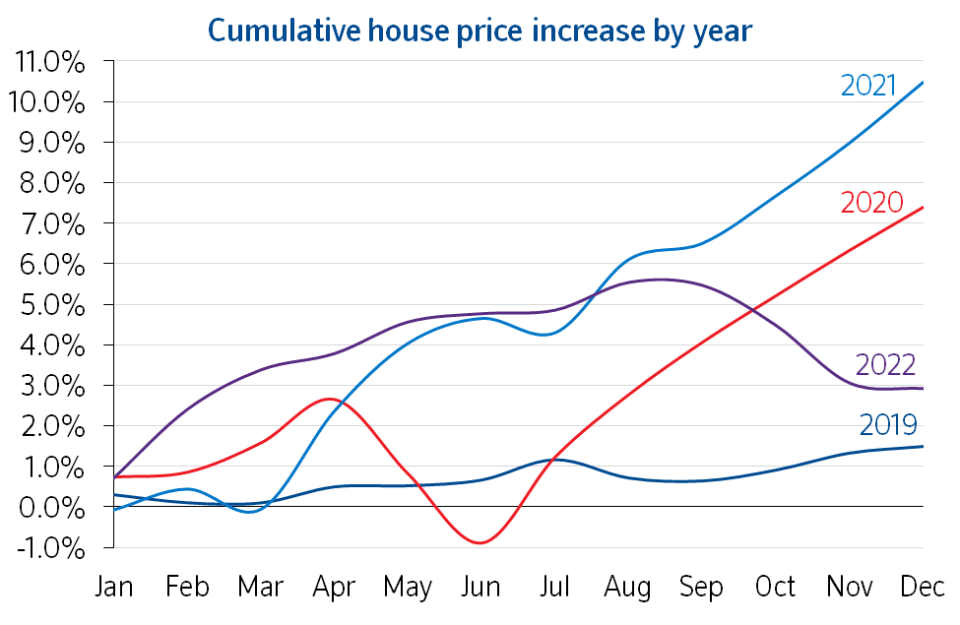

House price growth falls for fourth consecutive month, worst run since 2008

House prices have plummeted for the fourth consecutive month by 2.8 per cent in December, the worst run since the financial crisis of 2008.

Nationwide’s latest House Price Index shows this month proved to be another sharp slow down in growth down from 4.4 per cent in November.

House prices fell by 0.1 per cent month-on-month, but marked the fourth consecutive month where they fell – which is the worst since 2008. In the 2008, prices were at 2.5 per cent lower than August.

Robert Gardner, Nationwide’s Chief Economist, said: “While financial market conditions have settled, mortgage rates are taking longer to normalise and activity in the housing market has shown few signs of recovery.

“It will be hard for the market to regain much momentum in the near term as economic headwinds strengthen, with real earnings set to fall further and the labour market widely projected to weaken as the economy shrinks.

Looking ahead to 2023, he said “the recent weakness in mortgage applications may, in part, represent an early seasonal slowdown. With the chaotic backdrop and elevated mortgage rates in recent months, it wouldn’t be surprising if potential buyers have opted to wait until the New Year to see how mortgage rates evolve before deciding to step into the market.”

“Longer-term interest rates, which underpin mortgage pricing, have returned towards the levels prevailing before the mini-Budget. If sustained, this should feed through to mortgage rates and help improve the affordability position for potential buyers, as will solid rates of income growth (with wage growth currently running at a c.7 per cent pace in the private sector), especially if combined with weak or negative house price growth.

“But the main factor that would help achieve a relatively soft landing (especially for house prices) is if forced selling can be avoided, and there are good reasons to be optimistic on that front. Most forecasters expect the unemployment rate to rise towards 5 per cent in the years ahead – a significant increase, but this would still be low by historic standards.“

This comes as many prospective home-owners are being squeezed by higher interest rates which increases the cost of borrowing, and inflation which is putting pressure on the cost of living, with food, energy and gas prices soaring.

Gardner added that looking to the next 12 months, “household balance sheets remain in good shape with significant protection from higher borrowing costs, at least for a period, with around 85 per cent of mortgage balances on fixed interest rates.”

“Affordability testing has been central to mortgage lending since the financial crisis and typically stress tested at an interest rate above those prevailing at the moment. This means that, while it will be difficult, the vast majority of those refinancing should be able to cope.

London

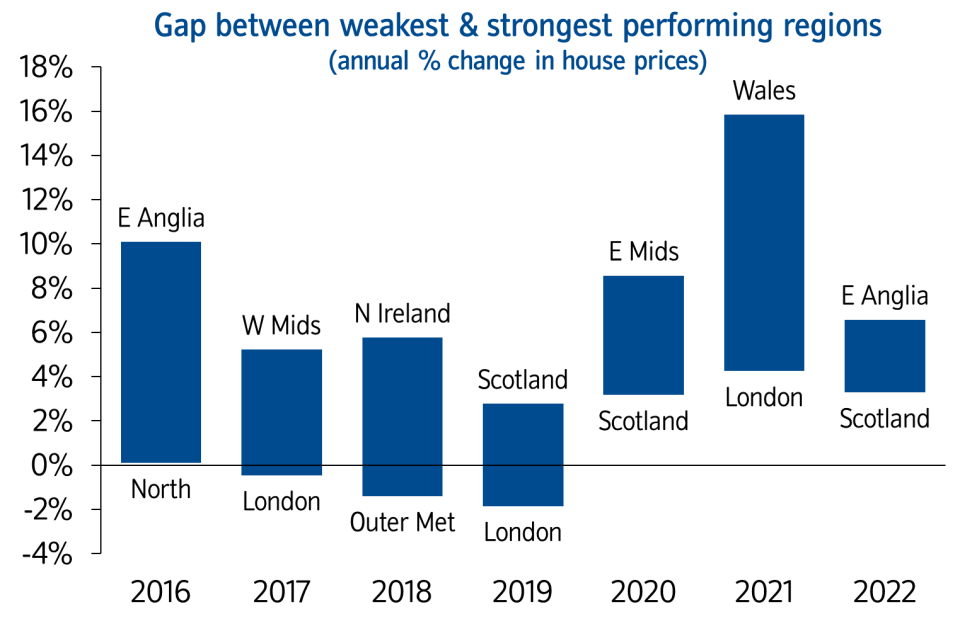

The index also showed that the gap between weakest and strongest regions was the smallest since Society’s regional indices began in 1974 – but London still remained weakest.

Gardner said the capital’s annual price growth slowed to 4.1 per cent, down from 6.7 per cent in the third quarter.

The home counties and south east had a similar rate of growth in 2022 overall, by about 4.2 per cent.

“Recent quarters have seen significant narrowing in the gap between the weakest and strongest performing regions in terms of annual growth, with Q4 2022 seeing the smallest difference – 3.3 percentage points (pp) – in the history of our regional indices, which stretch back to 1974.

“As shown on the chart below, last year the gap between the best performing region (Wales) and worst performing region (London) was 11.6pp, whilst this year it was just 3.3pp (between East Anglia and Scotland).

Reacting to the HPI, Matthew Thompson, head of sales at estate agent Chestertons, said “the market was considerably active with an uplift in cash buyers and offers being agreed.

“This market dynamic was further supported by seasoned buyers who have experienced differing market conditions in the past and were keen to finalise their purchase as soon as possible. Meanwhile, first-time-buyers and second steppers have been more hesitant and decided to observe how the market might develop in the New Year.

“We also noted that, due to the festive season, December has seen fewer appraisals compared to previous months. This will lead to fewer properties coming onto the market during the first quarter of 2023, which will inevitably lead to a more limited choice and more competitive market conditions for buyers.”

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.