Market’s tech focus is ‘shortsighted,’ with a broader bull run coming, portfolio manager says

Tech stocks on display at the Nasdaq.

Peter Kramer | CNBC

The market’s affinity for Big Tech stocks this year is “shortsighted,” according to portfolio manager Freddie Lait, who said the next bull market phase will broaden out to other sectors offering greater value.

Shares of America’s tech behemoths have been buoyant so far in 2023. Apple closed Wednesday’s trade up almost 33% year-to-date, while Google parent Alphabet has risen 37%, Amazon is 37.5% higher and Microsoft is up 31%. Facebook parent Meta has seen its stock soar more than 101% since the turn of the year.

This small pool of companies is diverging starkly from the broader market, with the Dow Jones Industrial Average less than 1% higher in 2023.

The gulf between Big Tech and the broader market widened after earnings season, with 75% of tech firms beating expectations, compared to a fairly mixed picture across other sectors and broadly downbeat economic data.

Investors are also betting on further rallies as central banks begin to slow and eventually reverse the aggressive monetary policy tightening that has characterized recent times. Big Tech outperformed for years during the period of low interest rates, and then got a major boost from the Covid-19 pandemic.

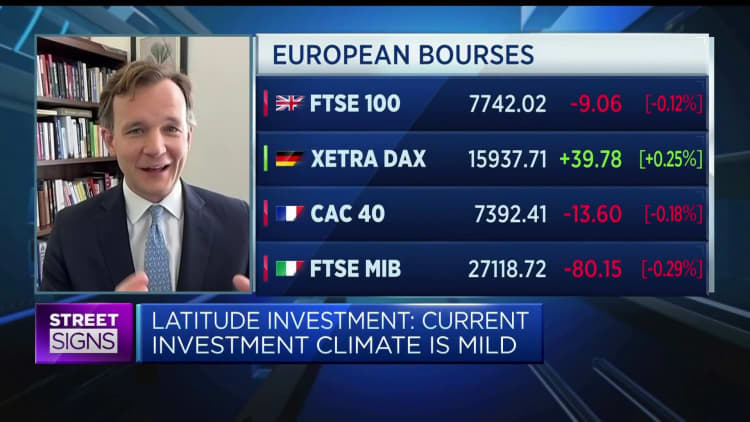

However Lait, managing partner at Latitude Investment Management, told CNBC’s “Street Signs Europe” on Wednesday that although the market’s positioning was “rational” in the circumstances, it was also “very shortsighted.”

“I think we are entering a very different cycle for the next two-to-five years, and while we may have a tricky period this year, and people may be hiding back out in Big Tech as interest rates roll over, I think the next leg of the bull market — whenever it does come — will be broader than the last one that we saw, which was really just sort of tech and healthcare led,” Lait said.

“You’ve got to start doing the work in some of these more Dow Jones type stocks — industrials or old economy stocks, to a degree — in order to find that deep value that you can find in otherwise great growth businesses, just outside in different sectors.”

Lait predicted that as market participants discover value across sectors beyond tech over the next six-to-12 months, the expanding valuation gap between tech and the rest of the market will begin to close.

However, given the strong earnings trajectory demonstrated by Silicon Valley in the first quarter, he believes it is worth holding some tech stocks as part of a more diversified portfolio.

“We own some of those technology shares as well, but I think a portfolio exclusively exposed to them does run a concentration of risk,” he explained.

“More interestingly, it misses out on a huge number of opportunities that are out there in the broader market: other businesses that are compounding growth rates at similar levels to the technology shares, trading at half or a third of the valuation, giving you more diversification, more exposure if the cycle is different this time.”

He therefore advised investors not to be roundly skeptical of tech shares, but to think about the broadening out of the rally and the “narrowing of the differential between valuations,” and to “pick their moments to get exposure.”

For all the latest World News Click Here

For the latest news and updates, follow us on Google News.