Game over for Dream Sports’ corporate venture arm; payment aggregator licence seekers under RBI scrutiny

Also in this letter:

■ NPCI features in local languages soon

■ IT Q2 report card — Infosys & HCLTech

■ Kareena Kapoor Khan, Sugar Cosmetics’ parent ink JV

ETtech in-depth: Rario collapse, tax woes bring curtains down on Dream Sports’ venture arm

Harsh Jain, cofounder and CEO, Dream Sports

Hi, Apoorva here in Mumbai. Today, my colleague Samidha and I are bringing you two significant news breaks from Dream Sports, the gaming giant which operates the fantasy gaming platform Dream11.

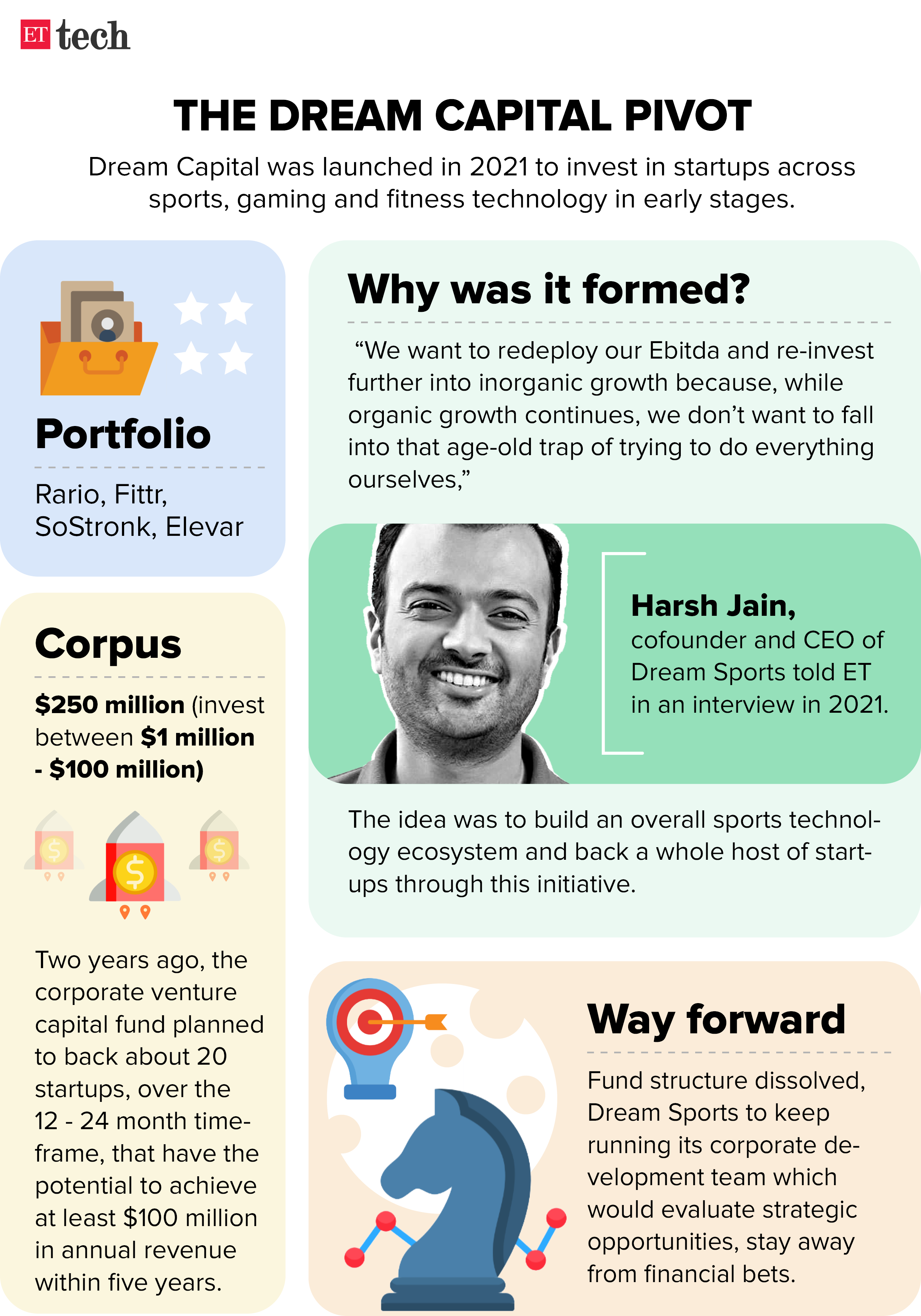

Venture arm rollback: Dream Sports has decided to roll back its self-funded corporate venture arm which had a committed corpus of $250 million, marking the end of an experiment by the gaming and sports-focussed company. The venture arm’s top boss, Dev Bajaj, who is also its chief strategy officer, is departing from the company.

Why this matters: Dream Sports’ decision comes at a time when it is facing a retrospective tax demand of Rs 25,000 crore and navigating its way through a newly introduced 28% GST levy. The venture arm was launched in 2021 to invest in sports and related sectors and give a boost to the parent’s inorganic growth ambitions.

Also Read | The harsh ‘reality’ facing real money gaming firms

Rario factor: The decision to discontinue the venture arm is partly due to its failed bet into cricket non-fungible token (NFT) platform Rario. In April 2022, Dream Capital contributed a majority of the capital in its $120 million funding round.

Rario is facing a legal challenge of its own. A Delhi High Court ruling invalidated the costly rights (Rs 148 crore for 170 licences) it had secured from cricket and cricketing associations for minting NFTs.

The unfavourable ruling led to the cancellation of a $20-$25 million funding round into Rario led by Dream Sports this year.

Also read | Decoding government’s tax math for online gaming players

What’s next? Rario’s new CEO Priyesh Karia and his team are busy renegotiating the licensing deals and Dream Sports plans to set up an internal corporate development team to look at strategic opportunities.

Lens on payment firms seeking aggregator tag

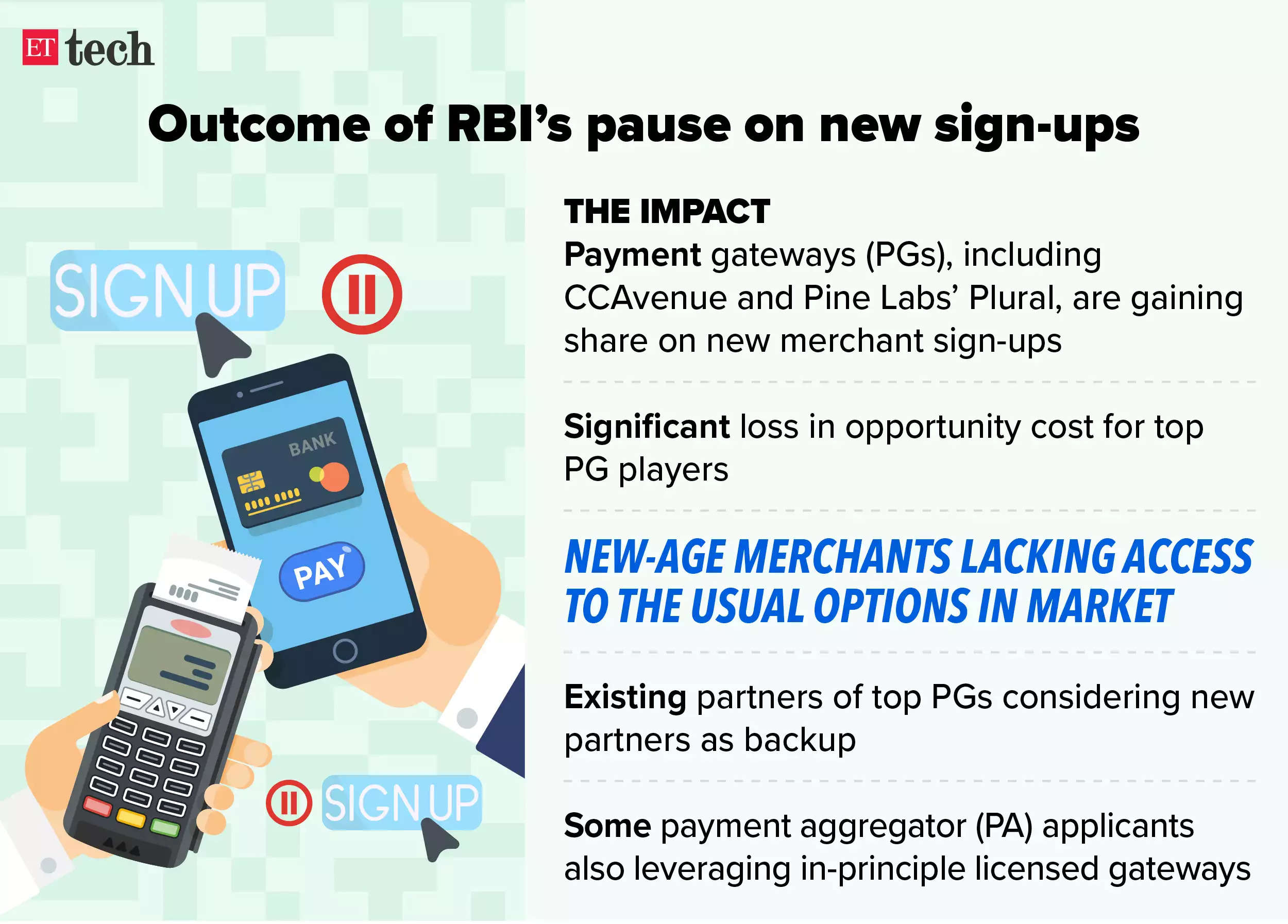

The Reserve Bank of India has stepped up its due diligence on companies that have applied for a payment aggregator licence. Sources told ET the regulator is looking at multiple aspects of these businesses before issuing the licence.

RBI is concerned about three major aspects:

- Internal access controls: The regulator wants to impose proper audit checks to ensure access control for employees is maintained.

- Investor profile: For any investor with a more than 10% shareholding, the RBI is looking at the ultimate beneficiary to ensure compliance with FATF guidelines.

- Data protection: Ensure customer data is protected and all safety systems are in place.

Also read | Exclusive: Rivals snag new users as top payment gateways hit by RBI freeze

Impact on business:

Large payment companies like Cashfree, Razorpay, Paytm, PayU have all been stopped from onboarding new customers. While PayU and Paytm have seen their applications rejected, Cashfree and Razorpay were hoping to get the final approval and begin merchant onboarding.

This has an impact on business, say industry insiders. Razorpay said that they are changing their go-to-market strategy.

Limited players: The RBI might not be very keen to give regulatory clearance to a lot of payment aggregators, sources say. Around 80 companies are in various stages of getting their PA licences. But one founder said that given it is a very serious business, the RBI might look at handing out a final licence to around 50 companies.

Talk to ‘Bhashini’ for UPI-based services in local languages

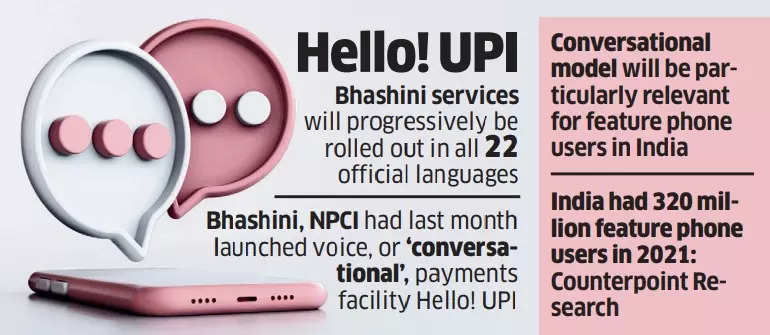

To advance linguistic inclusion in the payments ecosystem, Bhashini – the government’s AI-powered multilanguage national language translation platform – is looking to expand voice-based facilities under the National Payments Corporation of India (NPCI).

Going local: Users can soon use different languages as the new facilities in the works include bank account balance check, business-to-business (B2B) transfers, electricity payment, Fastag recharge, mobile and landline payments, gas payment, challan payments, metro card recharge and insurance renewal through voice commands.

Also read | AI4Bharat: Putting India on the global map of cutting-edge AI innovation

Bridging the divide: “In some way we are looking to bridge the digital and literacy divide to a large extent, and for that, it is important for us to get into transactions. NPCI is one such case, and the farmer bot (for PM Kisan yojana) is another case,” Bhashini chief executive Amitabh Nag told ET.

Also read | Bhashini to launch RBI’s platform for frictionless credit in multiple languages

A demo for you! Users can call in to the number 080-45163802 and use English or Hindi to ask to transfer money. The bot will then ask whom the money is to be transferred to, and the user has to provide the beneficiary’s number.

But, Nag said, implementation of voice-based transactions across languages is bound to take time given the scale of these projects and their data requirements.

Also read | ETtech in-depth: Government chatbot powered by Bhashini, OpenAI’s ChatGPT is at your service

IT Q2 earnings: Infosys trims FY24 guidance; HCLTech profit up 7%

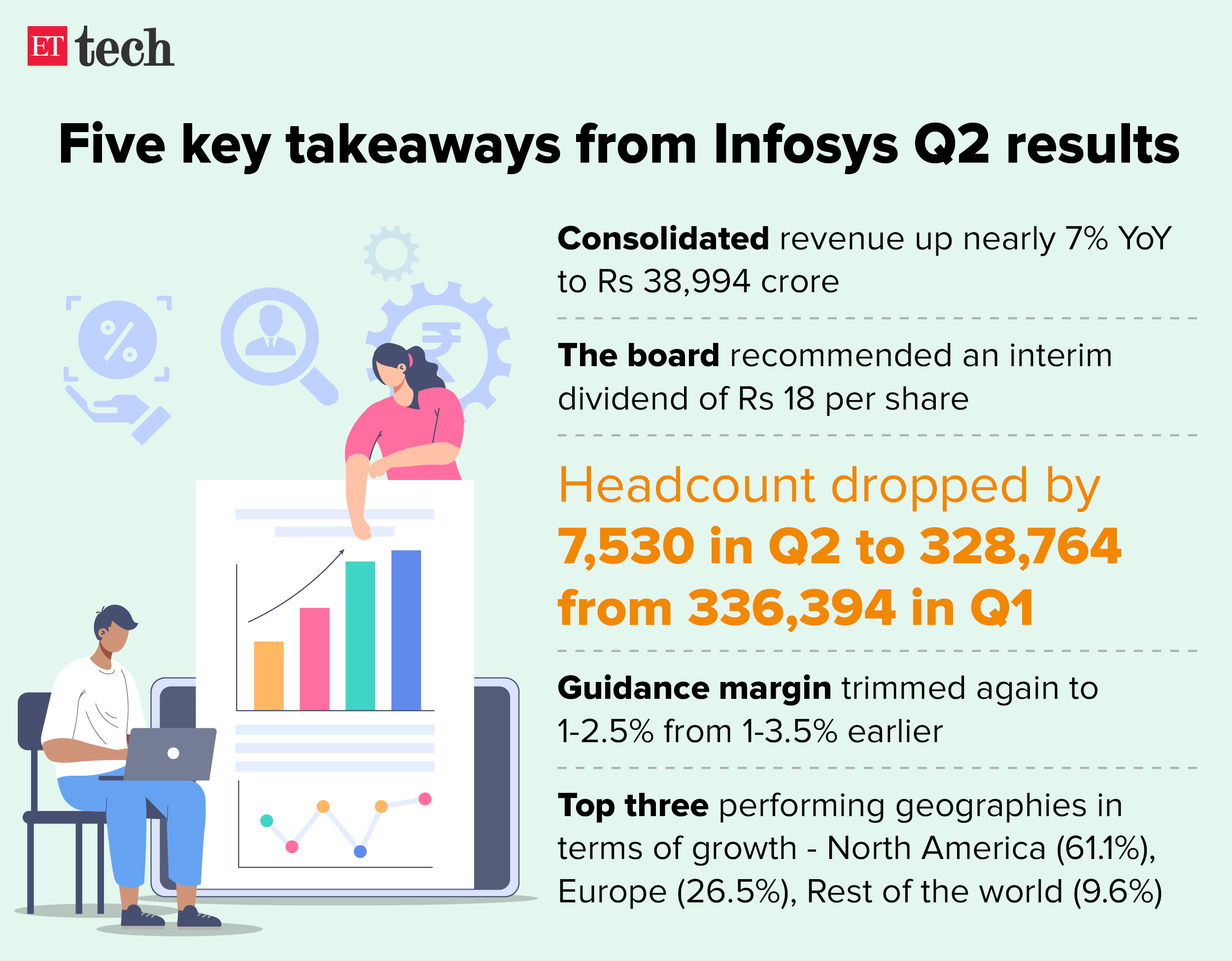

Infosys on Thursday reported a 3% year-on-year (YoY) growth in consolidated net profit for the quarter ended September to Rs 6,212 crore. Consolidated revenue grew nearly 7% on year to Rs 38,994 crore. The board has recommended an interim dividend of Rs 18 per share.

FY24 guidance: The software major yet again tweaked its guidance for FY24. Infosys sees revenue growing 1-2.5% in constant currency terms in FY24, compared to 1-3.5% earlier. The net headcount was down by 7,530 in the September quarter to 328,764.

Also read | Indian techies may be in for a long wait as IT firms defer hikes

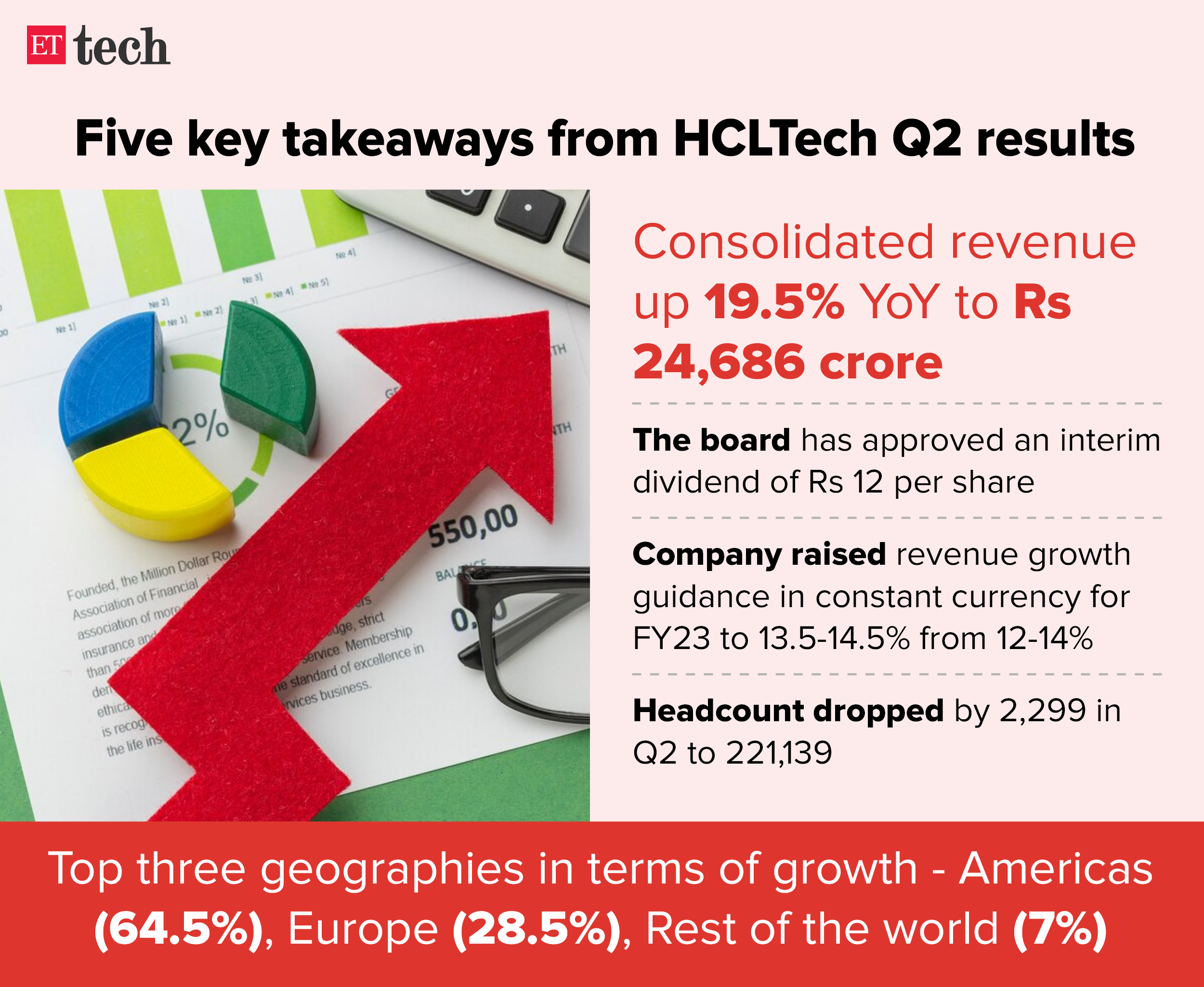

HCLTech profit beats estimates: HCL Technologies posted a 7% YoY rise in its profit for the quarter ended September. On a sequential basis, its profit jumped 6.3% to Rs 3,489 crore. Revenue for the quarter stood at Rs 24,686 crore, up 5.2% sequentially, and 19.5% on year. The company’s board has approved a dividend of Rs 10 per share.

Kareena Kapoor Khan, Sugar Cosmetics parent form JV to sell Korean products

Actor Kareena Kapoor Khan has inked a strategic partnership with Sugar Cosmetics’ parent company Vellvette Lifestyle Pvt Ltd, to set up a joint venture company called Quench Botanics which will sell premium Korean beauty products.

Tell me more: Sugar Cosmetics founder and CEO Vineeta Singh said Quench is expected to be a Rs 100-crore business in net revenue over the next 12 months. “My vision for investing in Quench is a reflection of my belief in the category of simplified natural beauty and making it accessible to all,” Khan told ET.

IPO on the cards? Singh plans to list Sugar Cosmetics on the stock exchanges in the next two-three years. “The timing will depend on market conditions, but it’s definitely on the cards,” she said.

D2C hype: Consumer startups in India have found new backers in Bollywood and sports personalities at a time when private equity and venture capital funding have dried up. Some of the celebrities, and the startups they have backed, are:

Other Top Stories By Our Reporters

HP is looking to expand its ‘Renew’ programme in India: HP is set to expand its ‘Renew’ programme in India, which offers a range of refurbished HP computing products, in a bid to promote circularity and sustainability. Read more about why the firm considers India to be one of its key markets for this programme.

Groww goes past Zerodha, becomes India’s biggest stockbroker with 6.6 million active users: Groww had 6.62 million active clients in September, up from about 6.20 million the previous month, as per latest data released by the National Stock Exchange. Zerodha’s active user base remained stable at 6.40 million.

Catamaran Ventures picks up 1.12% stake in garment maker Gokaldas Exports: Gokaldas Exports, one of India’s largest garment manufacturers and exporters, is promoted by Florintree Advisors, a private equity firm run by former Blackstone executive Mathew Cyriac.

US tech firms keen to invest $3 billion in Karnataka, say ministers MB Patil, Priyank Kharge: The ministers shared details of their interactions with top executives during their recent US tour at a media conference. Some of these companies were already in the process of investing about $ 1 billion in the state.

Global Picks We Are Reading

■ Why Japan should sell Nintendo (Financial Times)

■ How AI reduces the world to stereotypes (Rest of World)

■ Nearly half a billion small tech items thrown away (BBC)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.