Exclusive: Big payday for PhonePe founders; key takeaways for tech, startups from Eco Survey 2023

To kick start the day, we have a packed edition of the ETtech Morning Dispatch. Bunch of stories on what the Economic Survey 2023 recommended for startups and tech sector and another big scoop on the PhonePe-Flipkart separation and its ongoing fundraise.

Also in this newsletter:

■ Eco Survey calls for simpler tax rules to bring startups back

■ SaaS topples fintech as largest unicorn creator in 2022

■ Vedantu’s FY22 losses extend to Rs 696.3 crore

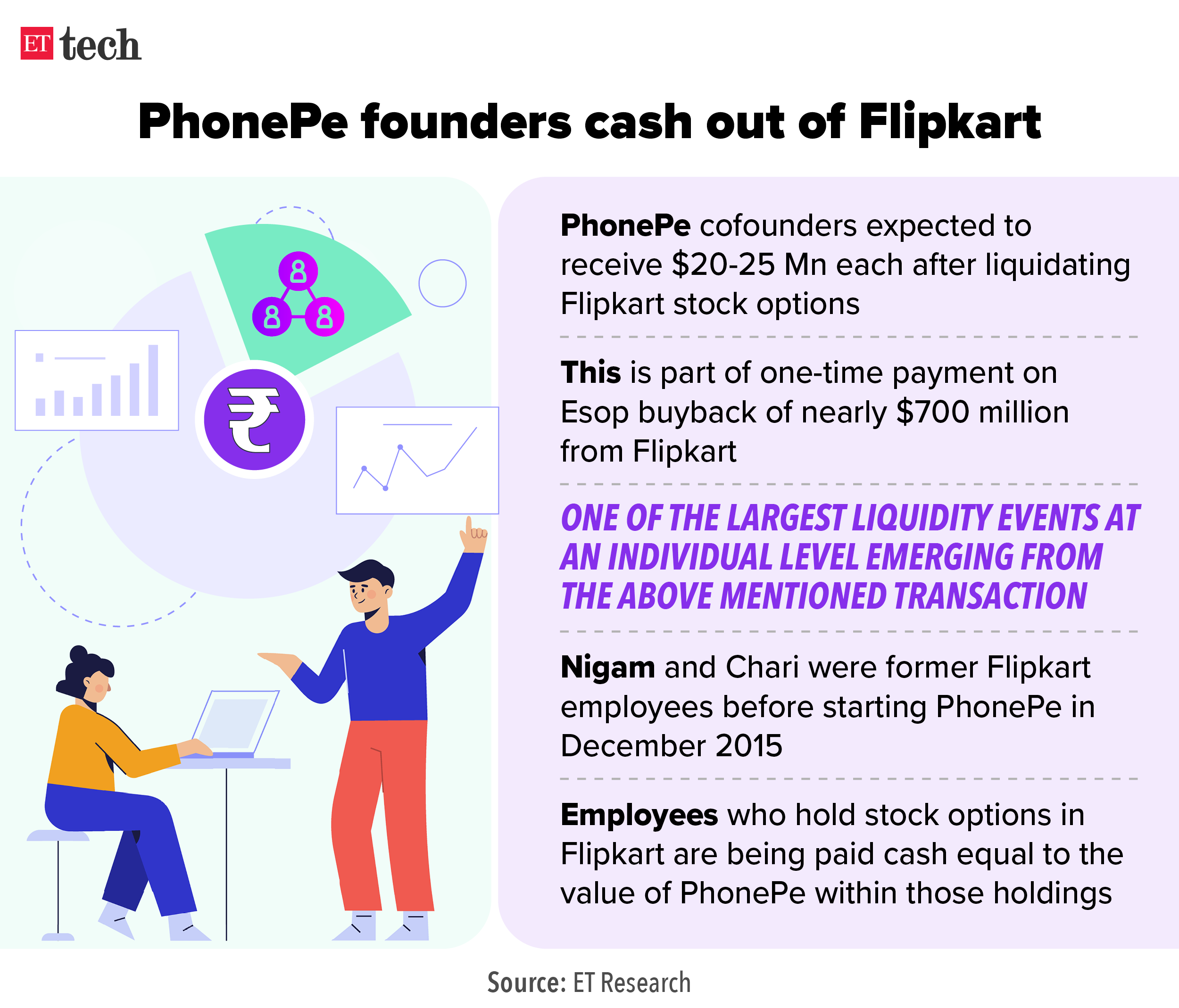

Exclusive: Big payday for PhonePe founders post Flipkart Esop buyback

Hi, Digbijay here in Bengaluru.

PhonePe founders–Sameer Nigam and Rahul Chari– are expected to make at least $20-25 million each, in cash payouts, as they have liquidated all of their stock options in the Flipkart group, PhonePe’s erstwhile parent firm, sources aware of the matter told us.

How will it work? PhonePe was founded in December 2015 and just about four months later, Flipkart acquired it. Nigam and Chari– who previously worked at Flipkart – were allotted stock options after the acquisition. The duo is now selling these options for a huge sum.

Tell me more? Since PhonePe has fully separated from the Flipkart group, the founders of the payments firm were allowed to divest all of their options from Flipkart as they will no longer have any role to play there, sources said. Nigam and Chari didn’t respond to emails sent by ETtech.

Who is paying for this? Walmart, the parent firm of both Flipkart and now PhonePe. In November, ETtech first broke the story about $700 million Esop buyback in Flipkart as part of the PhonePe separation and the ongoing funding round–which could be around $1.5-2 billion in size. PhonePe has already received the first tranche amounting to $350 million as part of the primary fundraise in January.

Economic Survey 2023 calls for simpler tax rules to bring startups back to India

Taking a note of the ‘reverse flipping’ trend, where startups are looking to move their domicile back into India from more tax-friendly countries like Singapore, the US, the UAE, etc, the Economic Survey has made a wishlist of measures for the government to accelerate this trend.

The key suggestions? Simplification of taxation of Employee Stock Options (Esops), and multiple layers of tax and uncertainty caused by tax litigations. The Survey has also recommended easing procedures for capital flows with lesser restrictions on the inflow and outflow of capital.

Also read | Economic Survey flags regulatory challenges from new technologies

Why is it important? PhonePe had in October last year moved its domicile from Singapore to India, and its CEO Sameer Nigam recently said that since then, about 20 unicorns and their investors have enquired about the process and are actively looking to move back to India. Nigam had said that the fintech’s investors had to pay Rs 8,000 crore in taxes “just to allow us to come back to India”.

What is flipping? ‘Flipping’ is the process of transferring the entire ownership of an Indian company to an overseas one, accompanied by a transfer of all IP (intellectual property) and all data hitherto owned by the Indian company.

What did the Economic Survey say? “The flipping phenomenon mentioned above reflects startups venturing out for short-term gains in the dynamic, uncertain geopolitical world. However, the flip can be reversed with the collective action by the government-related regulatory bodies and other stakeholders. With solution-oriented strategies, start-ups will continue to be the messengers of India’s entrepreneurial dynamism”.

Digital public infrastructure can aid GDP growth: CEA

The Economic Survey 2022-23 released was big on outlining the role of digital public goods (DPGs) which is being applauded globally. India’s DPI can add around 60-100 basis points (BPS) to the country’s potential GDP growth rate and there is a lot of justified optimism around it, said Chief Economic Advisor V Anantha Nageswaran while presenting the Economic Survey of 2023.

On RBI digital currency: The Survey said the introduction of Central Bank Digital Currency (CBDC) will provide a boost to digital financial services by laying the framework for “another generation of financial innovation”.

Agritech funding: Agritech startups have raised around Rs 6,600 crore over the last four years from private equity investors, witnessing a growth of over 50% per annum, the Economic Survey 2022-23 said. There are over 1,000 such agritech startups that are assisting farmers in improving farming techniques, the Survey said.

EV market outlook: The Economic Survey 2023 has said that the automotive industry is expected to play a critical role in transition towards green energy, pointing out that the domestic electric vehicles (EV) market is likely to grow at a compounded annual growth rate (CAGR) of 49% between 2022 and 2030, hitting 1 crore units in annual sales by 2030.

Cryptocurrency approach: The Survey highlighted the need for a common approach for regulation of cryptocurrencies, adding that an unregulated crypto market is challenging the financial systems around the world. It also said that India’s e-commerce market is projected to post gains and grow at 18% annually through 2025, citing Global Payments Report by Worldpay FIS.

IT sector growth: The increasing focus on digitisation of services and India emerging as a key “powerhouse” to undertake engineering research and development (ER&D) activities by global multinational firms has helped the Indian IT-business process management (BPM) clock 15.5% growth on year for FY22, as per the Economic Survey report 2022-23. This compares with 2.1% growth for the fiscal year 2020-21.

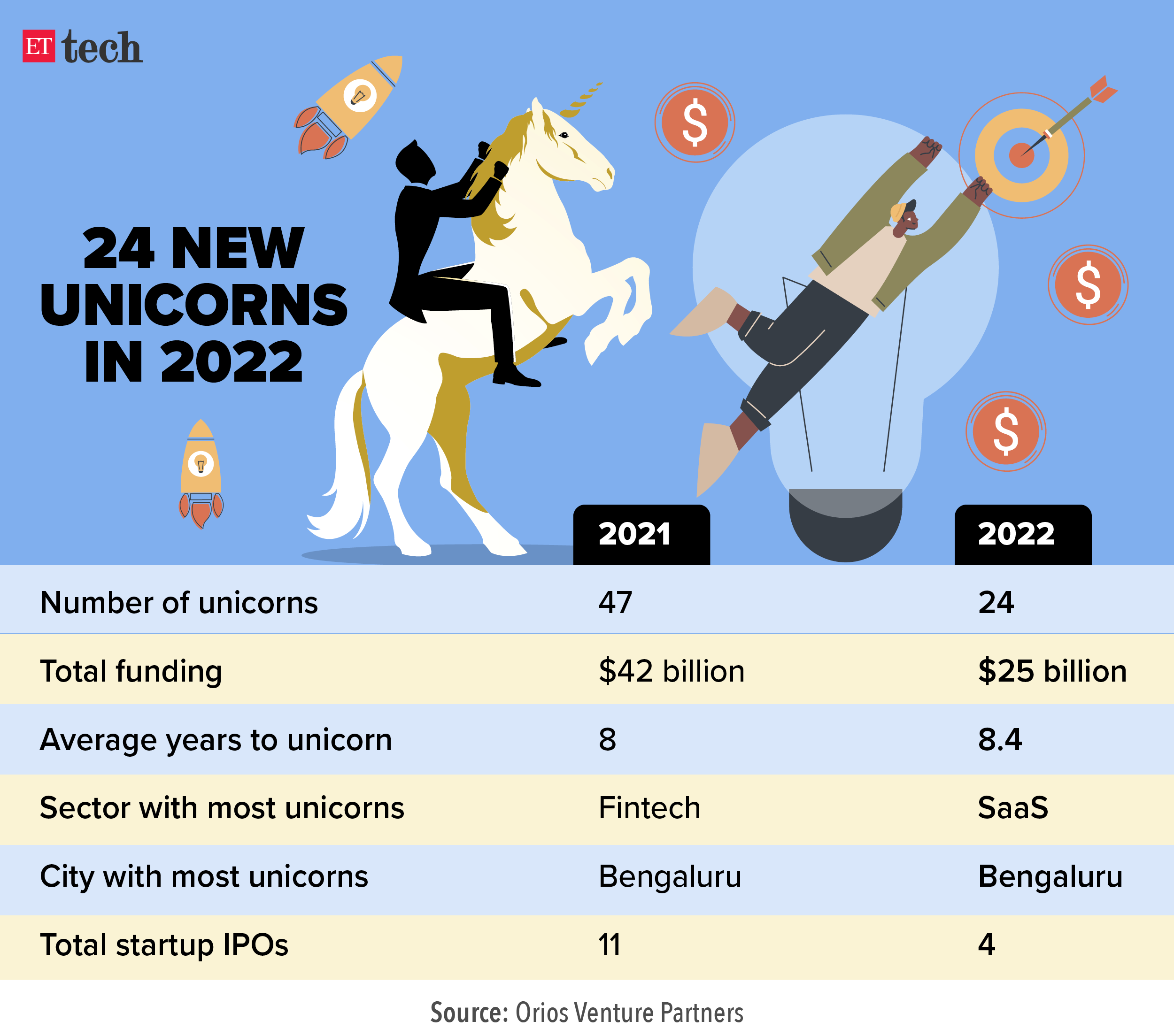

SaaS topples fintech as largest unicorn creator in 2022

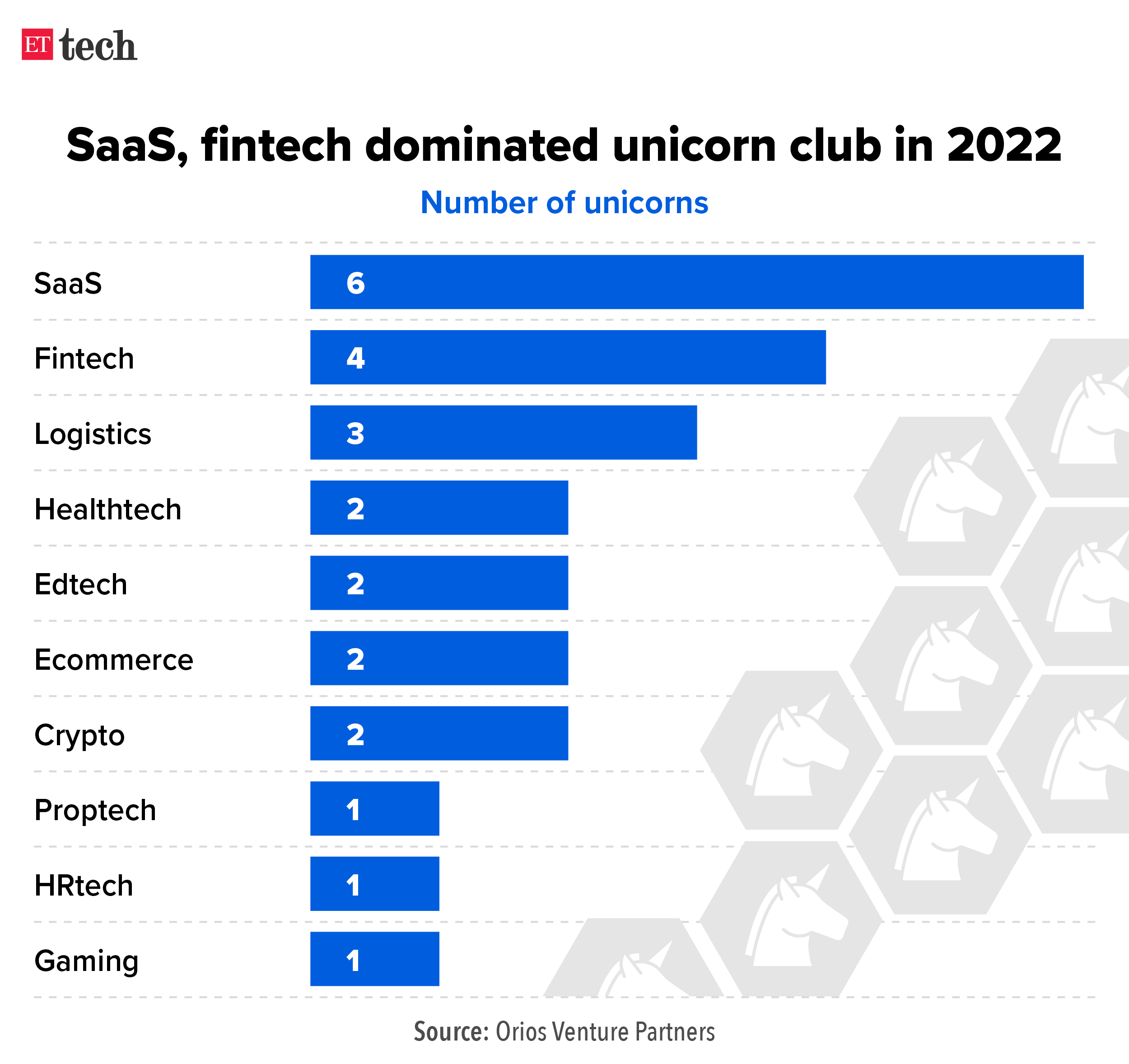

Software-as-a-service (SaaS) dethroned fintech as the sector that produced the most number of unicorns last year, as per a report by early-stage venture capital fund Orios Venture Partners.

What gives? Managing partner Rehan Yar Khan told us that many of the software unicorns reached the coveted $1 billion valuation on the back of inflated revenue to valuation ratios, until negotiations about valuations…

Quote unquote: “What I would certainly do is I would check the toplines of these companies. I think what surprised me was that these companies are not very large and then suddenly they were all unicorns,” Khan told ET.

What else? Apart from how SaaS produced six out of 24 unicorns in 2022, other top findings by the PharmEasy backer’s annual report of ‘India Unicorns and Exits Tech Report 2022’ included startups having raised a total of $25 billion in total in the year, that 1 out of 13 unicorns globally was born in India, and that the year also saw 229 acquisitions and 4 technology public listings.

Vedantu’s FY22 losses extend to Rs 696.3 crore

Vedantu Innovations, the Bengaluru-based company that owns and operates an eponymous online education platform, ballooned its total loss about 13% in latest financials, buoyed by people costs.

By the numbers: Total loss for the financial year ended March 2022 reached Rs 696.30 crore against Rs 616.27 crore in the previous year, as per consolidated earnings filed with the Ministry of Corporate Affairs sourced by Tofler.

Operational revenue in the reported period, FY22, was up 80% at Rs 168.91 crore.

The remaining ‘other income’ – that accounts for interest income and gain on sale of current investment – went down 38% at Rs 25.74 crore, bringing the total revenue from Rs 134.93 crore to Rs 194.64 crore.

Total expenses, which was led by people costs, vaulted up 19% in the reported period of FY22, at Rs 890.93 crore.

Layoffs: People costs, a growing concern for the company over the years, went up 20% to Rs 489.29 crore.

To correct these costs, Vedantu has been laying off its staffers across four rounds starting early 2022. In the latest round of layoffs, it culled roles of 385 employees in December last year.

In total, the company has laid off over 1,100 employees last year, as a covid-led growth tapered off and the slump in late-stage funding has made it harder for Indian edtech firms to raise fresh funds.

Infographic Insight: Data could help large organisations grow, says survey

Large organisations in India could grow their annual business revenue by 13.6% or about Rs 745 crore if they can harness the power of data, as per a study by Amazon Web Services (AWS).

The Demystifying Data 2022 report, commissioned by AWS and prepared by Deloitte Access Economics, surveyed 521 senior business decision-makers in Indian organisations.

Other top stories by our reporters

Profit.co raises $11 million: Profit.co, which provides software that allows clients to set, track and measure objectives and key results (OKR) for their employees, said on Tuesday that it raised $11 milli on in its first external round of funding after about four years of bootstrapping.The fresh capital will be used to scale up the sales and customer success teams at the company, as per a statement.

Sameer Singh named TikTok’s Head of global business solutions, North America: Sameer Singh has been elevated as the head of TikTok’s global business solutions in North America. After TikTok withdrew from India in 2020, Singh has been leading business solutions for the platform in Southeast Asia. His move to the North American market comes at a time when TikTok is being heavily scrutinised by the US government and amid widespread calls for a blanket ban on it.

Zoho sees $1b revenue for ManageEngine in a year: Cloud demand will drive India to the second largest market for enterprise IT management software ManageEngine despite larger macroeconomic concerns, Zoho Corporation cofounder Sridhar Vembu said on Tuesday. Speaking at ManageEngine UserConf Mumbai 2023, Vembu said the Zoho management expects its enterprise IT management division to cross $1 billion in revenue by the next year, given the demand metrics.

Global Picks We Are Reading

Instagram’s co-founders are mounting a comeback (Platformer)

How a Tiny Bank in a Washington Farming Town Got Tangled Up With FTX (WSJ)

Binance offshore exchange tapped same Washington lobbyists as US affiliate (FT)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.