Now, Twitter flags India’s data bill; Yulu’s pandemic pivot

Also in this letter:

■ Can Yulu pull off its pandemic pivot?

■ What’s next for Indian startup IPOs?

■ Crypto platforms explore ‘tax-free’ products

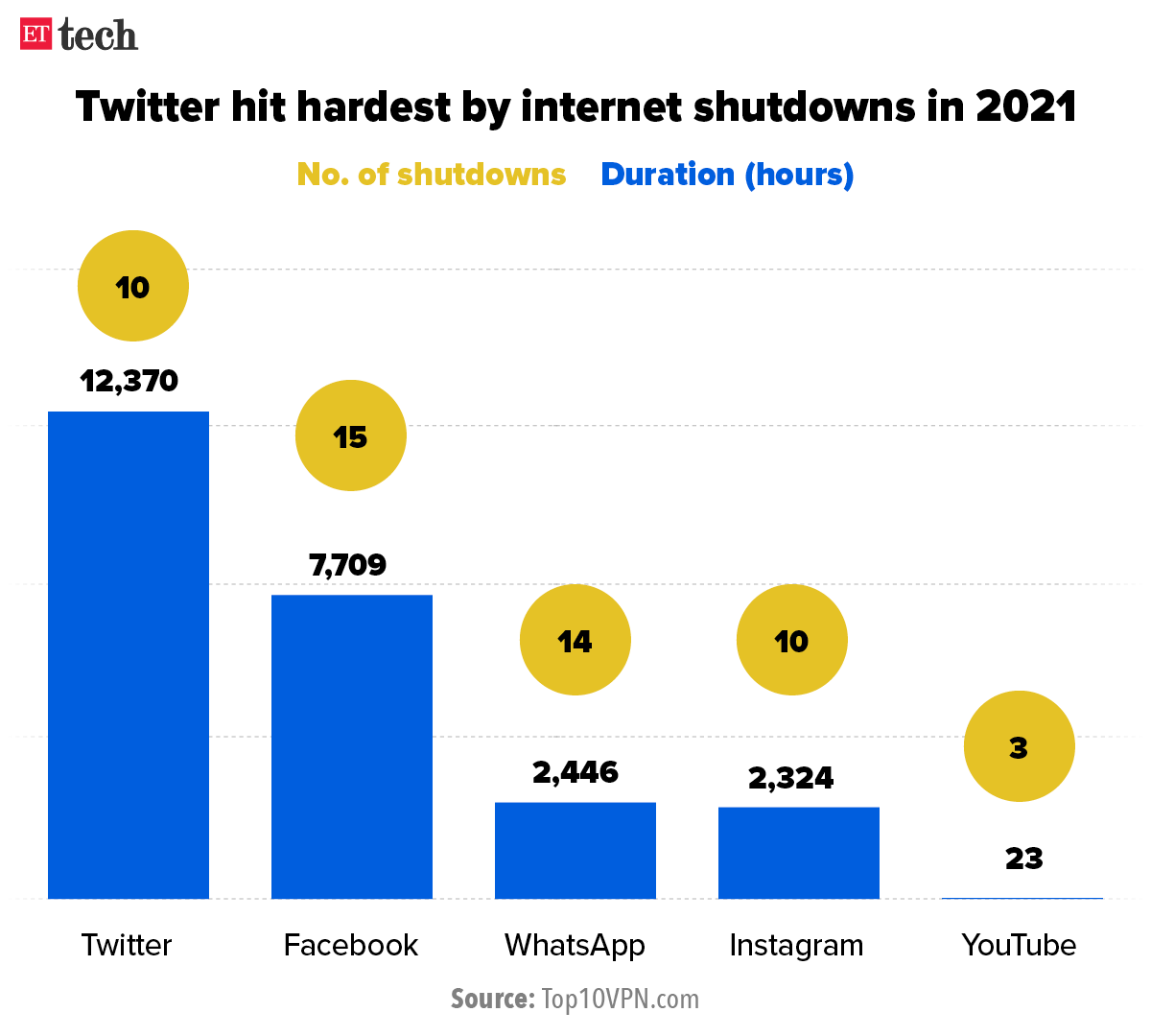

Now, Twitter says it’s concerned about India’s Data Protection Bill

Twitter has said it is concerned about proposed legislation in India that could impose fines on the company for failing to remove content deemed inappropriate or inflammatory.

With this, the company joins Alphabet and Meta Platforms in flagging concerns with the Personal Data Protection Bill, 2019, under which companies would face heavy penalties for non-compliance.

Driving the news: Twitter raised these concerns in its annual 10-K filing with the US Securities and Exchange Commission last week, The filing is part of a report on financial performance required from all publicly traded companies in the US.

What else? Twitter also raised issues of compliance with respect to privacy, data protection, data localisation and cybersecurity, without naming India.

The company added that the use of feature phones in both India and Pakistan was hampering its monetisation efforts.

The social media company also said it was being kept on its toes due to increased competition from regional websites and apps. While Twitter did not explicitly mention India in this context, regional language micro-blogging site Koo is pitching itself as a strong alternative.

Meta and Alphabet: Twitter’s statement after Meta Platforms flagged concerns about India’s upcoming privacy legislation, which seeks local storage and in-house processing of data, in its SEC filing on February 2.

Alphabet Inc also said in its regulatory filings earlier this month that similar issues were plaguing its operations, without naming any specific country.

New privacy law? On February 17 we reported, citing sources, that India may draft a completely new privacy bill, putting aside the current version of the Personal Data Protection Bill 2019, which has been in the making for nearly five years.

Can mobility startup Yulu pull off its pandemic pivot?

Joydeb, 21, does not own a bike or even have a licence to ride one. For him, renting a Yulu Miracle 2.0 electric bike and using it to deliver food has become an easy way of earning some money.

The bike cannot cross 25 km per hour, so it doesn’t come under the Motor Vehicles Act. This means riding it doesn’t require a licence – the Miracle 2.0 electric bike is considered a bicycle under the law. But it’s still had its share of legal hassles.

Many like Joydeb have taken to Yulu’s EV as demand for food and essential delivery has skyrocketed amid the pandemic. Yulu’s cofounder Amit Gupta told ET that 60% of the company’s revenue now comes from the delivery workforce and that he expects this to go up to 80% by the end of the year.

Pandemic pivot: Yulu was founded in 2018, offering cycles and later electric vehicles to white-collar office-goers for last-mile connectivity. The pandemic was a body blow for all mobility companies and Yulu found itself in a downward spiral as work from home took over.

But something changed after the second wave of Covid in 2021. The demand for delivery workers skyrocketed amid rising demand for home delivery of both food and essential goods.

“We treated them [delivery workers] like a stepchild,” said Gupta. “Occasionally they were using it. Then the second wave happened and we started seeing value in catering to that use case.”

Yulu’s pivot was more accidental than calculated. The company, which competes with the likes of Bounce and Vogo, is set to deploy its new model, Yulu Dex, which is more suitable for deliveries.

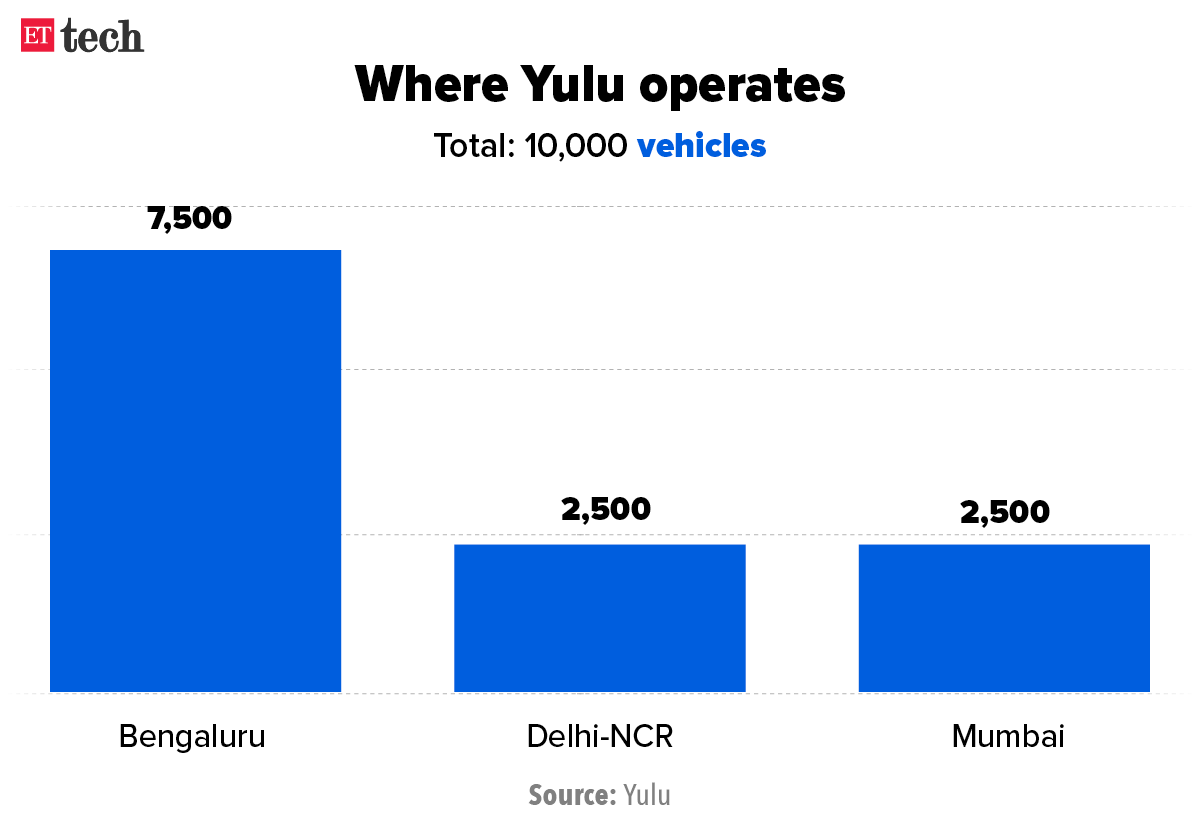

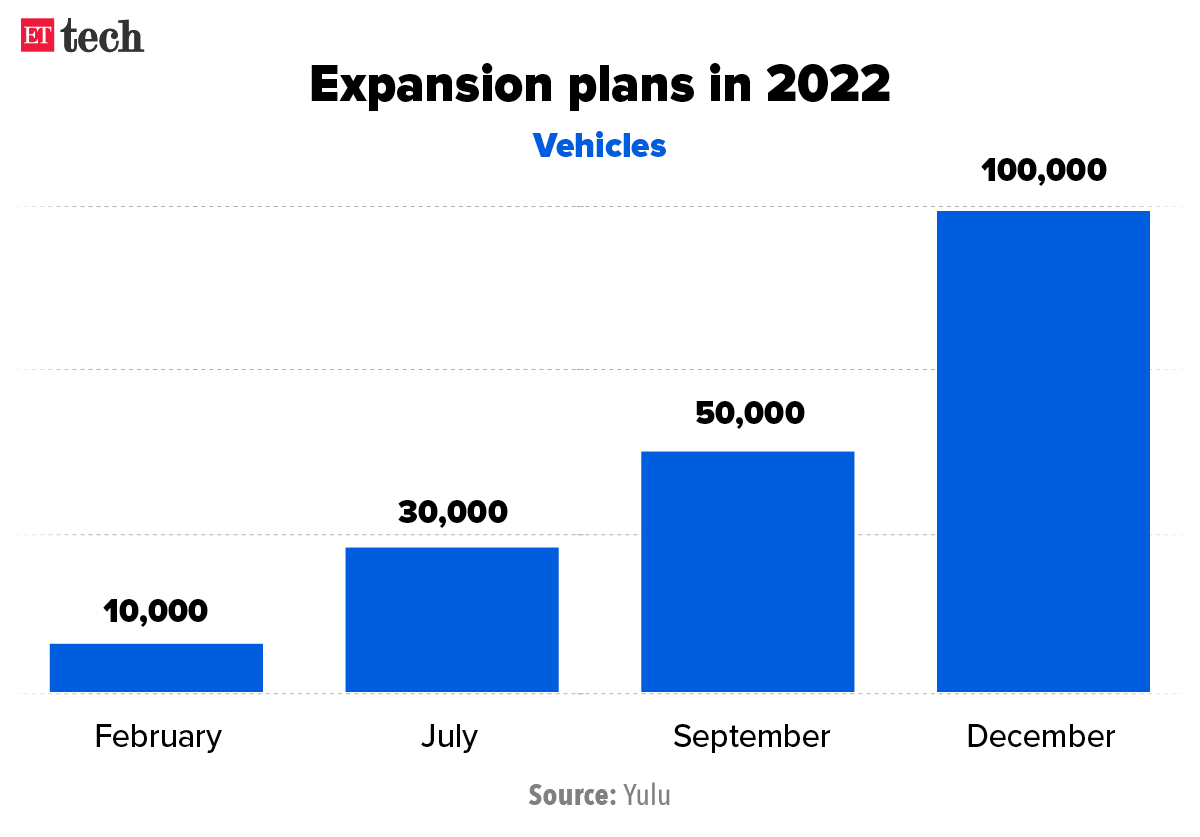

Gupta said that Yulu Dex has a better shock-absorber and a carrier at the back. He is confident of increasing the current fleet of 10,000 vehicles to 100,000 by the end of the year, with the Dex comprising the lion’s share.

INFOGRAPHIC INSIGHT

What’s next for Indian startup IPOs?

As markets get more cautious, startup IPOs are likely to hit rough waters amid a global decline in tech stocks and sub-par quarterly results from publicly listed Indian startups, Zerodha founder Nikhil Kamath said on the latest episode of The Rundown by ETtech, our chat show on Twitter Spaces.

The liquidity from the US percolated to emerging markets such as India in 2021, inflating valuations and creating a bubble. As this liquidity dries up, many companies that are highly leveraged will be adversely affected, Kamath added.

In a lively discussion on February 18, Kamath, A91’s Abhay Pandey, and Pankaj Naik, digital and technology lead at Avendus Capital, offered an unfiltered view on what’s playing out in the public and private markets, and what’s expected for the next crop of IPO-bound companies including Delhivery, Pharmeasy and Snapdeal.

Reality check: According to data from our Markets team, the prices of new-age companies stocks are well below their listing prices. Nykaa is down 34%, Zomato 29%, Paytm 46%, Policybazaar 37% and Cartrade 59%.

What they said: “It’s very hard to equate the numbers (Zomato and Nykaa) are putting out with their valuations even today. To value them today like the future has already happened might be a bit far-fetched. I think where they sit today is overvalued. They are still good companies with interesting use cases [but] I would still be averse to entering these companies,” said Kamath.

Pandey added, “I think expectations are so high that it’s just hard for companies to meet them. We saw what happened when Shopify delivered pretty strong results and 41% growth. The market said, ‘That’s not enough’. That is a problem. Expectations in valuations are built to a level which are not possible to deliver.”

On the next crop of startup IPOs, Naik said, “Not-so-good companies actually don’t have access to the private market, but think ‘Let me come and sell it to public market investors and continue to do what I was doing’. Those companies definitely are in trouble.”

TWEET OF THE DAY

Crypto platforms explore ‘tax-free’ products

As investors explore ways to save tax on their crypto investments, crypto platforms are planning on introducing a slew of new products to help them earn interest on their deposits or draw loans against them without attracting the new tax.

The budget proposed a 30% tax on returns from digital currencies and a 1% Tax Deducted at Source (TDS) on digital assets. The government has not used the term “cryptocurrency” in the budget, but rather “virtual digital assets.”

But this means there shouldn’t be any tax on crypto-based products, some founders and investors said.

“The way the regulations are today, investors who invest in crypto-based products should not be covered either under the 1% TDS, or 30% tax on income. However, we have sought clarity on this from the government and will be approaching them in this regard,” said Darshan Bathija, cofounder and chief executive of Vauld, a Singapore-based cryptocurrency exchange.

Crypto platform executives said if crypto-based products are not taxed, demand from investors could shoot up.

“It (tax) will increase our operations as people will prefer to take out a loan on their crypto holding instead of selling it, to avoid the tax,” said Kumar Gaurav, founder and CEO of Cashaa. It will also boost long-term holders, who will use our savings account to generate passive income without trading, which will trigger TDS complications, he added.

Crypto prices crash as threat of war looms

Cryptocurrencies crashed over the weekend as the threat of Russia invading Ukraine escalated, causing the crypto investor community to offload their risky digital assets and protect their portfolios.

On Friday, US President Joe Biden said that Russian President Vladimir Putin had decided to invade Ukraine, and that a military strike could happen in days.

On Saturday and Sunday, there were reports of shelling and multiple explosions in Donetsk, eastern Ukraine, further driving fear into the crypto markets.

Bitcoin was trading on Coinbase at $38,265 at 5 p.m. India time on Sunday, down 4% in 24 hours and 9.6% lower over the previous seven days.

Rally halted: The Ukraine-Russia crisis has halted the rally that the crypto market had been recording. Bitcoin had made a smart recovery in the past few weeks, touching $45,855 on February 10 after a low of $32,327 on January 24. Ethereum went up to $3,284 on February 10 from a low of $2159 on January 24.

Eka Software, valued at $450 million, is up for sale

Eka Software, an enterprise cloud platform for commodity and supply chain management, has put itself up for sale.

It is in talks with global private equity firms such as PAG, TA Associates and Advent International for the same, three people with knowledge of the development said. The company is valued at $450 million.

“The final bids will come anytime soon, currently the due diligence is going on,” said one of the people.

Founded in 2001 by Manav Garg, Eka provides a commodity management platform covering trading and position management, physical supply chain, enterprise risk management and compliance and analytics.

It competes with the likes of OpenLink, FIS, Sapient, Accenture, Trayport, Allegro, ABB, Triple Point, SAP, and Amphora.

ETtech Done Deals

■ Supply chain and inventory management startup Increff has raised $12 million in its latest funding round, led by TVS Capital Funds, Premji Invest, and Binny Bansal’s 021 Capital. It has also raised capital from six angel investors as part of this round. The company said it will use the capital to set up offices and strengthen its teams in the US and Europe, and expand its product offering and services.

■ Digital insurance marketplace RenewBuy has acquired Bengaluru-based fintech start-up Artivatic.AI, as it looks to scale up business and improve technology solutions to better serve customers in insurance claim settlement, risk assessment and underwriting. Artivatic.AI is valued at $10 million while acquisition is done by a combination of cash payment and share-swap deals. Promoters of the AI-based start-up have received shares of RenewBuy, according to the chief executives of both the firms. The deal was closed in the first week of February.

Other Top Stories By Our Reporters

Why crypto firms are on a flight to Dubai: Crypto experts estimate that between 30 and 50 Indian crypto entrepreneurs, like Polygon’s founders, now run their blockchain and crypto startups out of Dubai and Singapore, stung by a 2018 circular by the RBI which banned banks from dealing with the digital asset. (Read more)

US to process more employment green cards this fiscal: In a welcome development for Indians in line for employment-based green cards in the United States, more visas will be available under high priority categories this year. On Friday, the US Citizenship and Immigration Services (USCIS), which administers the immigration process, said eligible employment-based green card applicants could move to a higher preference category. (Read more)

Top companies tap freelancers to overcome attrition, talent shortage: Demand for freelance professionals has reached a new high in the country as companies across sectors, from technology and banking to consumer and consultancy, are increasingly relying on gig talent amid rising attrition rates and limited supply of skilled talent. (Read more)

Hinduja Global Services wins UK Health Security Agency contract: Business process management firm Hinduja Global Solutions’ UK subsidiary has won a 211-million-pound (Rs 2,100 crore) contract from the UK Health Security Agency (UKHSA) to provide critical customer support to the country’s citizens. The contract is for an initial period of two years, with an option to extend. (Read more)

Global Picks We Are Reading

- $1.7 million in NFTs stolen in apparent phishing attack on OpenSea users (The Verge)

- Who Is Behind QAnon? Linguistic Detectives Find Fingerprints (NYT)

- Even Salesforce’s own employees think its NFT plans are dumb (Mashable)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.