How United Airlines expects electric planes to change the way passengers make travel decisions

United Airlines, the nation’s No. 3 carrier, has a contract to buy electric 30-seat planes from startup Heart Aerospace, which Heart said it plans to introduce in 2028.

Heart Aerospace

One of the hardest things to figure out about cutting greenhouse gas emissions has been what to do about aviation, since most commercial jets are too heavy to fly under electric power with today’s technology. But United Airlines is beginning to provide a picture of how electric planes will be part of its future and a key to remaking the way travelers think about aviation as a choice for shorter distance routes.

The nation’s No. 3 carrier has a contract to buy electric 30-seat planes from startup Heart Aerospace, which Heart said it plans to introduce in 2028. In a twist, United’s plan is not to replace big jets, but to focus the new planes on regional service. The airline is also preparing to introduce eVTOL (electric vertical takeoff and landing) craft to do local transport like taking passengers from central cities to airports.

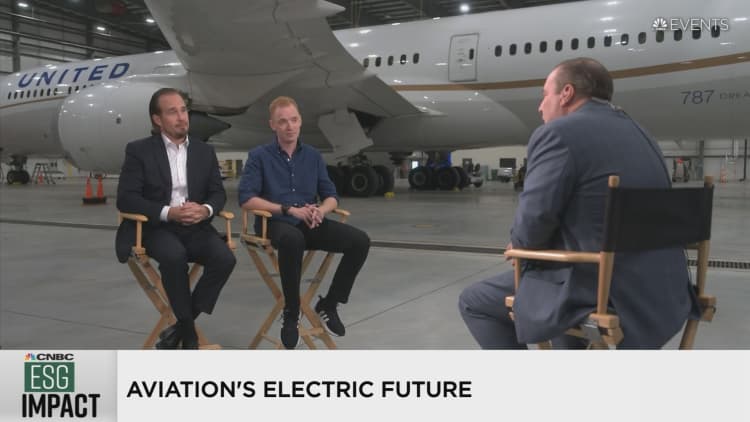

The idea is less to shift how fliers behave than to convince small-city residents who now drive on trips of 250 miles or less to take a plane instead, Mike Leskinen, United’s vice president of corporate development and president of its United Ventures investing arm, said at the CNBC ESG Impact earlier this month. If it works, it opens up a new market for carriers like United, especially outside major metropolitan areas.

“There’s absolutely a lot of hurdles to clear but aerospace development cycles are measured in decades and you have to get started now,” Leskinen said. “We cannot continue doing and operating our business the way we do. It is imperative that we change it and the way we’re going to change it is through investing in technology.”

As electric cars and SUVs move toward 5% of the new-car market in the U.S. and 9% globally, few airlines have made any major push toward electric planes. Sustainability plans being pursued by American Airlines, Delta Air Lines and Southwest Airlines barely mention electric planes. Engineers can’t make an electric battery light and powerful enough to serve a plane the size of today’s jets, said Eliot Lees, vice president and aviation analyst at consulting firm ICF in Cambridge, Massachusetts.

The United plan is based on the idea that less than 1% of travelers making a 250-mile trip choose to fly.

“It used to be different,” said Anders Forslund, CEO of Gothenburg, Sweden-based Heart Aerospace, which has a contract to supply United with 100 30-seat electric planes. “Go back to the 1990s, there were hundreds of small aircraft serving a lot of communities that have now lost service.”

United and Air Canada have also bought stakes in Heart Aerospace.

Why small city plane travel stopped

People in smaller towns stopped flying because jet engines made for planes were too expensive to serve those communities profitably, Forslund said.

“It’s a remarkable technology but it’s holding us back now,” he said. “When you bring in an electric motor … you can get a lot of synergies with what’s happening in the automotive industry. They can start building small planes that have completely different unit economics.”

Travelers will be unlikely to see any major difference in the interior of an electric-powered plane, Leskinen said. And the ability to change planes in as little as 30 minutes will mean planes can be in use 10 or 11 hours per day, allowing for flexible schedules.

“What that means is that a small city is going to either get service they didn’t have, that they had to drive to a [bigger] airport, or they’re going to have greater frequency of service,” Leskinen said at the CNBC event. “That’s going to allow that customer from that small town to make a trip in and out on the same day, whereas before you couldn’t do that with traditional jet powered aircraft.”

And the United Airlines executive predicts that these electric plans will be cheaper for the airline than traditional jet engines within a decade. “As we adopt electric aircraft, I think the cost for a 30-seat aircraft, 50-seat aircraft as the industry evolves is going to be lower cost than a traditional aircraft.”

Other airline climate change plans

Most airlines’ push to lower emissions has focused on plans to remake their existing fleet by replacing older planes with more efficient newer models. In addition, airlines, including United, are focused on investments in sustainable aviation fuel startups. The U.S. Energy Dept. says sustainable airline fuels, or SAF, emit “dramatically lower” carbon levels, but not zero, and says some SAF technologies under development could lead to negative net greenhouse gas emissions.

Delta’s announced goal is to replace 10% of fuel with SAF by 2030. It has partnered with Airbus to study hydrogen-fueled aircraft but considers SAF its primary medium-term means to reduce emissions with new technology. “We have a multi pronged strategy of things we can do today, things we can do tomorrow like investing in SAF, and investing in the future,” Fletcher said in an interview. “All of them have to start now.”

American is also pointing toward cutting emissions via moving toward sustainable fuels, according to its annual report on environmental, social and governance management. It plans to switch 10% of its fuel to SAFs by 2030, as part of a plan to reduce emissions 45% by then and to reach net zero emissions by 2050.

Even SAFs are not really there yet, due to a severe capacity crunch the industry is scrambling to fix in time for 2030, he said. The industry has been given an economic boost by the passage of President Biden’s climate legislation, which is seen as key to providing the financial incentives needed to scale these new operations. The Inflation Reduction Act Congress passed in August with several provisions targeting aviation. One is a blenders’ tax credit of $1 a gallon for biofuels designed to give incentives to build SAF plants faster, and longer-term initiatives to accelerate technologies including hydrogen-powered aircraft and point-source capture of carbon dioxide to create new green fuels, Leskinen said.

“We have a portfolio pipeline of sustainable aviation projects at United that’s 177 companies deep, and we were pencils down on a number of those because without this legislation the hurdles were just too [high] to develop this technology,” he said. “There are literally dozens of companies that wouldn’t have worked that are now viable startups that you’ll hear about United Airlines and United Ventures investing in in the coming months.”

Early versions of SAF technology will use lipids to blend with conventional jet fuel, while Fletcher says later versions will rely on carbon capture technology that will actually make net emissions from some planes negative.

ICF projects that 70% of the cuts in airline emissions by 2050 will come from switching to SAFs, while only 10% will come from adopting electric (or hydrogen-powered) planes. The other 20% will likely come from scheduling improvements and planes that get better fuel mileage, Lees said.

Electric planes have already slipped behind the most aggressive promises for when they might be government-approved and ready for service, and more delays are likely, Lees said. Most likely, electric planes will serve small markets, hydrogen-powered planes will serve medium-sized passenger loads, and SAF-powered jet engines will serve major cities.

“Everyone is optimistic about these aircraft,” Lees said. “The [companies that make them] are especially optimistic about when.”

American, which declined comment, has invested in London-based eVTOL company Vertical Aerospace. The company’s ESG report says the four-passenger eVTOLs it expects to deploy can transport passengers between cities at up to 200 miles per hour. This can alone can be a $12 billion market by 2030, said Chris Raite, airline analyst at research firm Third Bridge Group in New York, but regulatory hurdles and supply chain issues make predictions that the technology will become common as early as 2024 unreliable.

“Our experts are very optimistic, but less optimistic about the aggressive time frames that are being marketed,” he said.

Just this month, Delta Air Lines invested in Joby Aviation. United is also investing in eVTOL: most recently, a $15 million order with Eve Air Mobility in September including an order for 200 aircraft; and a $10 million investment in Archer Aviation and order for 100 Archer eVTOLs. But United thinks that the impact on flying from that technology will be smaller, though it could allow for a trip from a major metropolitan area to a small city within the region to be entirely carbon free.

“eVTOL is going to change the way we live and work,” Leskinen said. “It’s not taking planes out of the sky, though. It’s taking cars off of the road. It’s going to allow us, if you live in Manhattan, to get out to the airport with predictability of seven, seven and a half minutes out to Newark. Maybe if you’re flying a regional flight, maybe you get on a Heart ES-30 aircraft and your entire trip will have been carbon free.”

How practical that is depends on both technology development and regulators, plus the rapid buildout of places for eVTOL to take off and land in cities, Raite said. The target is to make eVTOL available for about the cost of a premium Uber Black car service ride, but that may require development and approval of pilotless eVTOL craft.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.