Migration as a step toward opening a business

Temporary migration of low-skilled workers to higher income destinations can represent an investment opportunity for those who, in their home countries, cannot raise funds to start their own business. A paper by Bocconi’s Laboratory for Effective Anti-poverty Policies (LEAP) scholar Joseph-Simon Goerlach documented the phenomenon for workers migrating from countries in South and Southeast Asia to richer countries such as Malaysia, Singapore or nations on the Arabian Peninsula.

This form of migration is costly and risky, but promises high returns, which often are used as capital for self-employment, Goerlach explains in a video of the LEAP Talks series. Therefore, it is an essential factor for policymakers to consider when designing their interventions, such as policies aiming to boost entrepreneurship.

Bocconi’s Laboratory for Effective Anti-poverty Policies (LEAP) scholar Joseph-Simon Goerlach, in a paper with Laurent Bossavie (World Bank), Caglar Ozden (World Bank and CReAM, IZA), and He Wang (World Bank), collected a large dataset, representative for migrants that recently returned to rural and semi-urban areas in Bangladesh. They aimed to find out when this kind of investment is worthwhile, and whether foreign earnings are merely used for consumption or for other purposes.

Low-skilled workers from countries in South and Southeast Asia are usually employed in construction and services, where they are matched with employers prior to departure. This matching is typically facilitated by agencies that charge high upfront costs. Migrants often take on large loans to cover these costs, in the hope of earning higher incomes abroad. Despite the formal work arrangement, migrants face many risks, for instance that wages paid are lower than expected, harsh working conditions, or being forced to return home if they lose their job. This form of migration is costly and risky, but promises high returns if successful, and thus has all the characteristics of an investment.

Bangladesh is one of the main countries of origin of international migrants, with an estimated 7.8 million Bangladeshis working abroad. International migration from Bangladesh is largely low-skilled, with men representing about 95% of migrants. The picture is similar for many other major migrant-sending countries, such as India, the Philippines, Egypt, Pakistan or Nepal.

The data show that the median total cost of migration equals approximately three years of earnings of a wage worker in Bangladesh, or more than two years of household income. Hence most migrants have to borrow to finance their migration, but the investment pays off for many of them. In fact, they break even after little more than one year, while the median length of stay is 4.7 years.

“A striking feature we see in our data is a strong movement into self-employment after return,” says Professor Goerlach. “Prior to migration, the individuals in our sample have a self-employment rate of around 30%, similar to non-migrants, but it increases to over 60% after return. Many of these are small-scale entrepreneurs, such as shop keepers or taxi drivers. Still, their earnings exceed those of dependently employed workers, many of whom are informal laborers in agriculture or construction.”

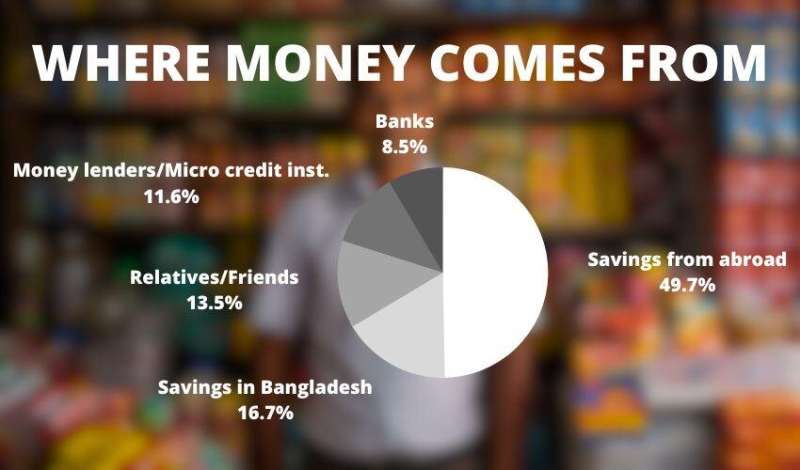

But why are workers able to borrow money to pay for emigration costs but not for self-employment activities? Like in many poor countries, credit access for entrepreneurship by low skilled Bangladeshis is very limited and comes with high interest rates. Instead, migrant loans are much more widely available. Temporary international migration can thus be an important stepping-stone on the route to self-employment. Correspondingly, the main source of self-employment capital (around 50%) for returnees is money saved while working abroad.

“Our paper reveals that migration and self-employment influence each other,” Prof. Goerlach concluded. “For instance, the effect of a loan subsidy for self-employment would be strongly overestimated if migration was ignored. The study finds that cutting the lending rate for entrepreneurial loans in half would reduce the emigration rate by 5.4% and shorten migration durations by 6.4%. Hence the implied lower savings repatriation undercuts the intended positive effect of the subsidy on self-employment.”

More information:

Temporary Migration for Long-Term Investment (Working paper). drive.google.com/file/d/11kdIg … EpBjxFnK4wk4EkV/view

Provided by

Bocconi University

Citation:

Migration as a step toward opening a business (2023, June 30)

retrieved 30 June 2023

from https://phys.org/news/2023-06-migration-business.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.

For all the latest Science News Click Here

For the latest news and updates, follow us on Google News.