RBI grants payment aggregator licence to 32 entities; Paytm Payments Bank launches UPI Lite

We have this and more in today’s edition of ETtech Top 5

Also in this letter:

■ ETtech Explainer: How MCA portal glitches are impacting companies

■ Microsoft lays off 150 cloud sales specialists

■ Elon Musk forced algorithm change to boost his reach

Reliance, Google, Zomato, others, receive payment aggregator licence; Paytm misses bus

The central bank gave in-principle approval to 32 entities for a PA licence, including Pine Labs, Razorpay, Reliance, Google, Zomato, and Worldline. While the RBI has rejected the PA licence applications of Freecharge, Paytm, PayU, and Tapits Technologies, it has added the licence applications of as many as 18 entities to the “still under process” category. Some big names under this category are PhonePe, Cred, MobiKwik and Instamojo.

RBI scrutiny: Multiple online payment gateways that were seeking the licence had come under intense scrutiny for know-your-customer (KYC)-related issues, past dealings with cryptocurrency exchanges and gaming apps, as well as for not complying with the minimum net worth criteria set out by the RBI, ET had reported earlier citing sources.

Framework needed: The payment aggregator framework was introduced in 2020 to further regulate the payments space.

Under this framework, only those firms that have been authorised to operate as payment aggregators by the RBI can acquire and offer payment services to merchants. Also, these firms will be directly supervised by the RBI. This, industry insiders told us, would lead to a more standardised and regulated payments ecosystem.

Detailed consultations: During its presentation with the fintech firms, the RBI also checked for aspects related to what percentage of the business revenue of the applicants came from unregulated entities such as online betting or crypto exchanges. It also evaluated money-laundering concerns. It also examined whether these aggregators were compliant with tokenisation norms or not.

Last year, the RBI rejected the PA licence of ZaakPay, which runs the fintech company MobiKwik, allegedly due to its crypto partnerships and failure to meet the minimum net-worth criteria.

Paytm Payments Bank goes live with UPI Lite

Now, Paytm Payments Bank users can make transactions of up to Rs 200 without using a UPI PIN as the company has gone live with UPI Lite.

What is UPI Lite? Launched in September 2022 by Reserve Bank of India governor Shaktikanta Das, UPI Lite aims to make low-value UPI payments faster and simpler.

The UPI Lite is an on-device wallet, or a virtual wallet, which users need to enable and add money from their bank accounts to the wallet. The balance in the wallet can be used to make payments without the need of PIN or even an active internet connection.

At present, only debit from your wallet is permitted and all credits to UPI Lite, including refunds, will directly go to your bank account.

PhonePe, Slice to follow suit: ET first reported on February 6 that in addition to Paytm, Walmart-owned fintech PhonePe was also planning to soon launch its UPI Lite offering.

Tiger Global-backed fintech Slice is also working on launching UPI Lite on its UPI payments product.

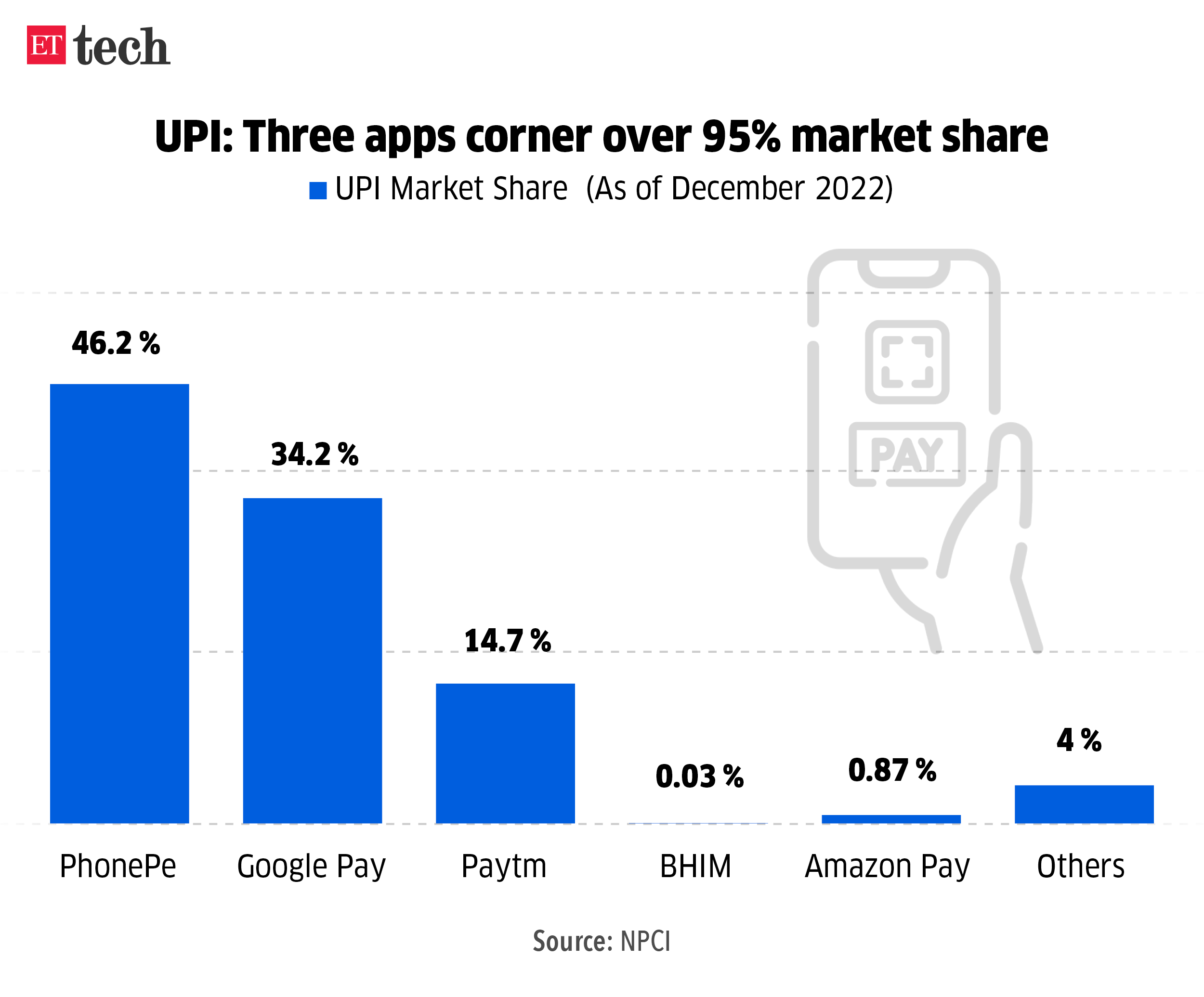

So far, only BHIM UPI app had UPI Lite feature live on the platform but a negligible amount of users transact through it now.

About 75% of the total volume of retail transactions, including cash, in India are below Rs 100 in transaction value. Additionally, 50% of the total UPI transactions are also of value Rs 200 or less, according to an NPCI circular issued in March last year.

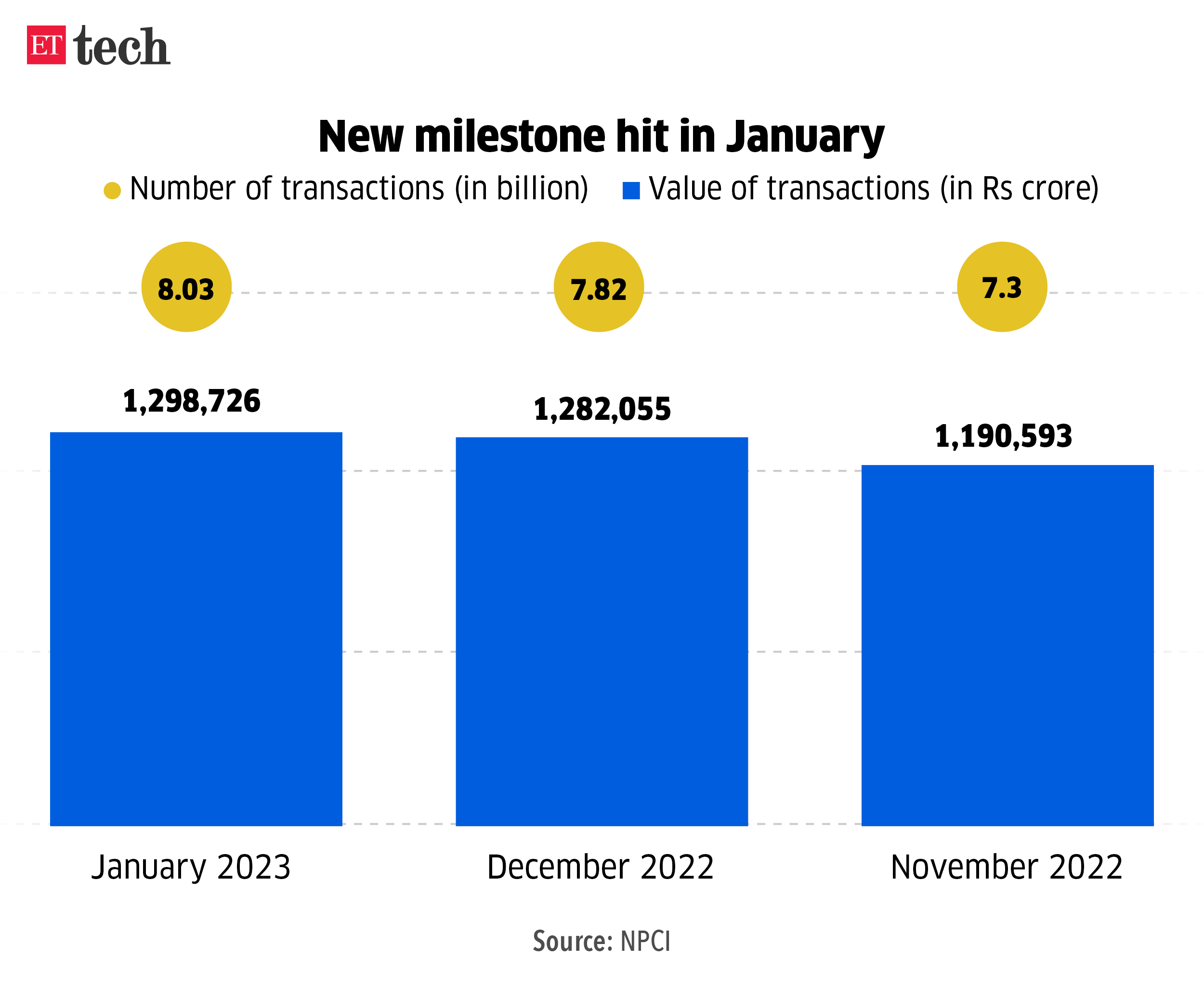

Digital push: In January 2023, for the first time, UPI clocked over 8 billion transactions in a month, but its overall growth in future has been a matter of debate to ensure how to keep growing on such a large transaction base.

NPCI has also initiated several other projects to bring in the low-value transaction consumers under the UPI umbrella.

This includes UPI 123PAY, which is a solution developed for feature phone consumers to use UPI without internet connectivity.

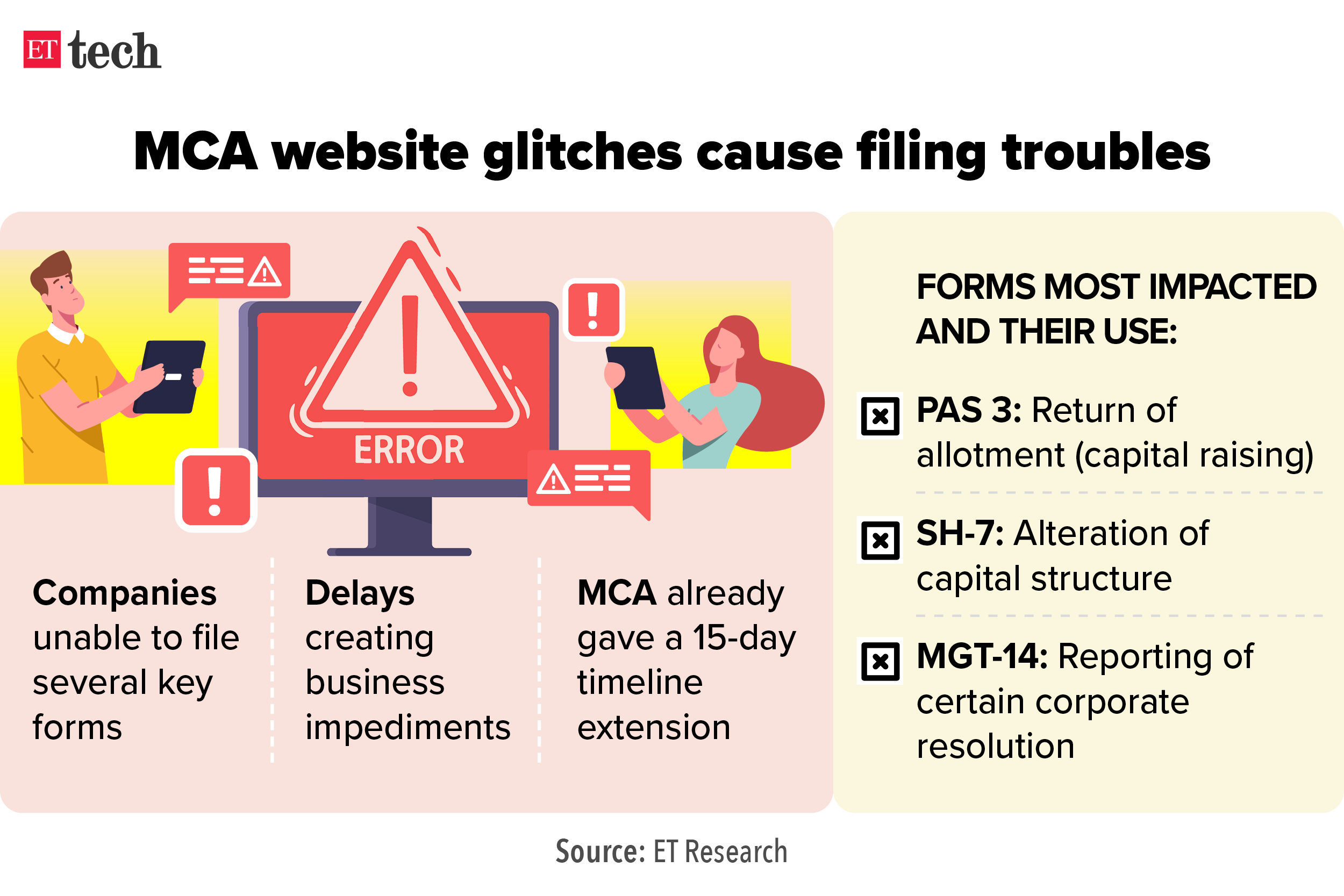

ETtech Explainer: How MCA portal glitches are impacting companies

Several companies are facing issues while filing disclosures as technical glitches continue with the Ministry of Corporate Affairs’ (MCA) MCA21 portal. While the portal has seen issues earlier as well, the latest episode turned out to be critical for a large number of unlisted companies.

What is the MCA21 portal? The MCA21 portal has been designed to automate processes related to enforcement and compliance of the legal requirements under the Companies Act 1956, New Companies Act 2013, and Limited Liability Partnership Act 2008. It provides digital services such as incorporation of a new company, registration of a new director, and several other company-related compliances.

Also read: FM directs MCA to address issues related to website glitches

Portal marred by glitches: On February 12, the Institute of Company Secretaries of India (ICSI) wrote a letter to MCA secretary Manoj Govil detailing 18 technical issues with the latest version of the MCA21 portal.

The concerns raised included those pertaining to the PAS-3 form, which companies need to file before they can use funds raised from investors. PAS-3 form, in addition to DIR-12 form, is submitted to notify the MCA of appointment of directors and key managerial personnel. The SH-7 form is for notifying alterations in the capital structure of a company, while the MGT-14 form for reporting of a corporate resolution.

Technical issues hit companies: A number of listed and unlisted companies are encountering business obstacles. Compliances related to disclosure of private placements, appointment of directors and creation of charge documents are among the major categories that have not been completed as the portal continues to face glitches, making uploading of forms difficult.

Microsoft lays off 150 cloud sales specialists

Microsoft has laid off about 150 cloud sales specialists, The Information reported. The company had in January announced that it would cut 10,000 jobs by the end of the third quarter of fiscal 2023.

Pink slips: The latest round of layoffs impacted about 150 employees from a team responsible for convincing medium-size companies to adopt cloud services such as Azure server rentals and Microsoft 365 productivity apps, as per the report.

Also read | Layoffs in 2023: Full list of companies that have cut jobs amid economic turmoil

Other affected companies: Microsoft’s LinkedIn has also initiated layoffs and employees in the recruiting department were impacted.

Earlier, the company had cut jobs in its hardware divisions, including HoloLens, Surface and Xbox teams.

Last week, GitHub, a software collaboration platform owned by Microsoft, announced it is laying off up to 10% of its workforce.

Catch up quick: The latest layoffs are part of Microsoft’s broader plan to eliminate 10,000 jobs or 5% of its total workforce.

CEO Satya Nadella wrote in a blog post that organisations in every industry and geography are now “exercising caution as some parts of the world are in a recession and other parts are anticipating one”.

However, Nadella also said that Microsoft would continue to hire in “key strategic areas”.

Tweet of the day

‘Unhappy’ Musk forced algorithm change in Twitter to boost his tweets: report

Elon Musk forced algorithm changes on his microblogging platform Twitter to boost his tweets after his Super Bowl tweet garnered less engagement than Joe Biden’s.

More followers, less engagement: Musk’s Super Bowl tweet got nine million impressions while Biden’s got 29 million. Musk has nearly 129 million followers, whereas Biden’s account has 37 million.

Details: Around 80 engineers built a system so that Musk’s tweets would be viewed by more users, according to Platformer. The engineers were able to send out a code that would allow Musk’s tweets to bypass the algorithm and boost his posts by a factor of 1,000, according to the report.

Feeds flooded with Musk’s tweets: The change, however, resulted in users’ feeds being flooded with Musk’s tweets. Several people took to the social media platform saying that the “For You” section is full of tweets and replies to tweets from Musk.

Twitter CEO by year-end: Elon Musk said on Wednesday that he anticipates finding a CEO for Twitter “probably toward the end of this year.” Speaking via a video call to the World Government Summit in Dubai, Musk said making sure the platform can function remained the most important thing for him. “I think I need to stabilise the organisation and make sure it’s in a financially healthy place.”

Today’s ETtech Top 5 newsletter was curated by Megha Mishra in Mumbai and Erick Massey in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.