Home loan, personal loan EMIs set to rise as SBI hikes interest rates after 3 years

SBI hikes interest rates on all loans after 3 years

The Reserve Bank of India (RBI) may not have hiked the repo rate in its latest monetary policy meeting, but the country’s largest lender State Bank of India (SBI) has increased the loan rates based on the Marginal Cost of Lending Rate (MCLR).

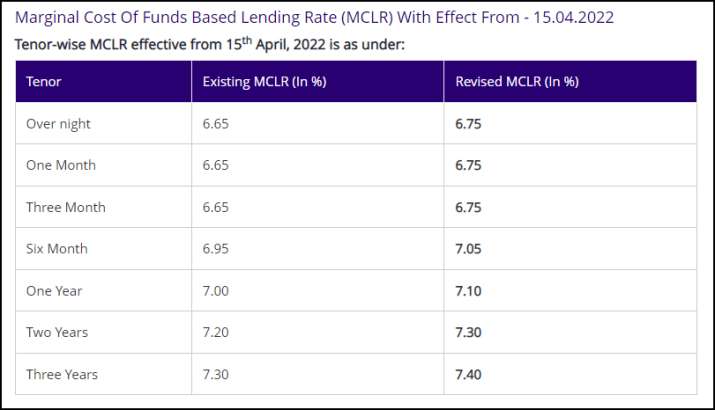

The bank has announced that the MCLR on all types of retail and institutional loans will become dearer by 10 basis points. The hike will be effective from April 15. One basis point is equivalent to a hundredth of a percentage point.

SBI’s decision to hike the MCLR will make all existing and fresh home, auto and personal loans costlier. MCLR is the base rate set for banks as per the new RBI guidelines. It replaced the earlier base rate system to determine rates of interest for loans. RBI implemented MCLR on 1 April 2016.

SBI hikes loan rates based on MCLR

SBI’s decision to hike the MCLR marks the start of an upward cycle in borrowing costs in the last three years. Other lenders could soon announce a hike in the rates.

Last week, Bank of Baroda (BoB), which is the fourth largest nationalised bank, announced a 0.05 per cent rise in the marginal cost of funds-based lending interest rates on all loans, effective April 12, 2022.

Latest Business News

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.