Fresh layoffs at Byju’s; iPhone shipments from India cross Rs 10,000 crore in May

Also in this letter:

■ WinZo cofounder on 28% tax on gaming firms

■ Research firms give thumbs-up to Indian wearables

■ Will Coinswitch click in India’s online broking space?

Byju’s undertakes another round of layoffs

It’s been a bad June for Byju’s. The beleaguered edtech major is letting go of a further 500-1,000 full-time employees across teams in a bid to prune costs, amidst tough macroeconomic conditions, multiple people confirmed to ET.

The details: Employees in marketing, sales, business development, as well as the product and technology functions, are expected to be impacted by this round of layoffs. According to sources, it also includes teams from its coding subsidiary – Whitehat Jr.

Previous layoffs: The edtech major laid off 2,500 employees in October last year to rationalise its workforce across departments such as product, content, media and technology in a phased manner. In February this year, the company announced another round of layoffs, impacting 1,000 employees, taking the total number of job cuts to 3,500.

In troubled waters: Earlier this month, the edtech startup sued its lender Redwood, an American investment management firm and its related entities in the New York Supreme Court for accelerating the repayment of a $1.2 billion Term Loan B (TLB). The edtech firm has also “elected” to not make any further payments to the TLB lenders till the matter is in court.

iPhone exports swell to record Rs 10,000 crore in May

India is biting big for global tech giant Apple. In May, the country shipped out iPhones worth over Rs 10,000 crore, boosting its overall smartphone exports.

Driving the news: In April and May, smartphone exports crossed ₹20,000 crore, over double the ₹9,066 crore in the comparable year-ago period, according to data from the India Cellular and Electronics Association. iPhones constitute 80% of smartphone exports from India, while South Korea’s Samsung and a few local brands make up the rest.

India story: The export figures underline Apple’s efforts to make India its second home for iPhone manufacturing. In FY23, India exported iPhones worth $5 billion, the first brand to hit that milestone. And, as Apple looks to diversify, China’s worsening ties with the US have come as a blessing in disguise.

Setting an example: During Prime Minister Narendra Modi’s upcoming visit to the US, Apple’s success story here will be touted to convince American companies such as Tesla to shift their supply chains to India. “The focus is to strengthen the supply chains,” a source told ET.

ETtech Explainer: Will Coinswitch click in India’s online broking space?

Ashish Singhal, CEO and cofounder, Coinswitch Kuber

Indian crypto exchange Coinswitch is considering entering the Indian online stock broking market after its plans to enable retail investment in US stocks were put on hold last year. While a bull run in the stock market bodes well for the cryptocurrency exchange, a slump in the number of active users on online broking platforms could be a worry. Still, its plan to expand into a full-fledged wealth-tech player could pay dividends.

Why the shift in focus? Coinswitch halted its plans for trading of US stocks on its platform after a hike in the tax collected at source rate on foreign remittances under the Liberalised Remittance Scheme. Secondly, regulatory ambivalence and subdued demand in the crypto market have forced exchanges to diversify into non-crypto asset classes.

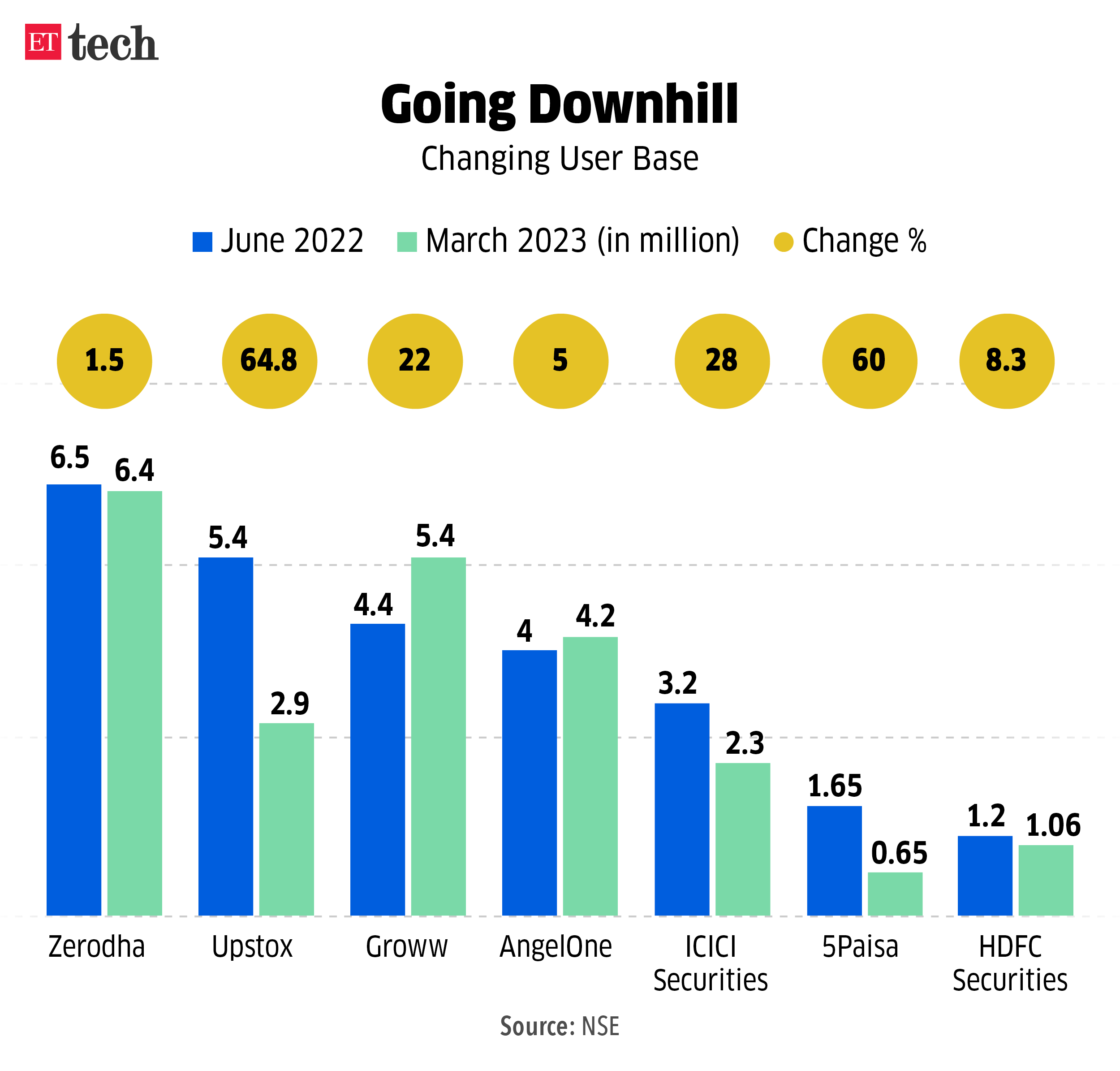

Overcrowded market: As too many players look to cash in on the pandemic-fuelled surge in the retail investor base, the online broking space is packed. While Zerodha boasts the largest user base at 6.4 million as of March 2023, other big contenders include Upstox, Groww and 5Paisa.

Hitting the slow lane: ET reported on April 28 that online stock broking startups have hit the slow lane as the bull run peters out and customers who dabbled in stocks during the work-from-home phase return to offices. According to NSE data, a few of the largest tech-led discount stockbrokers have seen a noticeable slump in the number of active users since H2 2022.

Read the full explainer here

Proposed GST on gaming firms will shrink player base: WinZo cofounder

Saumya Singh Rathore, cofounder, WinZo Games

A 28% Goods and Services Tax on gaming companies still in the process of building IP and technology could deter many players apart from shortening the runway for early-stage startups, Saumya Singh Rathore, cofounder of gaming platform WinZo Games, told ET in an exclusive interaction.

Some key takeaways:

Proposed 28% tax: “Companies that have achieved stability might be able to handle any additional tax burden, as they have a stable revenue model at scale and matured margins,” she said.

Sin tax tag: “Categorising gaming as a sin tax not only impacts the industry economically but also culturally. It may deter some of the best talent from engaging in the sector to build technology and IP for export from the country, thus obstructing the growth and potential success of the industry.”

On categorisation of games: “The central government’s inclusion of online gaming in the IT rules is a net positive. It further legitimises the category and resolves conflicts between companies and states regarding game classification. The certification process through the SRO is a critical process.”

Research companies raise India’s wearables shipments forecasts

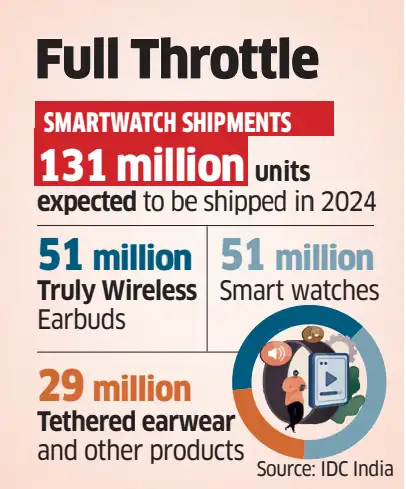

Falling average selling prices (ASPs), exponential demand from new-generation consumers and fitness and tech enthusiasts, and a boost in local manufacturing will boost India’s wearable device shipments in 2024, according to research firms.

Data decoded: IDC India has revised its forecast for the year to 131 million units — up from the 120 million units projection after the first quarter. Similarly, Counterpoint Research now forecasts smartwatches to grow at 56% from a mid-40s growth rate earlier, while truly wireless earbud shipments (TWS) are expected to grow at 41%.

Expert take: “The two growth drivers have been etailers (ecommerce platforms) and India-based vendors. They have really been the key pillars of growth, with low-priced, affordable devices and marketing activities,” said Upasana Joshi, principal analyst for wearable devices, IDC India.

The ASP factor: IDC said India will have the lowest ASP for wearables, down from $31 in 2021 to a forecast of $23-25 by the end of 2023. Counterpoint Research expects the ASP for smartwatches to decline by 15% from Rs 4,800 in 2022, the ASP of TWS to drop 5% from Rs 2,300, and that of neckbands to decline 8% from Rs 1,400.

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.