Prosus CEO warns of more startup valuation cuts; RTP Global closes $1 billion fund

Also in the letter:

■ IAMAI flags gig workers’ plight amid Delhi’s EV transition

■ Turmoil at Byju’s highlights hurdles for Indian startups

■ Shark Tank deal completion can take 3-9 months: Anupam Mittal

Expect further corrections in startup valuations: Prosus CEO Bob van Dijk

Prosus chief executive Bob van Dijk

A day after Prosus slashed the valuation of beleaguered edtech firm Byju’s to $5.1 billion, its chief executive Bob van Dijk warned that more valuation markdowns are likely in the near future.

More valuation cuts: “In private markets, the dynamic where we’ve seen a lot of fundraising while rates were low and money was flush, that hasn’t entirely shaken out, I would say. So, what I see is that many companies that raised (funding at) high valuations basically have managed to not raise capital. The ones that did have to raise capital, typically, have seen a fairly significant haircut to their valuations,” the Prosus chief said during a post-earnings conference call.

Prosus’ India investments: Prosus Ventures has infused $200 million in early-stage startups in India, Dijk said. The fund has backed marquee names such as Mensa Brands, Urban Company, Meesho, Elastic Run, IndiGG, Fashinza and The Good Glamm Group in the country.

“If you look at the capital that the Ventures team has deployed, the vast majority of it has been deployed in India. And if you take sort of the top 10 of the most exciting, fastest growing startups in India that are still private, I think we’re probably in seven out of 10 of those,” he said.

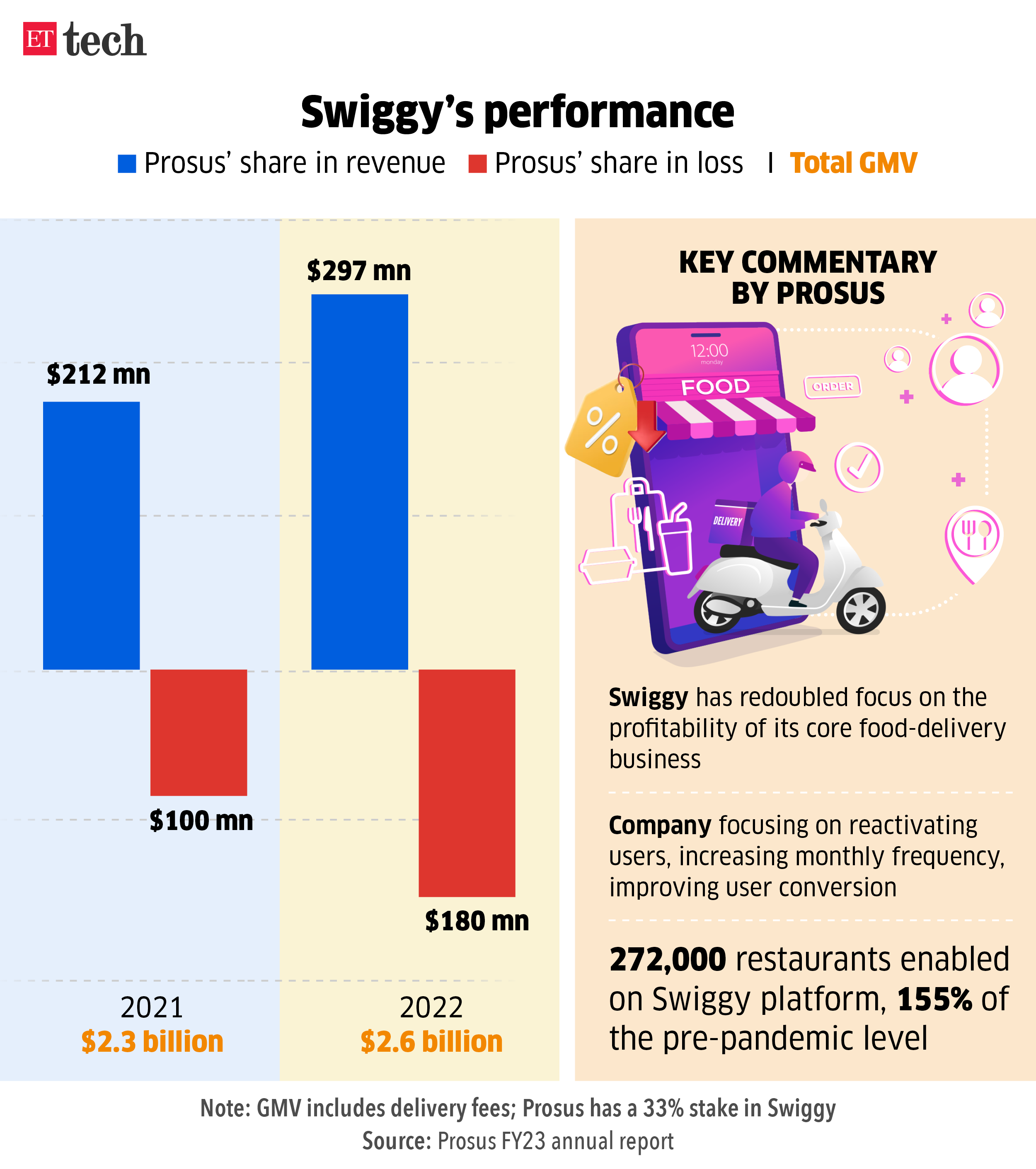

Catch-up quick: Prosus, a key investor in Swiggy, indicated in its annual report on Tuesday that losses at the food delivery company in calendar year 2022 ballooned 80% year on year.

It also said that PayU India, its Indian fintech subsidiary, had generated total revenues of $399 million in FY23, up 31% from the previous fiscal year.

RTP Global (Asia) investment partners Nishit Garg and Galina Chifina

Global early-stage investor, RTP Global, which has backed Cred, Rebel Foods and MPL, has announced its fourth fund (RTP IV), with a total corpus of $1 billion. RTP Global is looking to invest almost one-third of that capital in India and Southeast Asia.

Fund details: Unlike other VC firms, which raise new funds from limited partners, RTP Global’s new fund has derived its corpus almost entirely from the returns on earlier investments.

Of the $1 billion raised, the fund has earmarked $660 million for new early-stage investments globally, while the remaining $340 million will be deployed on its top performers.

Partner speak: Nishit Garg, investment partner at RTP Global in Asia, said that the fund will continue its pace of backing 20-22 companies across India and Southeast Asian markets over the next three years.

Rishi Navani, founder & managing partner, Epiq Capital

Epiq Capital closes second fund at $225 million: Rishi Navani’s venture capital firm Epiq Capital has closed its second India-dedicated fund at $225 million, higher than the initial target of $150 million.

“70% to 80% of the Nifty 50 will be tech firms in the near future; our aim is to find and invest in them,” Navani said.

Anil Goteti’s Scapia raises $9 million in seed capital: Scapia, a startup founded by Anil Goteti, a former senior executive at Flipkart, has raised $9 million (around Rs 73 crore) in its first round of funding.

Who are the investors? The round was led by Matrix Partners India with participation from Tanglin Venture Partners and Binny Bansal’s Three State Ventures. Both Matrix Partners and Tanglin Venture Partners were investors in Goteti’s previous startup, Protonn, which shut down and returned more than $9 million to its investors.

Turmoil at Byju’s highlights hurdles for Indian startups

Already stuck in a funding slump, newer companies are in danger of becoming collateral damage to the country’s biggest startup crisis in years, Bloomberg has reported. Beleaguered edtech startup Byju’s is in turmoil after missing a deadline on financial statements, skipping payments on a $1.2 billion loan, and losing its auditor and some board members.

Challenges faced by entrepreneurs: The consumer market in India is fast-growing but still has relatively limited spending power, resulting in intense price competition that makes it harder for startups to reach profitability.

A sudden decline in tech valuations last year, coupled with rising interest rates and slowing economies, caused venture capital firms to hit the brakes on new funding rounds, with emerging markets like India getting hit hard.

What’s the latest on Byju’s? Bringing some relief to Byju’s, a Delaware court rejected a request by its Term Loan B lenders to investigate a $500-million transfer from US-based Byju’s Alpha to other entities.

The company has also been trying to assuage investors about its financial situation after a string of high-level exits from the company’s board last week.

Byju’s has told its investors that it will file the much-delayed audited financial results for fiscal year 2022 by this September while the results for the year ended March 2023 will be submitted by December.

IAMAI says gig workers will be hit by Delhi’s EV transition

The Internet and Mobile Association of India (IAMAI) has warned that Delhi’s aggressive transition towards electric vehicles for delivery services and bike taxis will leave gig workers in the city in a lurch.

IAMAI’s stance: The industry body has flagged “significant disruption” to the livelihoods of gig workers because of the Delhi government’s mandates for aggregators and delivery service providers. “In particular, the EV conversion targets prescribed pose a significant risk to gig workers who have heavily invested their capital, often through loans, in internal combustion engine (ICE) powered vehicles,” the industry body said in a statement.

The body represents delivery companies such as Zomato, Swiggy, Zepto, and others.

Delhi’s plan ‘ambitious’: A draft policy paper issued by the Delhi government proposes allowing only electric bike taxis in the city, and a phased transition for delivery fleets and four-wheeler taxi aggregators. However, IAMAI points out that the dearth of charging stations and battery-swapping infrastructure in the capital make the ambitious targets virtually impossible to meet.

Delhi has mandated immediate adoption of EVs for bike taxi operators and has given delivery companies till 2030 to fully convert their fleets.

Impact on gig workers: According to cab aggregator industry estimates, up to 80,000 riders use bike taxis every month across platforms. IAMAI said the extremely high costs associated with owning an EV make it “commercially unfeasible” for most gig workers.

Quick recap: The tussle between two-wheeler taxis and the Delhi government began in February, with Delhi issuing a public notice prohibiting bike taxis in the national capital territory. This was challenged by Uber and Rapido in the Delhi High Court, which stayed the notice, thereby allowing the bike taxis to operate. Earlier this month, the Supreme Court set aside the Delhi High Court order, re-imposing the ban.

Shark Tank India deal completion can take 3-9 months, says Anupam Mittal

After contestants on the reality TV show Shark Tank India alleged there were delays in getting promised capital from investors, leading to a social media backlash, Shaadi.com founder Anupam Mittal clarified that deals inked on the show can take between three and nine months to be completed.

Mittal’s note: In a LinkedIn post, the ‘shark’ explained that deals are closed depending on the readiness of the company and the Shark Tank India founder-investors.

“Most of the businesses on the Tank are at a very early stage. Many are proprietorships, which first need to be registered as companies. The founders have never seen an SHA [shareholder agreement], nor do they have readily available numbers. Our teams hand-hold them through many of these issues,” the post read.

He said that about 60% of the deals committed on air at Shark Tank US go through, whereas Shark Tank India season 1, which aired last year, saw the completion of two-thirds (66%) of the deals.

The allegations: Some contestants on the show said that investors had resorted to delaying tactics when it came to actually putting money into their businesses.

“Sharks (investors) purposely drag things out (after the episode is shot) until the pitch airs. They want additional paperwork, their legal team won’t return your calls, and their team members will provide lame excuses like they are on vacation or the new year has arrived,” one contestant told ET. Some contestants have written off the show as a marketing opportunity, not expecting any real investment.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra in Mumbai and Vaibhavi Khanwalkar in Bengaluru. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.