Energy crisis: Households could begin switching suppliers in search for cheaper deals as price cap plummets

Millions of Brits could switch suppliers in the second half of 2023 in search of cheaper deals.

The shift comes as the energy market is expected to become more competitive as gas prices ease later this year.

Market forecasters Cornwall Insight anticipate that falling energy wholesale prices coupled with reduced government support will provide suppliers the chance to offer discounted offers for the first time since the energy crisis, in the summer of 2021.

Since the start of winter, the price cap and the support package has left the standard variable tariff lower – the default option for households – cheaper than almost all other energy tariffs.

This has effectively constrained the savings households can make by switching.

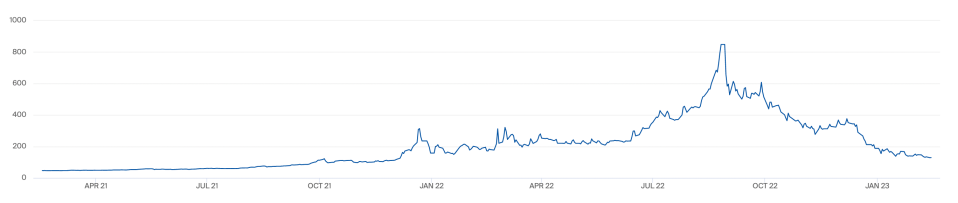

Seeing no incentive to switch suppliers and save money, household switching rates dropped from an average of 496,000 electricity supply points moving per month in 2019 to just 85,000 per month in 2022.

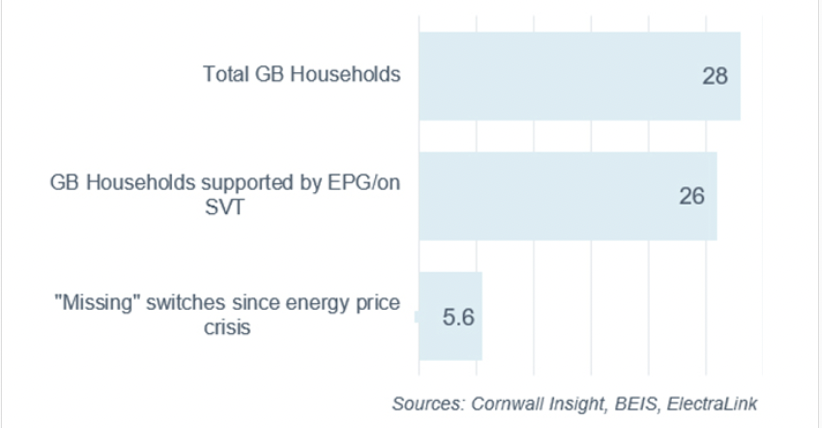

Using the average switching rates from the two years up to October 2019 as a baseline, Cornwall Insights 5.5m switches that might have been expected did not occur since the energy crisis began.

However, with subsidy rate for the Energy Price Guarantee rising to £3,000 in April, and decreasing wholesale prices lowering supplier costs, Cornwall Insight predicts suppliers will be able to offer fixed tariffs that compete with the capped government prices – reviving the benefits of switching suppliers.

Such an outcome is subject to wholesale market volatility, early indications are that suppliers may be able to offer competitively priced tariffs within a matter of weeks.

Gas prices have dropped from last autumn’s peak of £8.75 per therm to £1.29 per therm on the spot market, which has driven forecasts for the price cap later this year from over £6,000 to barely a third of that – with Cornwall Insight recently predicting third and fourth quarter caps of around £2,300.

Market changes jeopardise a return to normal

One potential headwind to switching is the the market stabilisation charge (MSC) – triggered by Ofgem last December to calm the energy market.

The MSC means if wholesale energy prices drop by more than 10 per cent from when the current price cap was set, the supplier that gains a customer pays the supplier that lost a customer in line with the MSC.

While the stabilisation charge does encourage responsible hedging practices, it also means suppliers may not be able to offer deals at prices as low as they would have liked due to the cost implications.

As wholesale prices could further drop in 2023, with the MSC triggered more frequently, Cornwall Insight expects the charge will face greater scrutiny.

Kate Mulvany, senior consultant at Cornwall Insight said: “The energy market is complex, making it difficult to predict the effects of policy changes on consumer behaviour and energy pricing. However, if suppliers’ costs decrease and government-supported rates remain relatively high, it is likely we will see a significant revival in reasonably priced energy plans, with millions of households finally able to take advantage of the savings they have been missing out on for years.

“There are many variables still in play, and it is difficult to know how fast and how far energy bills will fall. The MSC charge adds another level of complexity, as while it may safeguard against supplier collapse it is likely to drive up the cost of energy deals offered by suppliers.

“To see rising switching we are also relying on consumers engaging with an energy market which many are understandably wary of. It is possible some households may choose to stick with what they know instead of choosing cheaper options.”

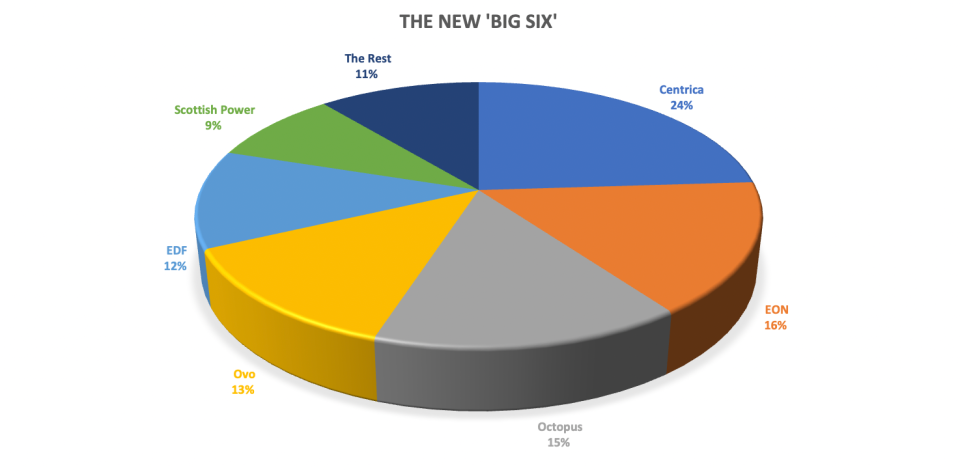

Alongside MSCs, the energy crisis has seen the collapse of 30 suppliers, including the takeover of Bulb by rival firm Octopus Energy – with the Big Six holding a 90 per cent share of the market.

Industry rivals such as Utilita and Good Energy have warned this could also be a factor in reducing choice for consumers, and future innovation in the market.

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.