PharmEasy devaluation: Thyrocare founder invokes anti-dilution; Flipkart employees to receive esop payout

Also in the letter:

■ Inside Paytm’s cashback offers for retailers

■ Chandrayaan-3 to lift off on July 14

■ Byju’s to form committee to advise CEO

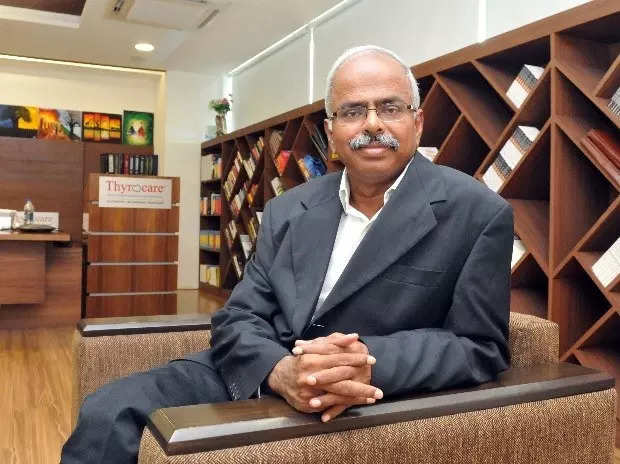

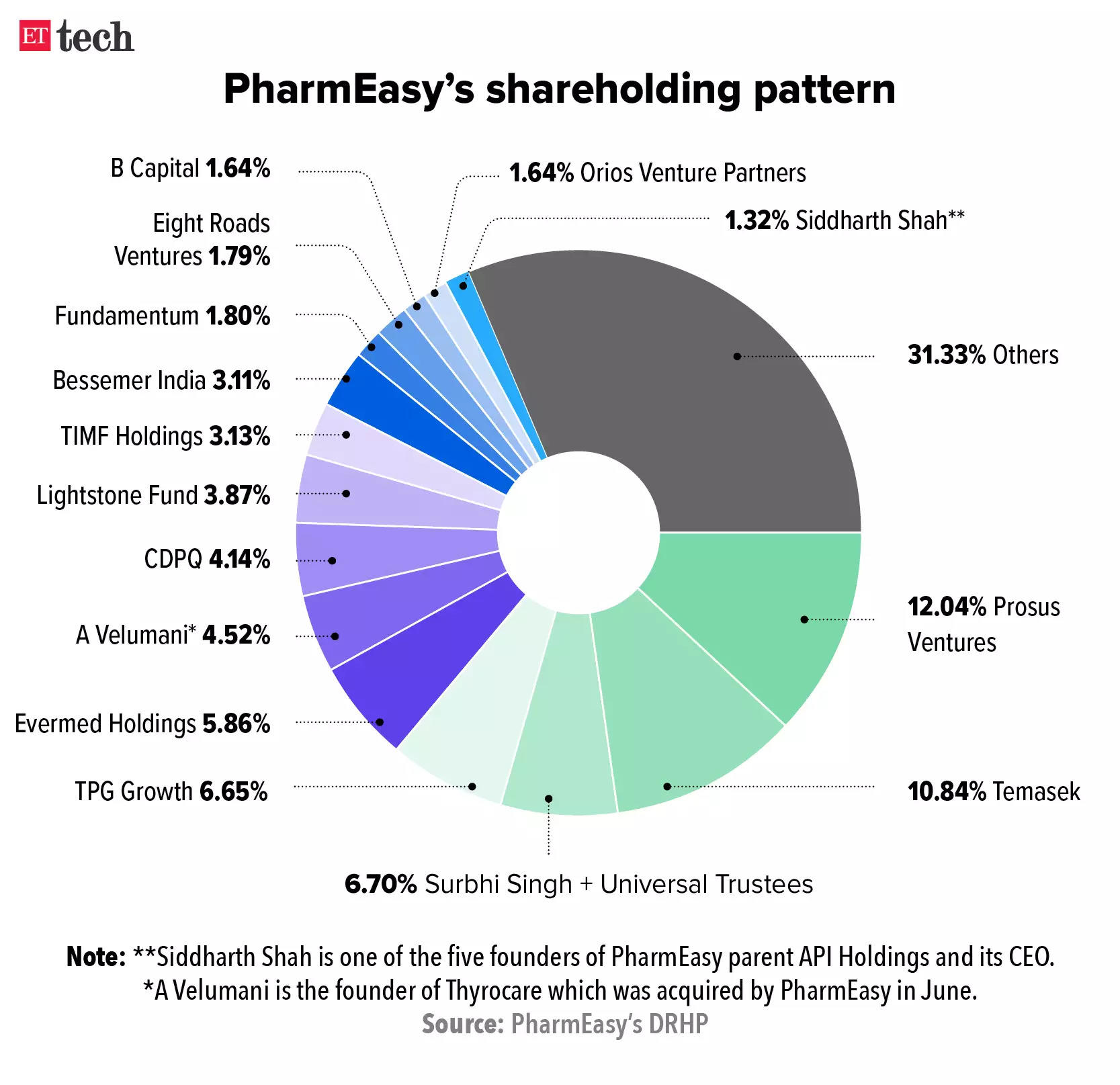

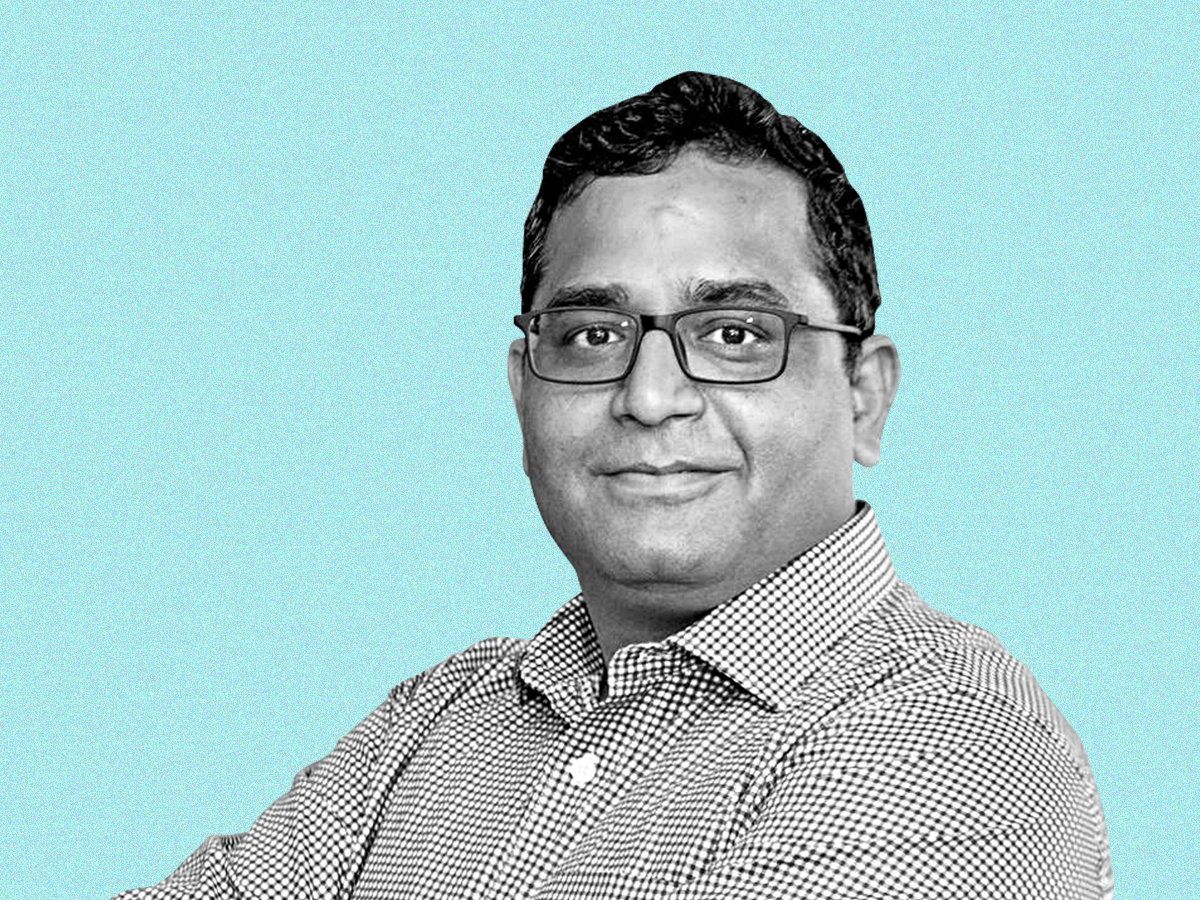

PharmEasy valuation crash may not hit Thyrocare founder Velumani’s stake

Arokiaswamy Velumani, the founder of Thyrocare, had obtained anti-dilution rights ahead of his Rs 1,500 crore investment in PharmEasy, the online pharmacy that acquired Thyrocare in 2021, according to sources familiar with the investment terms.

Jargon buster: Anti-dilution rights ensure that the share an investor has in a firm is not reduced in case the company undergoes a down round or a share issue, thus protecting the investor’s shares from losing value. In this case, Velumani will be allocated new shares in PharmEasy to compensate for the erosion in the value of his holding in PharmEasy. Velumani purchased 5% of the company in 2021, when it was valued at $4 billion.

PharmEasy is seeing a significant decrease in its valuation, as its rights issue pegs its shares at Rs 5 each, in contrast to Rs 50 per share in 2021, ET reported on July 6.

Subsidiary sued: According to court filings reviewed by ET, Velumani has filed a case against DocOn, a subsidiary of API Holdings. The ongoing conflict revolves around the alleged higher tax payout imposed on Thyrocare’s promoters as it was an off-market transaction, as opposed to an on-market sale.

In an off-market transaction, the transfer of shares occurs directly between two parties without the involvement of the clearing corporation and the stock exchange. This attracts a higher rate of long-term capital gains tax.

Down round: If the rights issue goes through at the Rs 5 per share, it would mark the first official down round for a large internet firm in a fresh fundraise. A down round is when a privately held firm raises funds at a valuation lower than its previous round.

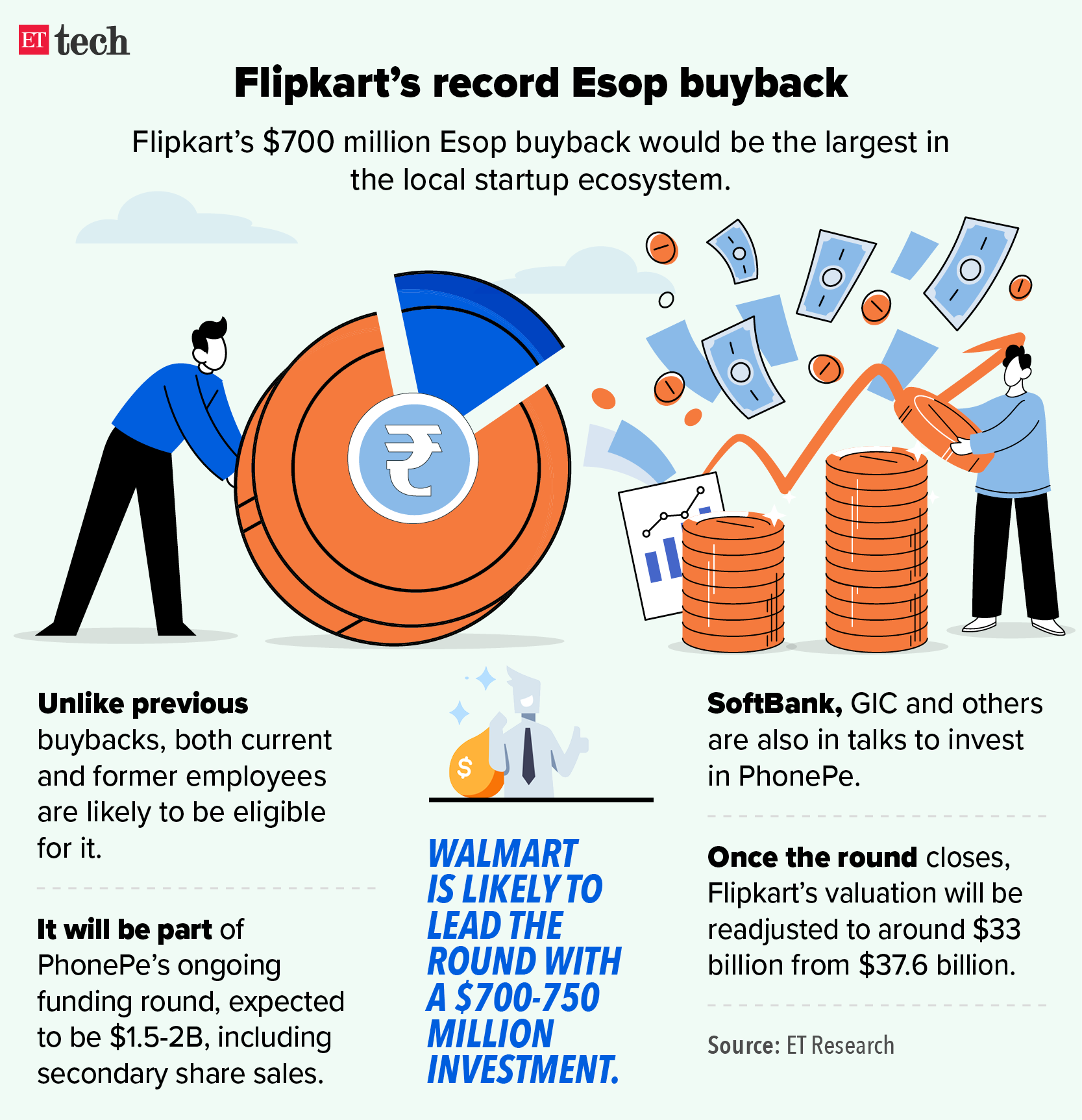

Flipkart employees to receive payout from PhonePe esop buyback

Employees of Walmart-owned ecommerce major Flipkart are all set to finally receive a one-time cash payout from the $700 million esop buyback by the company following its separation from PhonePe, sources in the know of the matter told ET.

Compensation: Flipkart employees who hold stocks under the company’s employee stock ownership plan would be compensated for the loss they would face as a result of the separation of payments firm PhonePe from the company. The legal formalities for the payout are currently underway, an internal note to employees said.

Besides this, existing investors and employees (esop holders) of the Flipkart group, including Myntra, can either reinvest in the latest PhonePe round, or sell shares in a secondary transaction.

The buyback, likely the largest ever by a new-age internet firm, comes as a broader funding winter is hurting tech firms and startups across the world.

Also read | Flipkart may go for $700 million Esop buyback as part of PhonePe financing round

Larger fundraise: The buyback is part of the $1.5-$2 billion funding being raised by PhonePe. The financing is spearheaded by Walmart, the largest shareholder in both Flipkart and PhonePe. As of now, PhonePe has raised around $850 million in this round, with General Atlantic also participating as an investor.

.jpg)

Notably, General Atlantic has invested close to $550 million, valuing PhonePe at $12 billion.

Flipkart Health+ CEO Prashant Jhaveri

Flipkart Health+ CEO to leave: Meanwhile, Prashant Jhaveri, chief executive of Flipkart’s online pharmacy Flipkart Health+, is leaving the firm after having joined just over a year ago, people aware of the matter said. Jhaveri, who was earlier chief business officer (CBO) at Apollo Health, will be replaced by internal candidate Kanchan Mishra, the sources added.

ETtech In-depth: Inside Paytm’s cashback offers for retailers

Fintech giant Paytm is back to offering cashbacks. This time, the money is being dangled before merchants, not consumers. And the strategy is proving to be quite a success, just as it did for consumer payments.

Give credit: Paytm aims to onboard a significant number of merchants and enable them to provide credit options in the upcoming months. To achieve this, Paytm is planning to offer attractive pricing for payment terminals and transaction charges, with cashbacks serving as an additional incentive, according to individuals familiar with the matter.

The company has structured these cashback schemes in such a way that merchants encourage consumers to convert their purchases into a ‘buy now, pay later’ (BNPL) option, or easy EMI schemes. This way, Paytm gets to push consumer loans too, the sources said.

Being pushy: The company has been pushing for a better offline presence, which is the only avenue open to Paytm now after the RBI halted its online merchant acquisition owing to issues with its payment aggregator licence application. The fintech firm has totally deployed 7.9 million PoS (point-of-sale) terminals, of which 4,00,000 were installed in June alone.

Big offer: In a pitch, reviewed by ETtech, to a large pharmacy chain that needed more than 100 terminals, Paytm offered an incentive of Rs 40 lakh per annum, provided the chain deployed at least 100 terminals. Another condition was that the retailer would offer customers credit solutions such as Paytm Postpaid (BNPL) or easy EMI options. On top of this, the listed fintech also offered to waive the security deposit of Rs 15,000 and per-terminal charge of Rs 2,000 for the pharmacy chain.

Chandrayaan-3 to lift off on July 14

ISRO chairman S Somanath announced that Chandrayaan-3, India’s third lunar exploration mission, is scheduled to be launched on July 14 at 2.35 pm.

Mission possible: Chandrayaan-3, which consists of a lander and rover similar to its predecessor (whose landing had failed) will most likely be ready for touchdown by the last week of August, Somnath said.

Talking about the problems with Chandrayaan-2, the ISRO chief said that the landing gear for the earlier lunar vehicle was designed to handle a speed of two metres per second, but that’s been increased by 50% for the new mission. The lander and the rover will both have a life of 14 days, Somnath added.

FDI in space: Earlier, Indian National Space Promotion and Authorization Center (IN-SPACe) chairman Pawan Goenka said that revival of the Space Foreign Direct Investment (FDI) policy is currently in the works and will be released soon. Asserting the significance of the growing number of space startups in the country, Goenka emphasised the importance of global partnerships in the sector.

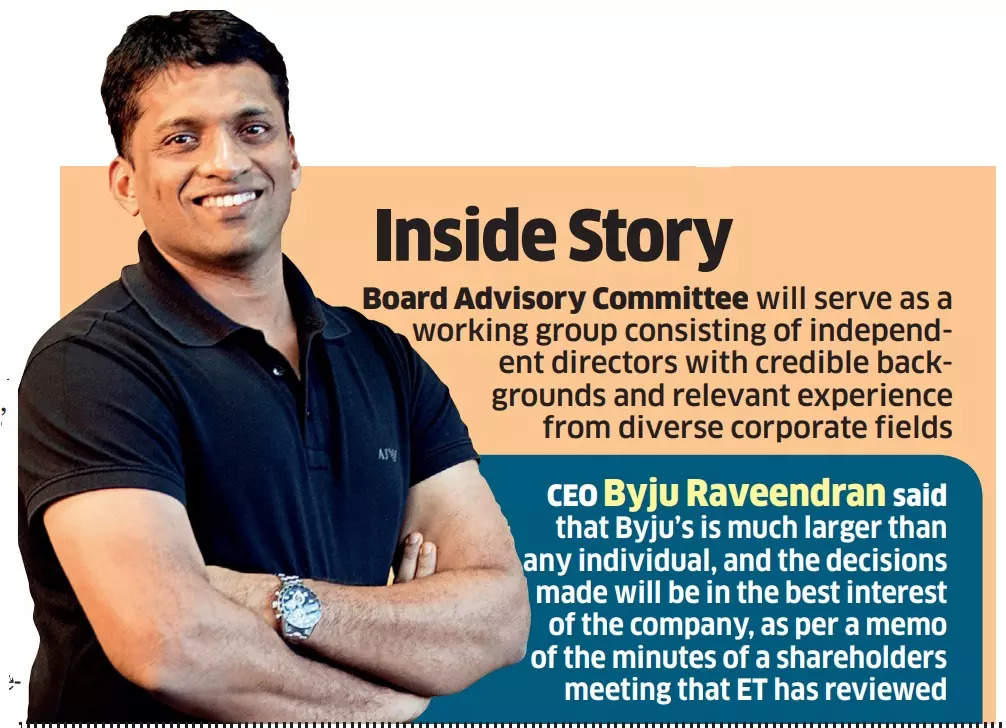

Committee to guide Byju on governance

Troubled edtech Byju’s CEO Byju Raveendran announced on Tuesday that the edtech major will establish a Board Advisory Committee (BAC) to provide guidance and advice regarding the composition of its board and governance structure.

Independent directors: The BAC, comprising independent directors with diverse corporate backgrounds and experience, will advise the CEO on board composition and governance that’s appropriate for Byju’s scale, size, and performance aspirations, as per minutes from a shareholders’ meeting reviewed by ET.

Also read | Byju’s and the debt trap haunting Indian tech startups

On finances: The company’s chief financial officer, Ajay Goel, issued several updates on the company’s financials. He told shareholders that BDO will audit Aakash, WhiteHat Jr, and Think & Learn, as well as the overall group. The timeline for the completion of the FY21-22 audit is set for the end of September, while the FY22-23 audit is expected to be concluded by the end of December.

Also read | Byju’s breaking bad: Will Indian startups feel the aftershocks

Other Top Stories By Our Reporters

Google accuses CCI of protecting Amazon: Google has told the Supreme Court that the Competition Commission of India (CCI) relied on “unreliable and uncorroborated” statements from Amazon to pass orders against it for abuse of dominance in the Android market space.

Will Meta’s Threads unravel Twitter here? Meta on Thursday launched a Twitter rival, Threads. The Facebook and WhatsApp parent is positioning the app as an extension of its Instagram platform, though it is a standalone application with features that are similar to Twitter. Experts ET spoke to said the app may dent Twitter’s user base in India, especially among the young.

Offer-shopping hits BFSI firms: At a time when companies in India’s banking, financial services, and insurance (BFSI) sector are looking to hire technology professionals specialised in niche skills to steer their accelerated digitisation drive, candidates with high-end tech expertise are ‘offer-shopping’, leading to several companies struggling with a low offer acceptance rate.

Sizing up the digital economy: The centre is looking at ways to estimate the size of the digital economy by identifying key performance indicators as well as gaps, and the possible solutions to grow it further. It has set a goal of reaching a $1 trillion digital economy in the next few years.

Global Picks We Are Reading

■ Give Every AI a Soul — or Else (Wired)

■ Just call them tweets (The Verge)

■ “Gig reviewers” are endorsing fake products for quick cash in Brazil (Rest of World)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.