Silicon Valley Bank drops another 60% and is halted, as pressure mounts on banking sector

Shares of SVB Financial Group, known as Silicon Valley Bank, tumbled for a second day Friday and weighed on the entire banking sector again on concern that more banks would incur heavy losses on their bond portfolios.

SVB’s CEO Greg Becker held a call with clients Thursday afternoon to calm their fears after a 60% tumble in the stock, CNBC has learned. The shares were down another 62% in premarket trading Friday.

Shares were halted in premarket trading for news pending. CNBC’s David Faber reported that the bank is in talks to sell itself after attempts to raise capital have failed, citing sources familiar.

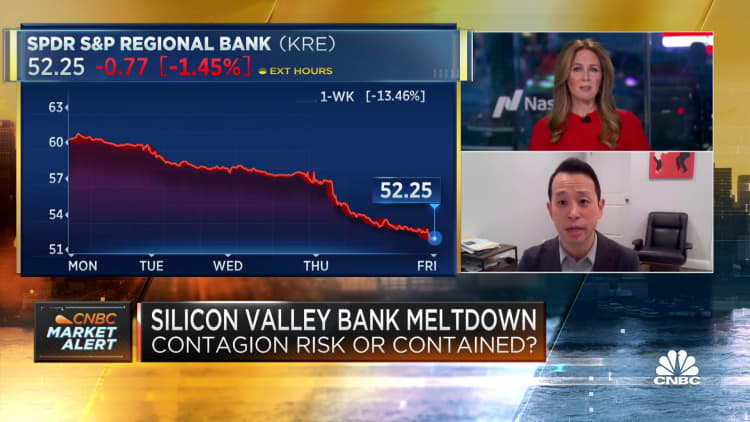

The SPDR S&P Regional Banking ETF was off another 3.3% Friday in premarket trading following an 8% tumble on Thursday. The Financial Select SPDR Fund was down by 0.5% following a 4% decline on Thursday. Signature Bank, which is known to cater to the crypto sector, was off 8% in premarket trading following a 12% tumble Thursday. First Republic Bank was off 22% following a 17% tumble on Thursday.

Major banks were under slight pressure with JPMorgan Chase down 0.41% early Friday after tumbling 5% on Thursday.

“Current pressures facing SIVB are highly idiosyncratic and should not be viewed as a read-across to other banks,” wrote analysts Manan Gosalia and Betsy Graseck with Morgan Stanley in a note Friday.

Negative shock

Concern among founders and venture capital investors spiked earlier this week after Silicon Valley Bank surprised the market by announcing late Wednesday it needed to raise $2.25 billion in stock. The bank had been forced to sell all of its available-for-sale bonds at a $1.8 billion loss as its startup clients withdrew deposits, it said.

That news, coming on the heels of the collapse of crypto-focused Silvergate bank, sparked another wave of deposit withdrawals Thursday as VCs instructed their portfolio companies to move funds, according to people with knowledge of the matter.

SVB customers said they didn’t gain confidence after Becker urged them to “stay calm” in a call Thursday afternoon, and the stock’s collapse continued unabated, reaching 60% by end of trading.

The mounting pressures on SVB prompted hedge fund billionaire Bill Ackman to speculate that if private investors can’t help shore up confidence in the California lender, a government bailout could be next.

‘Idiosyncratic pressures’

SVB said in a letter Wednesday that it sold “substantially all” of its available-for-sale securities made up of mostly U.S. Treasurys.

The bank also previously reported more than $90 billion in held-to-maturity securities, which wouldn’t necessarily incur losses unless it was forced to sell them before maturity to cover fleeing deposits. As the Federal Reserve consistently raises interest rates, it is lowering the value of Treasuries. For example, the iShares 20+ Treasury Bond ETF, which is made up of longer maturity Treasuries, is down 24% in the last 12 months.

Investors are also worried about lack of support from Silicon Valley Bank’s funding base of tech start-ups, an area hit hard from the slumping stock market and surging rates. Peter Thiel’s Founders Fund and other large venture capital firms asked its companies to pull their funds from SVB, Bloomberg News reported.

“Falling VC funding activity and elevated cash burn are idiosyncratic pressures for SIVB’s clients, driving a decline in total client funds and on-balance-sheet deposits for SIVB,” wrote the Morgan Stanley analysts. “That said, we have always believed that SIVB has more than enough liquidity to fund deposit outflows related to venture capital client cash burn.”

SVB had a market value of $16.8 billion to end last week. On Thursday, the bank was worth $6.3 billion with that value set to drop even more when trading begins Friday.

This is a developing story. Check back for updates.

Correction: The Financial Select SPDR Fund declined 4% on Thursday. An earlier version misstated the day.

For all the latest World News Click Here

For the latest news and updates, follow us on Google News.