IT salary hikes expected to trim down to 8-10% in FY24; PhonePe’s commerce app Pincode goes live

This and more in today’s ETtech Morning Dispatch.

Also in this letter:

■ A big chunk of ONDC transactions comes from mobility

■ Iron Pillar closes $129-million fund

■ More wearable, hearable brands get India-made PCBs

Majority of IT staff to receive less than 10% pay hike in FY24

IT employees will receive salary hikes in the range of 8-10% — down from 10-11% — HR experts told us. The hit in the figures is mainly due to the great resignation wave of 2021-2022 calming down, resulting in a wage correction during the FY24 appraisal cycle.

Expert take: “Due to the great resignation and high demand environment, the level of hikes had gone up. However, this fiscal we expect hikes to remain between 8-10% with the majority of employees expected to get below 10% hikes,” said chairman and regional managing director of Korn Ferry India Navnit Singh.

Moderating expenses: According to a report by credit rating firm Crisil, almost 70% of the total cost of IT companies relates to employee expenses, which are expected to moderate in the 2024 fiscal due to cautious hiring.

Go deeper: Coupled with the larger concerns around layoffs in the tech sector, HR experts suggest that even for those switching jobs, hikes will normalise to pre-pandemic levels after a period of highly competitive salaries seen in the first half of 2023. Hikes for lateral hiring will remain in the range of 20-25% compared to even 100% hikes seen last year.

Muted earnings: We reported on Tuesday that global macro-economic and financial sector headwinds are set to severely dent FY24 for the Indian IT sector and revenue growth is expected to nearly halve from a year ago, analysts said.

Further, the fourth quarter of FY23 itself is expected to be muted due to longer deal cycles, impact on the banking financial services insurance (BFSI) sector and seasonal headwinds.

PhonePe’s hyperlocal commerce app Pincode goes live on ONDC

From left: PhonePe cofounders Rahul Chari and Sameer Nigam

Walmart-owned fintech major PhonePe has announced the launch of Pincode, an app built on top of the government-backed ONDC platform. The app will have a pilot in Bengaluru with categories such as grocery, food, pharma, electronics and home decor, a statement from the company said.

About the app: The Pincode app hopes to promote local shopkeepers and sellers and digitally connect each city’s consumers with all the neighbourhood stores that they usually buy from offline.

Why a separate app? According to PhonePe CEO Sameer Nigam, the company opted to launch a separate app instead of having an ONDC store on PhonePe itself due to the large volume of orders. Mixing ecommerce with existing digital payment activities was not something the company was willing to do.

Longstanding aspiration: The fintech player’s online commerce ambitions aren’t new. ET had reported in August last year about its plans to enter the ecommerce space. The fintech previously made attempts to enter the space with Switch, loosely based on the super app concept, and Stores, which was aimed at facilitating the hyper-local discovery of merchants.

The company had earmarked up to $15 million for its ONDC entry and was planning to deploy the capital over 18 months.

Quote unquote: “It (ecommerce) is somewhere between moonshot – because of ONDC – and a very large market to tap into… The opportunity is larger than payments but it is much riskier… because nowhere in the world any government or industry has aggregated so many aspects of fulfilment – logistics, inventory management, seller and buyer platforms among others,” Nigam had told ETtech in August last year.

Mobility accounts for a big chunk of ONDC transactions: CEO

Among all transactions on the government-backed Open Network for Digital Commerce (ONDC), mobility accounts for the highest share, the network’s chief executive Thampy Koshy told us.

What’s driving the news: “We have 25,394 sellers and 24,51,796 stock-keeping units (SKU) but a big chunk of our transactions happens in the mobility category. On the KOMN, we have 2,550 vehicles, but on Namma Yatri, we have 47,783 registered drivers. Ever since it integrated with ONDC on March 24, it has been clocking 20,000 rides every day,” said Koshy.

Yes, but: None of the five buyer apps on ONDC — Paytm, Mystore, Craftsvilla, Spice Money and Meesho — offer mobility as a category. One must download the Namma Yatri app to avail mobility services unlike in the retail category where each of these buyer apps have ONDC on their interface where they can order products.

However, Koshy believes it is only a matter of time before the buyer apps offer mobility.

Go deeper: The network will have five online dispute resolution (ODR) platforms like Sama, CADRE, webnyay, Presolv360, Wevaad, (which are empanelled with Sahamati, the non-profit industry alliance that enables account aggregators in India) for grievance redressal, Koshy said.

But so far, the network has ensured the resolution of grievances at the network participant level and has not let complaints reach a stage where it required an ODR platform to mediate, he said.

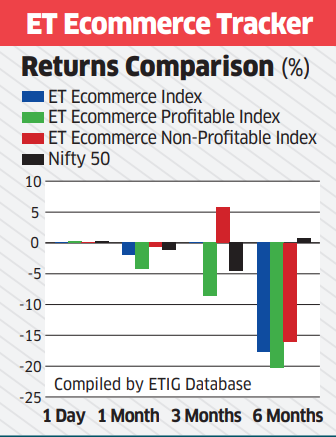

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Iron Pillar closes $129-million fund to back cloud, SaaS firms

(From L to R): Mohanjit Jolly, partner; Anand Prasanna, managing partner, and Ashok Ananthakrishnan, partner, Iron Pillar

Venture capital investor Iron Pillar, which has backed the likes of FreshToHome, Uniphore, Servify and Curefoods, has closed a $129 million fund focussed on making investments in global cloud software companies from India.

SaaS firms in focus: Iron Pillar’s managing partner Anand Prasanna told us that the fund will look at investing in growth-stage startups with an emphasis on software-as-a-service (SaaS) and cloud infrastructure segment including investment themes such as cyber security and governance, DevOps tools, future of work and education, and automation.

On macroeconomic pressure: The new fund comes at a time when SaaS companies globally are under pressure, as worsening macroeconomic conditions have pushed companies to curtail enterprise contracts and save costs. This has led to growth slowing down for several of India’s software unicorns. “I don’t think we have seen the bottom of it. Our advice to founders is that your growth rate plus Ebitda (earnings before interest, taxes, depreciation, and amortization) should be at 40%,” added Prasanna.

Tweet of the day

Wearables, hearables manufacturers ramp up local production

Local value addition in wearables and hearables manufacturing is set to increase with India’s major smartwatch and headphones manufacturers making printed circuit boards (PCBs).

Details: Dixon Technologies, which manufactures hearables for Imagine Marketing (Boat), the largest wearables brand in India, will introduce SMT (surface-mount technology) for circuit boards for hearables in April with a capacity of 1.2 million pieces a month, said Sunil Vachani, chairman, Dixon Technologies.

Expansion plans: Optiemus, which manufactures mainly for Noise, the second-largest wearable brand in India, has secured the capacity to make circuit boards for both hearables and wearables, and is open to supplying them to other electronics manufacturers. “We have set up a capacity to make about 3-4 million boards a month, only for hearables and wearables,” said Nitesh Gupta, director, Optiemus Electronics.

Why does it matter? The wearables segment has seen rapid growth, clocking 46.9% year-on-year growth in 2022 as shipments reached 100 million, as per IDC India.

Other Top Stories By Our Reporters

Indian cryptocurrency investors recoup losses as prices surge: Indian crypto investors, who suffered significant losses throughout 2022, are now experiencing some relief thanks to the price appreciation of major cryptocurrencies in the first quarter of 2023. Bitcoin’s year-to-date gains in the January-April 4 period were 68.56%, at 5 pm on Tuesday on Coinmarketcap.

SaaS buying platform Spendflo raises $11 million: Software-as-a-Service (SaaS) buying and management solution Spendflo on Tuesday said it has raised $11 million in a Series A funding round led by Prosus Ventures and Accel.

Patient monitoring startup Dozee raises $6 million: Healthtech startup Dozee on Tuesday said it has raised $6 million as part of its Series A2 funding from existing investors such as Prime Venture Partners, 3one4 Capital, YourNest VC, and new investors which include State Bank of India, J&A Partners Family office.

Dozer raises $3 million in funding, emerges from stealth mode: Dozer, an open-source data infrastructure platform that helps software engineers create application programming interfaces (API), on Tuesday said it has raised $3 million in a seed round of funding.

Zyod raises $3.5 million in funding: Zyod, a business-to-business fashion ecommerce marketplace for apparel sourcing and manufacturing, said it has raised $3.5 million in seed funding in a round led by Lightspeed Venture Partners. The startup plans to use the funds to improve technology and hire more people.

Global Picks We Are Reading

■ A Tiny Blog Took on Big Surveillance in China — and Won (Wired)

■ Twitter Users Are Still Waiting for a Check-Mark Reckoning (NYT)

■ Universities express doubt over tool to detect AI-powered plagiarism (FT)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.