FTSE 100 close: Bleak IMF UK recession warning knocks pound and London index

London’s FTSE 100 dipped and the pound stumbled today, both driven lower by the International Monetary Fund (IMF) warning the UK is on course to be the only major economy to contract this year.

The capital’s premier index fell 0.17 per cent to 7,771.69 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, shed 0.46 per cent to drop to 19,845.72 points.

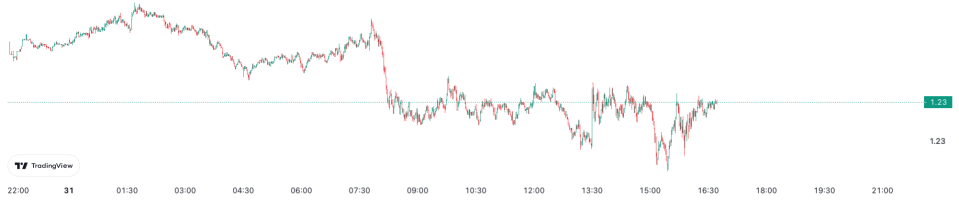

The pound weakened nearly 0.3 per cent against the US dollar off the back of the IMF’s dire economic warning. Sterling also slipped nearly 0.4 per cent against the euro.

Late last night, the IMF, the world’s economic watchdog, published fresh forecasts in which it predicted Britain’s economy will shrink 0.6 per cent this year, making it the only G7 country to be hit by a contraction in 2023.

Rapidly rising interest rates, compounded by high inflation and tax rises will choke economic growth, the IMF said.

That warning depressed market sentiment in the City, forcing the FTSE 100 index lower.

Pound tumbled against US dollar today

Banks led the premier index into the red due to investors focusing on rising default risks amid the economic slump instead of the boost from higher interest rates.

High street lenders HSBC and Barclays dropped nearly one per cent and around half a per cent respectively, while Asia-focused bank Standard Chartered was trading near the bottom of the FTSE 100.

Online supermarket and middle class favourite Ocado was the worst performer, losing 4.75 per cent. The firm’s shares have been extremely volatile this year, swinging between topping and anchoring the FTSE 100.

The upcoming US Federal Reserve meeting tomorrow in which the central bank is expected to announce a 25 basis point rate increase also jilted market confidence.

“Stocks have had a good run higher this year so some profit-taking ahead of the uncertainty of the Fed makes sense too. The Fed is seen slowing the pace of hikes to 25bps tomorrow, with the two-day meeting kick off today,” Neil Wilson, chief market analyst at Finalto, said.

Fresh European inflation data out later this week is likely to drop again. Although falling further, the European Central Bank is expected to hike rates 50 basis points again on Thursday to prevent price pressures from sticking around.

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.