Edtech firms join forces to set rules; Tata’s new financial marketplace

Also in this letter:

- Tata Digital sets up financial marketplace

- Omicron unlikely to affect unicorns’ hiring spree

- Online canvassing: More cons than pros?

Edtech set for (self) regulation

Top edtech firms such as Byju’s, Unacademy, upGrad and others are joining forces to implement a self-regulatory code on how they do business in India. While edtech founders have discussed the regulatory landscape for the long-term in India in private, this is the first time they are working on it seriously, and with the knowledge of the government.

Self-regulate? Why? China’s regulatory crackdown last year on its top edtech firms led to murmurs here, causing founders to wonder whether India could ever see such wide-ranging policy overhaul. Most of them think it won’t be as drastic. But last month, Lok Sabha member Karti Chidambaram raised in the Lower House the issue of edtech companies misleading students and their partners to sell their courses.

- Soon after, the government said students and parents must be careful when signing up for online courses.

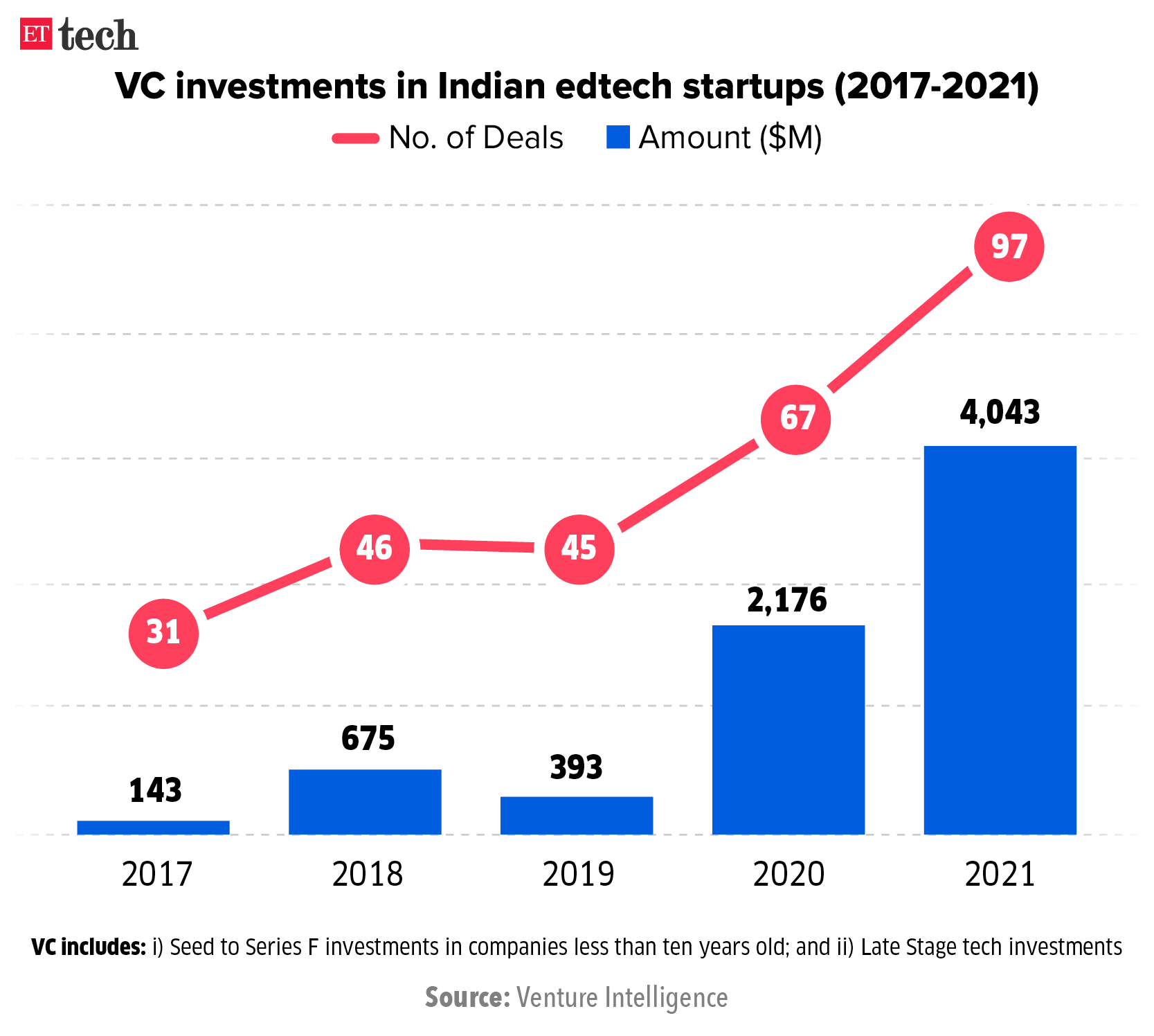

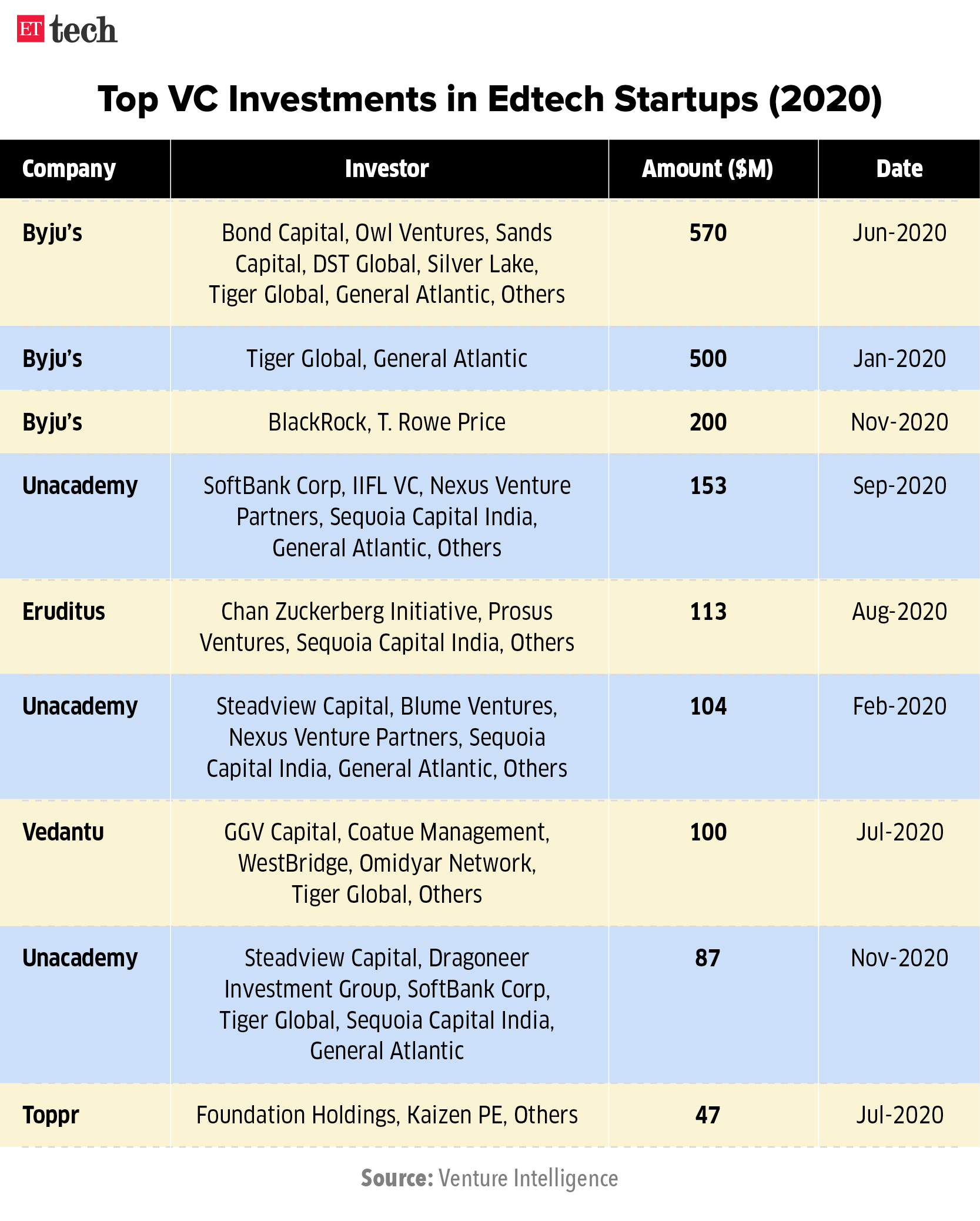

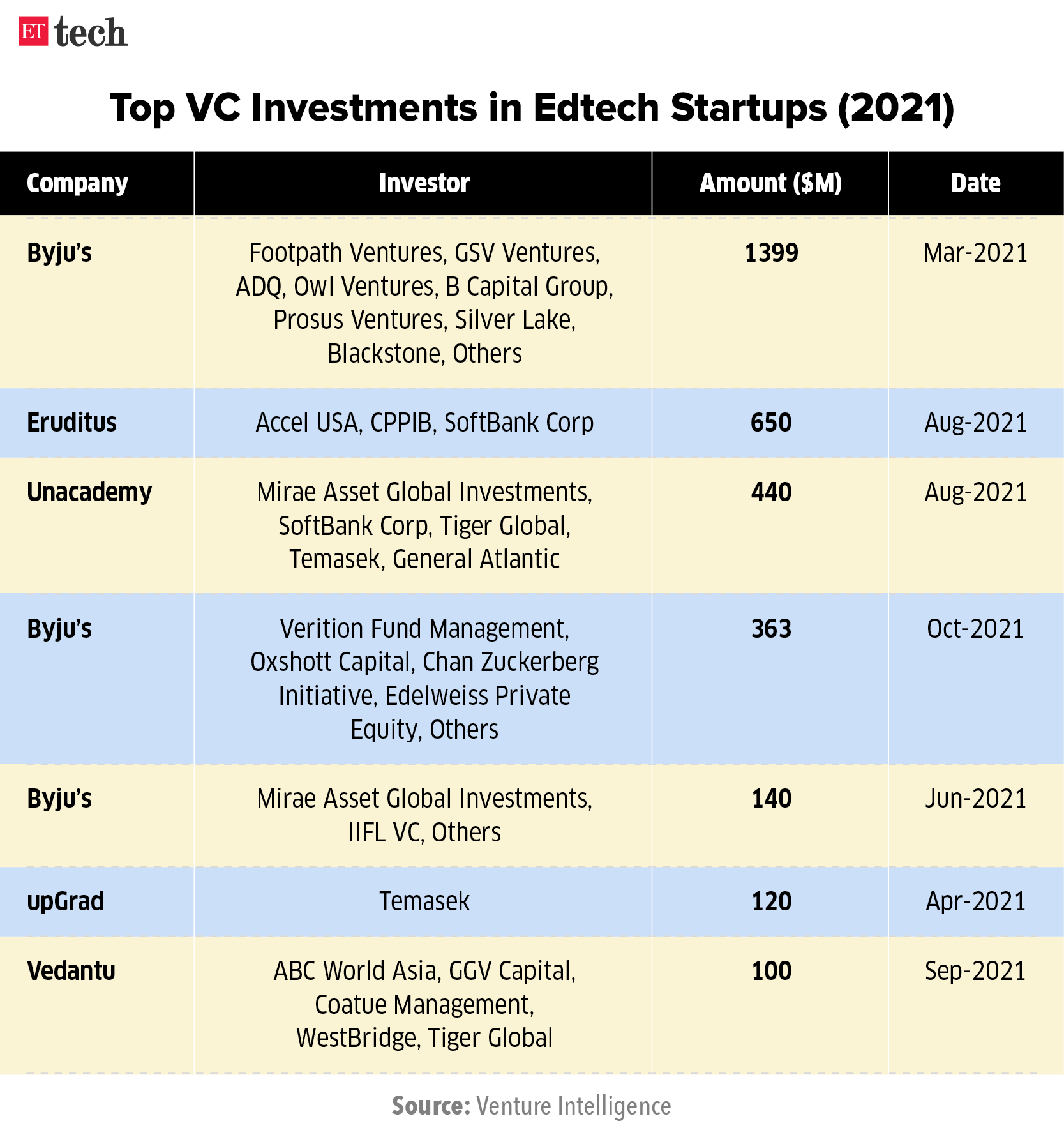

Alarm bells: This set alarm bells ringing among some of the highest-valued startups in the sector. They are well aware of the existing issues and realised they must act amid growing demands to regulate the sector, in which billions of dollars have been invested in the past two years.

The code: As the top edtech unicorns got together to set up a framework, they sought to address two core issues: misleading advertisements and unscrupulous business practises.

For instance, consumers have alleged that some education companies sold them courses on a monthly renewal basis but arranged financing or loans for up to three years—meaning they couldn’t really unsubscribe after a month or two.

Sources told us that industry executives are looking to ensure fair and transparent functioning of a robust grievance redressal mechanism, with escalation to an grievance review board with independent members.

Quote: “With the sole purpose of improving the delivery of education services, it is now crucial for us to foster and sustain stakeholder trust by safeguarding their interests,” said Mayank Kumar, co-founder and managing director of upGrad and co-chair of the edtech committee at IAMAI. It is this committee that worked on the code.

What’s the government saying? Last week, Education Minister Dharmendra Pradhan said that his office is in talks with the Union Ministry of Law and the Ministry of Electronics and Information Technology to work out a regulatory policy for the edtech sector.

Is self-regulation enough? The jury is out on this one. Sources, including people who have worked on these codes, have said it is important to see how it is implemented.

“One thing is clear: regulation is on the way. Especially after what has happened in China, companies here don’t want to take a risk. They want to reach out to the government to show they are trying to address some of the concerns,” one of the sources told us.

China factor: Last year, China banned edtech startups that teach the school curriculum from making profits, raising capital or going public. This was a massive policy change that was bound to have its impact on what is an estimated $100 billion industry there.

The results are clear. On Monday, Bloomberg reported one of the largest edtech firms in China—New Oriental Education & Technology Group Inc.—had to fire 60,000 people recently.

No one is expecting such drastic policy shifts in India, even when the government does come out with rules for edtech companies, but companies have realised that regulation will be part of the story going forward. That’s why some of these startups are actively seeking to hire senior public policy executives in the national capital to liaise with government officials.

Tata Digital sets up financial marketplace entity

Tata Digital has set up a new financial marketplace entity called Tata Fintech to help the conglomerate compete with heavyweight rivals Amazon and Reliance.

Details: Tata Fintech seems to be building a financial services portfolio and hiring senior talent with digital and financial backgrounds. The new entity, incorporated in November, will offer a host of financial products including a retail payment gateway.

The fintech vertical is a natural extension of the group’s broader ecommerce business, a source told us. “There are a lot of integrations being planned in terms of offering ‘buy now pay later’ solutions and other financing options,” the person said. “These are being worked out through the fintech unit.”

Its board includes Mukesh Bansal, Ankur Verma and Modan Saha, who was recently made CEO of financial services. Its consumer app TataNeu is currently being tested by its two-lakh-plus employees.

Helping hands: Officials close to Tata Capital, which has its own digital arm, told us that it was working closely with Tata Digital to build the financial services platform. Tata Consultancy Services, meanwhile, is offering tech expertise.

“Tata Fintech does not yet have an NBFC licence, so the entity will focus on payments and other products. But there is reasonably good coordination between the two entities,” said an official.

Tata Fintech’s services may also include services such as credit card applications, insurance distribution, micro loans and even merchant management.

Tweet of the day

Omicron unlikely to affect unicorns’ hiring spree

Indian unicorns—especially newly minted ones—are set to continue their hiring spree in 2022 as the third wave of Covid-19 is unlikely to affect their recruitment plans.

Meesho, Acko, Razorpay, Zeta, Spinny, Apna, Vedantu and Cred are among those looking to grow their teams by up to 100% in the coming months, with a focus on technology, product, design, sales and marketing roles, companies told us.

Who’s doing what: Ruchi Deepak, co-founder of Acko, said the digital general insurer is expecting 50% growth overall. “With the recent round of funding, there are plans to scale the business and define the trajectory for the next level of growth…we need to have the right talent on board,” she said.

Social ecommerce company Meesho plans to increase its workforce across technology and product by 2.5 times. “In the last one year, our business has grown more than 10x, which has resulted in the expansion of teams,” its chief HR officer Ashish Kumar Singh said.

Banking tech company Zeta is planning to hire people across engineering, product, sales, marketing and other business verticals, as it grows its presence, its HR head Margaret D’souza said.

A survey by Xpheno, shared exclusively with ET, showed that Indian unicorns’ combined headcount grew 27% year on year as of December 2021.

Online canvassing: More cons than pros?

The headquarters of the Election Commission of India in New Delhi.

The Election Commission’s mandate permitting virtual campaigning in the upcoming state elections opens up significant opportunities for social media platforms, according to political analysts who also fear that monitoring the heightened activity could pose a huge challenge for the polling watchdog.

While the EC’s move offers more voters a chance to interact with political leaders without risking their health amid a raging pandemic, privacy experts are questioning whether it can provide a level-playing field for all parties in a technology-led arena.

- “It may create an unequal playing field for parties since those with the technology resources and deep pockets may be able to create bigger and deeper campaigns,” said Jagdeep S. Chhokar, cofounder of Association for Democratic Reforms.

Privacy experts are of the view that the EC may also not have the latest tech tools to monitor social media platforms that favour a specific party and accord prominence to its content over others through its algorithms.

- “It will be crucial for the social media platforms to store the relevant recordings from the campaigns as per the data retention mandates envisaged under IT Rules 2021 to enable the Election Commission to review any complaints regarding violation of the Model Code of Conduct,” The Dialogue’s Kazim Rizvi said.

Infographic Insight

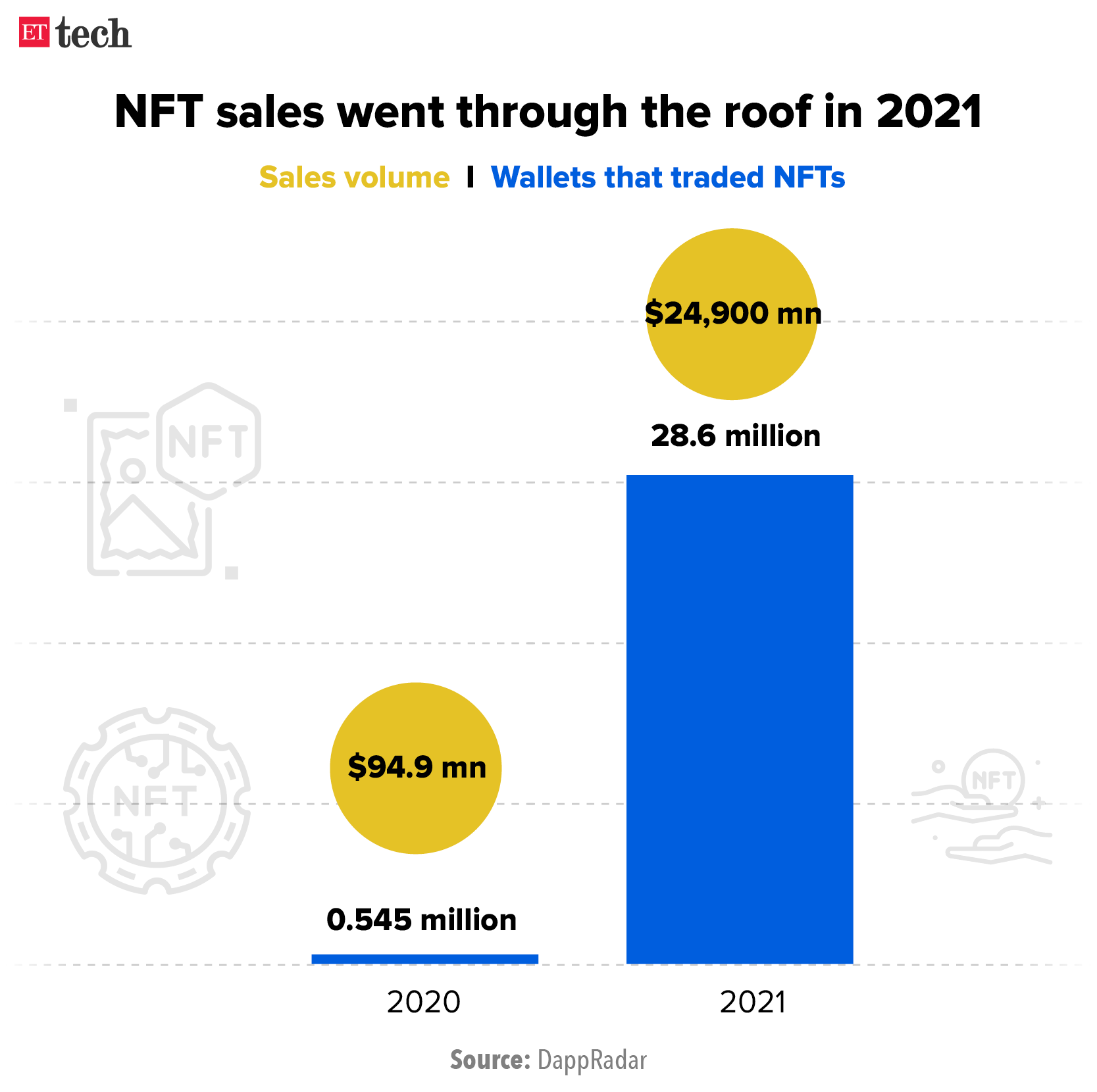

Around 28.6 million crypto wallets traded NFTs worth a combined $25 billion in 2021, a huge jump over 2020, according to data from market tracker DappRadar.

Anicut Capital raises Rs 875 crore for its second fund

Anicut Capital, a venture debt firm, has closed its second fund, raising a corpus of Rs 875 crore entirely from domestic investors, a senior company executive said.

- The plan was to raise Rs 700 crore, but the firm has also retained Rs 175 crore from oversubscriptions under the green-shoe option.

- The money has been raised from institutional investors, wealthy individuals and family offices, cofounder and managing partner Ashvin Chadha said.

Anicut’s fundraising signals the continued interest of domestic investors in venture debt firms that invest in the startup ecosystem. Other venture debt funds—such as Trifecta Capital, Alteria Capital, Stride and Innoven Capital—have also recently raised large pools of capital to back Indian startups.

The firm is likely to launch a Rs 1,500-crore third fund in the middle of 2022, Chadha said.

Quote: “We have already deployed around 70% of the capital from the second fund in more than 12 early-stage startups, with an average deal size of Rs 15-100 crore,” Chadha said. “We will fully deploy the capital by the end of the current calendar year.”

Other Done Deals

■ FPL Technologies, which operates credit score platform OneScore and issues credit cards under the OneCard brand, has raised $75 million as part of a Series C funding round, at a post-money valuation of $750 million.

■ Gold loans provider Rupeek has raised $34 million in a funding round led by Lightbox. The capital will be used for expansion and to invest in new products.

■ Neobank Muvin has raised $3 million in debt and equity in a funding round led by WaterBridge Ventures. The capital will be used for product development and hiring.

■ IppoPay has received $2.1 million in seed funding from Coinbase Ventures and others. The capital will be used to develop the fintech startup’s technology stack and for expansion.

■ Recykal, a tech-enabled waste management company, has raised $22 million from funds managed by Morgan Stanley India. The company has launched India’s first B2B marketplace for waste that connects participants across the waste value chain.

Key highlights from Microsoft’s FutureReady event

Day one of Microsoft’s FutureReady event saw the who’s who of India Inc. and policymakers speak on the 10 technology trends that will set the global, as well as local, agenda going forward. A look at what some of these personalities said:

■ Rishad Premji: The hybrid work environment will continue, Wipro Chairman Rishad Premji said, adding that companies will have to work on creating stronger engagement with employees in order to retain talent. (read more)

■ N. Chandrasekaran: India should take up as national priority better access to healthcare and education for its people, based on a policy framework created by the government in association with the corporate sector, the Tata Sons chairman said. (read more)

■ Satya Nadella: Microsoft is building identity systems of the future for real-time action, enabling computing solutions to be embedded in the real world and bring real presence into virtual spaces, the CEO said. (read more)

■ Rajeev Chandrasekhar: India can turn itself from a provider of software services into a hub for semiconductors, R&D and more in the next five to seven years, the junior IT minister said. (read more)

Other Top Stories By Our Reporters

PayU’s LazyPay launches credit product ‘LazyCard’: LazyPay has partnered with SBM Bank India for the prepaid instrument, as the company looks to up the ante against card-based ‘buy now, pay later’ firms Uni and Slice, among others. (read more)

Elevation Capital promotes Mukul Arora to co-managing partner: The IIM-Lucknow grad joined Elevation as an associate in 2010 and has since led or co-led investments in some of the fastest-growing consumer internet startups in India. (read more)

For tech firms, soft skills are as important as digital skills: Even as the demand for tech talent continues to remain high, not only in the IT services sector, companies will need to relook at the kind of skills they are hiring for. (read more)

Global Picks We Are Reading

■ Economists pin more blame on tech for rising inequality (NYT)

■ Why SaaS IPOs are outperforming other tech IPOs (The Information)

■ Are Musk’s satellites overcrowding space? Rivals say so (WSJ)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai. Illustrations are graphics by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.