ET Startup Awards, Infosys kind of allows moonlighting and other top stories

ETSA comes at a time when the global tech startup ecosystem is surrounded by economic and geopolitical turmoil. The volatility in valuations of publicly listed companies, which began in the US late last year, is spilling over into the private markets. Indian startups have also felt the turbulence and sliding investor interest with funding drying up in the previous six months.

This year, jury members are looking for startups that have a resilient business model, built with an extremely-long-term mindset that will see them become corporate giants in a little over a decade.

The ideal winners will be startups that are not just successful today but have the potential to be category-defining, enduring companies that can shape the ecosystem over the next few decades, said Shailendra Singh, MD, Sequoia India & Southeast Asia.

“Given the constantly evolving socio-economic environment and its impact on commodities and services, having a resilient business model is critical to success. Innovation, creativity, and the ability to scale in the given environment would be a few others to look out for,” said Sahil Barua, cofounder and CEO, Delhivery.

More on the jury’s expectations here

Check out the nominees below

Top Innovator

Comeback Kid

Bootstrap Champ

CCI Cracks Down on Tech Firms

Anti-trust regulator Competition Commission of India (CCI) has clamped down on digital companies to check for abuse of market dominance. The regulator slapped a fine of Rs 1,337.76 on global tech giant Google for abusing its commanding position in the local smartphone market.

The regulator said makers of devices that run on Android shouldn’t be forced to pre-install Google services on their devices. It also asked Google to provide fair access to all stakeholders.

The company said it would review the decision and weigh its next moves. “The CCI decision is a major setback for Indian consumers and businesses, opening serious security risks for Indians… and raising the cost of mobile devices,” a Google spokesperson said.

Read: CCI draws red line for tech firms with fines on Google, booking sites

Google is not the only firm that has evoked the wrath of the CCI. The anti-trust watchdog has, in the last week, fined hotel-booking companies MakeMyTrip Ltd and Goibibo and IPO-bound hotel chain Oyo a combined $47 million for unfair practices.

The CCI has directed MakeMyTrip and Goibibo (MMT-Go) to amend their market behaviour after fining them about $27 million. Oyo was fined $20 million.

Read more: Google reviewing CCI penalty order and evaluating next steps

Tech and Public Markets

Shares of logistics and supply chain company Delhivery dropped 32% to Rs 383 in two trading sessions after the firm on Wednesday said that it expects moderate growth in shipment volumes through the rest of the financial year 2023.

“While the festive season sale surge in shipment volumes will spill over to Q3FY22 as well, we anticipate moderate growth in shipment volumes through the rest of the financial year,’’ Delhivery said in a BSE filing on Wednesday.

The stock, which was listed on the bourses in May, fell below the issue price of Rs 487 for the first time on Thursday.

Read | Delhivery stock hits record low, falls another 18% on muted guidance

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Tracxn debuts on bourses

Software as a Service (SaaS) platform Tracxn made a rather unremarkable debut on the bourses on Thursday. The stock listed at Rs 84.5, a premium of 5.63% over its issue price of Rs 80 on the NSE. The stock, however, made some gains post listing and eventually closed at Rs 91, 2.41% on Friday

Founded in 2013, Tracxn Technologies provides market intelligence data to private companies. The company has an asset-light business model and operates a SaaS platform.

Read more here

Tata-Backed Cult.fit Looking at IPO in 12-18 Months

ET recently learnt that fitness startup Cult.fit is aiming for an Initial Public Offering (IPO) in 12-18 months. Cult.fit’s revenue had also grown more than 50% compared to pre-Covid-19 levels, Naresh Krishnaswamy, business head, told us.

“The two businesses — our fitness and fitness products business — will lead the charge for Cult.fit over the next 12-18 months as we look towards turning completely profitable at an Ebitda level and as we look towards our IPO event in the next 12-18 months,” Krishnaswamy said.

Moonlighting in Focus, Again

Infosys allows moonlighting, sort of: Amid the ongoing debate over moonlighting, IT major Infosys has allowed its employees to take up gig work outside the firm with prior approval from managers and human resource executives.

This is after CEO Salil Parekh categorically declared that the company does not support dual employment. The unexpected announcement comes amid rising instances of moonlighting among Indian techies.

Companies hire forensics firms to nab moonlighters: Forensic and employment verification companies have recorded a rise in the number of companies hiring them to weed out moonlighters.

In addition, they are also being roped in to review compliance and control frameworks as concerns around moonlighting grow and the true extent of the problem slowly emerges.

“We are definitely getting more calls from concerned clients and the mandates range from pre-screening to investigations,” said Nikhil Bedi, head, Deloitte Forensic practice.

Read | IT industry could fall apart due to moonlighting: TCS’ Subramaniam

Hiring Trends in the IT Sector

Net employee addition by the top IT service providers has dropped by about one-fourth in the first two quarters of the current fiscal year and is expected to fall by almost half for the full year as the next two quarters are historically weak for the $227 billion software exports industry.

This comes as the sector faces the fallout from the geopolitical turmoil in Europe and macroeconomic concerns in the United States.

Tata Consultancy Services (TCS), Infosys, Wipro and HCLTech reported around 81,700 net headcount additions during the first half, almost 24% lower than the 107,616 net recruitment during the same period last fiscal year, an ET analysis showed. Analysts said that net additions in the July-September quarter (Q2) were also lower than in the first quarter.

Fresher hiring unaffected

IT companies have said that fresher additions will continue in the second half of the financial year, too, and macroeconomic factors will have no bearing on this.

Milind Lakkad, chief HR officer at TCS, said during the company’s earnings call that 10,000 more freshers will be onboarded in the second half of FY23.

HCL CEO C Vijayakumar said the company would onboard at least 30,000 freshers this fiscal year.

Read: IT services fresher hiring in H1 exceeds same period last year

In Other Top News

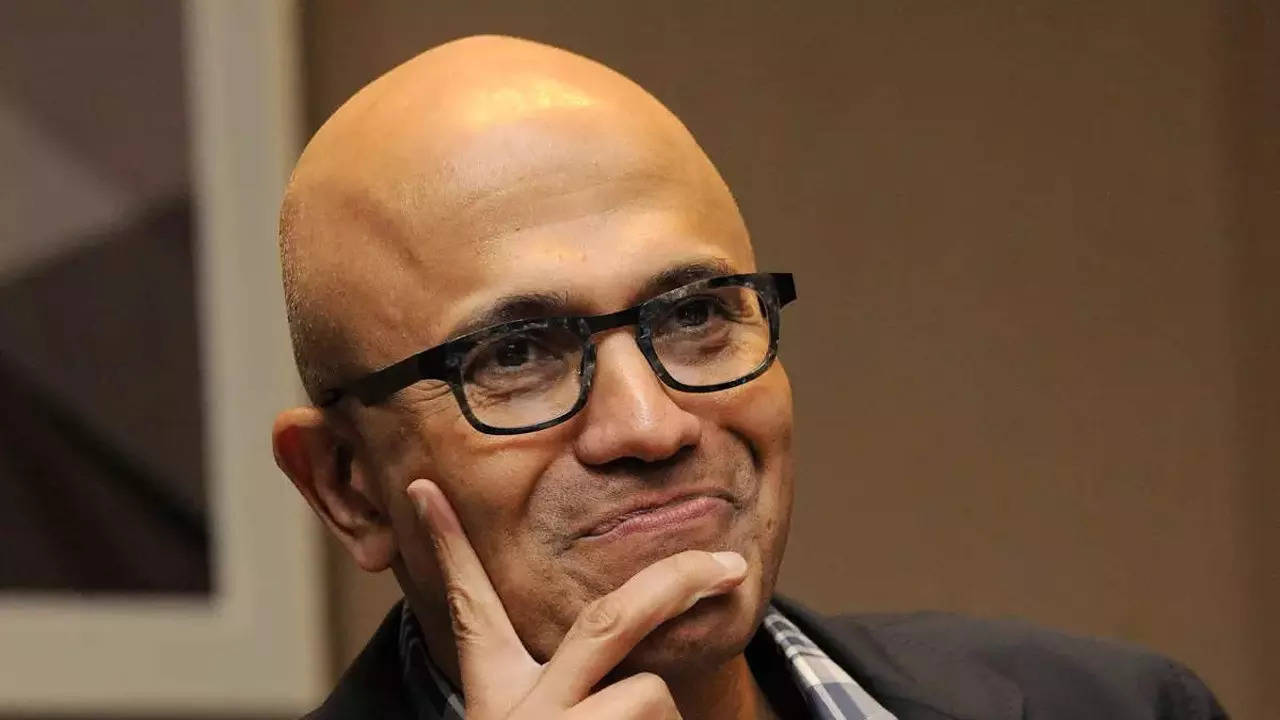

The Satya Nadella interview: In an exclusive interview with ET, Microsoft chief Satya Nadella said that the world is experiencing a once-in-a-lifetime change in “how, where, and why we work” and it is “not going back to 2019.”

Companies need to accept that and find a new path forward, he said, adding that investment in digital infrastructure and skilling is equally important in the current macroeconomic scenario. Digital technology is a “deflationary force in an inflationary economy” and can help “navigate uncertainty,” he noted.

Nadella spoke about hybrid working, growth opportunities in India, competition in cloud space and more. Read the full interview here

Byju’s raises $250 million: Byju’s closed a financing round of $250 million from its existing investors, including Qatar Investment Authority (QIA), which led the round with over $100 million.

The primary fundraise was executed at its previous valuation of $22 billion while the secondary stake sale took place at a discounted price, sources in the know told us.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.