Money View hits $900M valuation; how 2022 killed the startup IPO party

Credit: Giphy

Also in this letter:

■ 2022 Year in Review | Is the startup IPO party over?

■ Over 500 consumer tech firms will be listed in 10 years: Stallion Asset’s Amit Jeswani

■ Hacker claims 400 million Twitter users’ data is up for sale

Money View valued at $900 million in latest fundraise

Bengaluru-based fintech startup Money View said on Monday it has raised $75 million in its Series E funding round led by private equity giant Apis Partners.

The round, which saw participation from Tiger Global, Winter Capital and Evolvence, values the online financial services provider at $900 million, the company said.

We reported in October that Money View was in talks to raise up to $150 million in a round being led by Apis.

What funding winter? This is the second fundraise in 2022 for Money View, which picked up $75 million in Series D funding from investors including Tiger Global, Winter Capital, Evolvence India and Accel in March, following which it was valued at $625 million.

Investments in growth- and late-stage startups have slumped this year thanks to high inflation, interest rate hikes in the US, the war in Ukraine, and other macro factors.

The startup said it will use the fresh funds to scale its core credit business, expand its team, and add to its product portfolio with services such as digital bank accounts, insurance, and wealth management solutions.

How’s business? Money View said it currently has an annualised disbursal run rate of $1.2 billion and managing assets under management (AUMs) of over $800 million. It added that it has been unit-economics positive since inception and profitable for the past two years.

WeWork India raises Rs 550 crore: Co-working major WeWork India said it has raised Rs 550 crore from funds managed by BPEA Credit. The funds will be used for future growth and potential consolidation opportunities.

It has a portfolio of around 70,000 desks spread over six million square feet in 41 centres across Bengaluru, Mumbai, Gurugram, Noida, Hyderabad and Pune.

2022 Year in Review | Is the startup IPO party over?

The market for initial public offerings fell off a cliff in 2022 in India and around the world. In India, IPO activity saw a dramatic slowdown in 2022 after a record-breaking 2021, thanks to heightened volatility caused by geopolitical tensions and global economic turmoil.

Poor post-IPO performance of new-age startups also caused many of their peers to rethink their listing plans.

2022 vs 2021: As many as nine startups listed on the bonuses in 2021, but only two – Delhivery and Tracxn Technologies – went public this year.

As the months passed, the list of startups that deferred going public only grew longer. Some of these were Snapdeal, Ola, Droom, MobiKwik, PharmEasy, Oyo, BoAt and Flipkart.

Listed firms continue to bleed: In addition to the market volatility, startups also deferred their listing plans because of the performance of startups that went public in 2021, such as Zomato, Paytm and Nykaa.

According to industry experts, these new-age companies took to the bourses at relatively high valuations only to see immediate and sustained corrections.

Over 500 consumer tech firms will be listed in 10 years: Stallion Asset’s Amit Jeswani

For investors in the new-age consumer technology companies, 2022 has not been a good year as valuations have seen a significant correction. However, the worst of it both in terms of stock price correction and earnings challenges, is behind us, according to Amit Jeswani, founder and CIO of Stallion Asset Pvt Ltd.

“We need to focus on this pack, and in the next 10 years, at least 500 consumer technology companies will get listed,” Jeswani told us in an interview.

Here are some edited excerpts:

Do you think the battered technology sector could get some respite in 2023? Do you see any investment avenues in this pack?

Absolutely! The worst in valuations and earnings are behind us. We need to focus on this pack, and in the next 10 years, at least 500 consumer technology companies will get listed. We are in a marathon here and have just finished 1 km out of the 42 km.

Which are the major sectors you would bet on in the near-to-medium term and why?

We believe financial, technology and consumer are the three sectors that will create the most wealth for the next three, five and 10 years in India.

Read the full interview here.

Also, read | Analysts advise caution as new-age stocks continue to plummet

Hacker claims 400 million Twitter users’ data is up for sale

.jpg)

A “threat actor” who goes by the username Ryushi has put data of 400 million Twitter users up for sale. The data was allegedly obtained through an exploit in Twitter up to early 2022.

Details: The person posted a sample database of 1,000 users with the private information of well-known personalities such as Alexandria Ocasio-Cortez, Brian Krebs, Vitalik Buterin, Kevin O’Leary and Donald Trump Jr, as well as the account of India’s information and broadcasting ministry.

Warning to Musk: The person warned Twitter and its chief executive Elon Musk of the consequences – including hefty fines under the General Data Protection Regulation (GDPR) – of such a large data breach.

“Twitter or Elon Musk, if you are reading this, you are already risking a GDPR fine over 5.4 million breach. Imagine the fine for a 400 million users breach,” the hacker wrote, adding, “Your best option to avoid paying $276 million in GDPR breach fines like Facebook did (due to 533 million users’ data being scraped) is to buy this data exclusively.”

Also, read | Meet the man who wants to be the next Twitter CEO

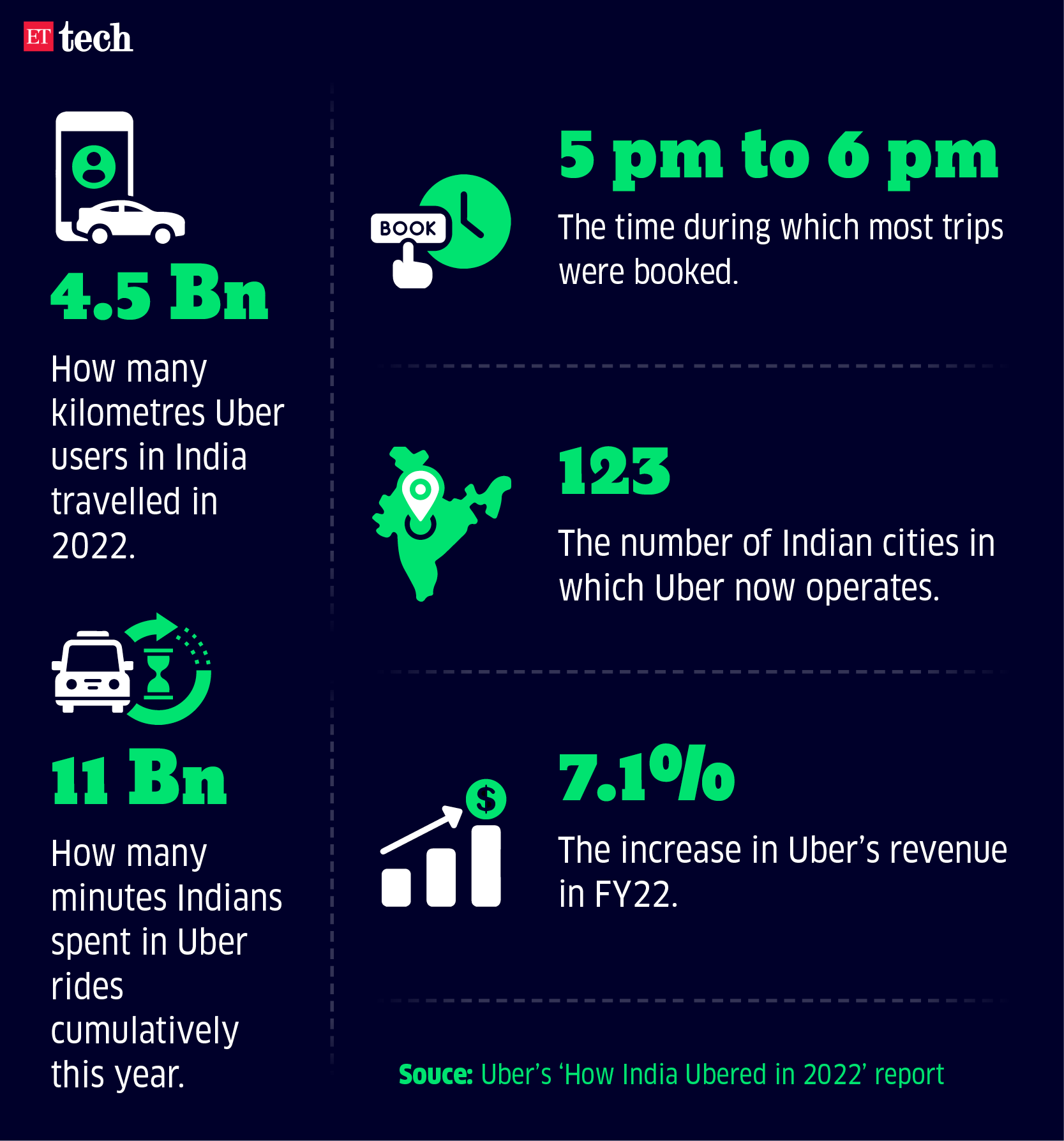

Indians travelled more than 4.5 billion km in Uber cabs in 2022: report

Indians travelled close to 4.5 billion kilometres in Uber taxis in 2022, according to an annual analysis by the company.

Driving the news: Uber released its report titled ‘How India Ubered in 2022’, giving a glimpse into the riding patterns of Indian consumers. According to the report, Uber’s low-cost cab option Uber Go was the most popular product, while Uber Auto was a close second.

According to the report, Delhi-NCR had the highest number of trips, followed by Bengaluru, Hyderabad, Mumbai and Kolkata. The report also said most trips were booked between 5 pm and 6 pm, reflecting the increasing number of people commuting to work.

It said users spent more than 11 billion cumulative minutes, or about 7.6 million days, in Uber rides.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Gaurab Dasgupta in Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.