More online gaming firms under I-T lens; Tatas may consolidate ecommerce biz under one entity

Also in this letter:

■ Tatas to bring startup businesses together under one roof

■ Cloudtail’s revenue jumped 15% before shutdown

■ Delhi HC issues notice to Centre on Cert-In cybersecurity rules

I-T dept issues notice to seven more online gaming firms for tax evasion

The Income Tax (I-T) department has issued show cause notices to seven online gaming companies and about three dozen high-value players active on their portals, officials with knowledge of the matter told us. The possible tax evasion in these cases could be to the tune of Rs 28,000 crore.

The action comes close on the heels of the GST intelligence wing issuing a similar notice earlier this month to a Bengaluru-based online gaming portal GamesKraft Technologies Pvt Ltd demanding Rs 21,000 crore in taxes, interest, and penalty.

Details: “We have the data and are in the process of issuing notices to some of the players and companies,” Nitin Gupta, chairman of the Central Board of Direct Taxes (CBDT) told us, without giving further details. Gupta had earlier said the I-T department was closely watching the online gaming business after authorities found instances of tax evasion.

Rules in the making: The CBDT is working out detailed guidelines on the taxability of the online gaming sector to clear any taxation ambiguity. The gross winnings face a flat 30% tax while the gaming portals are mandated to deduct tax at source at the rate of 0.1% for winnings of over Rs 10,000.

Lack of clarity: Gupta said it was observed that the gaming companies were not strictly enforcing the tax deduction at source (TDS) provisions. The gaming industry maintains that the liability to pay tax did not lie with them. Industry officials say there is also a lack of clarity about the deduction of tax in cases where the payment was in kind such as free travel, or made to overseas residents.

Tatas may bring startup businesses under one roof

We reported on September 21 that Tata Digital was increasing its authorised share capital from Rs 15,000 crore to Rs 20,000 crore, setting the stage for fresh capital infusion by its parent Tata Sons.

Meanwhile, people aware of the matter told us Tata Industries is set to hive off some of its significant startup businesses to consolidate the scalable ecommerce entities under one entity. The development comes amid a larger group consolidation strategy led by the principal investment holding company Tata Sons.

Consolidation on the cards: Tata Cliq, Tata Cliq Luxury, Tata CLIQ Palette and Tata Health will be brought under Tata Digital in the next two weeks to consolidate the scalable ecommerce entities under one roof, people aware of the matter told us.

Catch up quick: An executive close to the development told us on condition of anonymity that capital allocation efficiency and scalability were the focus. “Smaller businesses need to scale up to be profitable and the ones that can are being housed in entities that can do so. Tata Cliq and Tata Health are all businesses that will scale under Tata Neu and get the kind of capital allocation they need to scale up.”

In November 2021, Tata Consumer Products acquired Tata SmartFoodz from Tata Industries Limited while Tata Advanced Materials was moved into Tata Aerospace. Employees in these startups were shifted and moved into various group businesses according to their experience and skills, insiders told us.

Amazon’s former seller Cloudtail’s revenue jumped 15%

Cloudtail, formerly the biggest seller on the e-commerce marketplace Amazon India, reported a 15% jump in revenue to Rs 19,076 crore as its losses widened 2.8 times to Rs 522 crore in the financial year 2021-22 (FY22).

Employee costs, however, shrank 45% to Rs 105 crore, indicating that its workers were already in transition before the company shut down in May following Amazon’s 100% acquisition of its parent firm Prione Business Services.

Quick recap: The shutdown was prompted by regulatory changes that prohibit a foreign entity running a marketplace and group companies from equity participation in any of the sellers, or having control over their inventory.

The transition from Cloudtail to new sellers has not been smooth for brands, including Amazon itself. Multiple sellers told us the new sellers faced operational issues soon after the transition.

In related news: Amazon Seller Services – which runs the Amazon India marketplace – reported a 32% jump in overall revenue to Rs 21,633 crore on a standalone basis from Rs 16,378 crore a year ago. It also managed to cut net losses by almost 23% to Rs 3,649 crore in FY22 from a loss of Rs 4,748 crore in FY21.

Amazon Transportation, its logistics business, and Amazon Pay India, the fintech arm, also managed to increase revenues in FY22 but reported increased losses.

TWEET OF THE DAY

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

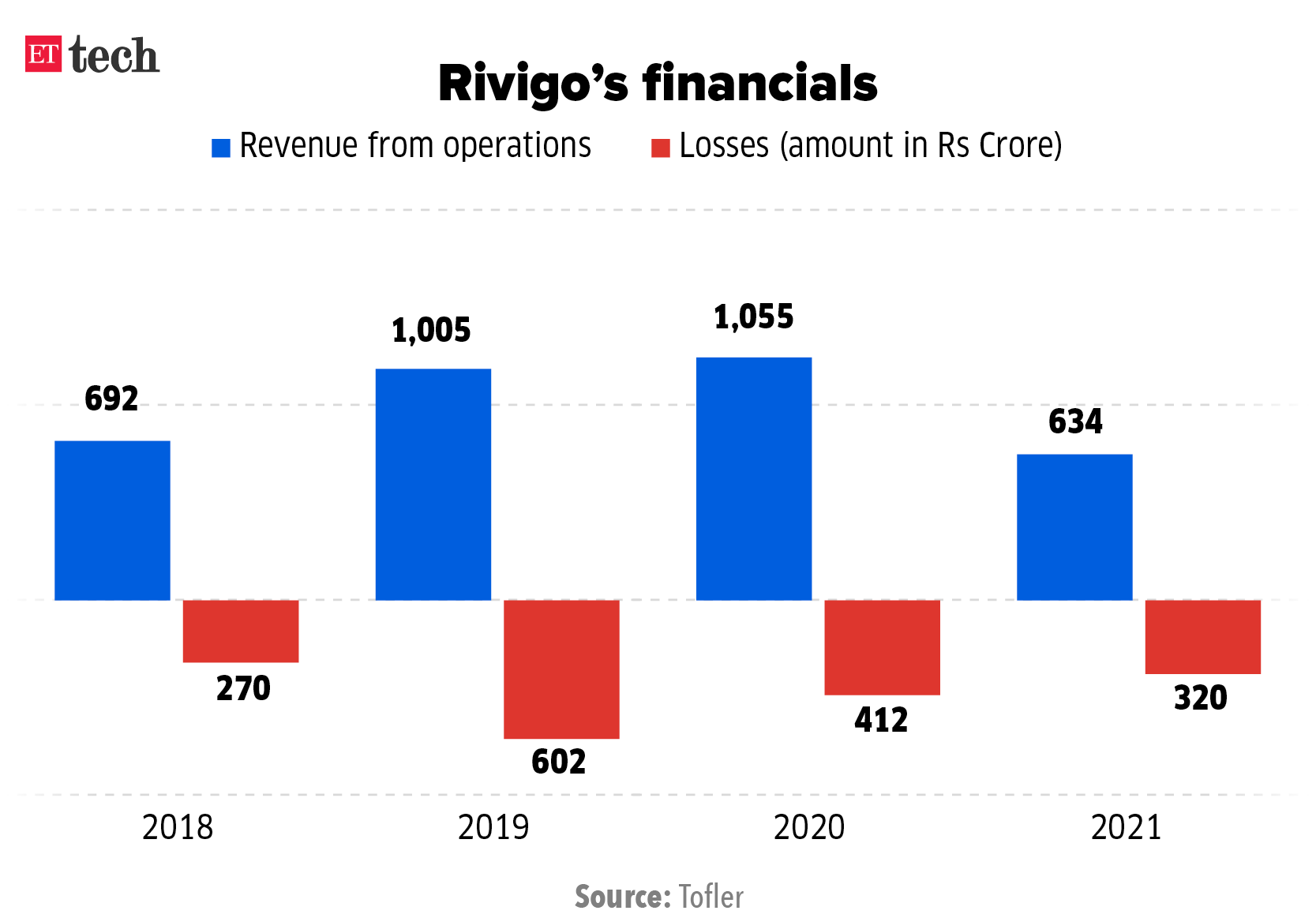

Rivigo deal will triple our express delivery biz: Mahindra Logistics MD

Mahindra Logistics managing director Rampraveen Swaminathan said the Rivigo deal will help the company nearly triple its express delivery business to over Rs 500 crore in a year. The business-to-business (B2B) express delivery operations of Rivigo, which it is acquiring, will form a significant portion of Mahindra Logistics’ business.

MD says: “So, while the press has reported about Rivigo’s financial problems, we believe that service quality metrics are good, unit margins are positive, and revenue yield per kilo or tonne is good,” Swaminathan told us.

Key details: In combination with Mahindra Logistics’ operations, Rivigo’s B2B express parcel service could gain the required scale to make the business profitable at the unit economics level, said Swaminathan, who is also its chief executive officer.

Challenges: Recently, new-age logistics company Delhivery faced multiple issues after acquiring Spoton resulting in its losses widening for the June quarter. For Mahindra Logistics, the express parcel B2B business is one of the fastest-growing within the company, as it is focussing on diversifying away from the line-haul full-truck load business.

Delhi HC issues notice to centre on CERT-In cybersecurity rules

The Delhi High Court has issued notice to the government on a plea by Virtual Private Network (VPN) firm SnTHostings challenging the legality of directions issued by the Indian Computer Emergency Response Team (Cert-In) in April on the mandatory record keeping of users.

What are the rules: Cert-In’s directions, issued under the Information Technology Act, 2000, require VPN providers and cloud service providers to report cyber incidents within six hours and maintain personally identifiable data of users for five years.

Under the rules, VPN providers will need to store validated customer names, their physical addresses, email ids, phone numbers, and the reason for using the service, along with the dates of use and their ‘ownership pattern’.

Counsel’s views: “Proton VPN and TunnelBear announced their departure around the weekend as Cert-In’s directions had to be followed from September 25 and (they had to) maintain user logs,” said Tanmay Singh, senior litigation counsel, IFF, who is representing SnTHostings proprietor Harsh Jain.

“He (Jain) is not challenging the entirety of Cert-In’s directions, but just direction IV and V which requires all service providers like data centres to maintain user logs for 180 days. This includes user activity, his/her data, which must be stored on the company’s server at his cost for six months or more,” Singh said.

Larger context: The directions by Cert-In on April 28 presented an existential crisis as they mandated the firm to collect a range of personal data and share it with Cert-In on demand and/or on the occurrence of a cybersecurity incident.

Other Top Stories By Our Reporters

Cognizant will focus on digital, stay away from “uneconomic” deals: Software exporter Cognizant will keep its focus on digital deals and stay away from those involving legacy technology as they have ended up being “uneconomic”, Rob Walker, president of global growth markets outside of North America, told us.

US SEC fines Oracle for creating slush funds to bribe officials in India, Turkey and UAE: The US Securities and Exchange Commission (SEC) has fined technology firm Oracle Corporation more than $23 million on charges that its company executives created and used slush funds to bribe officials in return for business in India, Turkey and the United Arab Emirates.

Global Picks We Are Reading

■ Voice assistants could ‘hinder children’s social and cognitive development’ (The Guardian)

■ In war-scarred Bosnia, tech startups fight massive brain drain (Rest of World)

■ The crypto world is on edge after a string of hacks (NYT)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.