Is the party over for tech and crypto markets?

Also in this letter:

■ Indian investors wary as crypto falls again

■ Zomato shares below listing price amid rout

■ Indian startups raised $24 billion in equity in 2021: Nasscom

Got a minute? ETtech’s goal is to bring you the latest news, exclusives, and analysis from the thriving technology and startup sector, and we’re always looking to improve. You can help us do so by filling in a short survey here. Thank you!

Top tech investors expect a correction in private markets

Two of the world’s most influential tech investors have signalled an impending softness in private valuations amid a major correction in the US public markets.

Driving the news: SoftBank Vision Fund CEO Rajeev Misra, at a virtual event organised by US news website Axios on Thursday, said private markets were overvalued compared to the public markets and that a rebalance was on the cards.

“If the public markets stay where they are, then the private markets, which are overvalued, have to rebalance. And we’re seeing that already,” he said.

Sequoia India and Southeast Asia managing director Shailendra Singh echoed his sentiments, saying on Twitter that he was looking forward to a much-needed correction in the startup funding environment and that thankfully, conversations were once again about revenues, products, unit economics and saving dollars.

Why it matters: The comments from Misra and Singh are significant as their funds power a large number of deals in India and abroad. This also means companies will have to readjust their valuation demands.

“I think some of it (correction) is visible (and the pace at which deals will close will also slow down). Startup valuations have been overheated throughout last year and a correction was overdue,” said a founder of one of the highest-valued Indian startups, which counts Sequoia Capital among its investors.

Tiger Global, the New York-based investment fund that has been instrumental in driving up the number of unicorns in India, previously said it had clocked losses in 2021. This was attributed to the free fall in tech stocks in the last two months of the year.

The potential slowdown in deal making follows a record-breaking year of funding in which India’s startup ecosystem raked in more than $36 billion and more than 40 unicorns were minted.

Zomato shares fall below listing price amid stock market rout

Zomato’s shares have fallen below their listing price for the first time since its market debut last July.

On Friday, the stock fell another 10% to hit a new low of Rs 113.15, less than the listing price of Rs 115 on NSE. With this, Zomato’s stock has lost nearly 17% in four sessions and its market cap is now less than Rs 1 lakh crore.

Back to earth: The food delivery platform listed with much fanfare and its share price doubled in just a few days. But Zomato and its tech-driven peers Paytm, PolicyBazaar Nykaa and CarTrade are all down 4-14% in the last five trading sessions, compared to a 3.5% fall in the Nifty.

Paytm was down 3.55% on Friday, falling for the 13th time in the past 14 sessions. PolicyBazaar fell 5.68%, while Nykaa dropped 2% and CarTrade lost 1.42%.

Zomato’s slide also mirrors that of its UK counterpart Doordash, which is more than 18% down since January 1 and more than 50% down from its 52-week high. It now has a median price target of Rs 166 in 12 months by 17 analysts. The most bullish projection pegs the stock at Rs 220, while the most bearish believes it will slide further to Rs 90.

US crash felt in India: Tech stocks in the US have been falling over the past couple of days and its impact has clearly been felt in India. On Thursday, the Nasdaq dropped 186.24 points, or 1.3%, to 14,154.02, its lowest level since June. The previous day it had closed more than 10% below its all-time high in November, confirming it was in a correction.

- After the bell on Thursday, shares of Netflix dropped sharply as the company fell short of Wall Street forecasts for new subscribers at the end of last year, and offered a weaker-than-expected forecast for early 2022.

- Shares of Peloton Interactive tumbled nearly 24% after reports emerged that the exercise bike maker was pausing production of its connected fitness products as demand wanes and the company looks to control costs. Peloton was one of the mainstays of the stay-at-home trade in 2020.

Netflix’s lack of success in India “frustrating”: Netflix co-founder, president and co-CEO Reed Hastings said in an investor call on Thursday the company’s lack of success in India was “frustrating” but added that it was “definitely leaning in there”.

While Netflix has never revealed the number of subscribers in India, market estimates place the figure between 4.3 and 4.5 million, a fraction of rivals Disney+Hotstar (close to 36 million) and Amazon Prime Video (over 17 million).

In December, Netflix had slashed its prices in India to make its service affordable to more people.

Indian investors wary of buying the dip as crypto crashes again

After a rollicking 2021, cryptocurrencies continue to slide in 2022. Bitcoin, Ethereum and Solana and other cryptocurrencies have lost 8-10% of their value since Thursday. The latest mini-crash was said to be the result of a proposed ban on cryptocurrencies in Russia and the fall in the US stock market.

- Bitcoin traded below $39,000 at 12.30 pm on Friday or nearly 8% lower than its value 24 hours ago. Its market captalisation sank to $733 billion.

- Ether, the native token of the Ethereum platform and the second-most popular cryptocurrency, fell nearly 10% and was trading below $2,900. Its market capitalisation fell to $335 billion.

Once burned, twice shy? For some, the initial excitement to get rich quickly seems to have worn off. Unlike in previous dips, during which Indian buyers were inclined to buy, there was caution amongst crypto investors and traders this time, and thus less action than usual on crypto exchanges, industry trackers told us.

“The buy intensity is definitely lower than the last several months. But this has less to do with India and more to do with global crypto sentiment. The global crypto sentiment isn’t negative. It’s cautious and investors are waiting to understand what direction the market will take in the coming weeks,” said Nischal Shetty, cofounder of WazirX.

Local issues: In India, a crackdown on crypto exchanges for alleged tax evasion and the possibility of tax clarity in the upcoming budget session of Parliament has added to the uncertainty.

Quote: “You should only invest money you are willing to lose. After studying the technicals for a year, I have understood that you can’t rely on crypto as a legitimate investment. Crypto seems to be based purely on demand and supply and lacks any fundamental backing,” said 20-year-old Mrityunjaya Lala, who has been a crypto and stock market investor for two years. Lala, who has invested in several cryptocurrencies, added that he too was cautious about buying the dip this time.

Russia proposes crypto ban: The latest rout was said to be partly down to a proposed ban on mining or using cryptocurrencies in Russia by the country’s central bank, which cited threats to financial stability, citizens’ wellbeing and its monetary policy sovereignty.

Russia has argued against cryptocurrencies for year, saying they could be used in money laundering or to finance terrorism. It eventually gave them legal status in 2020 but banned their use as a means of payment.

Tweet of the day

Indian startups raised $24 billion in equity in 2021: Nasscom report

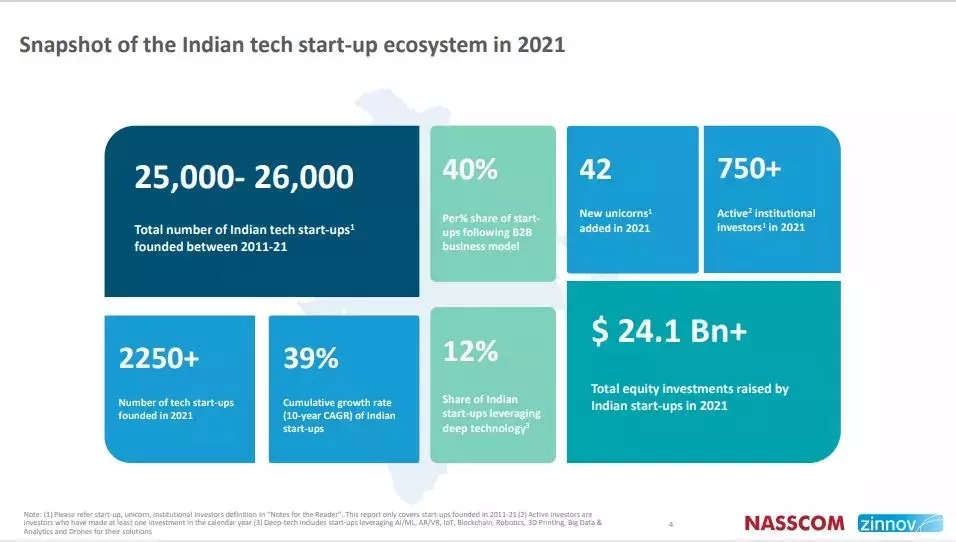

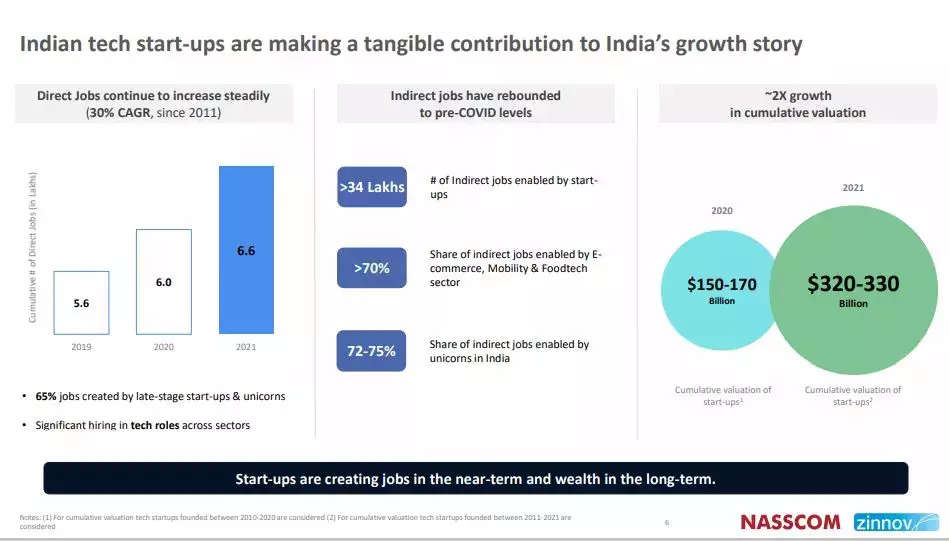

In 2021, the Indian startup ecosystem raised $24.1 billion in equity investments, according to a Nasscom report. Of this, 61% was raised by 42 companies that became unicorns, according to The Nasscom Startup Ecosystem Report 2021, which was released by Union minister for commerce and industry Piyush Goyal and Nasscom president Debjani Ghosh.

In 2021, startups raised more than twice what they did in 2019 and three times the 2020 total, the report said. The country saw a massive increase in the number of unicorns last year, and Nasscom has zeroed down on another 135 ‘soonicorms’, which it expects will achieve unicorn status in the next 2-3 years.

Close to 65% of the jobs created by the startup ecosystem have come from unicorns and late-stage startups, the report said.

Also Read: 2021 Year In Review | The Year Of The Unicorn

The minister also said that 2021 was a year that defied all the odds and that 2022 would be a breakthrough year, in which India would unlock immense value. “India at 100 will be renowned as a startup nation,” he said.

Goyal also asked the startup ecosystem to use deep tech to build solutions for local and global markets in the areas of AI, big data, data analytics, blockchain, virtual reality, 3D printing and drones, and tap the potential of tier II and III cities.

Diverse ecosystem: According to the report, the Indian startup ecosystem is becoming increasingly diverse as it matures. Around 40% of startups founded in 2021 are based outside the top startup hubs in the country and around 20% of the startups in the ecosystem are building solutions for low-income groups in the country, it said.

The report also said that 12-15% of Indian startups have at least one female cofounder. About 36% of female-founded startups focus on areas like edtech, healthtech and retail tech.

ETtech Deals Digest

Robotics company Addverb Technologies, California-based technology company Pixis and SaaS company Lummo were among the startups that raised funding this week.

Click here for the top funding deals of the week.

Today’s ETtech Top 5 newsletter was curated by Aditya Rangroo in New Delhi and Zaheer Merchant in Mumbai.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.