Google brings user-choice billing to India; comply with lending rules by Nov 30, says RBI

Also in this letter:

■ Comply with lending rules by Nov 30, says RBI

■ Be wary of Zomato, Swiggy dine-in schemes, NRAI tells members

■ SoftBank plans at least 20% staff cuts at Vision Fund

Google expands user-choice billing pilot to India, four other markets

Google said on Friday it was rolling out the next phase of its user-choice billing pilot to users in India, Australia, Indonesia, Japan, and the European Economic Area.

Catch up quick: Earlier this year Google announced a new pilot to explore user-choice billing for Google Play apps, allowing participating developers to offer users an alternative to its own billing system.

This came after a crackdown by South Korea, which in August 2021 barred “the act of forcing a specific payment method to a provider of mobile content”.

Now, all non-gaming developers globally will be able to sign up for the pilot and offer a choice of billing systems to users in India and the other markets, the company said.

Users will continue to have the choice to use Play’s billing system, it said, and that “reasonable service fees” would continue to apply in order to support its investments in Android and the Play Store.

“We will be sharing more in the coming months as we continue to build and iterate with our pilot partners,” Google added.

Global rollout? The tech giant said the process would take time and require close collaboration with the developer community, but added it was looking forward to exploring this further and and one day making this available to users around the world.

India probe: Google is the subject of a Competition Commission of India (CCI) investigation that is looking into whether its billing system for Play Store developers is “unfair and discriminatory”.

Ensure existing loans comply with new rules by Nov 30, RBI tells digital lenders

To allow for a smooth transition to the new digital lending guidelines, the Reserve Bank of India on Friday said all entities under it had until November 30 to ensure all existing digital loans abide by the new rules.

Catch up quick: The central bank last month issued new digital lending rules for banks and non-bank lenders that have digital lending apps, to bring such services under tighter supervision.

Under the rules, the disbursal of loans and collection of repayments must be executed only between borrowers and entities it regulates, with no third party involved in this process.

The regulations are based on the recommendations of a working group set up by RBI last year to assess governance issues and consumer complaints about digital lending platforms offering quick loans, which have mushroomed during the pandemic.

Many are accused of charging usurious interest rates, employing high-handed collection strategies and even operating illegally.

What’s new: Apart from setting the November 30 deadline on Friday, the RBI reiterated that it was the duty of banks and non-bank lenders to ensure that their outsourcing partners adhered to the rules.

It also advised all banks and non-banks that all instructions contained in the digital lending circular would apply to existing customers availing fresh loans, and to new customers.

Be wary of Zomato, Swiggy dine-in schemes, restaurant body tells members

The National Restaurant Association of India (NRAI) issued an advisory to its members on Friday, asking them to exercise caution and good judgement before choosing to participate in food delivery firms’ new dine-in programmes.

Why? NRAI said in its note that both dine-in programmes had more or less the same construct. Restaurants must offer a compulsory 15-40% discount – entirely borne by them – to participate, and must also pay a compulsory 4-12% commission on every transaction made through Zomato or Swiggy, it said.

It said the programmes offered no tangible value to restaurants, would not solve any problems for the industry, and would benefit Swiggy and Zomato at the cost of restaurants.

After “squeezing the last drop of revenue from the delivery business”, food delivery firms want to get a “firm foothold” in the dine-in business, NRAI added.

Catch up quick: Both food delivery majors are piloting dine-in programmes – Zomato Pay and Swiggy Diner – in Hyderabad, offering discounts of up to 25% to customers who pay their restaurant bills through their apps.

Zomato responds: Zomato said a a statement: “With our new dining product, now live in Hyderabad for a few weeks with great results, we are confident that we will create tremendous value and growth for the industry. We are looking forward to working with progressive restaurants who see the bigger picture.”

Swiggy did not immediately respond to our queries.

CCI probe: In April, India’s anti-monopoly watchdog ordered a probe into Zomato and Swiggy for allegedly unfair pricing practices and other issues flagged in a complaint by NRAI last year.

SoftBank plans at least 20% staff cuts at Vision Fund

SoftBank Group is planning to cut at least 20% of staff at its loss-making Vision Fund following public pledges from founder and CEO Masayoshi Son to reduce headcount at the world’s biggest tech investor, Bloomberg reported, citing people familiar with the matter.

At least 100 jobs: The will slash a minimum of 100 positions and may announce the job cuts as early as this month, the sources said.

The cuts will mostly be in the UK, US and China operations, which have the highest headcounts, they added. The Vision Fund unit has about 500 employees including Latin America funds staff.

Catch up quick: Son said in August he had plans for widespread cost-cutting at his conglomerate and the Vision Fund investment arm after a record $23 billion loss. Most of the losses came from a plunge in the valuations of portfolio companies, including Coupang and DoorDash. SoftBank also reported a $6 billion foreign exchange loss because of the weaker yen.

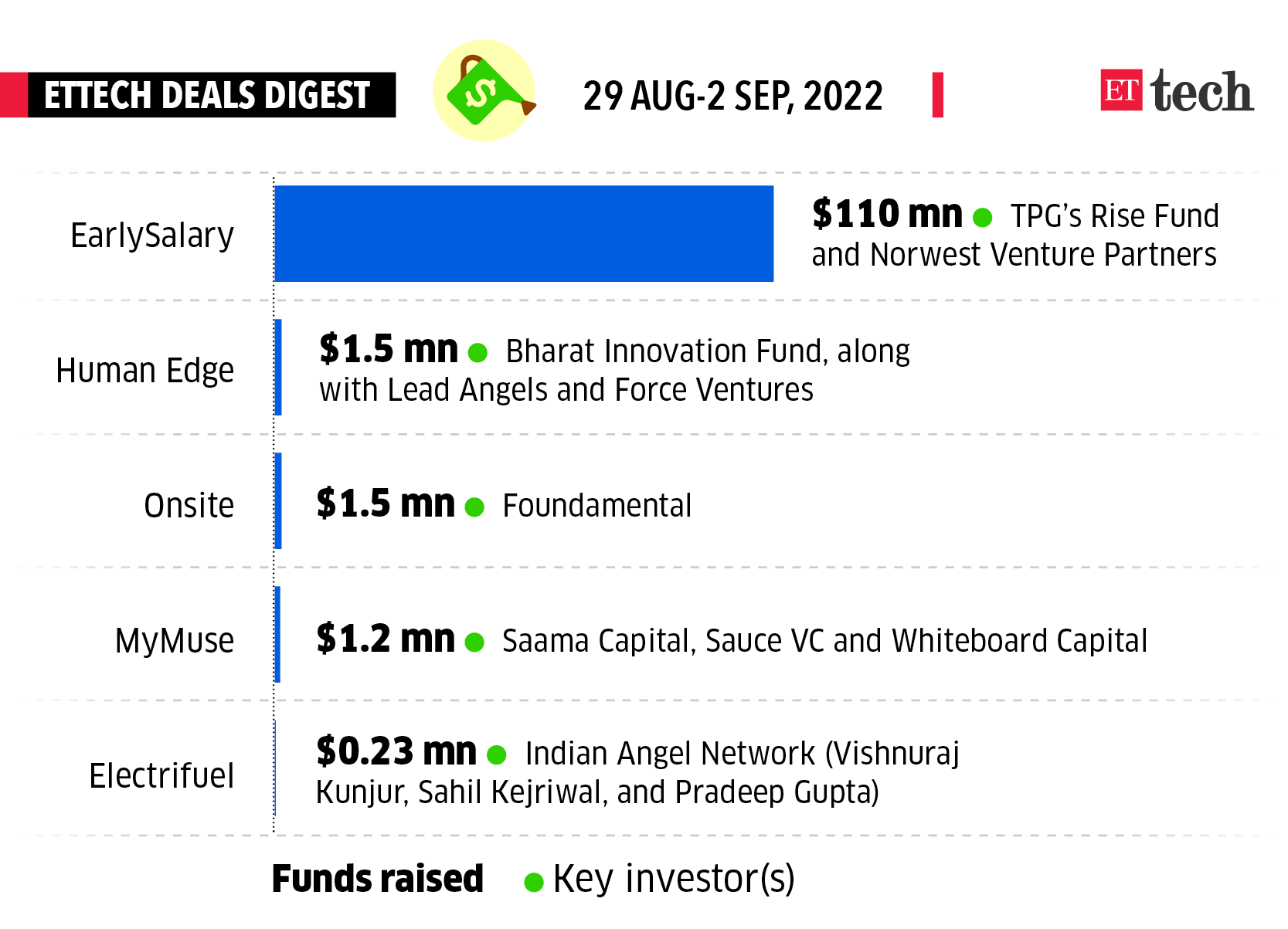

ETtech Deals Digest

Earlysalary bagged $110 million in a week which saw fewer and smaller deals than the previous one. MyMuse and Human Edge were two startups that raised over $1 million.

Here is a list of all the startups that raised funds this week.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Judy Franko in Bengaluru . Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.