Jim Cramer says Nike, FedEx quarters demonstrate a key lesson for investors

CNBC’s Jim Cramer said Wall Street’s reaction Wednesday to quarterly results from Nike and FedEx offers an important lesson for investors: It’s misguided to focus purely on Federal Reserve commentary and predictions on where S&P 500 will go next.

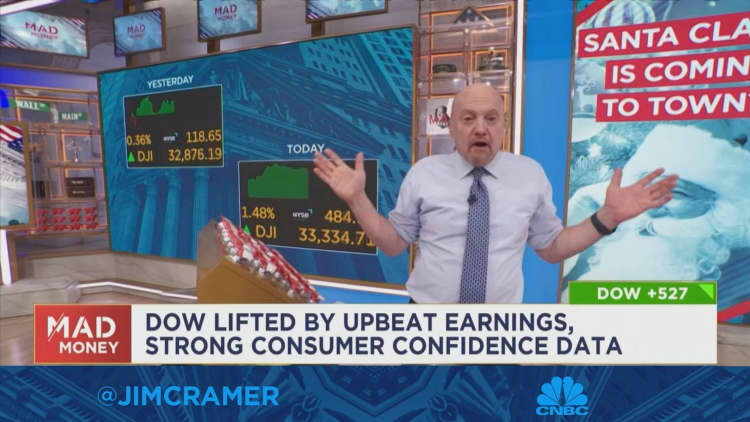

Both companies on Tuesday night reported better-than-feared earnings, sending their respective stocks higher and helping to boost sentiment across the market. All three major U.S. stock indexes posted strong gains Wednesday, reversing some of the declines seen in December.

related investing news

“You’ve got a whole contingent of professional commentators and money managers who act like nothing matters beyond statements from the Fed and the price levels of the S&P 500,” Cramer said. “See, they’re dead wrong, but that mentality explains why so few of them saw today’s rebound coming.”

Cramer said it’s possible the more positive attitude on Wednesday quickly fades and the bearish waves rush over the market again. He said the unexpected bounce — sparked in large part by corporate earnings — shows the benefit of focusing on individual companies who can outperform expectations. Putting too much emphasis on the S&P 500’s next move can make that task difficult, he said.

“Stocks are not just bushels of wheat or bales of hay or any other kind of grain varietal. There are huge differences between individual companies,” Cramer said.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.