Ola Electric to refund Rs 130 crore to customers for EV charger; What’s plaguing Nykaa?

This and more in today’s ETtech Top 5.

Also in this letter:

■ BharatPe acquires 51% in NBFC Trillion Loans to bolster lending play

■ Why are Indian startups imploding?

■ ETtech Done Deals

Ola Electric to refund Rs 130 crore to customers for EV charger

The government has closed its probe against Ola Electric in a case related to the mispricing of its electric two-wheelers after the company agreed to reimburse buyers the cost of chargers sold separately with scooters, officials said.

A senior government official told ET that the company will reimburse about Rs 130 crore to nearly 1 lakh customers who had purchased Ola S1 Pro electric scooters as of March 30, 2023.

What’s the issue? Some manufacturers billed chargers and proprietary software separately to customers to price vehicles below the eligibility threshold to avail the FAME-II subsidy, prompting an investigation by the Ministry of Heavy Industries (MHI).

The ministry subsequently paused the release of subsidy to electric vehicle makers, including Ola, while the investigation was on.

Ola, however, continued to sell its electric scooters at the subsidised price, leading to a build-up of subsidy dues to the tune of Rs 500 crore.

More details: The Centre offers financial support for 10 lakh electric two-wheelers under the FAME II incentive scheme. Electric vehicle companies can offer a discount of up to 40% on the cost of locally manufactured vehicles and claim it as a subsidy from the government. The Rs 10,000-crore subsidy programme is available only to electric two-wheelers that retail below Rs 1.50 lakh per unit.

Zypp Electric deploys 2,000 e-scooters in Bengaluru: EV startup Zypp Electric has announced the deployment of 2,000 electric scooters in Bengaluru. It has also onboarded 2,000 delivery executives to facilitate efficient last-mile delivery. Zypp aims to integrate 5,000+ more riders with its service in the coming 2 months, and add 8,000 additional electric scooters to its fleet in the city.

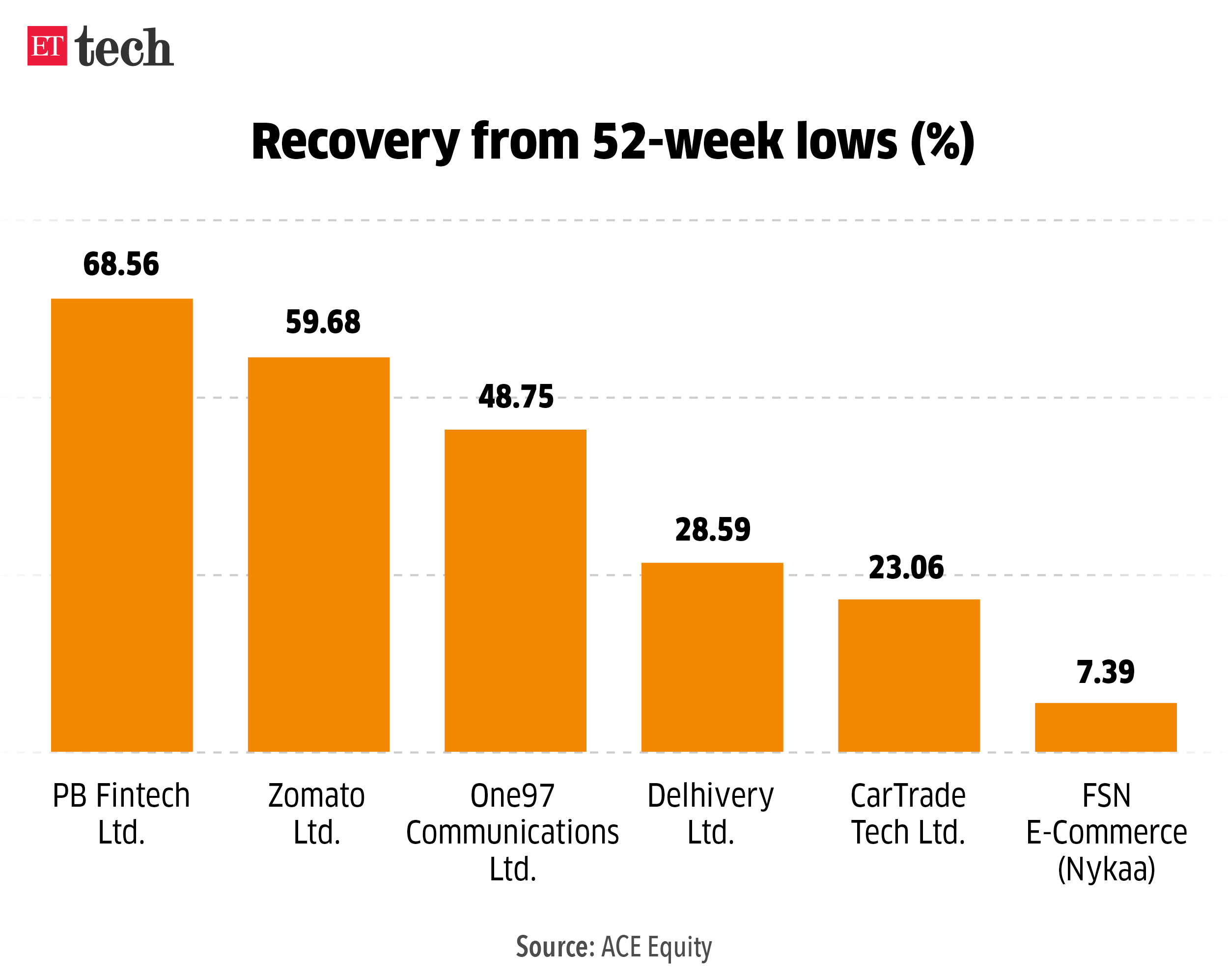

What’s plaguing Nykaa, the erstwhile poster boy of new-age stocks?

Despite a sharp recovery in new-age stocks, shares of fashion and beauty etailer Nykaa, dubbed the most promising of the lot at the time of its IPO, are languishing.

Stock update: Nykaa has been in freefall ever since it released its March quarter business update. It sank to an all-time low of Rs 114.30 last week on the BSE, only to recover some ground on Friday. The company’s share price has plunged 57% in the last 12 months, 25% in the last six months, 21% in the year to date (YTD) and 3% in the last month.

What about its peers? In comparison, shares of most new-age stocks, including One97 Communications (Paytm), Zomato, CarTrade Tech, PB FinTech and Delhivery have recovered between 23-69% from their lows. Barring CarTrade, these stocks have also given positive returns on a 3-month, 6-month and YTD basis.

Pain points: A series of big-ticket exits from the company, rising competition, and a fiasco around a bonus share issue are among the red flags that investors have raised.

Nykaa has witnessed a mass exodus, with five senior executives leaving the company in 2023 alone. In addition, chief financial officer Arvind Agarwal had resigned last November.

On top of this, Nykaa now faces fresh competition from big players Tata Group, Reliance and Shoppers Stop. Reliance Retail has made its entry through a focused brand, Tira. The Tata group is also eyeing an opportunity, while Shoppers Stop has unveiled SS beauty stores and plans to go online.

BharatPe acquires 51% in NBFC Trillion Loans to bolster lending play

Fintech platform BharatPe said on Tuesday that it has acquired a majority stake in Mumbai-based non-banking financial company (NBFC) Trillion Loans to boost its lending business.

Quote, unquote: BharatPe founder and chief operating officer Shashvat Nakrani said: “Today, we facilitate loans of over Rs 500 crore every month to our merchant partners. Providing access to credit to our merchant partners is key to our business model, and this acquisition will further propel our growth and accelerate our journey to profitability”.

Details: Trillion Loans offers secured and unsecured loans to small and medium enterprises (SMEs), including small business loans as well as working capital loans. Additionally, the company also offers consumer products such as auto, gold, and education loans.

NBFC tack: The acquisition comes in the backdrop of fintechs focussing on lending through their own NBFC units while reducing their dependency on partnerships given the heightened regulatory scrutiny following the issuance of digital lending guidelines by the Reserve Bank of India (RBI) last year.

What the others are doing: ET reported on Monday that Kunal Shah-backed Cred is bolstering its credit play as it looks to raise separate capital for its NBFC Newtap Technologies. The NBFC has discussed raising $50-70 million to help scale its participation and credit exposure to Cred’s user base.

Last week, ET had reported exclusively that neobanking startup Jupiter was granted an NBFC licence by the RBI. Jitendra Gupta, founder of Bengaluru-based Amica Financial Technologies Ltd, which runs Jupiter, had told ET that the startup intends to capitalise its lending business with around Rs 100 crore, and raise an additional Rs 100 crore in debt to fund its credit operations.

ETtech Done Deals

Pocket FM secures $16 million in debt funding from Silicon Valley Bank: Audio series platform Pocket FM on Tuesday said it has secured $16 million in debt funding from US-based Silicon Valley Bank (SVB), now a division of First Citizens Bank. The company said that with this additional capital infusion, it will look to double its strategic priorities to strengthen its audio series library, expand its creator community globally and accelerate its revenue.

Hypd raises $4 million funding from Orios, existing investors: Content commerce platform Hypd has raised $4 million in a pre-series A round from Orios Venture Partners. Existing investors Sauce VC and Better Capital also participated in the round, it said in a statement. The startup said it will utilise the funds to speed up the acquisition of creators, branch out into more categories, and expand its team and product.

Food-tech startup Pluckk acquires mealkit brand KOOK: Pluckk, a digital lifestyle-oriented fresh food brand in the fruits and vegetables (F&V) space, on Tuesday announced the acquisition of KOOK, an Indian food-tech startup that offers a range of DIY meal kits, at a deal value of $1.3 million. The acquisition was through a combination of cash and equity, the company said in a statement.

Tweet of the day

Why are Indian startups imploding?

Various government programmes — such as Digital India, Startup India — are supposed to have energised the startup ecosystem, notes a report by news agency Bloomberg. Senior officials have insisted that “visionary and astute leadership” have “turned India into the [world’s] third-largest startup ecosystem.”

Yes, but: In the cold, hard light of 2023, however, much of that enthusiasm seems misplaced, or at least overstated, said the report. By some estimates, 92 companies in the sector have laid off over 25,000 employees since the beginning of the year.

Lowered expectations: Many that had planned to go public have postponed their offers or cut IPO size. For instance, hospitality service Oyo Hotels has reduced the size of its initial public offering to less than half of its original estimate of $1.2 billion.

In other cases, big financial firms have marked down the value of some of their investments by as much as half.

Funding taps run dry: By some estimates, the amount of funding for the sector fell 75% in the first quarter of this year, compared to the same quarter in 2022. Late-stage startups looking for funding to scale up their operations have found it particularly hard to raise money.

Today’s ETtech Top 5 newsletter was curated by Erick Massey in New Delhi and Megha Mishra in Mumbai. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.