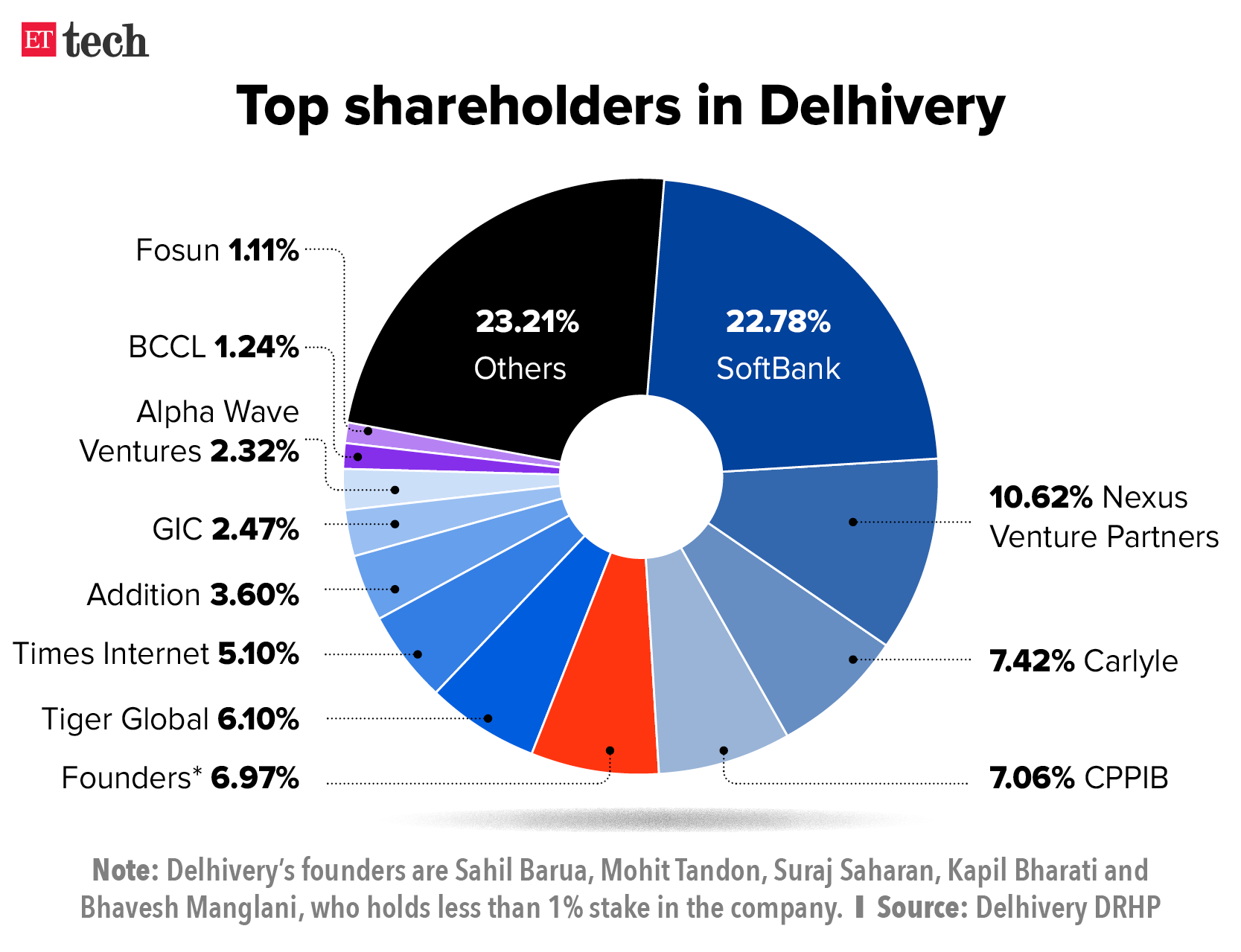

Selling shareholders: The new-age logistics company plans to raise Rs 7,460 from its IPO, including Rs 5,000 crore through fresh shares and the remaining through an offer for sale (OFS), in which Carylye, SoftBank and Times Internet others will dilute their holdings.

Kapil Bharati, Mohit Tandon and Suraj Saharan, three of Delhivery’s five founders, will also sell shares in the IPO, the DRHP said. Times Internet is part of the Times Group, which also owns ETtech. The company is seeking a valuation of around $6-6.5 billion for its listing, we reported earlier.

Pre-IPO round: In September, Lee Fixel, a former partner at New York-based investment firm Tiger Global, had invested $125 million in Delhivery through his fund Addition, partly through a secondary purchase of shares from China’s Fosun. The Chinese fund sold 1.32% of its 3.8% stake in the company, after which it was valued at $4 billion, we reported last month.

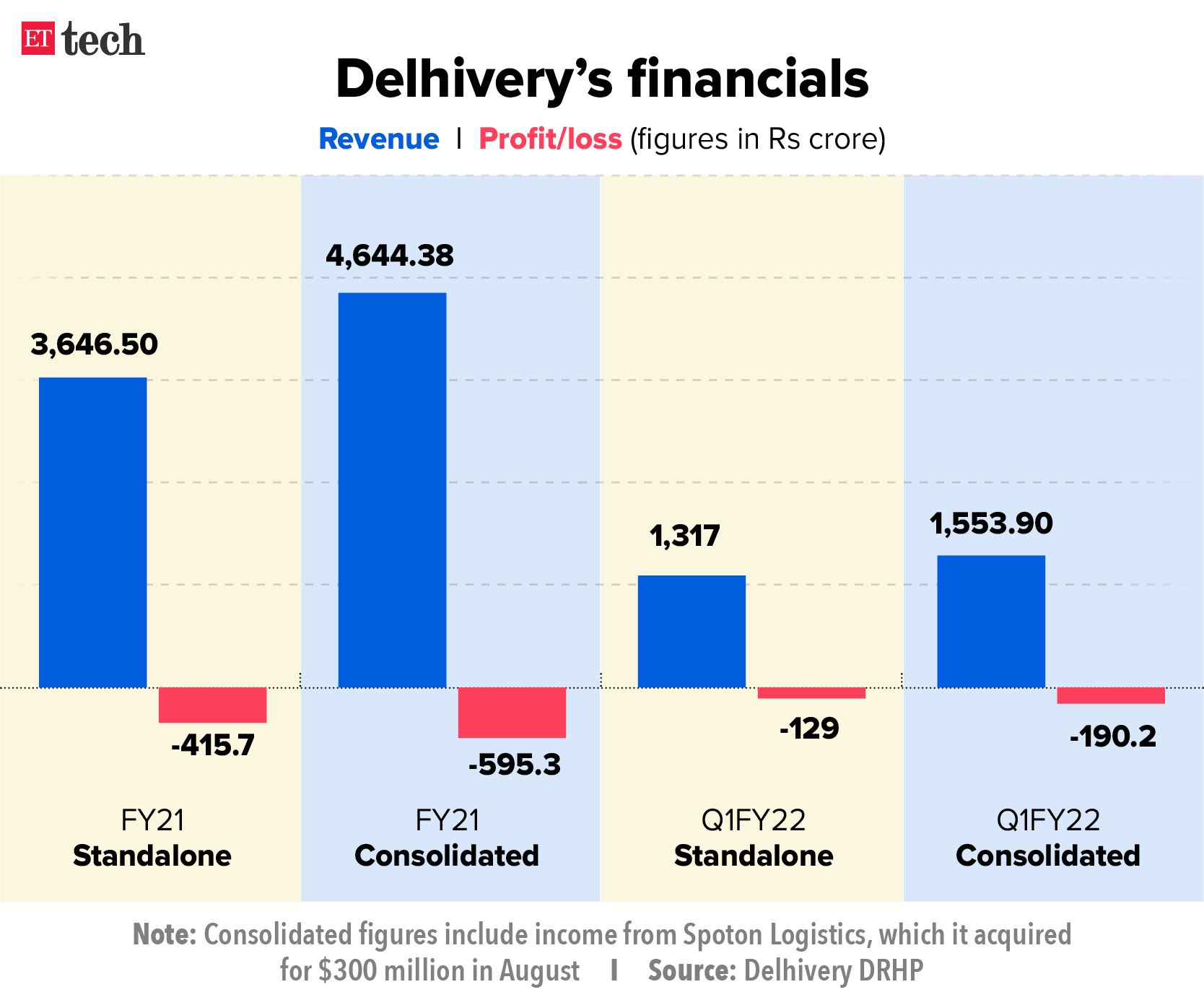

Financials: Delhivery reported consolidated revenue of Rs 4,644.38 crore and a loss of Rs 595.3 crore in FY21. These numbers include income from its subsidiary Spoton Logistics, which it acquired for $300 million in August.

Also Read: ETtech IPO Watch: A decade of Delhivery

Proceeds of the issue: According to its DRHP, Delhivery will spend around Rs 2,500 crore to fund organic growth initiatives and Rs 1,250 crore to fund inorganic growth through acquisitions and other strategic initiatives. It will use the remaining amount for general corporate purposes, the draft prospectus said.

IPO coverage: Policybazaar parent’s IPO fully subscribed on Day 2

Tweet of the day

Ola reports first operating profit ahead of potential IPO

Ola CEO Bhavish Aggarwal

Ola, which is backed by Japan’s Softbank Group, has recorded its first-ever operating profit since it was founded a decade ago, company documents showed.

The numbers: The company reported a standalone operating profit or earnings before interest, tax, depreciation and amortisation (Ebitda) of Rs 89.82 crore for FY21, versus a loss of Rs 610 crore in the previous fiscal.

Though revenue was down 65% from the previous year owing to the pandemic and lockdowns, Ola turned profitable on the back of aggressive cost-cutting and workforce reduction, according to its filing with the government.

IPO plans: As we reported earlier, Ola is exploring a public offering early next year, aiming to raise at least $1.5-2 billion at a valuation of $12-14 billion. It plans to raise half this sum by issuing fresh shares and half through an offer for sale (OFS), in which a few early backers will sell some or all their shares.

Last month, we reported that two top executives at the ride-hailing firm had quit amid preparations for the IPO. Ola’s chief operating officer Gaurav Porwal and chief financial officer Swayam Saurabh left the Bengaluru-based firm.

- Porwal had joined the Bengaluru-based company in 2019. He handled various assignments including roles in Ola Delivery and Ola Foods before he took over as COO last November.

- Saurabh, a veteran finance hand with more than two decades of experience, took charge as CFO in April. He was previously the CFO for Hindustan Zinc, Philips and has had stints at Asian Paints and L&T. He will be moving on to pursue other opportunities in mid-December, the mail said.

Growing footprint: Ola has a majority share of India’s ride-hailing market, where it competes with Uber. It also has a growing presence in several global markets such as Australia and the UK.

Google India’s profit rose 38% to Rs 808 crore in FY21

Google India’s profit jumped 38% to Rs 808 crore for the year ended March 31, regulatory documents sourced from business intelligence platform Tofler showed. The tech giant earned 73% of its revenue from providing IT and IT-enabled services, while the rest came from reselling of digital advertising space in India.

By the numbers

- Revenue rose 14% to Rs 6,386 crore from the previous financial year.

- Total expenses came in at Rs 5,297 crore.

- Google Payments India, which facilitates payment services for Google’s businesses in India, reported a 210% increase in profit to Rs 1.4 crore on revenue of Rs 14.8 crore for the year.

Market dominance: Google is the dominant player in internet search in India and controls a large chunk of the country’s digital advertising industry as well. The company’s Android operating system for smartphones has a market share of more than 90%, while YouTube has over 400 million users in the country. Google is also among the largest cloud services providers in the country, alongside Amazon Web Services and Microsoft’s Azure.

IT rules seriously undermine privacy, IFF says in rebuttal to govt’s FAQs

On Monday, the Ministry of Electronics and Information Technology (MeitY) released a document that it said was meant to “bring clarity” on Part II of the IT Rules, 2021. On Tuesday, the Internet Freedom Foundation (IFF) published a 12-point fact-check of the government’s “FAQs”.

Catch up quick: The rules themselves were notified in February and came into effect on May 26. Part II of the rules deals with the due diligence required by intermediaries and the government’s grievance redressal mechanism. When the government released the FAQs on Monday, it said the aim was to bring clarity and to “explain the nuances of the due diligence” that intermediaries must follow.

Yes, but: IFF said many claims were presented as facts in the document.

On public consultation: The first of these was MeitY’s claim that it had invited public comments on the draft rules in December 2018, and adopted the rules based on the comments and suggestions it received. IFF said that while there was indeed a public consultation in 2018, the IT Rules, 2021 are “drastically different” from the draft that was released back then. “No public consultation was held for this version of the rules,” it said.

On privacy: IFF also said the government’s claim that the rules “focus on protecting online privacy of individuals and are consistent with the fundamental right to privacy” was incorrect. It said the rules are not consistent with the right to privacy and in fact seriously undermine the right to privacy. “In particular, Rule 4(2) considerably weakens end-to-end encryption, which has now become the privacy standard for mobile-based messaging platforms,” IFF said. Rule 4(2) says messaging platforms such as WhatsApp, Facebook Messenger and Telegram “shall enable the identification of the first originator of the information on its computer resource as may be required by a judicial order passed by a competent court or authority”.

On traceability: IFF countered the government’s claim that intermediaries only have to be able to trace the first originator of a message or post when it directs them to do so. Instead, it said, such services would have to enable first-originator traceability for all texts, all the time, “since it is impossible to predict which message may receive an order against it for tracing of the first originator”.

Legal challenges to IT rules: The new IT rules have been challenged in various courts since they came into effect earlier this year. Two high courts—Bombay and Madras—have stayed portions of the rules that seek to regulate digital news publishers and OTT platforms that have a physical presence in India or “conduct systematic business activity of making content available in India”

Coinbase acquires Agara to further India push

Coinbase Global, the largest cryptocurrency exchange in the US, has acquired Agara, an artificial intelligence-powered support platform, to further its India push.

The Nasdaq-listed firm plans to leverage the platform’s deep learning and conversational AI technology to automate and enhance its customer experience tools, according to a company blog post.

Quote: “The acquisition reinforces our commitment to delivering world-class support for customers, and brings Agara’s deep expertise in machine learning and natural language processing to Coinbase’s engineering team,” Manish Gupta, executive vice president (engineering) at Coinbase Global, said.

Focus on India: Coinbase began hiring in India this year and expanding to build a high-quality tech hub. Pankaj Gupta, VP of engineering and site lead, India, had said in July that the company was on the lookout for acquisitions in India given the growth in crypto talent in the country.

- “To support our ambitious growth plans in India, we are also exploring startup acquisitions and acquihires. Founders who might be interested in joining Coinbase’s journey and mission, please contact me,” he had said.

In July, Brian Armstrong, cofounder and CEO, announced that the company was building an office and setting up a team in India.

Other Top Stories By Our Reporters

Freshworks overtakes larger rival Zendesk in market cap: Freshworks Inc., the poster child of Indian SaaS, surpassed rival Zendesk Inc. in terms of market capitalisation for the first time, after investors in the San Francisco-based firm punished the stock for the company’s decision to acquire Momentive Global, the makers of SurveyMonkey, for about $4 billion in stock.

New US Bill could increase H-1B filing fees: H-1B visas could become more expensive if the United States approves the proposed Budget reconciliation Bill in its current form. The Bill has proposed to include a supplementary $500 charge for each H-1B visa petition.

Will do whatever it takes to rope in manufacturing giants, says Rajeev Chandrasekhar: India has a unique opportunity post-Covid-19 to gain market share from other geographies and further cement its position as an electronics manufacturing hub and the government will do “whatever it takes” to help attract global value chains (GVCs) and manufacturing giants, Minister of State for Electronics and IT, Rajeev Chandrasekhar, said.

Global Picks We Are Reading

- ByteDance to reorganise into six units, CFO steps down to focus on TikTok (Reuters)

- EV startup Rivian could be worth nearly as much as Honda in US IPO (Reuters)

- India’s fintech gold rush to manifest in Paytm IPO next week (Bloomberg)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.