London’s FTSE 100 weighed down UK banks tumbling

London’s FTSE 100 was marred by the UK’s largest listed lenders falling sharply today on fears over borrowers struggling to pay home loans.

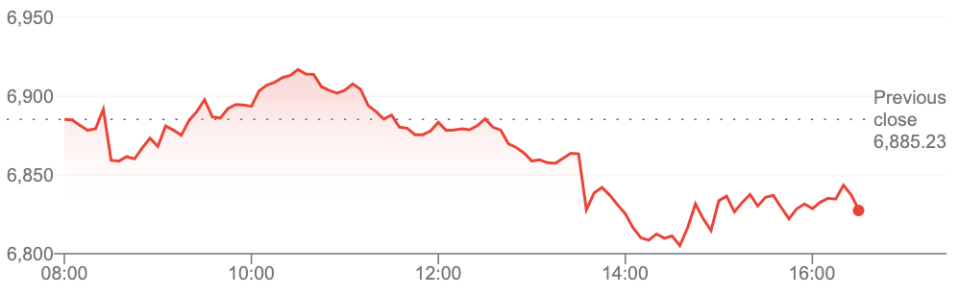

The capital’s premier index fell 0.86 per cent to 6,826.15 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, dropped 1.73 per cent to 16,611.16 points.

The City is bracing for a super-sized rate hike by the Bank of England at its next meeting on 3 November to tame inflation.

The central bank’s chief economist Huw Pill today repeated his judgement that a “significant” monetary policy response is required next month to tame UK financial market volatility in the wake of the mini budget.

FTSE 100 closed lower today

That has been interpreted as a sign the Bank will launch the biggest rate hike since it was made independent 25 years ago.

It has already lifted rates seven times in a row to 2.25 per cent.

However, confidence in the UK’s financial credibility has been knocked by prime minister Liz Truss and chancellor Kwasi Kwarteng launching £43bn worth of tax cuts.

The Bank is likely to be coaxed into a big rate hike to support the pound and tackle fears it is being guided by government policy instead of reducing inflation.

Volatility in the UK bond market has pushed average mortgage rates to over six per cent. Economists are worried that will put too much pressure on households and may spark tension in the UK housing market.

As a result, UK banks’ shares plummeted today.

Lloyds, Britain’s biggest mortgage fell 5.8 per cent.

NatWest fell more than four per cent.

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.