In big relief, US regulators backstop all Silicon Valley Bank deposits, while HSBC buys UK arm of failed bank

This and more in today’s edition of ETtech Top 5.

Also in this letter:

■ EV makers may take govt to court for withholding subsidy

■ Infographic Insight: a look at India’s SaaS story

■ Delhi HC grants more time to parties in BharatPe case

US backstops all SVB deposits, HSBC acquires Silicon Valley Bank UK unit for £1

US regulators stepped in on Sunday to backstop the region’s embattled namesake bank. They said that depositors at the Silicon Valley Bank, which was shuttered Friday, would have access to their funds on Monday, putting to rest fears that startups would struggle to pay their employees this week.

The Federal Deposit Insurance Corporation, appointed as the receiver for the bank, named former Fannie Mae head Tim Mayopoulos as the chief executive officer of Silicon Valley Bank, a subsidiary of the now-defunct SVB Financial Group.

SVB UK sold: HSBC said on Monday it is acquiring the UK subsidiary of Silicon Valley Bank for £1 hours after US regulators said all deposits are safe to stem any wider fallout from the sudden collapse of the tech-focused lender Silicon Valley Bank.

Deal details: As of March 10, Silicon Valley Bank UK Limited had loans of around £5.5 billion and deposits of around £6.7 billion, HSBC said.

SVB UK’s tangible equity is expected to be around £1.4 billion, HSBC said. It will complete the transaction immediately and fund it from the bank’s existing resources. Further, the assets and liabilities of the parent companies of SVB UK are excluded from the transaction.

Quote, Unquote: “This morning, the Government and the Bank of England facilitated a private sale of Silicon Valley Bank UK to HSBC Deposits will be protected, with no taxpayer support I said yesterday that we would look after our tech sector, and we have worked urgently to deliver that promise,” tweeted UK chancellor Jeremy Hunt.

Impact on India startups: Minister of state for electronics and information technology Rajeev Chandrasekhar on Monday welcomed the US government’s intervention to resolve the ongoing crisis. “With this US govt action, looming risks to Indian Startups hv passed Learning for Indian Startups from this crisis – trust Indian banking system more,” Chandrasekhar tweeted.

Startup crowdfunding under regulatory scanner

Amid an ongoing tech winter, funding crunch and the latest crisis at tech lender Silicon Valley Bank, the startup ecosystem has come under the regulatory glare for its crowdfunding activities. A ruling by the ministry of corporate affairs (MCA) has struck at the core of the modus operandi of several small companies to raise money using fintech platforms that connect businesses with investors.

Case in point: The Registrar of Companies (RoC), New Delhi has penalised Anbronica Technologies and two of its promoter-directors after the company used the platform offered by Tyke Technologies to raise money by reaching out to investors who could be interested to subscribe to compulsorily convertible debentures (CCDs) issued by Anbronica.

Ownership issues: Some businesses tap the fundraising platforms to pool in money from investors to venture into real estate and leasing. In such deals, investors receive fractional ownership in a business by subscribing to shares or units issued by vehicles that invest the amount collected in commercial properties or machinery which are rented or leased out.

TWEET OF THE DAY

EV makers may take govt to court for withholding FAME subsidy

A section of electric vehicle (EV) makers, whose subsidies under the Rs 10,000-crore Faster Adoption and Manufacturing of Electric and Hybrid Vehicles (FAME) II scheme to promote clean mobility have been withheld over allegations of non-compliance, are likely to challenge the government’s move in courts and are seeking legal opinion on the matter, sources told ET.

Catch-up quick: Last year, the ministry of heavy industries, which administers FAME, launched an investigation into the alleged misappropriation of subsidies under the scheme by two-wheeler EV makers. Subsequently, the ministry halted the release of subsidies in some cases.

Moving court: “We are contemplating how we can go to court and request for the formation of a high-level committee to analyse the issue,” said Abhishek A Rastogi, founder at Rastogi Chambers, who is representing one such company. Certain parts which were imported for use in the vehicles are not available locally, and hence the government could look at “pragmatically” allowing the import of such parts, Rastogi said.

EV makers have argued that the government’s localisation timeline was difficult to achieve due to the impact of the Covid-19 pandemic.

Yes, but: The move comes soon after some of the EV makers met government officials to defend themselves following recent whistleblower allegations that they are mispricing their products to avail subsidies under the scheme.

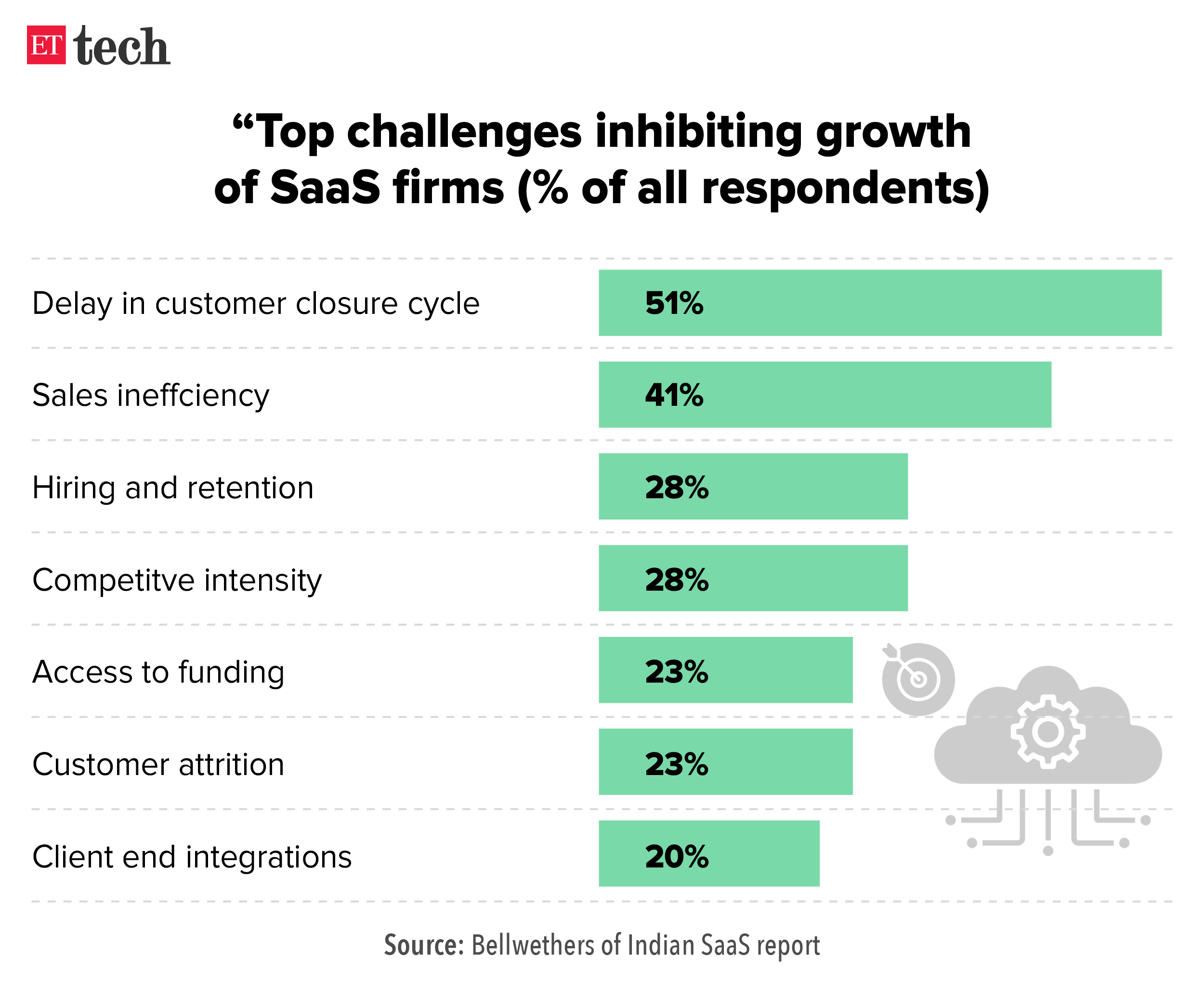

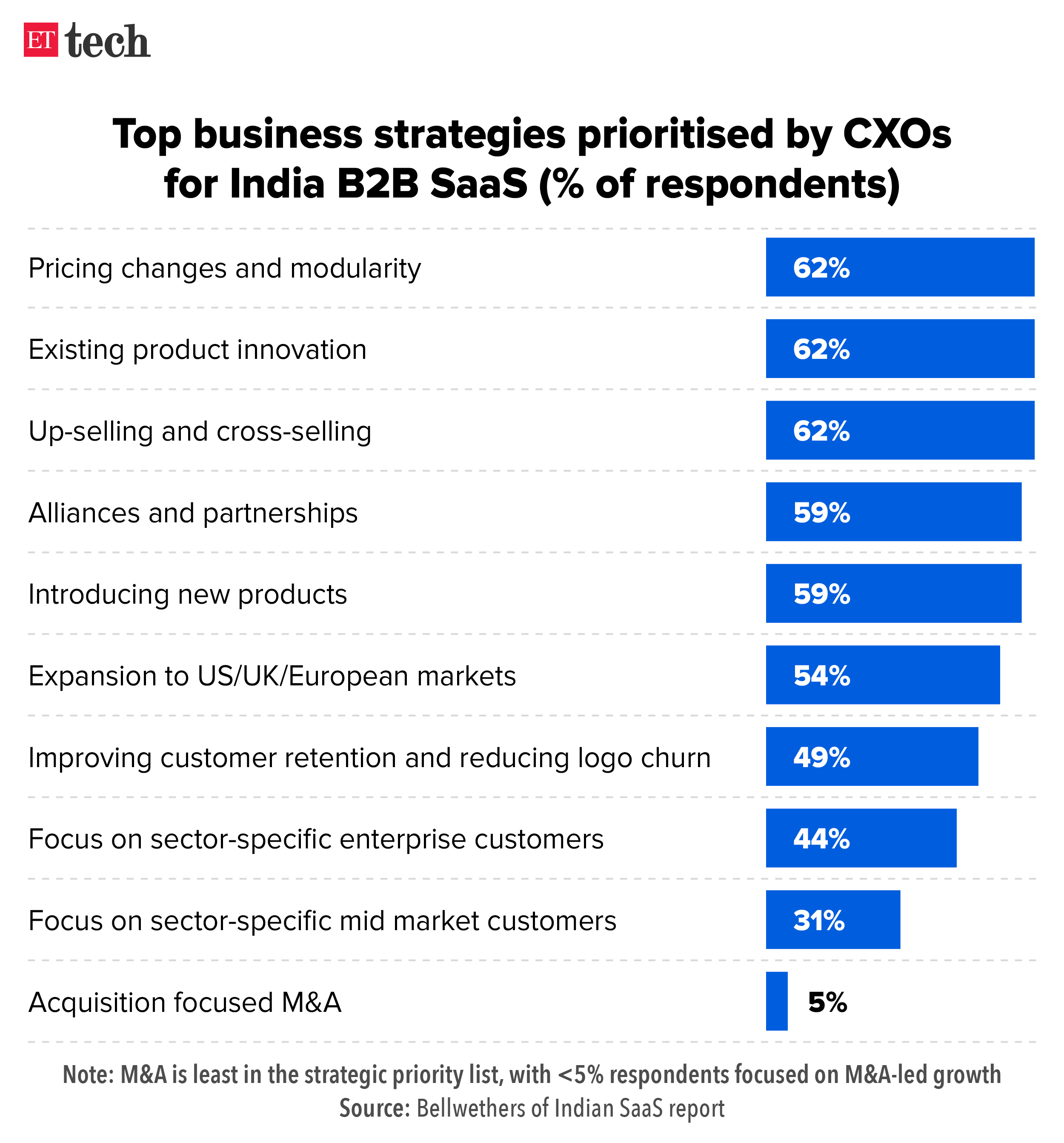

Infographic Insight: India’s SaaS story on efficient, resilient growth path

Indian SaaS companies are likely to continue to grow and have a bullish outlook in 2023 as per the Bellwethers of Indian SaaS report, by EY in partnership with Upekkha Value SaaS Accelerator.

Indian SaaS growth is highly capital-efficient by default across stages and remains largely unmoved by recessionary trends of the past year, it said.

This study is based on a survey of 140 B2B SaaS companies. Nitin Bhatt, technology sector leader at EY India, said there were several factors such as prioritising efficient growth over growth at any cost and capital efficiency that made Indian SaaS companies more resilient than their global counterparts.

Ashneer Grover vs BharatPe case: Delhi HC grants more time to parties to file responses

The Delhi High Court on Monday granted additional time to parties in the BharatPe case against its cofounder and former managing director Ashneer Grover, his wife Madhuri Jain Grover, and their family members, to file additional responses to the notice issued in the case. This also involves a corrigendum by the plaintiffs to the responses filed by the defendants.

Court proceedings: The court will hear the matter again on May 24. During the court’s proceedings, a single-judge bench of Justice Navin Chawla admitted the condonation of delay application, through which the parties sought additional time to file the documents.

The counsel representing the defendants pointed out that between the plaintiffs and the defendants, 85 filings have been made in the course of this case, which was first heard by the court in December.

What are the cases? In December, BharatPe filed civil and criminal suits against the defendants and a complaint filed with the Economic Offences Wing (EOW). We reported on December 10 that it also approached the Singapore International Arbitration Centre (SIAC) seeking to claw back Grover’s restricted shareholding in the company.

In a separate case, BharatPe’s original cofounder Bhavik Koladiya moved the Delhi High Court against Grover to reclaim the disputed shares, saying Grover has not paid for the shares as per the agreement.

Today’s ETtech Top 5 newsletter was curated by Erick Massey and Gaurab Dasgupta in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.