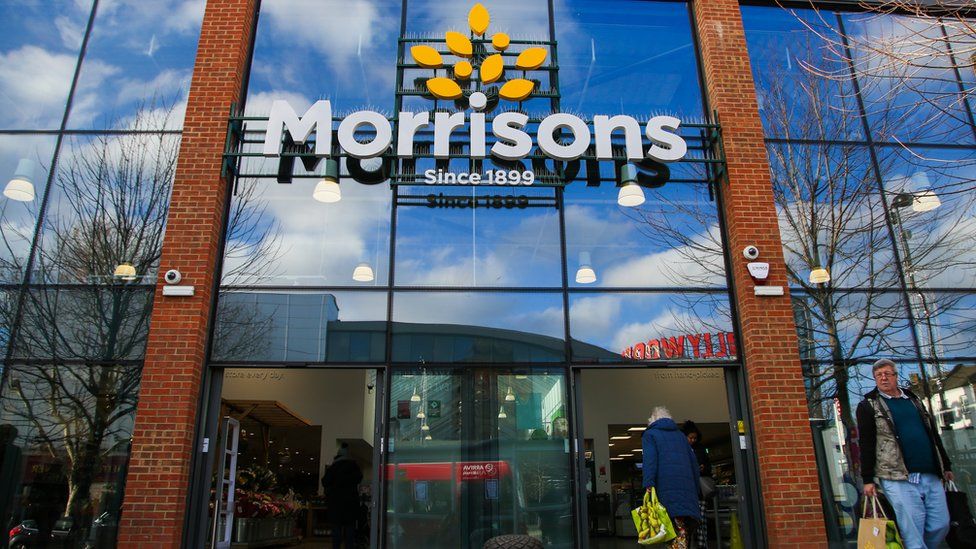

Morrisons starts hunt for new CEO after private equity takeover

Morrisons has started the hunt for a new chief executive in the wake of its £7bn takeover last year.

The private equity firm behind the supermarket, Clayton, Dubilier & Rice (CD&R), have started looking for someone to replace David Potts.

Morrisons’ current CEO, who has been in the post since 2015, is to step down in about two years.

CD&R have joined forces with headhunters Skill Capital, according to The Telegraph newspaper.

The recruitment firm had already approached some potential candidates at the end of last year, it was reported.

CD&R beat the Fortress Investment consortium at auction with a bid of £7bn for the supermarket last year.

Clayton, Dubilier & Rice (CD&R) bid 287 pence per share – 2 pence per share above their existing offer and just a penny above the 286 pence offered by a consortium led by SoftBank-owned Fortress Investment.

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.