Sequoia sells 2% of Zomato; CoinDCX marks DeFi foray

Also in this letter:

■ CoinDCX forays into decentralised finance with Okto

■ Zuckerberg admits Facebook censored story on Joe Biden’s son

■ Fintech firms plan pushback as RBI’s lending rules disrupt ops

Sequoia Capital sells 2% stake in Zomato

Sequoia Capital India, one of Zomato’s early backers, has sold a 2% stake in the company in the open market, according to a BSE filing by Zomato on Friday. Sequoia now holds a 4.4% stake in the food delivery firm.

When Zomato made its debut on the public bourses in 2021, Sequoia held 502.6 million equity shares or 6.41% of the total share capital.

Details: Zomato said Sequoia Capital India Growth Investment Holdings I and SCI Growth Investments II sold 171.9 million shares or a 2.01% stake in the company.

The sale took place in two tranches. Sequoia first sold its Zomato shares between September 6 and October 14 last year. The latest sale took place between June 27 and August 25.

Exodus: Since the one-year lock-in period for Zomato’s pre-IPO investors ended on July 23, high-profile investors and shareholders have sold their shares in the company.

- Moore Strategic Ventures sold all of its 42.5 million shares in the open market days within days, causing the stock to plummet.

New investors: Two institutional investors – Fidelity and ICICI Prudential – have picked stakes in Zomato following these exits.

CoinDCX forays into decentralised finance with Okto

Neeraj Khandelwal and Sumit Gupta, cofounders, CoinDCX

Crypto exchange CoinDCX forayed into the burgeoning decentralised finance (DeFi) space with the launch of Okto — a keyless, self-custody wallet for peer-to-peer trading.

Okto will work across over 20 blockchains and over 100 decentralised finance (DeFi) protocols, said Neeraj Khandelwal, cofounder of CoinDCX.

What is DeFi? It’s a system in which customers can access crypto-based financial products from others on a blockchain network, without the need for middlemen such as banks and brokerages. Read our explainer here.

Yes, but: “Using a decentralised website is not as easy as using Swiggy or Zomato. If web3 has to be successful the internet has to be more decentralised, but if customers find it difficult to access these applications and developers find it hard to build them, then it will be a big challenge. That’s what Okto solves.”

Earlier this year, the company also launched CoinDCX Ventures to invest Rs 100 crore in emerging web3 startups and help the nascent sector grow.

Crypto crackdown: The news comes amid a crackdown on Indian crypto exchanges by the Enforcement Directorate, as part of its money-laundering probe into the instant micro loan app scam.

The ED on Thursday carried out searches at five locations linked to CoinSwitch Kuber. The agency had previously frozen funds of WazirX and Flipvolt, the Indian arm of troubled Singaporean crypto exchange Vauld.

Zuckerberg admits Facebook censored story on Joe Biden’s son

Meta CEO Mark Zuckerberg has admitted that Facebook algorithmically censored the Hunter Biden laptop story for a week.

Appearing on The Joe Rogan Experience podcast, Zuckerberg said the platform did so following a general request from the Federal Bureau of Investigation (FBI) to restrict election misinformation.

Rogan asked how Facebook handles controversial issues like the Hunter Biden laptop story and whether it was censored, to which Zuckerberg responded:

“So we took a different path than Twitter. I mean, basically, the background here is that the FBI basically came to us… some folks on our team. They were like, hey, just so you know… you should be on high alert. We thought there was a lot of Russian propaganda in the 2016 election, we have it on notice. That’s basically…there’s about to be some kind of dump that’s similar to that. So just be vigilant.”

Zuckerberg criticised Twitter for completely blacking out the story, but admitted Facebook did censor the story by decreasing its reach.

Tweet of the day

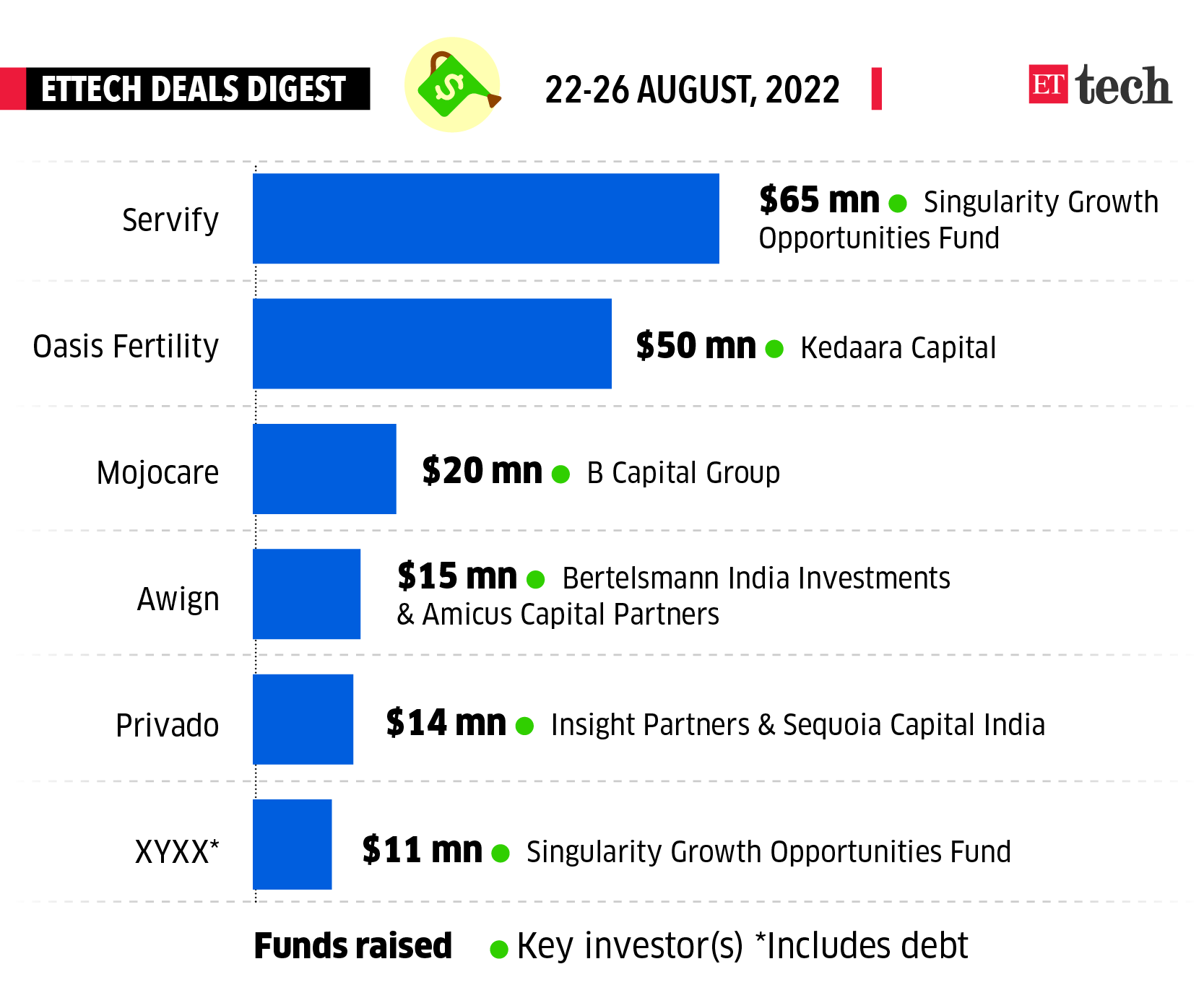

ETtech Deals digest

Device management startup Servify closed the largest funding round in what turned out to be another subdued week for startup funding. Oasis Fertility and Mojocare were the other firms that managed to pull in moderate amounts.

Here is a list of all the startups that raised funds this week

Fintech firms plan pushback as RBI’s lending rules disrupt ops

India’s strict new digital lending rules have disrupted card services of foreign-backed fintech firms and jeopardised Amazon’s loan offerings, prompting companies to chart a lobbying pushback, Reuters reported, citing industry sources and a document it has seen.

Catch up quick: The Reserve Bank of India (RBI) this month said a borrower must deal directly with a bank, dealing a blow to prepaid card providers and shopping websites, which act as intermediaries and instantly process deferred loan payments.

Fintech feels the heat: The new rules have already hit prepaid card offerings of Tiger Global-backed Slice and Accel-backed startup Uni. Uni suspended its card services this week due to the RBI rules, while Slice has stopped issuing new cards.

Bigger fish: Worries are also rising that the rules will throttle plans of bigger players Amazon and Flipkart to expand their popular buy-now-pay-later schemes, which are used by millions of users, three industry sources said.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.