Govt’s PIB fact-check plan on hold; SoftBank deals hit record low

Now, the government has put this plan on hold pending further discussions.

Also in this letter:

■ SoftBank deals hit record low, sapping funding for startups

■ Budget 2023: govt may unveil measures to support startup ecosystem

■ Meta to reinstate Donald Trump’s Facebook and Instagram accounts

PIB fact-check plan on hold for more talks

The government has deferred notifying a contentious proposal under the IT Rules, which required intermediaries to take down content declared fake by the fact-check unit of the Press Information Bureau (PIB) or any other competent authority, officials told ET.

A fresh round of consultations on the proposed rules is likely to take place in February, a government official said.

“Since it is an entirely new proposal, a fresh consultation has to be done, which will happen in February. Only after that can the rule be notified, with changes, if any,” the official said.

Catch up quick: Last week, the government introduced this clause along with a set of proposed changes to the IT Rules that were aimed at regulating the online gaming industry.

A late-night update to the draft of the rules last week included the fact checking clause, and extended the deadline for stakeholder comments to January 25.

On hold: The government plans to release the final notification with respect to online gaming companies by January 31, the officials said.

But the fact check clause will not be a part of this notification, sources added.

Pushback: Several public policy experts have said that the draft rules could give the government more influence on content shared on social media platforms.

The Editors Guild of India (EGI) raised concerns in an open letter to the Ministry of Electronics and IT, saying the proposed rule could lead to government censorship.

SoftBank deals hit record low, sapping funding for startups

SoftBank Group’s new startup bets hit a record low last quarter as valuations continued to slide, chilling an already frosty startup winter.

By the numbers: The world’s largest tech investor — which at one point took part in $30 billion worth of financing rounds in more than 90 startups in a single quarter — participated in just eight investment rounds totaling $2.1 billion in the three months ending in December, according to data compiled by Bloomberg.

It was the first time the number of SoftBank’s deals fell to single digits since the launch of its Vision Fund.

Startup investments by SoftBank’s Vision Fund unit came below $350 million in the quarter just ended, a person familiar with the matter said. In total, the segment invested more than $144 billion in five-and-a-half years, which averages out to more than $6 billion per quarter.

Misery loves company: Rivals Tiger Global Management, Sequoia Capital and Coatue Management have also tightened their spigots after shouldering big writedowns in 2022.

Denied lucrative exits by a rout in tech valuations, deep-pocketed investors have pulled back, hitting pause on billion-dollar funding rounds that had become common in recent years.

How SoftBank changed the game: SoftBank’s Vision Funds transformed the venture capital ecosystem, directing billions of dollars into hundreds of startups and forcing other investors to match their big bets.

By flooding private markets with easy money, SoftBank and its rivals allowed companies to chase growth while avoiding the scrutiny of public listings.

Budget 2023: govt may unveil measures to support startup ecosystem

The finance ministry may announce measures to support the startup ecosystem in the upcoming Budget, PTI reported, citing sources.

PLI on the cards: Fiscal incentives under the production-linked incentive (PLI) scheme to some more sectors are also likely to be announced in the budget, which will be presented on February 1.

Besides, the government may consider providing funds to infrastructure projects approved by the Network Planning Group (NPG), constituted under the PM Gati Shakti initiative.

The budget may also address inverted duty issues in certain sectors to promote domestic manufacturing.

Quick recap: The government has taken a series of steps to promote startups in the country.

Under the Startup India initiative, it has launched the Fund of Funds for Startups (FFS) scheme, Startup India Seed Fund Scheme (SISFS) and Credit Guarantee Scheme for Startups (CGSS) to provide capital to companies at different stages of their business cycle.

TWEET OF THE DAY

Meta to reinstate Donald Trump’s Facebook and Instagram accounts

Following a two-year suspension, Meta announced on Wednesday that it will reinstate former US President Donald Trump’s Facebook and Instagram accounts in the coming weeks. The company had banned Trump two years ago after he praised rioters who stormed the US Capitol on January 6, 2021.

Details: Meta said in a blog post that it has “put new guardrails in place to deter repeat offences.”

“In the event that Mr. Trump posts further violating content, the content will be removed and he will be suspended for between one month and two years, depending on the severity of the violation,” said Nick Clegg, Meta’s president of global affairs.

The restoration of his accounts may be a big boost to Trump, who announced in November he will make another run for the White House in 2024.

He has 34 million followers on Facebook and 23 million on Instagram, platforms that are key vehicles for political outreach and fundraising.

His Twitter account was restored in November by new owner Elon Musk, though Trump has not been active on the platform.

Advertisers unaffected: Meanwhile, ad agency executives said that Trump’s return to Facebook and Instagram is unlikely to change how advertisers spend money.

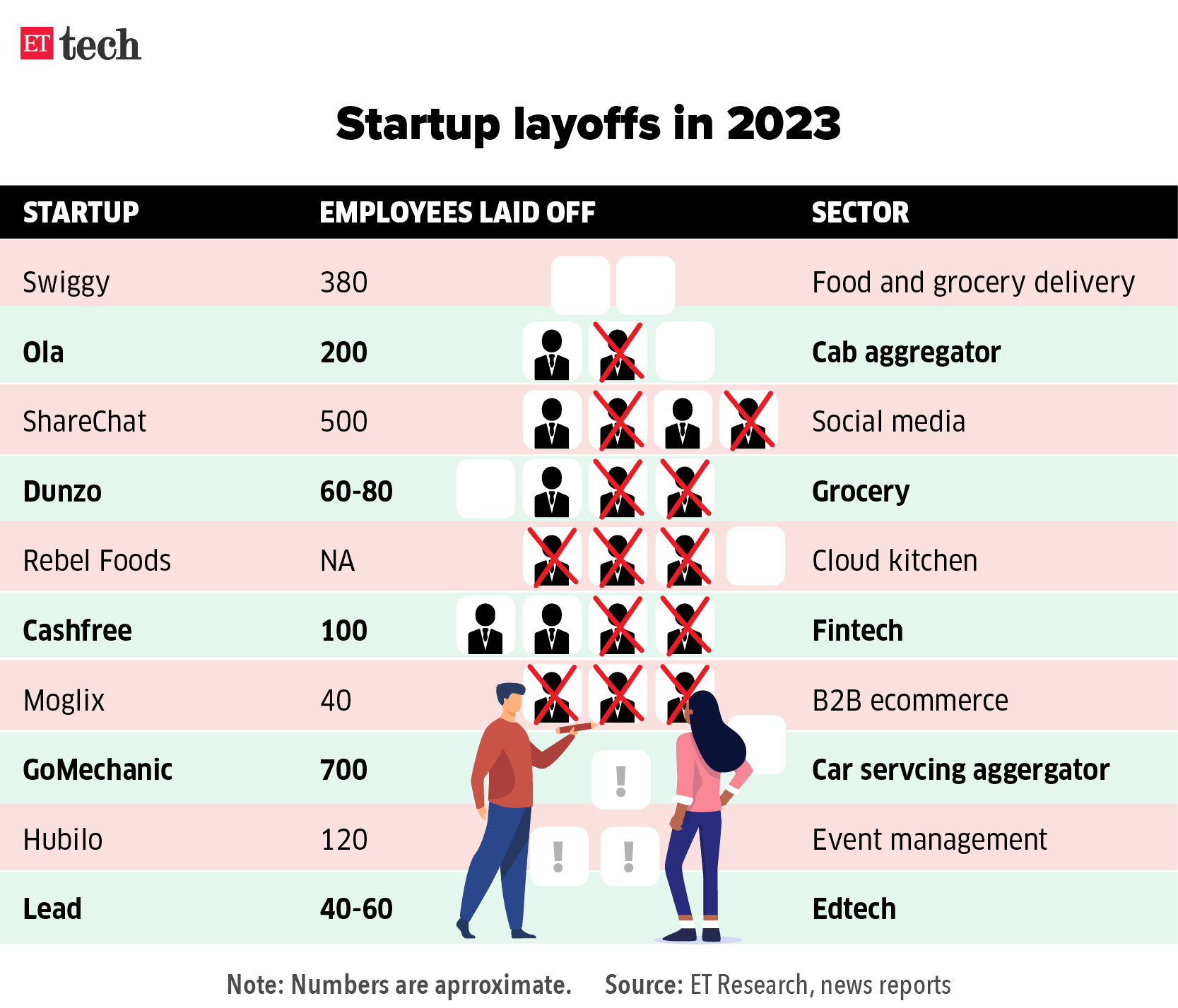

IBM and SAP collectively cut nearly 7,000 jobs

IBM Corp on Wednesday announced that it will cut 3,900 employees, while SAP said it plans to lay off 3,000 employees or 2.5% of its global workforce.

Why? IBM missed its annual cash target, dampening cheer around beating revenue expectations in the fourth quarter. IBM’s 2022 cash flow was $9.3 billion, below its target of $10 billion, due to higher-than-expected working capital needs.

The company also forecast annual revenue growth in the mid-single digits on constant currency terms, weaker than the 12% it reported last year.

Cost cuts: SAP on the other hand said that the German software company looks to cut costs and focus on its cloud business. It is also exploring the sale of its remaining stake in survey-software seller Qualtrics, which it purchased for $8 billion in 2018 and took it public in 2021 at a valuation of nearly $21 billion.

The layoffs come even as SAP reported a 30% revenue increase in its cloud business in the fourth quarter, helped by strong demand for its software.

Also read | Big Tech is firing employees by the thousands. Why? And how worried should we be?

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Siddharth Sharma in Bengaluru. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.