EDF backs Ofgem reforms as Centrica makes fresh ringfencing push in bid to ‘protect’ consumer balances

EDF Energy has backed Ofgem’s plans to toughen financial requirements for suppliers – which stop short of of the full ringfencing of customer credit balances supported by rival and British Gas owner, Centrica.

Currently, firms are not required to ringfence credit balance – instead allowing them to invest them.

This could lead to customers not being able to recoup credit balances – effectively, energy paid for up front – if a supplier goes bust.

EDF praised the watchdog’s decision to bring in capital adequacy demands, announced last November, as the regulator pushes to clean up the energy market.

An EDF spokesperson told City A.M.: “EDF remains supportive of Ofgem taking measures to improve the financial resilience of the retail market, which will lead to more sustainable competition in the long-term, to the benefit of consumers.”

It has also not backed Centrica’s calls for energy firms to tell customers whether credit balances are fully protected if they go bust.

By contrast, the French energy firm seemingly prefers a more targeted approach, encouraging Ofgem to step in if and when it had issues with a supplier’s financial strategy.

This includes their use of funds allocated for buying customers’ energy.

“We support Ofgem taking powers to ensure that it is able to act where it has concerns around an individual suppliers’ activities, including but not limited to their use of customer credit balances,” EDF explained.

Ringfencing proposal snub angers Centrica

EDF’s comments come after Centrica made contact with consumer rights charity Citizens Advice, asking for its support to bring in disclosure requirements across the industry – according to The Guardian.

The newspaper revealed that Centrica’s group general counsel Raj Roy has written to charity’s chief executive, Dame Clare Moriarty.

He said: “Whilst this approach cannot be an effective substitute for the robust protection of customer credit balances, it would, at the very least, make suppliers properly accountable to their customers over the use of their deposits and provide all customers with an informed choice when selecting their energy supplier.”

Centrica reportedly has expressed “profound concern” over the financial resilience of some its competitors in the domestic energy market.

The industry crisis has seen nearly 30 suppliers collapse over the past two years, including the de-facto nationalisation of Bulb Energy.

It has been driven by soaring wholesale costs amid rebounding post-pandemic demand, and has worsened following Russia’s invasion of Ukraine.

The crisis has come at a cost of £2.7bn to taxpayers, with the costs of keeping Bulb on life support estimated at £6.5bn by the Office for Budget Responsibility – the biggest state bailout since RBS in 2008.

Meanwhile, households are paying record bills for their energy, with the Government stepping with historic support packages to ease the financial burden.

Centrica estimates that customers lost £400m from collapsed suppliers, based on data gathered from requests for information sent to the regulator.

Citizens Advice has previously Ofgem criticised for failing to act against “unfit energy suppliers for nearly a decade”.

It pointed the finger at the watchdog for “mistakes and missed opportunities” in its report on the energy sector, accusing Ofgem of leaving the industry vulnerable to the crisis.

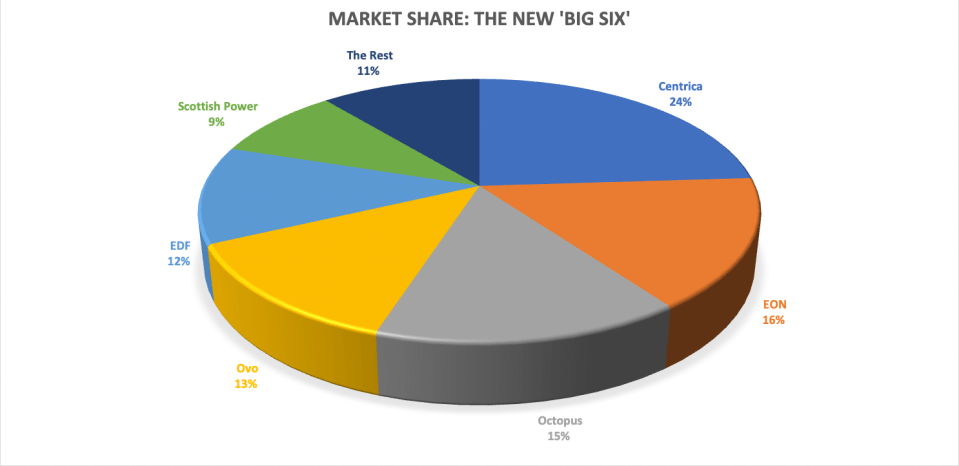

(Source: Ofgem)Ofgem grapples with tricky balancing act for troubled energy sector

Ofgem’s unveiled capital adequacy requirements will mean firms have to set aside a minimum amount of funds to withstand future shocks in the market.

The measure will be rolled out this year, alongside ringfencing requirements for renewable obligation payments, and a demand for suppliers to closely monitor the use of credit balances

However, Ofgem will not demand energy firms fully ringfence customer credit balances, after a protracted industry row over the issue.

City A.M. understands Ofgem reconsidered its position – having initially proposed ringfencing in its consultation – amid concerns it would create high barriers for entry that could stifle innovation and put undue financial strain on challenger suppliers.

This has been a difficult balancing act for the regulator, which has sought to clean up the market without reshaping the industry in favour of established big players.

Ringfencing would have meant suppliers would have been obligated allocate customer funds used for procuring energy into a separate account from the commercial operations of the firm.

Customers typically overpay for their energy use in the summer months, and then that credit is used over the winter to keep direct debits consistent throughout the year.

Centrica boss Chris O’Shea slammed Ofgem’s decision at the time, suggesting the lack of ringfencing showed “lessons have still not been learnt” from the energy crisis.

The UK’s largest energy supplier was at loggerheads with Octopus Energy over the role of ringfencing in the energy sector for months, with multiple suppliers taking opposite sides in an increasingly bitter debate over the policy proposal.

| Ringfencing – in favour | Ringfencing – opposed |

| British Gas – Centrica | Octopus Energy |

| EON | Ovo Energy |

| Utilita | Good Energy |

| Utility Warehouse | So Energy |

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.