Elon Musk fires Twitter CEO to ‘free the bird’; Govt to form social media grievance panels in 90 days

Credit: GiphyAlso in this letter:

■ Social media grievance panels in 90 days

■ ETSA 2022: Winners to be declared on October 31

■ Nykaa shares hit all-time low amid new-age-stock rout

Elon Musk closes $44-B Twitter deal, sacks CEO Parag Agrawal

Putting months of uncertainty to rest, Elon Musk closed the $44-billion Twitter deal on Friday. The world’s richest person first declared his intent of acquiring Twitter public in April, in an SEC filing.

What followed was more than six months of mud-slinging, accusations of Twitter withholding information on ‘bots’, and claims of incompetency within Twitter’s top management by Musk.

Musk pulled out of the deal at one point only to be sued by Twitter in the Delaware Chancery court. The court gave Musk an October 28 deadline to complete the deal, failing which the case would have moved to trial, likely forcing him to follow through. Musk finally gave in and closed the deal a day before the deadline.

CEO, CFO fired on Day 1: Musk began his reign as Twitter’s boss by firing some of Twitter’s top brass in what could be considered a stark message to the upper echelons of the microblogging platform — either toe his line or leave.

On Day 1, Musk fired Parag Agrawal, the Indian-origin CEO; Vijaya Gadde, head of legal, policy and trust; Ned Segal, chief financial officer, who joined Twitter in 2017; Sean Edgett, who has been Twitter’s general counsel since 2012; and Sarah Personette, the chief customer officer

Interim CEO: Bloomberg reported that Musk would replace Agrawal and assume the role of interim CEO till he had found a successor.

Sending a note to Twitter’s advertisers on Thursday, Musk wrote: “There has been much speculation about why I bought Twitter and what I think about advertising. Most of it has been wrong.”

He added: “The reason I acquired Twitter is that it is important to the future of civilization to have a common digital town square, where a wide range of beliefs can be debated in a healthy manner, without resorting to violence.”

Must comply with Indian rules: Musk’s takeover of Twitter will not change India’s expectation that it will comply with the country’s rules for such companies, said Rajeev Chandrasekhar, minister of state for electronics and information technology, adding that India’s new IT rules would be out in days.

“Our rules and laws for intermediaries remain the same regardless of who owns the platforms,” said Chandrasekhar. “So, the expectation of compliance with Indian laws and rules remains.”

Also read | A series of chats that possibly sealed the fate of Twitter’s ex-CEO Parag Agrawal

Social media grievance panels in 90 days, suggest draft rules

The government will set up one or more centrally appointed Grievance Appellate Committees (GACs) within three months of notification of amendments to the Information Technology (IT) Rules of 2021 under the IT Act, per the final draft of the amended rules, reviewed by us.

The idea behind setting up committees is to give users of social media platforms, including Facebook and Twitter, recourse other than approaching courts to settle complaints.

Final rules: The final rules also prescribe shorter timelines of 24 hours to act upon sensitive content, along with instructing intermediaries to “respect all the rights accorded to citizens under the Constitution, including in Articles 14, 19, and 21”. There is also some relief for platforms on conducting “due diligence” on user-generated content.

According to the provisions in the final draft, the GAC will have three people — a chairperson and two whole-time members appointed by the Centre.

Relief for intermediaries: Any person who is aggrieved by a decision of the grievance officer of an intermediary can, within 30 days, appeal against the decision, per the provisions of the draft.

ET reported on September 27 that the government had decided to go ahead with its contentious proposal to appoint multiple GACs despite industry lobbying for a self-regulatory body. The government is of the view that the platforms do not act on user grievances in a timely manner, our source told us.

ET Startup Awards jury meets to decide winners

The 2022 edition of the Economic Times Startup Awards saw its high-powered jury pick winners across nine categories on Friday to recognise and celebrate excellence in the burgeoning Indian startup ecosystem.

Led by Salil Parekh, chief executive and managing director of Infosys, the jury met virtually to choose the winners, at a time when the global startup and technology ecosystem is being roiled by economic and geopolitical uncertainty.

Nominees revealed: We have revealed the nominees in all 9 categories — Bootstrap Champ, Top Innovator, Comeback Kid, Social Enterprise, Best on Campus, Woman Ahead, Midas Touch, CEO of the Year, and Startup of the Year— with each category having five nominations.

Juryspeak: While sentiment globally has turned negative, digital India still has much potential, and startups here can have a positive impact on the whole world, jury members had said earlier.

Salil Parekh, CEO & MD, Infosys, said: “One of the main areas of differentiation for a new business is the idea that it brings to the world. This, backed by a strong team with the ability to execute relentlessly, makes for a successful business. We will be privileged to learn more about entrepreneurs and their creations as we look across industry landscapes.”

“The continuous ups and downs of a startup founder are now par for the course. Founders must be able to find a balance between ambitious visions and drives for innovation, alongside prudent business management and conservative planning. We are fortunate, though, that digital India still has so much potential and optimism ahead, even as sentiment globally has become considerably more negative,” said Satyan Gajwani, vice chairman, Times Internet.

Watch this space tomorrow to learn more!

TWEET OF THE DAY

Nykaa shares hit all-time low as stocks of new-age firms get pummelled

Having seen 56% of shareholder wealth wiped out from its 52-week high, shares of new-age beauty and fashion retailer Nykaa on Tuesday hit a record low on Friday, going below its IPO issue price of Rs 1,125.

As investors continued to dump Nykaa (FSN E-Commerce Ventures) ahead of the mandatory lock-in expiry date for pre-IPO investors on November 10, the stock slipped into three-digit territory for the first time as it fell over 5% to close at Rs 994.8.

Until recently, Nykaa was among the best-performing new-age stocks on the stock exchanges, nearly doubling in price on its listing day last November

Brokerages still bullish: Global brokerage firm Nomura, which recently initiated coverage on the stock with a target price of Rs 1,365, said the risk-reward is quite favourable for long-term investors, with the stock having the potential to double over the next five years.

“It is quite unique compared with most online companies due to its strong focus to curate brands and helping customers in their discovery journey. Brands see it as a key partner in educating customers and driving adoption of premium products,” Nomura said.

Delhivery’s free fall continues: Stocks of new-age ecommerce logistics firm Delhivery continued to be in free fall during Friday’s trading session. The scrip plummeted over 4% to end the day at Rs 355. It has crashed close to 38% over the last month.

The free fall began after the company issued a muted growth outlook. In a stock exchange filing last week, Delhivery said it was likely to see an adverse impact from high inflation and would clock moderate growth in shipments for the rest of the financial year.

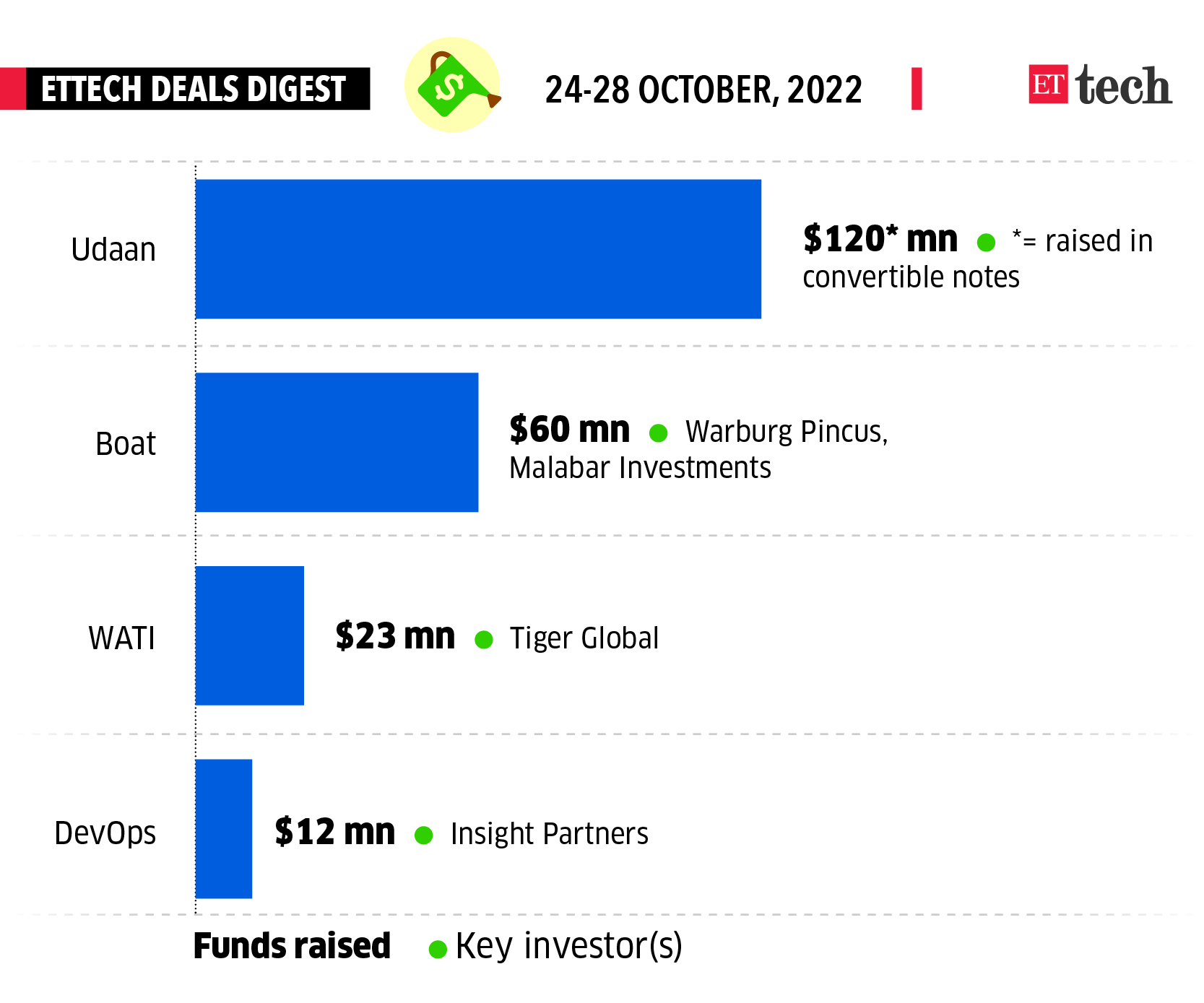

ETtech Deals Digest

Post-festival season gloom for Indian startups is evident, and it looks like it’s here to stay. Yet another week has gone by and the funding drought continues for startups. Investors, both institutions and angels, are looking more hesitant than ever in backing new ventures. The current global macroeconomic climate seems to be behind the funding taps going dry, with energy prices soaring because of geopolitical volatility and the West facing a recession.

Startups have been finding new ways of raising money, and using convertible notes is one such hack. This week, B2B e-commerce startup Udaan raised $120 million through convertible notes while delaying its IPO plans.

Here’s the list of all the done deals this week

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta in New Delhi and Siddharth Sharma in Bengaluru. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.