Put profits before valuation, says Zerodha CEO; bitcoin catches a cold as Celsius drops

Also in this letter:

■ Celsius chills crypto, bitcoin falls again

■ Musk set for first ‘date’ with Twitter employees

■ Google launches accelerator for women-led Indian startups

Chase profits, not valuations, Zerodha’s Nithin Kamath tells founders

Nithin Kamath, CEO of Zerodha, has said that startup founders ought to chase sustainability and profits, not valuations.

In his words: “Today, everyone around is celebrating valuation as a success. If a start-up or an SME is making a Rs 2 to 3 crore profit annually, then it’s brilliant. Why does one have to become a Rs 500 crore valuation business? They are making Rs 2-3 crore a month without any investor obligation. Not every business can scale,” Kamath said in an exclusive interview with the YouTube channel Intellectual Indies.

Bootstrapping advice: Kamath said entrepreneurs should also understand that not every business can be built without funding. A business can only be bootstrapped when it has an edge over its competitors.

“For anyone who is building a business, the first thing they should consider is if what they are building is easily copyable? If it can be copied easily, then raise some money and put some distance from your competition,” he said.

He said if he were starting Zerodha today, bootstrapping it wouldn’t have been possible as the market has evolved. “If someone is thinking of bootstrapping, don’t chase the valuation outcome. Instead of eyeing to become a unicorn, start chasing profitability and sustainability. If your business is profitable and sustainable, you have done a great job,” he added.

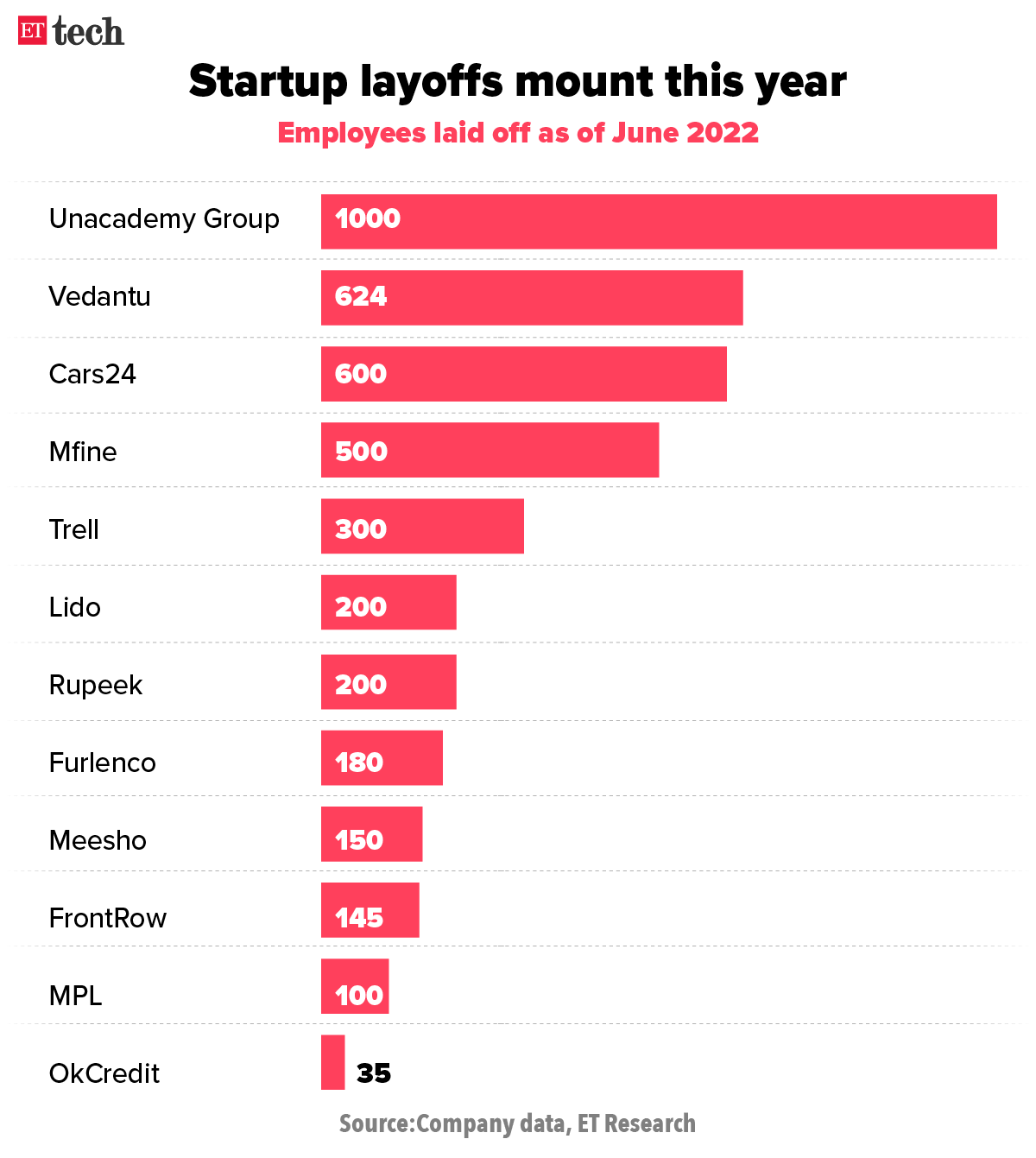

Timely: Kamath’s advice is particularly salient in the current economic climate, when startups are rushing to cut costs and shift their focus from growth to profitability. Startups including Unacademy, Meesho and Trell have laid of thousands of employees since the start of the year.

Over the past month, several prominent venture capital firms including Beenext, Sequoia and Y Combinator have warned their portfolio founders to prepare themselves for a long funding winter.

Also Read: After BharatPe and Grofers, Ashneer Grover says it’s time for ‘third unicorn’

Bitcoin catches a cold as Celsius drops

Bitcoin crashed to a new 18-month low on Tuesday before recovering slightly, as major crypto lender Celsius Network’s freezing of withdrawals and the prospect of sharp US interest rate hikes shook the volatile asset class.

Bitcoin clawed its way to positive territory after falling as much as 7.3% to $20,816, its lowest since Dec. 2020. It was last up 0.2% at $22,487.

Bloody Monday: The world’s largest cryptocurrency fell a whopping 15% on Monday, its sharpest one-day drop since March 2020. This dragged the total market cap of all crypto assets below $1 trillion for the first time since February 2021, more than 66% down from a peak of over $3 trillion last November. On Tuesday, it briefly fell below $900 million.

Bitcoin has shed about half its value this year and over 20% since Friday alone. It has slumped nearly 70% since its record high of $69,000 in November.

Celsius drops: Citing “extreme” market conditions, New Jersey-based Celsius, one of the world’s largest crypto lending platforms, said on Monday that it had frozen withdrawals and transfers between accounts “to stabilise liquidity and operations while we take steps to preserve and protect assets”.

The Celsius Network’s cryptocurrency, CEL, has fallen from about $0.78 on June 6 to $0.33 on June 14.

More chaos? Bitcoin’s fall could also have wider consequences. US software firm MicroStrategy – a major backer of bitcoin – said last month a drop below $21,000 would trigger a demand for extra capital against a loan secured by some of its bitcoin holdings.

That could see it stake more bitcoin against the loan or trigger the sale of some of its vast holdings, leading to more chaos in the markets.

Tesla India policy executive quits after company halts entry plan

A key executive who was leading Tesla’s lobbying effort in India has resigned, weeks after the company put its plans to sell electric cars in India on hold, two sources told Reuters.

Manuj Khurana, a policy and business development executive at Tesla in India, was hired in March 2021 and played a key role in forming a domestic market-entry plan for the US carmaker.

He lobbied the Indian government for more than a year to slash the import tax on electric cars to 40% from as high as 100%, a move Tesla said would allow it to test the market with imports from its production hubs like China before investing in a factory.

But the government insisted Tesla must first commit to manufacturing cars locally before it can offer any concessions. With talks deadlocked, Tesla put its plans to sell cars in India on hold, reassigned some of the domestic team and abandoned its search for showroom space.

“Tesla’s plans to launch in India right now are as good as dead,” said one of the sources.

Tesla chief executive Elon Musk said on Twitter last month that the company would not set up manufacturing in any location where it was not allowed first to sell and service cars.

India’s loss: The carmaker has also shifted its focus to other markets in Southeast Asia, like nickel-rich Indonesia, where it is looking at a potential battery-related investment, and Thailand, where it recently registered a local unit to sell cars.

Musk’s first ‘date’ with Twitter employees: Meanwhile, Musk will interact with Twitter employees for the first time at a meeting on Thursday, a source told Reuters, citing an email from Twitter’s chief executive Parag Agrawal. A large number of Twitter employees are no fans of Musk. During a meeting in April, they expressed their displeasure to Pagarwal about Musk’s potential takeover.

ETtech Done Deals

■ Elon Musk’s rocket company SpaceX has raised $1.68 billion in equity financing, regulatory filings revealed. SpaceX has been heavily investing in its rocket development and broadband internet satellite verticals — Starship and Starlink. Since 2019, it has launched about 2,600 Starlink satellites as it seeks to become the largest satellite internet provider.

■ Microsavings platform Siply has raised $19 million from Qi Ventures, LetsVenture and a couple of angel investors including chief operating officer of Swiggy. Started in 2020, Siply helps underserved customers invest in mutual funds, digital goals and other financial instruments.

■ Sequoia Spark’s crypto startup Nume has raised $2 million from Sequoia Capital India, Beenext and a few other investors. Nume is a layer-two protocol that facilitates crypto payments between merchants and buyers for near-zero gas fees. The company plans to use the funds launch its product in the next two to three months.

■ SaaS buying platform Spendflo raised $4.4 million in a seed round from Accel India and founder-focused venture partner Together Fund. It plans to use the fresh funds to hire people in India and the US.

Google launches accelerator for women-led startups in India

Google has launched a cohort-based accelerator programme for women-led startups in India. Called the Google for Startups Accelerator Women Founders Programme, it aims to boost female entrepreneurship in the country.

Tell me more: About 20 women founders or co-founders will be selected in the programme’s first batch, which will run for three months.

It will offer courses in categories like artificial intelligence and machine learning (AI/ML), cloud, UX, product strategy and growth, along with providing access to mentorship, funding and hiring — issues that many women founders struggle with for a number of reasons, including low representation.

Goal: The tech giant aims to increase women’s representation in India’s digital workforce through the programme. Google pledged to invest $10 billion in boosting digital adoption across the country last year.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.