London holding off UK recession but businesses sweat over inflation

London appears to be withstanding the UK’s wider economic decline, with businesses hiring at a record pace and expecting their finances to fatten up over the coming year, a new survey out today reveals.

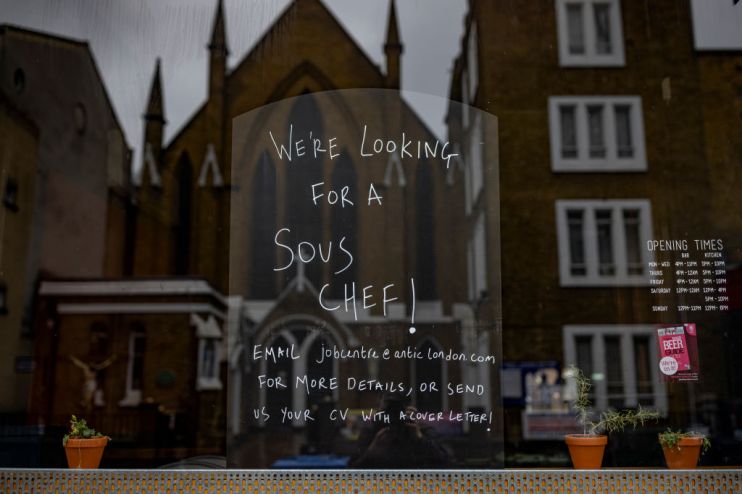

The capital’s jobs market is running at red hot levels, according to the London Chambers of Commerce and Industry’s (LCCI) latest Capital 500 quarterly economic survey.

Nearly one in four companies tried to take on more staff over the three months to December, the highest proportion ever recorded by the LCCI. Some 17 per cent expect to step up hiring in the coming months.

And, the proportion of London companies confident their revenue will jump in 2023 is rising, leading their expectations for the UK economy to tick up marginally.

Surveys out over the past couple weeks from KPMG, the Recruitment and Employment Confederation and S&P Global’s purchasing managers’ indexes have signalled the wider UK jobs market is weakening.

Some 22 per cent of firms based in the capital trousered a sales bump in the last quarter, up from 18 per cent. However, nearly a third of the 500 companies surveyed by the LCCI said purchases had fallen over the same period.

The surprisingly upbeat outlooks among London firms “is reasonably encouraging,” possibly suggesting the capital could experience a shallower recession compared to the rest of the UK, Vicky Pryce, chief economist advisor and board member at the Centre for Economics and Business Research, said.

Experts suspect the UK has already entered what could be a recession that burns throughout 2023. Although the slump will not be as deep as the Covid-19 and financial crises decline, it may be the longest recession in a century.

“Time and again London businesses demonstrate their resilience when faced with adversity and they will be crucial to driving an eventual economic recovery,” Richard Burge, chief executive of the LCCI, said.

London firms expect to be dragged down

Despite chinks of optimism, just over half of London firms do expect to be dragged into the wider reversal and that the city’s economy will shrink this year.

The nationwide slump has been engineered by soaring inflation – at a 40-year high of 10.7 per cent – and the Bank of England’s nine back-to-back interest rate hikes to tame it chilling household and business spending.

The LCCI’s next quarterly survey is likely to reveal weaker business confidence due to rail strikes during Christmas and the first week of the new year have also stopping people heading to the capital for work and pleasure.

Swelling costs are forcing firms across Britain to trim unprofitable activity, and London companies are not immune.

Nearly two in five complained of higher debt costs eroding their bottom lines, while over quarter are sweating over inflation.

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.