Ideaforge opens to bumper listing; Nykaa sees beauty, fashion biz grow despite slowdown

Also in this letter:

■ ETtech Deals Digest

■ Big Four firms undergo technology overhaul

■ Blume Ventures cutting back on ‘frivolous’ investments

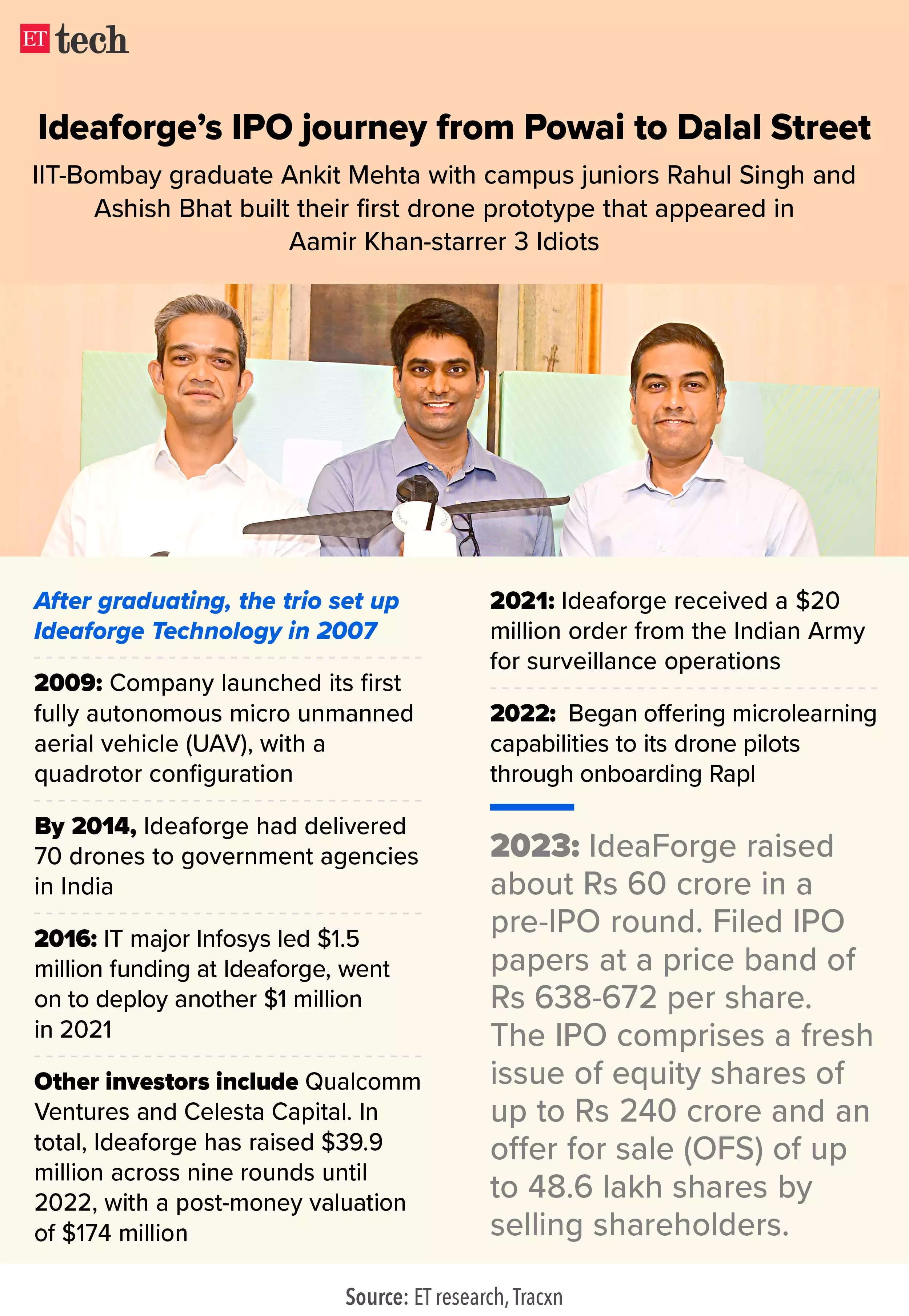

Ideaforge soars on market debut, investor wealth nearly doubles

Ideaforge, one of the pioneers in the country’s unmanned aerial vehicle market, did not disappoint D-Street on its stock market listing on Friday. It debuted at Rs 1,305.10 per share on the BSE, a 94% premium to the initial public offering (IPO) price of Rs 672. It did just as well on the NSE, with a 93% gain at Rs 1,300 per share. The stock ended the day at largely the same level.

Also read | Ideaforge closes with 93% gain on Day 1: All you need to know

Debut details: The IPO of India’s leading drone maker was subscribed 106 times at close. The quota reserved for retail individual investors (RIIs) was subscribed 85.1 times, that for qualified institutional buyers by 125.81 times, and non-institutional investors (NIIS) by 80.5 times.

Why the investor frenzy? Despite an expensive valuation ask, Ideaforge attracted a solid response across investor categories mainly due to its market leadership in the Indian Unmanned Aircraft Systems (UAS) market (50%) and the lack of direct competitors in the listed space. Ideaforge’s drones are capable of a wide range of mining area planning, and mapping applications.

Fund utilisation: Of the issue proceeds, Rs 50 crore will be used to repay certain debts availed by the company, Rs 135 crore will go towards funding working capital requirements, and Rs 40 crore will be invested in product development and general corporate purposes.

Don’t kill the golden goose: “I don’t think anyone has seen a great future by killing the golden goose … You don’t want a major customer who is willing to scale with you to descale just for the sake of diversification, so it makes more sense for other industries to mature and catch up,” Ideaforge chief executive Ankit Mehta had told ET when asked about diversification.

Also read | Ideaforge IPO expected to fuel drone startup’s flight

Nykaa sees beauty, fashion biz grow despite discretionary spending slowdown

Nykaa CEO Falguni Nayar

Omnichannel fashion and beauty platform Nykaa expects its consolidated revenues during the first quarter of FY24 to grow in the mid-twenties year-on-year (YoY).

Robust business: In its Q1FY24 performance update, Nykaa said its beauty and personal care (BPC) business continues to remain strong despite an overall discretionary spending slowdown. “Our BPC business NSV (net sales value) for the quarter is expected to grow in the early twenties YoY. This is supported by strong urban demand in the category,” the update read.

Q4 results: Nykaa’s Q4FY23 earnings were a mixed bag. While its revenue jumped 33% YoY to Rs 1,301 crore in the fourth quarter, net profit fell 71.83% to Rs 2.4 crore due to rising expenses. For the quarter, Nykaa’s overall GMV rose 36% to Rs 2,445 crore year on year while Ebitda margin grew 84% to Rs 70 crore.

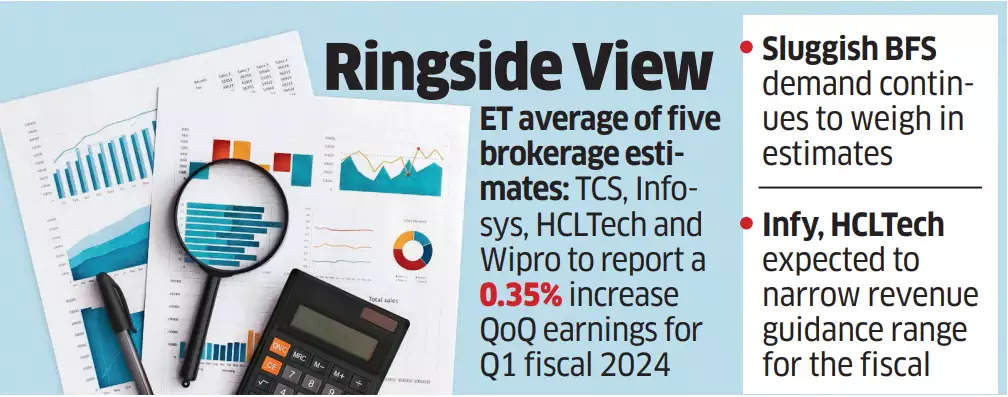

Q1 IT preview: ET reported earlier this week that India’s top four IT firms are expected to post only a marginal increase sequentially in Q1FY24 revenue in constant currency, as weakness in the banking and financial services (BFS) sector and persistently high-interest rates in Europe and the US will weigh on their results.

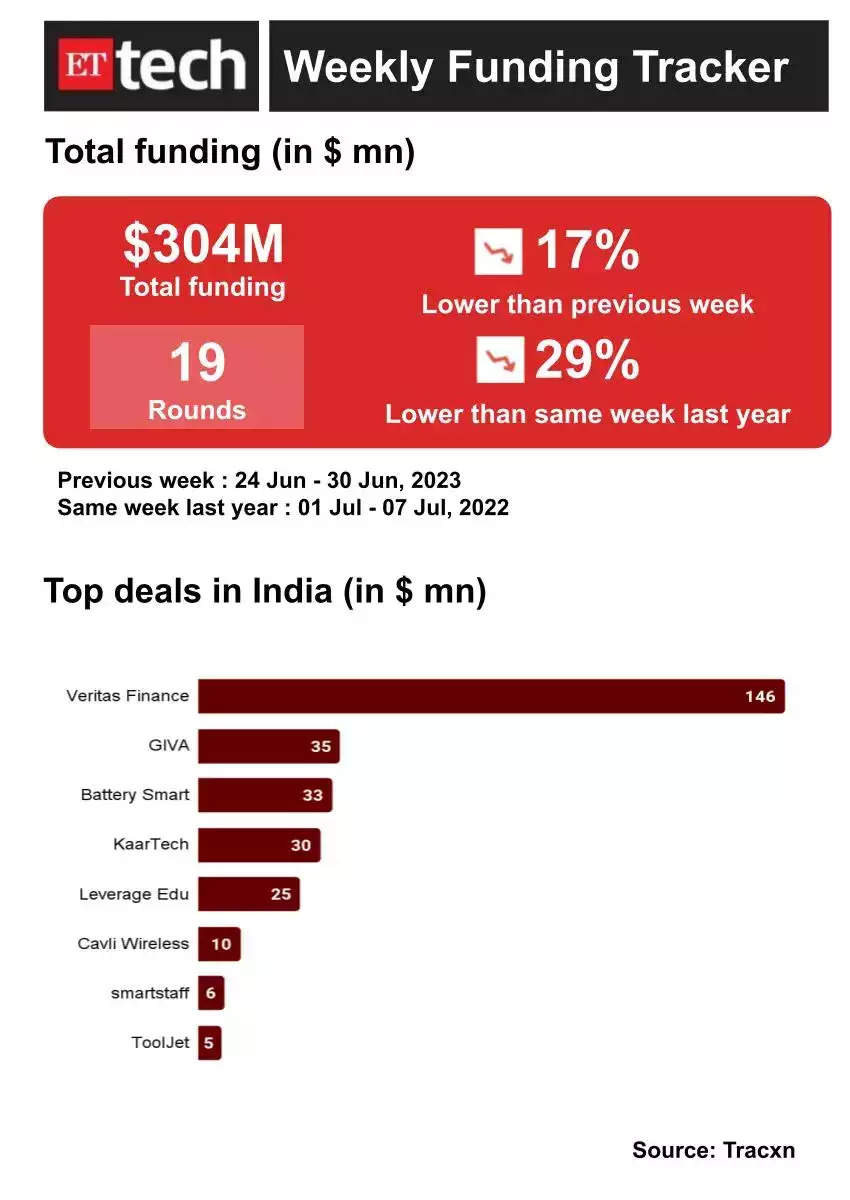

ETtech Deals Digest: Indian startups raise $304 million this week

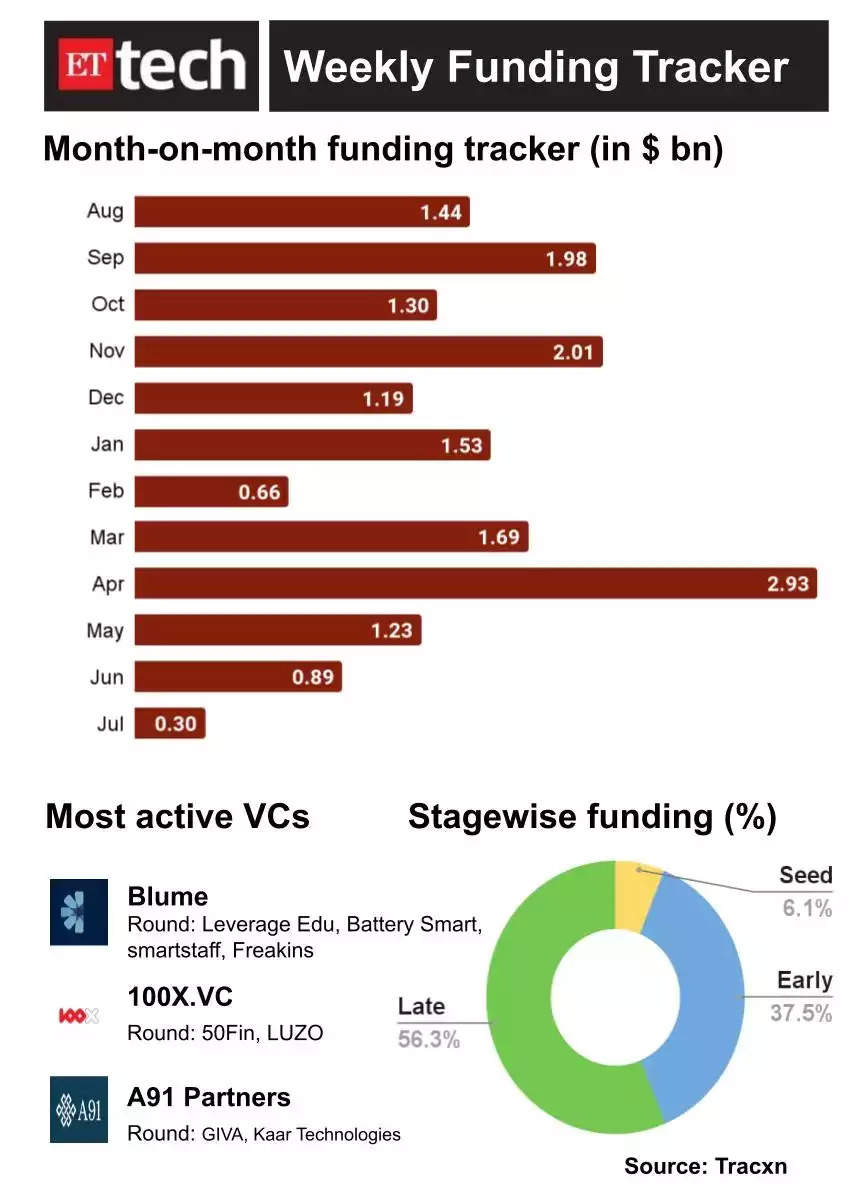

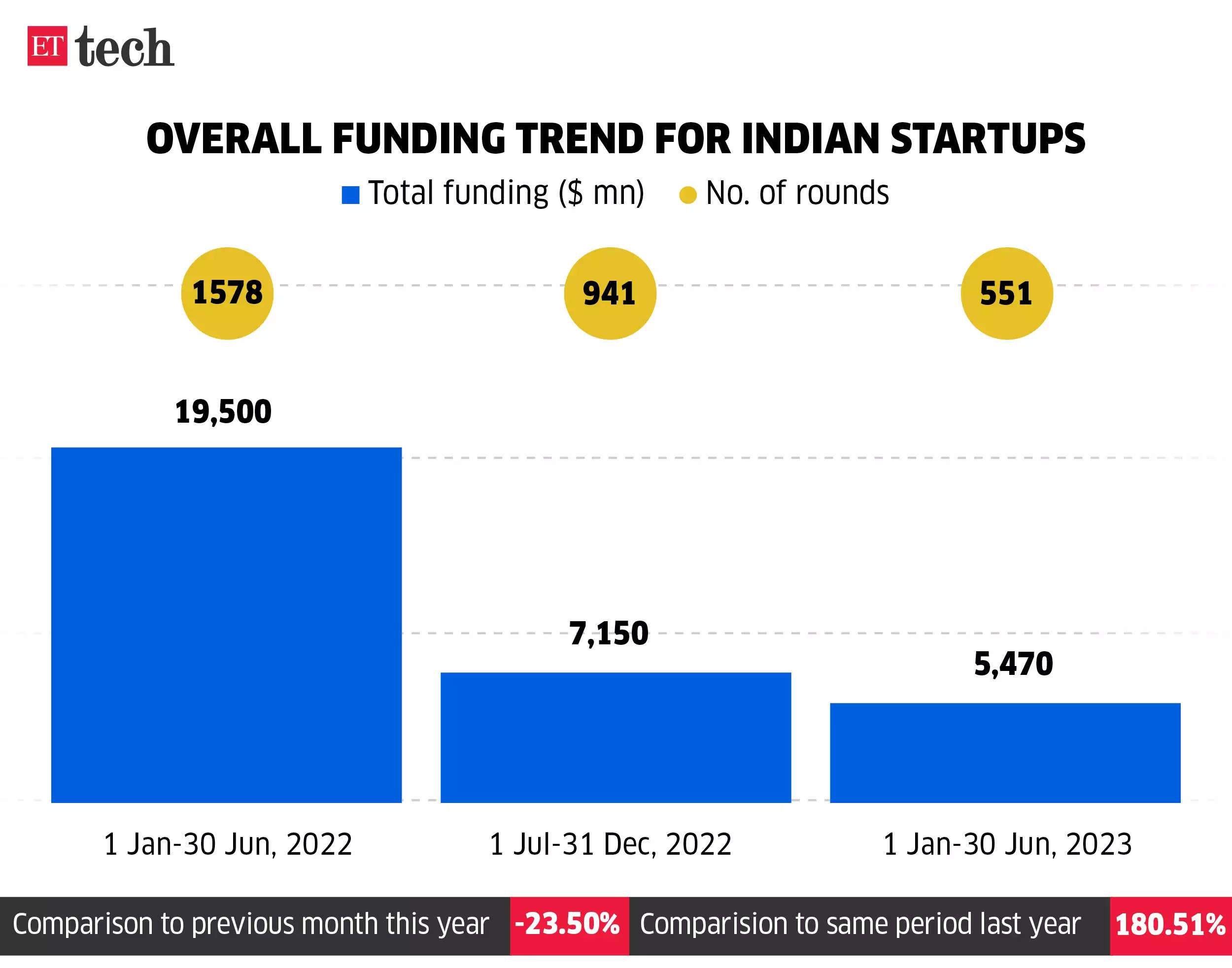

The funding landscape for Indian startups continues to remain tough with new-age companies managing to raise only $304 million across 19 rounds this week. This is a 29% decline from the same period last year, when investments poured in at a much higher rate with a total of $427 million coming in from 77 rounds.

Sequentially, funding activity dipped 17%, compared to $366 million raised across 31 rounds, last week. Of the total funding raised this week, late-stage funding accounted for $171 million, making up 59% of overall funding activity.

Here are the startups that got funded this week

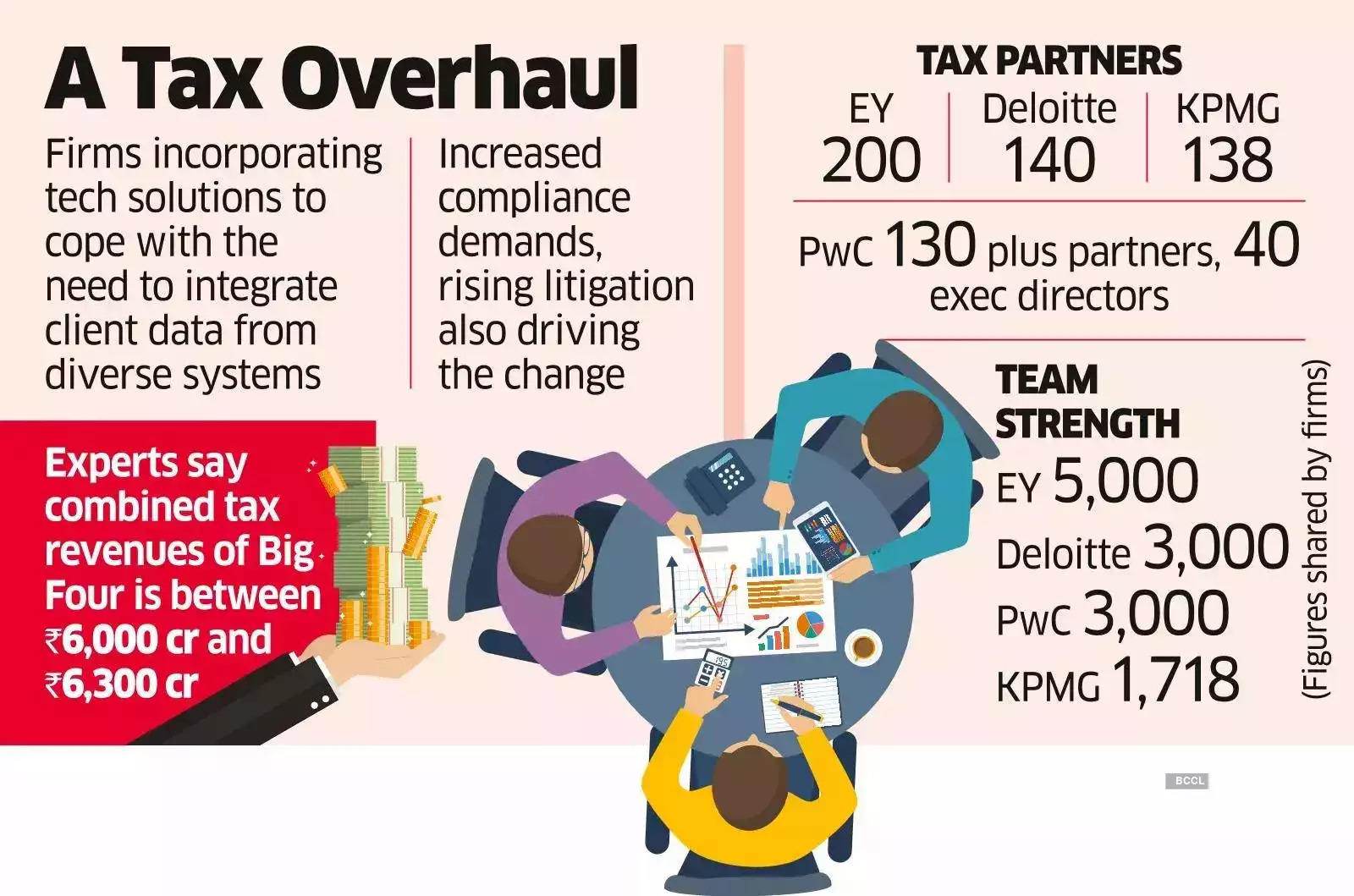

Tech transformation underway at Big 4 tax firms

Owing to a surge in digitisation in India Inc, and the tax department’s expeditious digitisation initiatives in recent years, taxation practices at the Big Four professional services firms are undergoing a change — from traditional advisory methods to technology-driven solutions.

What’s happening? The tax businesses have had to shift gears swiftly in terms of developing new client-focused solutions, upgrading tax skills, and adopting technology in all aspects of internal systems, from knowledge management to research to in-house business tools.

Also read | Future imperfect: how will FY24 pan out for the Indian IT industry

IT department’s role: The income-tax department has also been ahead of the curve in digitisation in the last seven-eight years, with the focus on making tax compliances more online, granular, and real-time, said Kunj Vaidya, partner, Price Waterhouse & Co. This includes initiatives like e-filing, e-invoicing, and faceless tax assessments.

More tech in future: Experts said the involvement of technology will continue to escalate: a clear example of this is the upcoming implementation of the OECD-recommended Pillar 2 rules, which will necessitate a constituent entity to handle an extensive set of 250 data-point requirements.

Byju’s aftermath: VC firm Blume Ventures cutting back on ‘frivolous’ investments

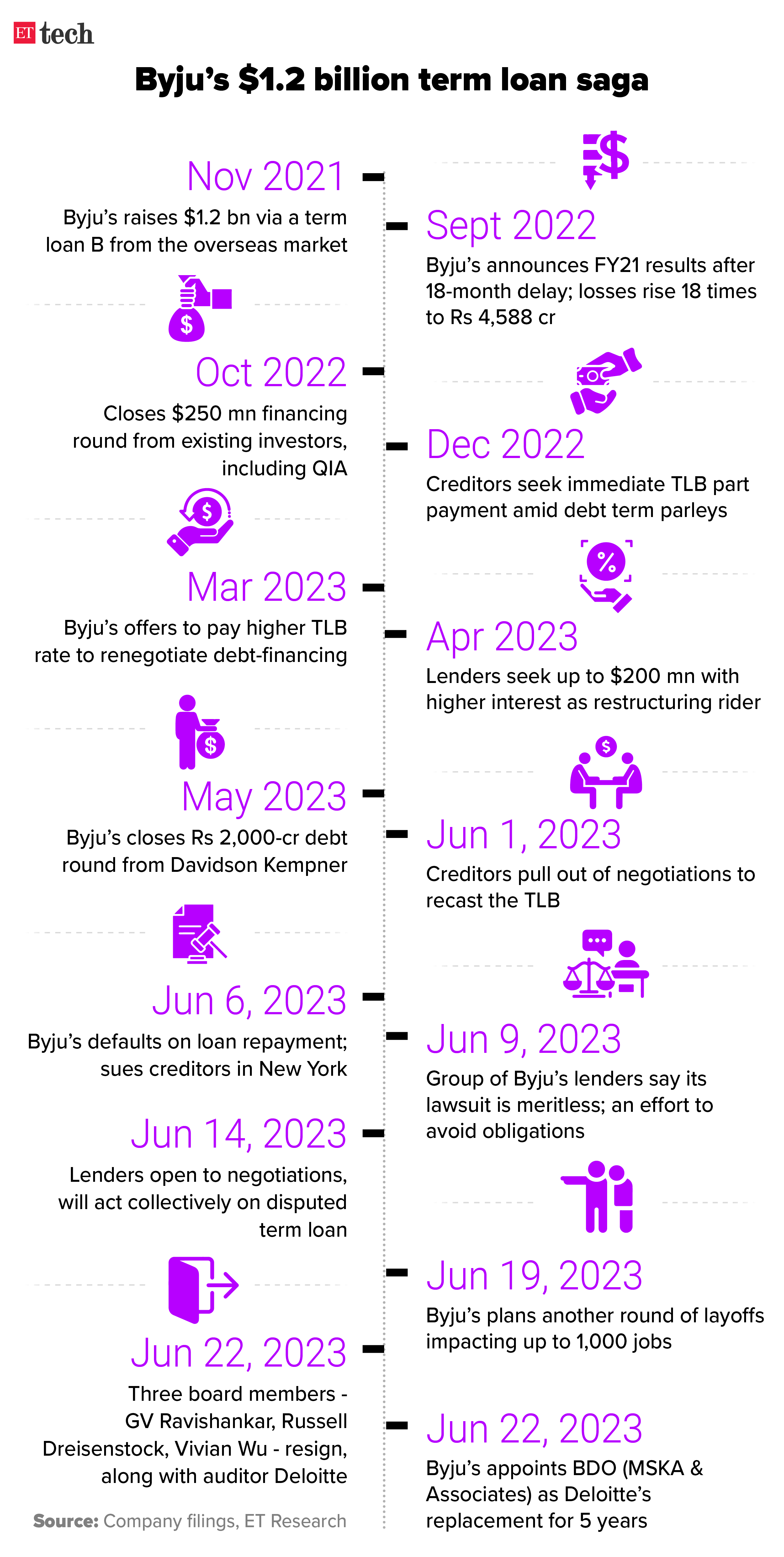

Rampant corporate governance problems in major Indian startups have compelled one of India’s prominent venture capital firms — Blume Ventures — to move with caution. Ongoing issues of beleaguered edtech giant Byju’s with its lenders coupled with high-level board exits and the resignation of its auditor Deloitte has had a spillover effect.

Driving the news: According to a Bloomberg report, Blume Ventures, which manages $625 million in assets and has backed the likes of Byju’s rival Unacademy, Dunzo and Cashify, is cutting back on “frivolous” investments as it pushes portfolio companies to increasingly shift focus to profitability, cofounder Karthik Reddy said.

Shaky ground: Reddy said about a third of its portfolio, which includes ecommerce and mobility firms, has turned “shaky” over the past year. The chaos at Byju’s has forced “the entire ecosystem to think about what could be wrong in every portfolio company,” he pointed out. “You get these questions from your investors.”

Funding pangs continue: New-age tech companies secured only $5.5 billion across 549 rounds in the first six months of 2023, recording a 72% drop compared to the year-ago period when startups raised $19.5 billion across 1,576 funding rounds.

Wary VCs, more due diligence: ET had reported in April that risk capital investors are being more stringent in their analysis of business models and are taking longer to close deals. In addition, investors deploying capital are picking the clear winners in a category. Further, deal closures are also being affected by the mismatch in valuation expectations between founders and potential investors.

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta in New Delhi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.