Flipkart gets interim relief in tax case; why Macquarie increased Paytm target price?

Also in this letter:

■ Travellers from G20 nations can now use UPI payments

■ Fundraising: most startup founders expect 2023 to be challenging, says report

■ Lendingkart acquires Upwards for about Rs 120 crore

Interim relief for Flipkart on Rs 1,100-crore tax demand

Flipkart India has been granted an interim stay by the Karnataka High Court in the case of income-tax demand of around Rs 1,100 crore. Flipkart was asked to submit the demand in four days, following which it moved the court challenging the notice.

The dispute: The I-T department had capitalised discount as marketing intangibles and disallowed Esops, amounting to about Rs 4,500 crore and Rs 180 crore, respectively, for the two assessment years.

Flipkart in the petition said the issue of capitalisation of marketing intangibles was decided in its favour by the Income-tax Appellate Tribunal (ITAT).

HC order: “The submission on behalf of the respondents (tax department) is that there cannot be any prohibition in the law against the issuance of a notice, but during the appeal period, no coercive measures may be taken, and as such, coercive measures will not be taken. This assurance shall be in force until the next date of hearing, and the office is directed to re-list this petition on 24.02.2023,” the Karnataka High Court said.

Flipkart’s submission: Flipkart said the appellate orders have been passed in gross violation of principles of natural justice as the documents forming the basis of findings were not provided to it and that it was not given a reasonable time period to deposit the demand.

ETtech Explainer: Why has Macquarie raised Paytm’s target price by a steep 80%?

Brokerage firm Macquarie Research raised its 12-month target price for Paytm stock to Rs 800 in a report released on Wednesday. Last year, Macquarie slashed the scrip’s target price twice – first from Rs 1,200 to Rs 800, and then further to Rs 450.

Catch up quick: The 80% increase in the target price comes after the payments company reported a positive Ebitda before Esops cost of Rs 31 crore for the quarter ended December, and narrowed its losses to Rs 392 crore from Rs 778.5 crore year-on-year.

Jargon buster: A target price is an estimate of the future price of a stock, given out by brokerage firms based on earnings forecasts and assumed valuation multiples.

Risks involved: Macquarie said that although Paytm does not have a balance sheet risk on the loans originated, it does carry significant business and reputational risk and that a few months of bad performance could result in lenders withdrawing their credit lines, thus affecting the firm’s ability to grow.

Macquarie’s rationale: Macquarie has cited the ongoing decrease in losses, the boost in loan distribution, and the improvement in Ebitda as key factors behind its revision of the stock target price. The report mentioned that the post-paid segment (accounting for over 95% of volume) and personal loans are performing well and the company has observed multiple repeat purchases or transactions in the past year.

Read the full explainer here

Fundraising: most startup founders expect 2023 to be challenging, says report

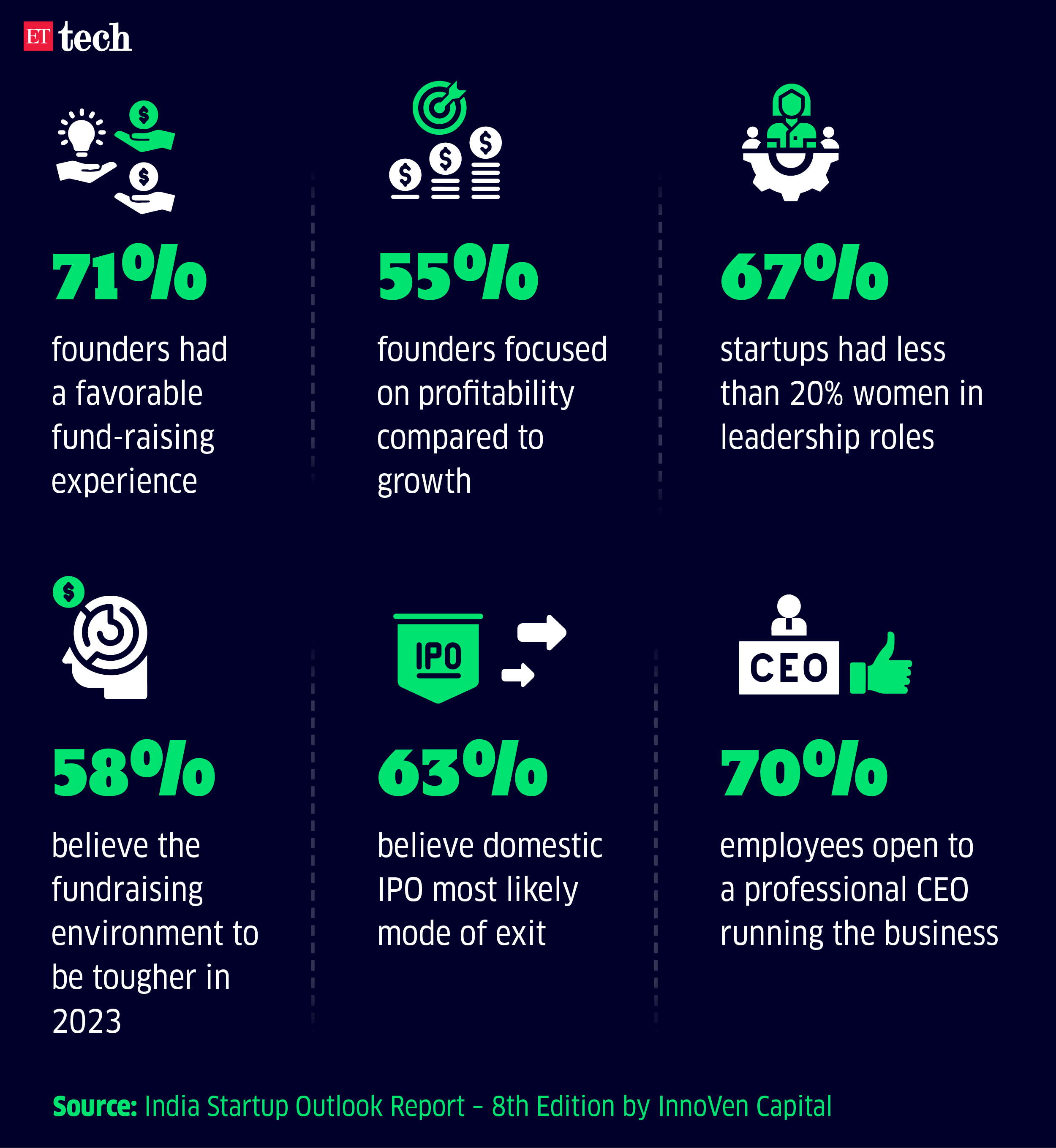

About 53% of startup founders had a positive fundraising experience (71% of those who attempted to raise), in 2022, according to the latest report by InnoVen Capital, titled India Startup Outlook Report. This figure was down from 92% in 2021.

Also, the report noted that the founders expect this year to be challenging, with 58% of founders expecting a tough fundraising environment to be tougher in 2023.

Tweet of the day

Lendingkart acquires personal loan platform Upwards for around Rs 120 crore

Digital lending platform for medium and small enterprises (MSMEs) Lendingkart has acquired personal loan provider Upwards in a cash-and-stock deal worth Rs 100-120 crore.

What’s the deal? Upwards’ investors Mayfield and India Quotient will get an equity stake in Lendingkart’s cap table as part of the deal, while Shunwei Capital, another major investor, will be taking a cash exit. Lendingkart will continue to retain the Upwards brand and absorb the 100-member team.

Quote unquote: “While catering to our MSME customers, we were figuring out what else we could do. We realised that there are a lot of businesses that are run by single-member teams who could take a personal loan. Even our MSMEs have a blue-collared workforce that doesn’t have access to credit or financial products. We look forward to solving these segments through the Upwards acquisition,” said founder and chief executive Harshvardhan Lunia.

Also read | In-depth: How startups are pruning costs as funding continues to plummet

ETtech Done Deals

- BlueLearn, a Bengaluru-based upskilling and job-finding platform, on Wednesday said it raised $3.5 million in funding led by Elevation Capital and Lightspeed. Other investors included Titan Capital, 2am VC, Meesho founders Vidit Aatrey and Sanjeev Barnwal, and Pixxel founder Awais Ahmed, among others. The capital raised is in addition to the previous rounds, led by Lightspeed and 100x VC.

- Zypp Electric raises Zypp Electric has raised $25 million in a funding round led by Taiwanese EV maker and battery-swapping company Gogoro. The round comprises $20 million in equity funding and $5 million in debt, which came from global impact fund IIX and a large national bank in India.

RBI’s digital push: foreign travellers from G20 countries can make UPI payments in India

Travellers coming to India will soon be able to use Unified Payments Interface (UPI) for retail payments in the country. On Wednesday, the Reserve Bank of India (RBI) announced that the UPI merchant payment facility will be extended to inbound travellers to India.

Who’ll benefit? To start with, this UPI facility will be extended to travellers from G-20 countries arriving at select international airports.

“UPI has become hugely popular for retail digital payments in India. It is now proposed to permit all inbound travellers to India to use UPI for their merchant payments (P2M) while they are in the country,” RBI Governor Shaktikanta Das said while announcing the outcome of the bi-monthly Monetary Policy Committee on Wednesday.

Further, this facility will be enabled across all other entry points in the country and the RBI will issue necessary operational instructions soon.

QR code-based coin-vending machines: Das also announced that QR code-based coin-vending machines will be available in 12 cities soon, enhancing the ease of access to coins and distributing coins using machines.

“These vending machines will dispense coins against debit to the customer’s account using UPI instead of physical tendering of banknotes. Based on the learnings from the pilot, guidelines will be issued to banks to promote the distribution of coins using these machines,” the RBI governor’s statement read.

Today’s ETtech Top 5 newsletter was curated by Siddharth Sharma in Bengaluru and Gaurab Dasgupta in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.